|

市場調查報告書

商品編碼

1664197

飛彈炮台的全球市場(2025年~2035年)Global Missile Battery Market 2025-2035 |

||||||

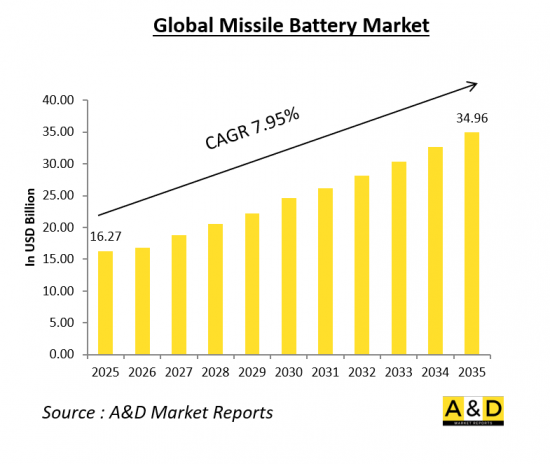

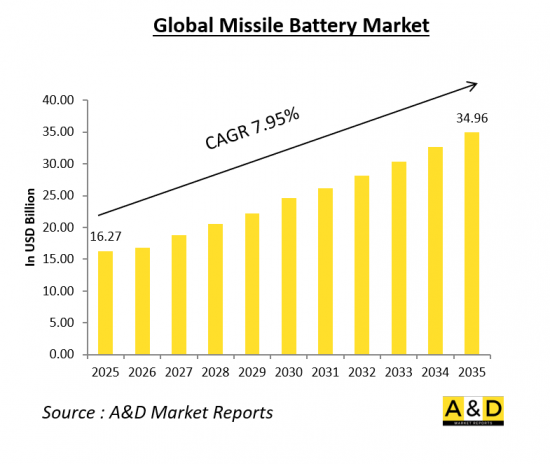

全球飛彈炮台市場規模預計將從 2025 年的 162.7 億美元增至 2035 年的 349.6 億美元,預測期內的複合年增長率為 7.95%。這一增長是由地緣政治緊張局勢加劇、軍事現代化活動增加以及全球導彈襲擊威脅日益加劇所推動的。飛彈發射裝置在空域防禦中發揮至關重要的作用,可以保護戰略資產和人口稠密地區免受彈道飛彈、巡航飛彈和無人機等空中威脅。技術進步和對飛彈防禦系統的持續投資進一步推動了市場擴張,鞏固了飛彈發射裝置作為現代防禦戰略的重要組成部分的地位。

飛彈炮台市場簡介

由於地緣政治緊張局勢加劇、國防預算增加以及飛彈系統的技術進步,飛彈炮台市場近年來顯著增長。飛彈發射裝置是現代防空和進攻能力的重要組成部分,使國家能夠有效地抵禦空中、海上和陸地威脅。這些系統廣泛應用於軍事應用,維護國家安全和戰略利益。全球對飛彈炮台的需求是由提高防禦能力以抵禦無人機(UAV)、巡航飛彈和高超音速武器等不斷演變的威脅的需求所推動的。此外,國防承包商和政府在開發下一代飛彈防禦系統方面加強合作,正在刺激市場擴張。

市場包括各種飛彈炮台系統,包括地對空飛彈(SAM)電池、彈道飛彈防禦系統和艦載飛彈發射器。主要國防製造商正在大力投資研發,以提高飛彈系統的準確性、射程和機動性。包括美國、中國、俄羅斯和歐洲國家在內的國防預算龐大的國家都在不斷升級其飛彈防禦基礎設施,以應對現代戰爭的新挑戰。各國為加強集體安全措施而建立的戰略聯盟和防禦協議進一步促進了這一增長。

飛彈炮台市場的關鍵推動因素

有幾個因素推動了飛彈炮台市場的成長。其中一個主要推動因素是飛彈襲擊和空戰威脅日益增加。各國正大力投資飛彈防禦系統,以保護其領土免受巡航飛彈、彈道飛彈和無人機等不斷演變的威脅。不斷升級的衝突和地緣政治緊張局勢進一步增加了對先進飛彈防禦解決方案的需求。

全球國防預算的增加也在飛彈炮台市場的擴張中發揮關鍵作用。為了維持軍事優勢,各國都優先投資於國防基礎設施的現代化。此外,分層防禦戰略(即同時部署多個飛彈防禦系統)的日益普及也推動了對先進飛彈防禦系統的需求。

非國家行為者和敵對國家之間的飛彈技術擴散增加了有效對策的必要性。世界各國政府都在積極尋求加強其飛彈防禦能力,以減輕裝備先進飛彈系統的對手所帶來的風險。這促使中國增加了對能夠抵禦一系列威脅的先進飛彈系統的採購。

國際防務合作和合資企業正在進一步刺激市場成長。兩國已建立戰略夥伴關係,利用共享的技術專長和資源來開發下一代飛彈系統。隨著各國尋求減少對外國國防供應商的依賴並加強國內製造能力,國內飛彈防禦計畫的發展也正在獲得動力。

對機動彈性飛彈防禦解決方案的需求日益增長,推動了可運輸飛彈發射裝置系統的發展。這些系統具有操作多功能性,能夠在各種作戰環境中快速部署。隨著軍事行動變得更加動態,對適應性強、可擴展的飛彈炮台解決方案的需求持續增長。

目錄

飛彈炮台市場報告定義

飛彈炮台市場區隔

各地區

各類型

各用途

今後10年的飛彈炮台市場分析

飛彈炮台市場市場技術

全球飛彈炮台市場預測

地區的飛彈炮台市場趨勢與預測

北美

促進因素,阻礙因素,課題

PEST

市場預測與情勢分析

主要企業

供應商層級狀況

企業基準

歐洲

中東

亞太地區

南美

飛彈炮台市場國的分析

美國

防衛計劃

最新消息

專利

這個市場上目前技術成熟度

市場預測與情勢分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

飛彈炮台市場機會矩陣

飛彈炮台市場報告相關專家的意見

結論

關於Aviation and Defense Market Reports

The global missile battery market is projected to grow from USD 16.27 billion in 2025 to USD 34.96 billion by 2035, at a Compound Annual Growth Rate (CAGR) of 7.95% over the forecast period. This growth is fueled by rising geopolitical tensions, increasing military modernization initiatives, and the expanding threat of missile attacks worldwide. Missile batteries play a vital role in airspace defense, safeguarding strategic assets and population centers against aerial threats such as ballistic missiles, cruise missiles, and unmanned aerial vehicles (UAVs). Advancements in technology and continued investments in missile defense systems further drive market expansion, solidifying missile batteries as essential components of modern defense strategies.

Introduction to Missile Battery Market

The missile battery market has witnessed significant growth in recent years due to rising geopolitical tensions, increasing defense budgets, and technological advancements in missile systems. Missile batteries serve as a critical component of modern air defense and offensive strike capabilities, providing nations with the ability to neutralize aerial, naval, and land-based threats effectively. These systems are widely used in military applications to safeguard national security and strategic interests. The global demand for missile batteries is driven by the need for improved defense capabilities against evolving threats such as unmanned aerial vehicles (UAVs), cruise missiles, and hypersonic weapons. Additionally, increasing collaborations between defense contractors and governments to develop next-generation missile defense systems are fueling market expansion.

The market includes a broad range of missile battery systems, including surface-to-air missile (SAM) batteries, ballistic missile defense systems, and shipborne missile launchers. Leading defense manufacturers are investing heavily in research and development (R&D) to enhance the precision, range, and maneuverability of missile systems. Nations with major defense budgets, such as the United States, China, Russia, and European countries, are continuously upgrading their missile defense infrastructure to address new challenges in modern warfare. This growth is further bolstered by strategic alliances and defense agreements among nations seeking to strengthen collective security measures.

Technology Impact in Missile Battery

The impact of technology on the missile battery market has been profound, with continuous innovations enhancing their effectiveness, reliability, and efficiency. One of the most significant advancements is the integration of artificial intelligence (AI) and machine learning (ML) to improve target acquisition and tracking capabilities. AI-driven systems enable missile batteries to identify and neutralize threats faster and with greater accuracy, reducing the reliance on human intervention. These intelligent systems also enhance predictive analytics, allowing operators to assess potential threats in real time.

Another major technological development is the incorporation of advanced propulsion systems that increase missile speed and maneuverability. The rise of hypersonic missile technology has necessitated the development of countermeasures capable of intercepting and neutralizing high-speed threats. Enhanced propulsion mechanisms, such as scramjet engines and solid-fuel boosters, are being implemented to extend the operational range and improve response times.

Additionally, modern missile battery systems are being integrated with network-centric warfare capabilities, enabling seamless communication between various defense platforms. Interoperability between missile batteries, radar systems, and command-and-control (C2) centers enhances situational awareness and improves response coordination. The development of modular and mobile missile batteries has also gained traction, allowing for rapid deployment and increased flexibility in combat scenarios.

Another key technological advancement is the use of directed energy weapons (DEWs) alongside missile batteries. Laser-based interception systems are being tested as a cost-effective alternative to traditional kinetic interceptors. These systems provide near-instantaneous engagement of threats and reduce reliance on expensive missile stockpiles. As nations continue to invest in cutting-edge defense technologies, the missile battery market is expected to evolve with enhanced capabilities to counter a broad spectrum of threats.

Key Drivers of Missile Battery Market

Several factors are driving the growth of the missile battery market. One of the primary drivers is the increasing threat of missile attacks and aerial warfare. Nations are investing heavily in missile defense systems to safeguard their territories against evolving threats such as cruise missiles, ballistic missiles, and UAVs. The growing number of conflicts and geopolitical tensions has further intensified the demand for advanced missile defense solutions.

Rising defense budgets worldwide have also played a crucial role in the expansion of the missile battery market. Countries are prioritizing investments in modernizing their defense infrastructure to maintain military superiority. Additionally, the increasing adoption of multi-layered defense strategies, which involve the deployment of multiple missile defense systems working in tandem, is driving demand for advanced missile batteries.

The proliferation of missile technology among non-state actors and adversarial nations has heightened the need for effective countermeasures. Governments are actively seeking to enhance their missile defense capabilities to mitigate the risks posed by hostile forces equipped with advanced missile systems. This has led to increased procurement of high-performance missile batteries capable of neutralizing a variety of threats.

International defense collaborations and joint ventures are further stimulating market growth. Countries are engaging in strategic partnerships to develop next-generation missile systems, leveraging shared technological expertise and resources. The development of indigenous missile defense programs is also gaining momentum, as nations seek to reduce reliance on foreign defense suppliers and enhance domestic manufacturing capabilities.

The rising demand for mobile and flexible missile defense solutions has led to the development of transportable missile battery systems. These systems provide operational versatility, allowing for rapid deployment in various combat environments. As military operations become more dynamic, the requirement for adaptable and scalable missile battery solutions continues to grow.

Regional Trends in Missile Battery Market

The missile battery market is witnessing varying trends across different regions, driven by distinct defense priorities and strategic interests.

In North America, the United States remains a dominant player in the missile battery market, driven by its extensive defense budget and continuous technological advancements. The U.S. military is heavily investing in next-generation missile defense systems, including hypersonic missile interceptors and AI-driven targeting solutions. The country is also focused on enhancing its homeland missile defense capabilities to counter potential threats from adversarial nations. Canada is also expanding its defense capabilities by collaborating with allied nations on missile defense initiatives.

In Europe, the ongoing security concerns related to Russia's military advancements have led to increased investments in missile defense systems. NATO member states are prioritizing missile battery acquisitions to bolster their defense against potential threats. European defense manufacturers are actively collaborating on missile defense projects, such as the development of new surface-to-air missile systems and radar-integrated interception platforms. Countries such as France, Germany, and the United Kingdom are enhancing their defense infrastructure to ensure strategic deterrence.

The Asia-Pacific region is experiencing significant growth in the missile battery market due to escalating territorial disputes and military modernization programs. Countries like China, India, Japan, and South Korea are investing heavily in missile defense technologies to counter regional threats. China's rapid advancements in hypersonic missile technology have prompted neighboring nations to strengthen their defensive capabilities. India is focusing on indigenously developed missile defense systems, such as the Akash and S-400, to bolster its national security. Japan and South Korea, in collaboration with the United States, are expanding their missile defense networks to enhance regional stability.

In the Middle East, the demand for missile battery systems is driven by ongoing conflicts and security challenges. Countries such as Saudi Arabia, the United Arab Emirates, and Israel are investing in advanced missile defense solutions to counter aerial threats, including ballistic missiles and drone attacks. Israel's Iron Dome and David's Sling missile defense systems have demonstrated effectiveness in intercepting incoming threats, setting a benchmark for regional missile defense initiatives.

Africa and Latin America are gradually expanding their missile defense capabilities, although at a slower pace compared to other regions. While defense budgets in these regions are relatively limited, select nations are investing in missile battery systems to enhance border security and counter emerging threats. Increased military cooperation with global defense suppliers is enabling these regions to acquire modern missile defense solutions.

Overall, the missile battery market is experiencing robust growth across multiple regions, fueled by technological advancements, increasing defense expenditures, and the need for enhanced security measures. As global security challenges continue to evolve, the demand for advanced and versatile missile battery systems is expected to remain strong.

Key Missile Battery Programs

Raytheon has secured a $208 million contract to equip Romania, a NATO member and Black Sea state, with mobile coastal anti-ship missile batteries, according to a Pentagon announcement on Thursday. In collaboration with Norwegian defense firm Kongsberg, Raytheon will supply Romania with an undisclosed number of Naval Strike Missile Coastal Defense Systems. The agreement has the potential to reach a total value of $217 million if all options are exercised. The majority of the work will be carried out in Norway and at Raytheon's facility in Tucson, Arizona, as stated in the announcement. Romania, which has a coastline extending over 100 miles along the Black Sea-home to Russia's Black Sea Fleet-is enhancing its coastal defense capabilities through this acquisition.

The Ministry of Defence signed a contract with BrahMos Aerospace Private Limited (BAPL) for the acquisition of Next Generation Maritime Mobile Coastal Batteries (Long Range) {NGMMCB (LR)} and BrahMos missiles. The deal, valued at over Rs 1,700 crore, falls under the Buy (Indian) category. The delivery of NGMMCBs is set to begin in 2027. These advanced coastal defense systems will be armed with supersonic BrahMos missiles, significantly strengthening the Indian Navy's multi-directional maritime strike capabilities.

Table of Contents

Missile Battery Market Report Definition

Missile Battery Market Segmentation

By Region

By Type

By Application

Missile Battery Market Analysis for next 10 Years

The 10-year missile battery market analysis would give a detailed overview of missile battery market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Missile Battery Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Missile Battery Market Forecast

The 10-yearmissile battery market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Missile Battery Market Trends & Forecast

The regional missile battery market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Missile Battery Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Missile Battery Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Missile Battery Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Missile Battery Market Forecast, 2025-2035

- Figure 2: Global Missile Battery Market Forecast, By Region, 2025-2035

- Figure 3: Global Missile Battery Market Forecast, By Type, 2025-2035

- Figure 4: Global Missile Battery Market Forecast, By Application, 2025-2035

- Figure 5: North America, Missile Battery Market, Market Forecast, 2025-2035

- Figure 6: Europe, Missile Battery Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Missile Battery Market, Market Forecast, 2025-2035

- Figure 8: APAC, Missile Battery Market, Market Forecast, 2025-2035

- Figure 9: South America, Missile Battery Market, Market Forecast, 2025-2035

- Figure 10: United States, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 11: United States, Missile Battery Market, Market Forecast, 2025-2035

- Figure 12: Canada, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Missile Battery Market, Market Forecast, 2025-2035

- Figure 14: Italy, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Missile Battery Market, Market Forecast, 2025-2035

- Figure 16: France, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 17: France, Missile Battery Market, Market Forecast, 2025-2035

- Figure 18: Germany, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Missile Battery Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Missile Battery Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Missile Battery Market, Market Forecast, 2025-2035

- Figure 24: Spain, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Missile Battery Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Missile Battery Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Missile Battery Market, Market Forecast, 2025-2035

- Figure 30: Australia, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Missile Battery Market, Market Forecast, 2025-2035

- Figure 32: India, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 33: India, Missile Battery Market, Market Forecast, 2025-2035

- Figure 34: China, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 35: China, Missile Battery Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Missile Battery Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Missile Battery Market, Market Forecast, 2025-2035

- Figure 40: Japan, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Missile Battery Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Missile Battery Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Missile Battery Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Missile Battery Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Missile Battery Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Missile Battery Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Missile Battery Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Missile Battery Market, By Type(Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Missile Battery Market, By Type(CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Missile Battery Market, By Application (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Missile Battery Market, By Application (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Missile Battery Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Missile Battery Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Missile Battery Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Missile Battery Market, By Region, 2025-2035

- Figure 58: Scenario 1, Missile Battery Market, By Type, 2025-2035

- Figure 59: Scenario 1, Missile Battery Market, By Application, 2025-2035

- Figure 60: Scenario 2, Missile Battery Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Missile Battery Market, By Region, 2025-2035

- Figure 62: Scenario 2, Missile Battery Market, By Type, 2025-2035

- Figure 63: Scenario 2, Missile Battery Market, By Application, 2025-2035

- Figure 64: Company Benchmark, Missile Battery Market, 2025-2035