|

市場調查報告書

商品編碼

1548966

供應商對 4 級自動駕駛的準備:感測器、系統、策略和市場佔有率Supplier Readiness for Level 4 Autonomy: Sensors, Systems, Strategy, Market Shares |

||||||

本報告的排名涵蓋了 ADAS 一級公司前 20 名,包括 APTIV、博世、大陸集團、電裝、Mobileye、法雷奧、採埃孚、百度、阿里巴巴、亞馬遜、華為和富士康。

- 了解每個供應商在感測器、功能、運算和軟體方面的技術能力,以實現 1 至 4 級駕駛和停車。

- 了解合作夥伴關係、投資、併購、新產品發布、供應鏈和商業模式等策略。

- 市場分析:市場優勢、各公司在 ADAS 上的收入、新進入所促使的競爭格局變化。

哪些 ADAS 供應商支援 4 級自動駕駛?

主要分析結果

- 現有一級供應商引領 ADAS 市場,但面臨轉型和競爭挑戰

- 中國新興供應商和新技術進入者威脅 ADAS 和電氣化領域的主要一級領導地位

- 感知、運算、人工智慧、SDV 和新市場的新機會

- 供應商應繼續投資技術、加強合作夥伴關係並建立以客戶為中心的業務模式

Auto2x發布了《4級自動駕駛供應商準備排名》報告。它分析了 ADAS(高級駕駛輔助系統)競爭格局的演變以及技術提供者的 4 級自動駕駛路線圖。

本次排名涵蓋了 ADAS 一級公司前 20 名,包括 APTIV、博世、大陸集團、電裝、Mobileye、法雷奧、採埃孚,以及百度、阿里巴巴、亞馬遜、華為、富士康。

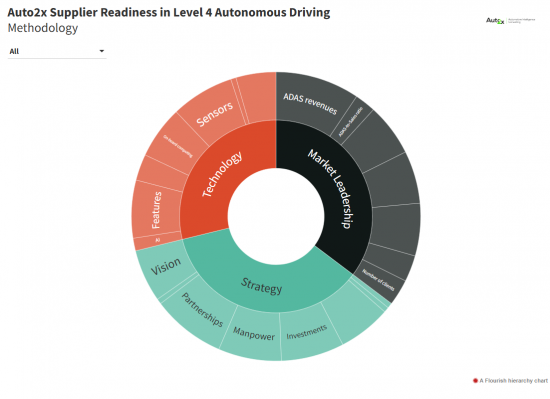

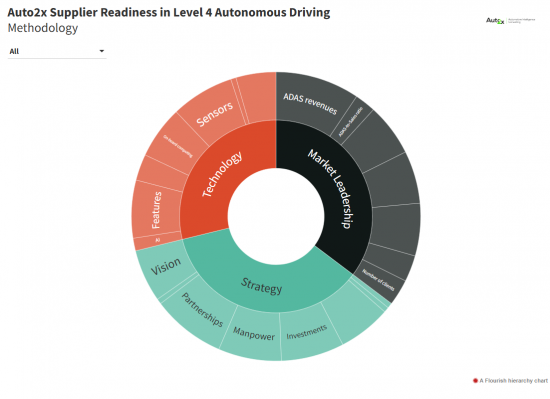

為了評估供應商的準備情況,本報告量化了以下項目:

- 供應商在感測器、功能、計算和軟體方面的技術能力,以實現 1-4 級駕駛和停車。 各供應商的

- 策略:合作夥伴關係、投資、併購、新產品發布、供應鏈、商業模式等。

- 供應商的市場地位和 ADAS 收入

目標受眾

- 汽車原始設備製造商和 1/2 級供應商的工程、策略、行銷、研發和創新人員

- 一家考慮進入汽車市場的科技公司的創新經理

- 專門研究汽車產業的投資者/財務分析師

- 汽車產業顧問/策略師

對讀者的好處

- 全面了解 ADAS 供應商格局。

- 確定自動駕駛技術合作夥伴及收購目標。

- 現有參與者和新進入者的競爭力評估

- 可以指導研發投資和市場定位的策略決策。

- 了解將塑造自動駕駛未來的新興趨勢和技術。

為什麼回應等級很重要?

為了在自動駕駛競賽中取得成功,供應商需要在三個參數上具有競爭力:

- 技術競爭力

- 執行策略的能力(強大的合作夥伴關係和投資網絡),以及

- 強大的市場定位,以獲得市場佔有率

策略

- 透過在正確的時間投資正確的技術和市場,可以在波動中預見不斷變化的市場需求。

- 確定因市場重組而產生的新收入池(新創新、亞洲收入池的變化等)。

面向未來的科技

- 3/4級自動駕駛所需的下一代軟體/硬體(DC、運算、4D成像雷達等):誰擁有優勢?

- 新的駕駛和停車功能在這裡:誰在創新以提供有競爭力的解決方案?

市場領導地位

- 適應不斷變化的需求和新興市場:建立或維持新的收入

- 新進業者威脅領導者:擁有人工智慧/雲端和內部開發部門的大型科技公司的存在

策略執行包括強大的願景、合作關係、投資和併購

使用互動式圖表來了解主要供應商和汽車製造商的策略。

技術競爭力內容:

- 強大的 1 至 4 級功能組合,適用於私家車、自動駕駛卡車和共享出行等用例(高速公路司機和城市代客泊車等 4 級功能正在開發中);

- 全面且強大的感測器組(成像雷達、固態光達等)。

- 集中式 E/E 架構、軟體堆疊、驗證/認證功能等。

博世案例研究 - 全球最大的汽車零件供應商

- ADAS 功能:Bosch正在開發 L4 高速公路功能,但目前正在評估其他 Tier 1(例如 APTIV)在該功能方面擁有更強的功能。

- 感測器:博世在 ADAS 領域擁有強大的地位,但 3/4 級需要更多創新。將LiDAR 和超級電腦添加到其產品組合中是朝著正確方向邁出的一步,但該公司正在與LiDAR 領域的其他一級公司(法雷奧用於梅賽德斯-奔馳的L3 ) 進行競爭。

- 驗證:博世領導了一個名為 "VVM" 的研究計畫。 VVM代表4級和5級自動駕駛車輛驗證和認證方法,於2019年7月11日推出,有效期四年。在博世和寶馬這兩個財團的領導下,並在聯邦經濟事務和研究與發展部的資助下,23家著名的行業和研究合作夥伴共同開發了一種合法可行、省時且具有成本效益的產品。以複雜的城市交叉路口應用為例,VVM 開發了將虛擬和真實測試結合的重要創新。

- 機器人計程車:戴姆勒和博世是城市環境中 L4 機器人計程車聯盟的成員,該聯盟於 2021 年 8 月結束。博世是一家感測器供應商,開發感測器,並正在開發一個運算平台,作為與戴姆勒合作的一部分。博世為 L3+ 開發了自己的軟體(目前不支援其他 L4)。

市場定位

此參數反映:

- ADAS 感測器和功能的客戶數量:包括汽車製造商、卡車製造商和 AMOD

- 四大主要市場的客戶數量:中國、美國、歐盟、日本

- ADAS 收入

- 市場佔有率:按感測器、功能和區域劃分

- ADAS 與銷售額的比率:反映了對 ADAS 的關注

ADAS 供應商的市場領導趨勢

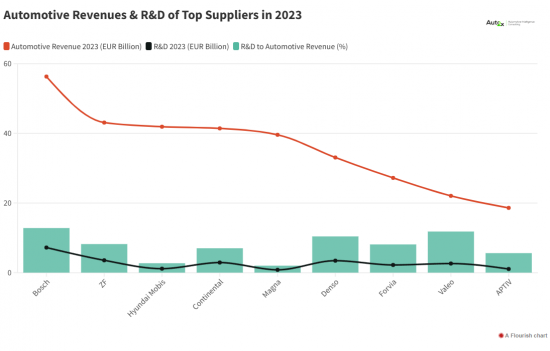

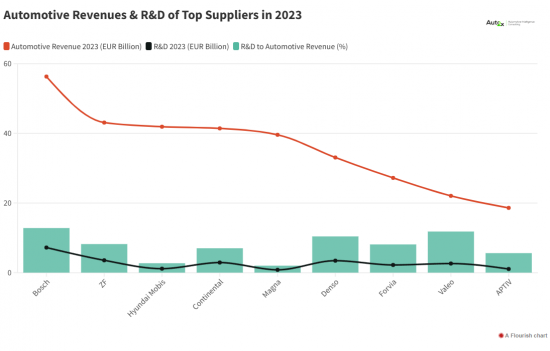

- 2023 年排名前 15 名的公司汽車銷售額達 3,600 億歐元。

- 2023 年排名前 10 名的公司研發支出為 257 億歐元。博世的研發支出最高,其次是採埃孚和電裝。

- Mobileye 在第一級研發強度最高,其次是博世和法雷奧。

哪些供應商已準備好迎接自主移動的新時代?

"Auto2x 根據主要一級供應商和新公司的技術競爭力、策略執行和市場定位評估了他們的準備程度。"

第一個參數技術競爭力反映了產品組合,包括感測器、功能、架構、軟體堆疊和創新(專利)。

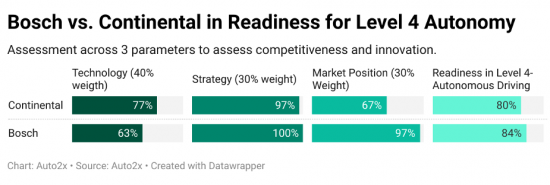

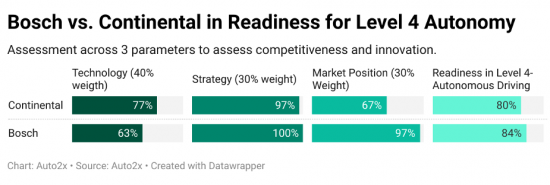

Auto2x 認為 APTIV 和大陸集團在 LiDAR、軟體堆疊和運算平台方面擁有成熟的產品/服務,因此對 4 級自動駕駛技術做好了高度準備。

百度憑藉Apollo的優勢提供有競爭力的技術。

- 第二個參數策略執行能力涵蓋供應商夥伴關係、投資、ADAS 人才和自動駕駛活動等內容。

博世和 Mobileye 憑藉強大的內部能力、高成長領域的合作夥伴生態系統以及對關鍵市場的投資,在這一參數上處於領先地位。

大陸集團是 100% 系統供應商,從設計和製造到驗證、系統整合以及新功能服務的擴展。因此大陸集團處於有利地位。

- 第三個參數市場定位反映了按感測器和功能、感測器市場佔有率、客戶群和地理位置劃分的 ADAS 收入。

博世、採埃孚、法雷奧、電裝和大陸集團等主要汽車一級供應商仍然在汽車收入中佔有很大佔有率。

此外,來自 ADAS、電氣化和新行動業務模式的收入也在增加。 2021年排名前12位供應商的ADAS銷售額年增12.5%,達到160億歐元。 Auto2x 預計到 2025 年這數字將翻一番,達到 350 億歐元。

大陸集團2015年至2018年在ADAS市場的銷售領先,主要利用其在攝影機市場的主導地位。

不過,它在 2019 年被博世超越,此後一直在 ADAS 收入方面領先市場。該公司的優勢在於能夠支援 ADAS 以及駕駛和停車功能的 OEM 合同,以實現更高水準的自動化。

- 整體準備:4 級自動駕駛的供應商準備排名是基於策略(30% 權重)、技術(40%)和市場地位(30%)的。

根據 Auto2x 的數據,博世在具有 1-2 級功能的感測器收入方面領先 ADAS 市場,但在 4 級自動駕駛技術準備方面落後。

另一個成功案例是Mobileye,它引領英特爾的自動駕駛策略,並在ADAS領域獲得了很大佔有率。 Mobileye 在 4 級自動駕駛準備度方面躋身前三名供應商。

歐洲供應商領先,但中國供應商正在迎頭趕上

採埃孚和大陸集團 ADAS 銷售額超過 20 億歐元,但挑戰依然存在

根據ADAS全球銷售排名,ADAS汽車零件供應商前四名都是歐洲企業:博世、法雷奧、採埃孚、大陸集團。 2022 年汽車產量成長 4%,以及 2-3 級系統感測器安裝率提高,為 ADAS 的銷售和訂單做出了貢獻。

- 採埃孚 2022 年 ADAS 銷售額達 24 億歐元,較 2021 年的 18 億歐元成長 33%。在 Auto2x 發布的 2021 年 ADAS 銷量全球排名中,採埃孚以 11% 的市佔率排名第三。

- 大陸集團的 ADAS 收入成長了 23%,從 2021 年的 17 億歐元增至 2022 年的 21 億歐元。 ADAS 佔大陸集團汽車銷量的 11%。

然而,隨著人工智慧和軟體能力的發展、軟體商業模式的拓展以及面臨新的競爭,各大汽車零件製造商正面臨進一步轉型。

汽車公司在實現 4 級自動駕駛方面面臨哪些挑戰?

汽車製造商在實現 4 級自動駕駛方面面臨多項挑戰,包括需要先進的感測器技術和高效能運算平台來即時處理大量資料。

必須克服監管障礙和安全標準,以確保自動駕駛汽車的合規性和社會接受度。

需要大量投資、研究和開發以及合作夥伴關係來建立成功部署所需的基礎設施和技術生態系統。

主要汽車 ADAS 供應商面臨哪些風險?

供應商面臨著競爭加劇帶來的風險,特別是來自大型科技公司和利用人工智慧和雲端技術的新公司的競爭,這可能會擾亂傳統的供應鏈。

汽車製造商向行動服務供應商的轉型迫使供應商快速適應軟體驅動的模式,這可能需要大量投資和重組。

此外,貨幣化從硬體到軟體的轉變給依賴傳統收入來源的供應商帶來了挑戰,並且需要有選擇性的業務策略來保持競爭力。

自動駕駛的新機會

車輪軟體革命將定義移動出行的未來

電氣化、自動駕駛、共享行動和互聯將推動更專業的軟體開發。大多數面向硬體的系統變得標準化和商品化。

配備先進軟體的 ECU 數量不斷增加,導致成本顯著增加、車輛軟體的複雜性增加以及優化車輛功能的限制。

下一代數位汽車將需要整合新的多樣化技術和複雜的邏輯運算,硬體架構將需要支援先進的軟體功能和可更新性。

新的合作關係和新的商業模式不斷湧現。

哪些新的軟體驅動功能具有巨大潛力?

軟體是汽車產業數位化的答案,但其實施存在挑戰。

SDV主要技術組成部分的主要創新集群如下。

- EE架構:評估主要汽車製造商和供應商的路線圖及其在集中式架構開發中的合作夥伴關係

- BMW整合的Aptiv主動安全網域控制器

- 偉世通的網域控制器SmartCore - 由賓士推出;

- 面向區域的控制單元(ZCU):將車輛劃分為多個區域,並將每個區域集成為一個區域ECU(子ECU不執行任何處理來實現車輛功能),博世面向區域的E/E架構;

- 跨域集中式單元 (CDCU):將多個域的功能整合到一個 ECU 中(類似於 DCU 架構),例如博世的以車輛為中心的 ECU。

- CarOS:了解 Google Android 汽車作業系統的日益普及以及 MBUX 和其他廠商的競爭性產品;

- 開源軟體開發

- 雲端:實現基於雲端的ADAS開發的車載雲的出現、汽車製造商的產品開發以及微軟、亞馬遜等的作用;

- OTA(無線)更新和按需功能的機會;

- 數位孿生

人工智慧和雲端運算的創新將如何影響自動駕駛?

人工智慧和雲端運算等新技術對於自動駕駛的未來至關重要,因為它們支援先進的數據處理、即時決策和可擴展的軟體更新。

人工智慧透過機器學習和車載助理增強車輛感知和自主性,雲端運算支援高效的功能開發和系統整合。

雲端運算支援高效的功能開發和系統整合。兩者將共同加速向更高水平自動化的過渡,並提高車輛的整體性能和安全性。

人工智慧與雲端運算的融合將改變自動駕駛汽車的消費者體驗。

人工智慧與雲端運算的整合將實現個人化的內部服務(例如客製化娛樂和即時導航輔助),從而顯著改善自動駕駛汽車的消費者體驗。

雲端運算可實現持續更新和增強,確保您的車輛保持最新的技術和安全功能。

此外,人工智慧驅動的虛擬助理可以在旅途中提供無縫互動並提高便利性和整體滿意度。

新供應商和大型科技公司如何顛覆大型一級供應商?

傳統 ADAS 供應商仍佔汽車供應商收入的大部分。但它面臨來自美國、中國和其他地方的大型科技公司的競爭,這些公司正在利用人工智慧、雲端和軟體方面的專業知識來改造汽車。

在2020 年代,汽車製造商將轉向更通用的平台以實現成本節約,現有企業將放棄垂直整合的重資產業務模式,以與新進入者競爭,因此,汽車軟體的價值將會提高。

軟體對於產品差異化至關重要,包括新功能、內容和新的個人化體驗。

本報告指出了高科技公司進入或破壞現有供應鏈的若干機會。

- 用於自動駕駛的下一代認知硬體

- 計算,例如用於自動駕駛的 Peta-Ops 晶片

所需的處理能力:

- Lv.2:需要 10TOPS 的處理能力(每秒兆次運算)

- Lv.4:100TOPS 或更多

- Lv.5:需要 1,000TOPS 的處理能力

- 人工智慧:無人駕駛人工智慧、HMI——車載人工智慧助理等。

- 基於數據的商業模式(例如車載電子商務)

- 5G-6G、互聯基礎設施、智慧城市

- 自主共享旅遊與無人配送

供應商如何保持競爭力並獲得優勢?

供應商應該如何做才能保持相關性並在自動駕駛領域獲得競爭優勢和市場佔有率?

供應商必須投資先進感知硬體、人工智慧和雲端運算等下一代技術,以滿足自動駕駛不斷變化的需求。

汽車製造商的另一個重要方面是建立開發更大自主性所需的自動駕駛軟體和感測器功能。

您還應該調整您的策略,以確定新的收入來源,並與創新合作夥伴合作,抓住高成長機會。

我們與領先的汽車製造商建立了商業和產品開發合作夥伴關係,以支援他們的連網電動車和 ADAS 路線圖。快速成長的中國市場中的人工智慧和連接領域對於新的AD供應商從全球一級供應商手中奪取市場佔有率至關重要。

此外,供應商必須不斷評估其競爭並增強其產品供應,以保持市場競爭力。

最後,鼓勵對創新技術和商業模式的投資,例如機器人出租車和最後一英里交付。

對新市場進入者的建議

新供應商的市場進入策略的要點是什麼?

新供應商的主要市場進入策略包括與現有公司建立策略夥伴關係、投資創新技術以及專注於自動駕駛領域的利基市場。

潛在技術包括下一代感知硬體、自動駕駛人工智慧以及先進運算解決方案。

- 聯想已與 NVIDIA 和法雷奧合作,作為一級供應商進入 AD-DC 市場。

- 華為向北汽集團提供L2+光達及車聯網服務。近日,華為在一場題為 "聚焦智慧汽車創新" 的產品發布會上,發布了自動駕駛領域的新產品,重點關注ADAS感測器(4D成像雷達)和HMI(AR-HUD)。

- 三星電子將與特斯拉共同開發HW4.0晶片;

三星電子可以進入哪些科技和國家?

可能的新供應商國家包括中國、美國和歐洲,這些國家對自動駕駛解決方案的需求正在迅速增長。

目錄

第一章供應商對4級自動駕駛的反應

- 1. 供應商回應等級:調查方法

- 2. 與 4 級自動駕駛 (AD) 的兼容性:整體排名結果

- 3.策略執行排名:概述

- 4.市場競爭力排名

- 5. 市場領導排名:概述

- 6. ADAS-AD 供應商的機會

- 7. 機會雷達:依行動、反應和觀察進行排名

- 8. 給現有公司和新進者的建議

- 9. 一級供應商組合中的差距

- 10. 威脅領導力的風險

第 2 章策略與執行

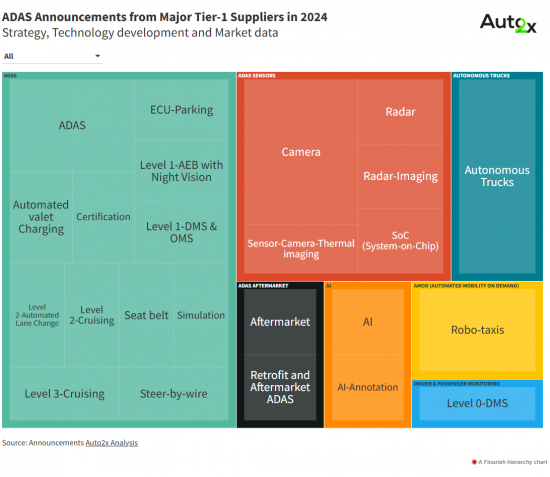

- 1. 供應商 ADAS-AD 策略的趨勢

- 2.供應商通往 4-AD 級的路線圖

- 3. 供應商研發 (R&D) 來推廣 AD 軟體(2023 年)

- 4. 新產品發表(2024 年)

- 5. 主要合作(2024)

- 6. AMOD(按需自主移動)策略

- 7. 3-4級自動駕駛平台供應商

- 8. 同區自動駕駛投資(2024年)

- 9. 新業務模式:SaaS、CaaS、DaaS、VaaS、Tier-X

- 10. 大陸集團汽車部門分拆

- 11. 聯想作為新的 DC Tier 1 進入 AD 市場

- 12.Mobileye 成像雷達

- 13. 法雷奧的大腦部分

- 14. 高通

- 15. 人工智慧監管與道德的趨勢

第三章技術競爭力

- 1. 技術競爭力排名

- 2. 主要一級供應商提供 ADAS L0-L4 功能

- 3. 主要一級供應商的感測器產品組合

- 4. ADAS 雷達與攝影機基準

- 5.下一代雷達/相機/LiDAR

- 6. 駕駛員與乘客/機組人員監控 (DMS-OMS-PMS)

- 7. 車載計算的興起

- 8. 3-4級自動駕駛的資料記錄

- 9. E/E 架構向互聯自動駕駛的演變

- 10. 軟體定義車輛 (SDV) 的創新

- 11. ADAS 和自動駕駛中的低程式碼/無程式碼解決方案

- 12. 專利、智慧財產權和科學文獻領域的創新者

- 13. Auto2x AD 雷達 ADAS 功能的未來

- 14. 生成式人工智慧與自動駕駛的新應用

- 15. 車對車通訊(V2V、V2I、V2X)

第 3 章市場領導與定位

- 1. 以汽車收入劃分的供應商排名(2023 年)

- 2. 供應商收入:ADAS 軟體分類

- 3. 依 ADAS 收入劃分的供應商排名(2015-2023 年)

- 4. 77GHz 雷達供應商市場佔有率

- 5. 中國成為主要廣告中心的優勢

- 6. 2 級 ADAS 在印度的興起

第 5 章 ADAS 與自動駕駛領域的供應商機會

- 1. 增加了 ADAS 感測器內容

- 2. 感測器市場預測和 TAM

- 3. L3/L4 的 LiDAR 收入預測

- 4. 對 ADAS 軟體的需求增加

- 5. 軟體定義車輛 (SDV)

- 6. ADAS 訂閱

- 7. AMOD(按需自主移動)

- 8. 3-4 級法規

- 9. 汽車元宇宙

- 10.自動交付

- 11. 3/4 等級自動駕駛保險

- 12.自動挖礦

The rankings cover the Top-20 ADAS Tier-1s, including APTIV, Bosch, Continental, Denso, Mobileye, Valeo, and ZF, Baidu, Alibaba, Amazon, Huawei, Foxconn and others.

- Learn about the technological capabilities of suppliers in sensors, features, computing and software to deliver Level 1-4 cruising and parking.

- Understand the strategies, including partnerships, investments, M&A, new product launches, supply chain and business models.

- Get insights on who is better positioned in the marketplace, their revenues from ADAS and how new entrants will shape competition.

Which ADAS Suppliers are Ready for Level 4 Autonomous Driving?

Key findings

- Incumbent Tier-1 suppliers lead the ADAS market, but they face challenges to transform and fight the competition

- Emerging Chinese Suppliers and tech entrants threaten the leadership of major Tier-1s in ADAS & Electrification

- New opportunities in perception, computing, AI, SDVs and new markets

- Suppliers should continue investing in tech, strengthen partnerships and build customer-centric business models

Auto2x has released its "Supplier Readiness in Level 4 Autonomous Driving Rankings" report, offering insights into the evolution of the competitive landscape of Advanced Driver Assistance Systems (ADAS) and the roadmaps to Level 4 autonomous driving from technology providers.

The rankings cover the Top-20 ADAS Tier-1s, including APTIV, Bosch, Continental, Denso, Mobileye, Valeo, and ZF, in addition to Baidu, Alibaba, Amazon, Huawei, Foxconn and others.

To assess the Supplier Readiness we quantify

- their technological capabilities of suppliers in sensors, features, computing and software to deliver Level 1-4 cruising and parking.

- their strategies, including partnerships, investments, M&A, new product launches, supply chain and business models.

- how they are positioned in the marketplace, their revenues from ADAS

Who Should Read This Report:

- Engineering, Strategy, Marketing, R&D and Innovation functions in Automotive OEMs and Tier 1-2 Suppliers

- Innovation Managers in Technology companies exploring automotive market entry

- Investors and financial analysts focused on the automotive sector

- Automotive industry consultants and strategists

How Readers Will Benefit:

- Gain a comprehensive understanding of the ADAS supplier landscape

- Identify partners or acquisition targets for autonomous driving technology

- Assess competition from both established players and new entrants

- Guide strategic decisions around R&D investments and market positioning

- Understand emerging trends and technologies shaping the future of autonomous driving

Why does a Readiness Level matter?

To succeed in the Autonomous Driving race suppliers must be competitive across 3 parameters:

- technological competitiveness,

- strategy execution (strong network of partnerships and investments), and

- strong market positioning to capture market share.

Strategy

- Foresee changing market needs amid volatility by investing in the right tech, market at the right time.

- Identify new revenue pools from new innovation, market consolidation, such as shift of revenue pools in Asia.

Future-proof Technology

- Next-gen SW-HW needed for Level 3/4 autonomy e.g., DC, compute, 4D imaging radar. Who has an edge?

- New cruising and parking features emerge: Who is innovating to offer competitive solutions?

Market Leadership

- Adapt to changing needs and emerging markets to build new revenues or maintain.

- Leaders are threatened by new entrants such as Tech Giants with AI, Cloud or in-house

Strategy execution includes a powerful vision, partnerships, investments and M&A

Use the interactive graph to learn about the strategies of major suppliers and carmakers.

Technological competitiveness includes

- a strong portfolio of Level 1-4 features for private cars, autonomous trucks, shared mobility and other use cases (Level 4 features, such as Highway Chauffeur, City and Valet Parking are in development);

- a comprehensive and robust set of sensors (e.g. imaging radar, solid-state lidar).

- capabilities in centralised E/E Architecture, SW Stack, Validation-Verification and others.

Let's have a look at some of them taking the example of Bosch, the world's biggest automotive supplier by revenue.

- ADAS Features: Bosch is developing L4-Highway features but we assess that other Tier-1s, such as APTIV, have stronger capabilities at the moment in this feature.

- Sensors: Bosch has a strong position in ADAS but needs further innovation for L3-4. The addition of Lidar and supercomputers to its portfolio is in the right direction but the company faces competition for Lidar from other Tier 1s, such as Valeo for Mercedes-Benz's L3.

- Validation: Bosch led a research project called 'VVM' , short for verification and validation methods of Level 4 and Level 5 autonomous vehicles, launched on 11 July 2019 with a duration of 4 years. Under the leadership of two consortium leaders Bosch and BMW, with funding from the Federal Ministry for Economic Affairs and Energy, 23 well-known industry & research partners will jointly develop legally viable, time-efficient and cost-effective verification and validation methods. Using the example of a complex urban crossroads application, VVM will develop essential innovations combining virtual and real-life tests.

- Robotaxis: Daimler - Bosch had a consortium for L4 robotaxis in urban environments that ended in Aug'21. Bosch is the sensor supplier, i.e. developing the sensors, and computing platforms as part of its partnership with Daimler who is the lead partner and developer of the SW. Bosch is developing SW on their own for L3+ (not any other L4 as of today).

Market Positioning

This parameter captures:

- Number of clients in ADAS sensors and features, incl. Carmakers, Trucks, AMOD

- Clients in Top-4 major markets: China, USA, EU, Japan

- ADAS revenues

- Market shares in sensors, features and regional

- ADAS-to-Sales ratio to show their focus on AD

Trends in Market Leadership of ADAS Suppliers

- The Top-15 Suppliers recorded Euro-360 Billion in Automotive revenue in 2023.

- The Top-10 Suppliers recorded Euro-25.7 Billion in R&D spending in 2023. Bosch led R&D expenditure followed by ZF and Denso.

- Mobileye has the highest R&D intensity across Tier-1s, followed by Bosch and Valeo

Which suppliers are better prepared for the new era of Autonomous Mobility?

"Auto2x assessed the readiness levels of major Tier-1 suppliers and emerging players based on their technological competitiveness, their strategy execution and their market positioning."

The first parameter, Technology Competitiveness, captures the product portfolio of sensors, features, architecture, software stack and innovation (patents).

Auto2x assesses that APTIV and Continental have high readiness levels in Level 4 Autonomous Driving Technology due to their mature offering in Lidar, Software stack and Computing Platforms.

Baidu offers competitive technology due to Apollo's strengths.

- Strategy Execution, the 2nd parameter, covers a supplier's partnerships, investments, ADAS manpower, activities in autonomous mobility and more.

Bosch and Mobileye lead the pack in this parameter, with strong in-house capabilities, a partner ecosystem in high-growth areas and investments in key markets.

Continental is a 100% system supplier from design and manufacturing to validation and expansion to new services in system integration and functions. This makes them well-positioned.

- Market Positioning, the 3rd parameter, captures the volume of ADAS revenues from sensors and features, sensor market share, client base and geographical presence.

Major Automotive Tier-1 Suppliers like Bosch, ZF, Valeo, Denso and Continental still maintain the lion's share in terms of automotive revenues.

Furthermore, their revenues from ADAS, electrification and new mobility business models are increasing. ADAS revenues from the Top-12 Suppliers rose 12.5% in 2021 y-y to Euro-16 Billion. Auto2x expects it will double by 2025 to Euro-35 Billion.

Continental led the ADAS market by revenues between 2015 and 2018, mainly by capitalising on its dominance in the camera market.

But they were overtaken by Bosch in 2019, who leads the market by ADAS revenues since then. The contracts with OEMs for ADAS and the ability to support driving and parking features for higher levels of automation are strengths.

- Overall Readiness Level: The Ranking of Suppliers Readiness in Level 4 Autonomous Driving is based on their competence in three parameters, Strategy (30% weight), Technology (40%) and Market Position (30%).

Auto2x found that Bosch leads the ADAS market by revenues from sensors for Level 1-2 features, but they lag in Technology Readiness for Level 4 Autonomous Driving.

Another success story is Mobileye which spearheads INTEL's Autonomous Driving strategy and has captured a large share in ADAS. Mobileye ranks at the Top-3 of Auto2x's Ranking of Suppliers by Readiness in level-4 Automated Driving.

European suppliers lead the race but Chinese Suppliers are catching up

ZF and Continental broke the Euro-2 Billion mark in ADAS revenues, but challenges remain

The Top-4 Automotive Suppliers of ADAS are all European, Bosch, Valeo, ZF and Continental, according to Global ADAS Ranking by Revenues. The 4% growth in automotive production in 2022 and the higher sensor fitment for Level 2-3 systems benefited their ADAS sales and Order Books.

- ZF achieved 33% growth in ADAS revenues in 2022 to Euro-2.4 Billion, from Euro-1.8B in 2021. ZF ranked 3rd in the Global ADAS Ranking by Revenues in 2021 from Auto2x with an 11% market share.

- Continental saw 23% growth in ADAS sales to Euro-2.1 Billion in 2022, from Euro-1.7B in 2021. ADAS accounted for 11% of Continental's Automotive revenues.

But major automotive suppliers face further transformation to develop capabilities in AI and software, expand into software business models and face new competition.

What challenges do automotive companies face in achieving Level 4 autonomy?

Automotive companies face several challenges in achieving Level 4 autonomy, including the need for advanced sensor technology and high-performance computing platforms to process vast amounts of data in real time.

Regulatory hurdles and safety standards must be navigated to ensure compliance and public acceptance of autonomous vehicles.

Significant investments, research and development, and partnerships are required to build the necessary infrastructure and technology ecosystem for successful deployment.

What risks do leading Automotive ADAS Suppliers face?

Suppliers face risks from increased competition, particularly from tech giants and emerging players that leverage AI and cloud technologies, potentially disrupting traditional supply chains.

The transformation of carmakers into mobility service providers pressures suppliers to adapt quickly to software-driven models, which may require significant investment and restructuring.

Additionally, the shift from hardware to software monetization poses challenges for suppliers reliant on traditional revenue streams, necessitating the refinement of their business strategies to remain competitive.

New opportunities in Autonomous Driving

Software-on-Wheels revolution will determine Mobility's future

Electrification, automated driving, shared mobility and connectivity push for more dedicated software development. A large part of hardware-oriented systems becomes more standardized and commoditized.

The growing number of ECUs with sophisticated software leads to significant cost increases, higher in-vehicle software complexity and constraints in optimising vehicular functions.

Next-generation Digital vehicles must integrate new, diverse technologies and complex logical operations; the hardware architecture has to support advanced software functionality and upgradability.

New partnerships and new business models are emerging.

What are some key new Software-driven features with high potential?

Software is the answer to the Digitization of the Automotive Industry but delivery is challenging.

Learn about top innovation clusters across major technological building blocks of SDVs.

- EE Architectures: Assess the roadmaps of leading carmakers and suppliers in the development of centralized architectures and their partnerships;

- Aptiv's Active Safety Domain Controller integrated by BMW,

- Visteon's Domain Controller SmartCore, launched by Mercedes Benz;

- zone-oriented control units (ZCUs), where the vehicle is divided into zones and each zone integrates into a zone-ECU (the sub-ECUs do not perform any processing to realize a vehicle function) e.g. Bosch's zone-oriented E/E architecture;

- cross-domain centralized units (CDCUs), where the functions of more than one domain are consolidated onto a single ECU (similar to the DCU's architecture) e.g. Bosch's vehicle-centralized ECU.

- CarOS: Learn about the rising adoption of Google's Android Automotive OS and the competitive offerings from MBUX and other players;

- Open-source software development

- Cloud: the emergence of automotive cloud as an enabler for cloud-based ADAS development, development of offerings from carmakers and the role of Microsoft, Amazon among others;

- Over-the-Air-updates and the opportunities for features-on-demand;

- Digital Twin

How could innovation in AI and cloud computing impact autonomous driving?

New technologies like AI and cloud computing are crucial for the future of autonomous driving as they enable advanced data processing, real-time decision-making, and scalable software updates.

AI enhances vehicle perception and autonomy through machine learning and in-car assistants, while cloud computing supports efficient feature development and system integration.

Together, they facilitate the transition to higher levels of automation and improve overall vehicle performance and safety.

The integration of AI and cloud computing will change the consumer experience in autonomous vehicles

Integrating AI and cloud computing will significantly enhance the consumer experience in autonomous vehicles by enabling personalized in-car services, such as tailored entertainment and real-time navigation assistance.

Cloud computing allows for continuous updates and feature enhancements, ensuring vehicles remain up-to-date with the latest technology and safety features.

Additionally, AI-powered virtual assistants can provide seamless interaction, improving convenience and overall satisfaction during travel.

How could new suppliers and Tech Giants disrupt major Tier-1s?

Traditional ADAS suppliers still maintain the lion's share in automotive supplier revenues. But they face competition from US, Chinese and other Tech giants who capitalize on their expertise in AI, Cloud and Software transforming automotive.

In the 2020s the vehicle's software value will exceed that of hardware as carmakers shift to more common platforms to achieve cost savings and existing players are forced to move away from vertically integrated, asset-heavy business models to compete with new entrants.

Software will be crucial for product differentiation such as new features, content, and new personalized experiences.

We have identified several opportunities for Tech Companies to enter or disrupt the existing supply chain.

- Next-gen Perception Hardware for Autonomous Driving

- Computing, e.g. Peta-ops chips for Autonomous Driving

"The computing power required for a

- Lv.2 vehicle is 10 TOPS (tera operations per second),

- Lv.4 exceeds 100 TOPS,

- Lv.5 vehicle will require a 1,000 TOPS computing processing power."

- AI: AI for Autonomy and HMI such as in-car AI assistants

- Data-based Business models such as in-car e-commerce

- 5G-6G, Connected Infrastructure and Smart Cities

- Autonomous Shared Mobility and autonomous deliveries

How can Suppliers stay competitive and gain competitive advantage?

What should suppliers do to stay relevant in autonomous driving, gain competitive advantage and market share?

Suppliers should invest in next-generation technologies, such as advanced perception hardware, AI, cloud computing to meet the evolving demands of autonomous driving.

Another important aspect is building competence in Autonomous Driving software and sensors needed by carmakers to develop higher autonomy.

They should also adapt their strategies to identify new revenue pools and collaborate with innovative partners to tap into high-growth opportunities.

By forming commercial and product development partnerships with volume carmakers to support their connected, electric and ADAS roadmaps. The AI and connectivity domains in the booming Chinese market are crucial for new AD Suppliers to claim market share from global Tier-1s.

Additionally, suppliers must continuously assess competition and enhance their product offerings to maintain a competitive edge in the market.

Finally, fuel investments in innovative technologies and business models incl. robotaxis, and last-mile delivery.

Recommendations for new market entrants

What are some key market entry strategies for new suppliers?

Key market entry strategies for new suppliers include forming strategic partnerships with established players, investing in innovative technologies, and focusing on niche markets within the autonomous driving sector.

Technologies with potential for entry include next-gen perception hardware, AI for autonomy, and advanced computing solutions.

- Lenovo has entered the AD-DC market as a Tier-1 Supplier with partnerships with NVIDIA and Valeo.

- Huawei supplies LIDAR and car networking to BAIC for L2+. Huawei has recently launched new products in Autonomous Driving focusing on ADAS sensors (4D imaging radar), HMI (AR-HUD) during their product launch titled 'Focused Innovation for Intelligent Vehicles'.

- Samsung Electronics will work together with Tesla to develop chips for their HW 4.0;

Which technologies show potential for them to enter and which countries?

Countries with promising opportunities for new suppliers include China, the USA, and in Europe, where demand for autonomous driving solutions is rapidly growing.

Table of Contents

1. Supplier Readiness in Level 4 Autonomous Driving

- 1. Methodology for the Supplier Readiness Level

- 2. Findings from the overall ranking of Readiness in Level 4-AD

- 3. Strategy Execution ranking summary

- 4. Technology Competitiveness ranking

- 5. Market Leadership ranking summary

- 6. Opportunities for ADAS-AD Suppliers

- 7. Opportunity Radar: rankings by Act, Prepare, Watch

- 8. Recommendations for incumbents and new market entrants

- 9. Gaps in the portfolios of Tier-1 Suppliers

- 10. Risks that threaten their leadership

2. Strategies and execution

- 1. Trends in Supplier ADAS-AD Strategy

- 2. Supplier roadmaps to Level 4-AD

- 3. R&D of Suppliers in 2023 to drive AD-SW

- 4. New Product Launches in 2024

- 5. Key collaborations in 2024

- 6. Strategies in AMOD (Automated-Mobility-on-Demand)

- 7. Suppliers of Level 3-4 Autonomous Driving Platforms

- 8. Investments in Autonomous Driving in 2024

- 9. New Business Models: SaaS, CaaS, DaaS, VaaS, Tier-X

- 10. Continental's Spin-off of the Automotive Segment

- 11. Lenovo's entry in the AD markets as a new DC Tier-1

- 12. Mobileye's Imaging Radar

- 13. Valeo's Brain segment

- 14. Qualcomm

- 15. AI Regulation and developments of Ethics

3. Technology Competitiveness

- 1. Ranking by Technology Competitiveness r

- 2. ADAS L0-L4 Feature Availability across major Tier-1 Suppliers

- 3. Sensor portfolio of leading Tier-1 Suppliers

- 4. ADAS Radar and Camera benchmarking

- 5. Next-generation radars, camera, lidar

- 6. Driver and passenger / occupant monitoring (DMS-OMS-PMS)

- 7. Rise of on-board vehicle Computing

- 8. Data recording for Level 3-4 Autonomous Driving

- 9. The evolution of E/E Architecture for connected and automated driving

- 10. Innovation in Software-Defined Vehicles (SDV)

- 11. Low-No Code solutions in ADAS and autonomy

- 12. Innovators in Patents, Intellectual Property and Scientific Literature

- 13. Future of ADAS features from Auto2x AD Radar

- 14. Generative AI and new applications in Autonomous Driving

- 15. Vehicle-to-Everything Communications (V2V, V2I, V2X)

3. Market Leadership and Positioning

- 1. Supplier Rankings by Automotive Revenue in 2023

- 2. Supplier Revenues by ADAS-Software divisions

- 3. Ranking of Suppliers by ADAS Revenues 2015-2023

- 4. Supplier market shares in 77GHz radar

- 5. China's strengths to become Top AD Hub

- 6. Rise of Level 2-ADAS in India

5. Opportunities in ADAS and Autonomous Driving for Suppliers

- 1. Rising ADAS sensor content

- 2. Sensor Forecast and TAM

- 3. Forecast of revenues from Lidar for L3/L4

- 4. Rising demand for SW for ADAS

- 5. (SDV) Software-Defined Vehicles

- 6. Subscriptions for ADAS

- 7. AMOD (Automated-Mobility-on-Demand)

- 8. Regulation for Level 3-4

- 9. CarMetaverse

- 10. Autonomous Deliveries

- 11. Insurance for Level 3-4 Automated Driving

- 12. Autonomous mining