|

市場調查報告書

商品編碼

1831816

海軍彈藥的全球市場:2025年~2035年Global Naval Ammunition Market 2025-2035 |

||||||

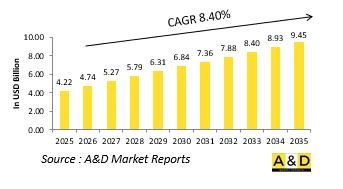

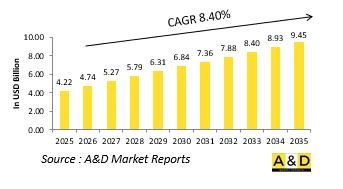

據估計,2025年全球海軍彈藥市場規模為42.2億美元,預計到2035年將增長至94.5億美元,2025年至2035年的複合年增長率(CAGR)為8.40%。

海軍彈藥市場簡介:

海軍彈藥市場是現代海戰的重要組成部分,為世界各國海軍艦隊的進攻和防禦能力提供支援。海軍彈藥涵蓋範圍廣泛,包括艦炮、飛彈、魚雷、深水炸彈和近程防禦武器系統(CIWS),每種彈藥都旨在應對水面、水下和空中領域的不同威脅。隨著海軍力量朝向多用途、多任務平台發展,對多功能、高精度、遠程彈藥的需求持續成長。海上力量在保護貿易航線、擴大影響力和確保國家安全方面的戰略重要性,提升了先進海軍彈藥的作用。這些武器不僅對常規海上作戰至關重要,而且對在爭議水域執行威懾、區域拒止和力量投射任務也不可或缺。向近岸作戰、反介入/區域拒絕戰略和一體化海上防禦的轉變,進一步拓展了海軍彈藥研發的範圍。現代海軍投入巨資提升彈藥的射程、精準度、殺傷力和適應性,以應對不斷演變的威脅,包括反艦飛彈、潛艇和集群攻擊。因此,海軍彈藥市場仍然是海上防禦現代化和戰略能力發展的關鍵驅動力。

科技對海軍彈藥市場的影響:

技術進步正在顯著改變海軍彈藥格局,推動射程、精準度、殺傷力和多功能性的提升。配備先進導引和導航系統的智慧彈藥能夠精確打擊移動和規避型目標,提高交戰成功率。推進劑和彈頭材料的創新提高了動能和穿透能力,同時減輕了重量並減少了儲存需求。可程式引信和多模式導引頭的整合使彈藥能夠動態適應各種目標類型,包括水面艦艇、飛機和潛水艇。電磁軌道炮技術和定向能武器的發展也影響未來海軍彈藥的研發,有望實現更遠的射程和更低的後勤負擔。此外,能夠接收來自指揮系統和無人平台即時更新的網路化彈藥,正在提升即時適應能力和任務效能。自動化裝填和火控系統簡化了彈藥操作,減輕了船員的工作負荷,提高了射速。此外,模組化彈藥設計增強了任務靈活性,使艦艇能夠根據具體的作戰需求量身定制有效載荷。這些技術進步正在重新定義海軍火力,確保現代艦隊擁有高強度、多域海上作戰所需的精確性、戰備性和韌性。

海軍彈藥市場的主要驅動因素:

海軍彈藥市場的成長受到多項戰略和作戰要務的驅動。地緣政治緊張局勢加劇和海上領域軍事化程度不斷提高,促使各國加強海軍攻防能力。遠洋海軍的擴張以及對海上控制、威懾和力量投射的日益重視,推動了水面作戰艦艇、潛艇和海岸防禦系統對先進彈藥的需求。多域作戰的轉變——海軍部隊必須應對來自空中、水面、水下和陸地平台的威脅——加速了多用途精確導引武器的研發。旨在用下一代武器系統升級現有海軍平台的現代化項目也在推動採購活動。此外,海軍演習、聯合行動和海上安全任務的日益頻繁,凸顯了可靠且可擴展的彈藥儲備的必要性。先進反艦飛彈、無人機群和隱形潛艦的擴散,進一步促使海軍投資研發更先進的防禦和攻擊性彈藥解決方案。此外,國防工業與研究機構之間的合作促進了技術創新,從而提高了彈藥的性能和成本效益。綜上所述,這些因素凸顯了海軍彈藥在確保海上優勢和維持海軍作戰準備方面的戰略重要性。

海軍彈藥市場區域趨勢:

海軍彈藥市場的區域動態受安全優先事項、海上戰略和國防現代化措施的影響。在北美,重點在於增強精確打擊能力和開發下一代彈藥,以支援航空母艦打擊群和遠徵艦隊。歐洲國家優先發展多用途彈藥,以加強聯盟框架內的集體海上防禦,並應對爭議水域日益頻繁的活動。亞太地區正經歷快速成長,其驅動力來自領土爭端、不斷擴大的海軍艦隊以及對反介入/區域拒止能力的追求。該地區各國正優先發展本土生產和技術合作,以增強自主能力和作戰彈性。在中東,隨著各國尋求保護戰略水道和近海基礎設施,海岸防禦和反艦能力正受到廣泛關注。拉丁美洲和非洲正逐步增加對經濟高效的海軍彈藥的採購,重點用於海上巡邏、反海盜和維護專屬經濟區安全。在各個地區,將智慧連網彈藥與先進感測器和目標瞄準系統結合的趨勢顯而易見,這反映了海上作戰向資訊驅動型作戰的更廣泛轉變。這一全球發展趨勢凸顯了海軍彈藥在塑造未來海上防禦能力方面持續且不斷擴大的作用。

主要國防海軍彈藥項目:

根據印度政府的 "自力更生印度" (Atmanirbhar Bharat)倡議,印度政府與位於塔那的中小微型企業Suryadipta Projects Pvt Ltd公司簽署了一份建造和交付11艘彈藥運輸船的合約。該系列第二艘駁船LSAM 16(126號船廠)於2023年9月6日交付印度海軍,印度海軍參謀長(首席執行官)MV MV Raj Krishna出席了交付儀式。該駁船依照印度船級社(IRS)船舶入級標準建造,設計使用壽命為30年。所有主要和輔助系統均採購自國內製造商,這充分體現了印度國防部 "印度製造" 倡議的成效。 ACTCM駁船的引進將使海軍艦艇在碼頭和外港之間有效率地進行彈藥及其他物資的運輸、裝卸,從而顯著提升印度海軍的作戰能力。

目錄

海軍彈藥市場- 目錄

海軍彈藥市場報告定義

海軍彈藥市場區隔

各類型

各技術

各地區

按口徑

未來十年海軍彈藥市場分析

這份未來十年的海軍彈藥市場分析報告詳細概述了海軍彈藥市場的成長、發展趨勢、技術應用情況以及整體市場吸引力。

海軍彈藥市場技術

本部分涵蓋預計將影響該市場的十大技術及其對整體市場的潛在影響。

全球海軍彈藥市場預測

以上各部分詳細闡述了該市場未來十年的海軍彈藥市場預測。

按地區劃分的海軍彈藥市場趨勢與預測

本部分涵蓋區域海軍彈藥市場的趨勢、驅動因素、限制因素和挑戰,以及政治、經濟、社會和技術因素。此外,也詳細包含了區域市場預測和情境分析。最終的區域分析包括主要公司概況、供應商格局分析和公司基準分析。目前市場規模是基於 "一切照舊" 情境估算的。

北美

促進因素,阻礙因素,課題

PEST

市場預測與Scenario分析

主要企業

供應商階層的形勢

企業基準

歐洲

中東

亞太地區

南美

海軍彈藥市場各國分析

本章涵蓋該市場的主要國防項目以及最新的市場新聞和專利申請。此外,本章也提供未來十年各國的市場預測和情境分析。

美國

防衛計劃

最新消息

專利

這個市場上目前技術成熟度

市場預測與Scenario分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

海軍彈藥市場機會矩陣

機會矩陣幫助讀者了解該市場中高機會細分領域。

關於海軍彈藥市場報告的專家意見

我們提供關於該市場分析潛力的專家意見。

結論

關於航空與國防市場報告

The Global Naval Ammunition market is estimated at USD 4.22 billion in 2025, projected to grow to USD 9.45 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.40% over the forecast period 2025-2035.

Introduction to Naval Ammunition Market:

The defense naval ammunition market is a critical component of modern maritime warfare, underpinning the offensive and defensive capabilities of naval fleets worldwide. Naval ammunition encompasses a wide range of munitions, including naval gun shells, missiles, torpedoes, depth charges, and close-in weapon system (CIWS) rounds, each designed to address different threats across surface, subsurface, and aerial domains. As naval forces evolve into multi-role, multi-mission platforms, the demand for versatile, high-precision, and long-range ammunition continues to grow. The strategic importance of sea power in safeguarding trade routes, projecting influence, and ensuring national security has elevated the role of advanced naval munitions. These weapons are vital not only for conventional naval engagements but also for deterrence, area denial, and power projection missions in contested maritime zones. The shift towards littoral operations, anti-access/area denial strategies, and integrated maritime defense has further expanded the scope of naval ammunition development. Modern navies are investing heavily in enhancing their munitions' range, accuracy, lethality, and adaptability, ensuring they remain prepared to counter evolving threats such as anti-ship missiles, submarines, and swarm attacks. Consequently, the naval ammunition market remains a cornerstone of maritime defense modernization and strategic capability development.

Technology Impact in Naval Ammunition Market:

Technological advancements are significantly transforming the naval ammunition landscape, driving improvements in range, precision, lethality, and versatility. Smart ammunition equipped with advanced guidance and navigation systems is enabling highly accurate targeting against moving and evasive threats, thereby enhancing engagement success rates. Innovations in propellants and warhead materials are increasing kinetic energy and penetration capabilities while reducing weight and storage requirements. The integration of programmable fuzes and multi-mode seekers is allowing ammunition to adapt dynamically to different target types, including surface vessels, aircraft, and submarines. Advances in electromagnetic railgun technology and directed-energy weapons are also influencing future naval ammunition development, promising extended range and reduced logistical burdens. Additionally, network-enabled munitions capable of receiving mid-course updates from command systems or unmanned platforms are improving real-time adaptability and mission effectiveness. Automation in loading and fire control systems is streamlining ammunition handling, reducing crew workload, and increasing firing rates. Furthermore, modular ammunition designs are enhancing mission flexibility, enabling ships to tailor their payloads to specific operational needs. These technological breakthroughs are redefining naval firepower, ensuring that modern fleets are equipped with the precision, responsiveness, and resilience required for high-intensity and multi-domain maritime operations.

Key Drivers in Naval Ammunition Market:

The growth of the naval ammunition market is driven by several strategic and operational imperatives. Rising geopolitical tensions and the increasing militarization of maritime zones are prompting nations to strengthen their naval strike and defensive capabilities. The expansion of blue-water navies and growing emphasis on sea control, deterrence, and power projection are fueling demand for advanced ammunition across surface combatants, submarines, and coastal defense systems. The shift towards multi-domain operations, where naval forces must counter threats from air, surface, subsurface, and land-based platforms, is accelerating the development of versatile and precision-guided munitions. Modernization programs focused on upgrading legacy naval platforms with next-generation weapons systems are also driving procurement activity. Additionally, the increasing frequency of naval exercises, joint operations, and maritime security missions is highlighting the need for reliable, scalable ammunition stocks. The proliferation of advanced anti-ship missiles, drone swarms, and stealth submarines is further pushing navies to invest in more sophisticated defensive and offensive ammunition solutions. Furthermore, collaboration between defense industries and research institutions is fostering innovation, leading to enhanced munitions performance and cost-efficiency. Collectively, these factors underscore the strategic importance of naval ammunition in ensuring maritime superiority and sustaining naval operational readiness.

Regional Trends in Naval Ammunition Market:

Regional dynamics in the naval ammunition market are shaped by distinct security priorities, maritime strategies, and defense modernization efforts. In North America, investments focus on enhancing precision strike capabilities and developing next-generation munitions to support carrier strike groups and expeditionary fleets. European nations are prioritizing multi-role ammunition to strengthen collective maritime defense under alliance frameworks and respond to increasing activities in contested waters. The Asia-Pacific region is witnessing rapid growth, driven by territorial disputes, expanding naval fleets, and the pursuit of anti-access and area-denial capabilities. Nations in this region are emphasizing both indigenous production and technology partnerships to enhance self-reliance and operational flexibility. In the Middle East, coastal defense and anti-ship capabilities are receiving significant attention as countries seek to protect strategic waterways and offshore infrastructure. Latin America and Africa are gradually increasing procurement of cost-effective naval munitions, focusing on maritime patrol, counter-piracy, and exclusive economic zone security. Across all regions, there is a clear trend toward integrating smart, networked ammunition with advanced sensor and targeting systems, reflecting the broader shift toward information-driven naval warfare. This global evolution highlights the enduring and expanding role of naval ammunition in shaping future maritime defense capabilities.

Key Defense Naval Ammunition Program:

A contract for the construction and delivery of eleven ammunition barges was signed with M/s Suryadipta Projects Pvt Ltd, Thane an MSME in alignment with the Government of India's Atmanirbhar Bharat initiative. The second barge in the series, LSAM 16 (Yard 126), was handed over to the Indian Navy on 06 September 2023 in the presence of Cmde MV Raj Krishna, CoY (Mbi). Built under the classification standards of the Indian Register of Shipping (IRS), the barge is designed for a service life of 30 years. Featuring major and auxiliary systems sourced entirely from domestic manufacturers, it stands as a strong example of the Ministry of Defence's Make in India efforts. The induction of the ACTCM barge will significantly enhance the Indian Navy's operational capabilities by enabling efficient transportation, embarkation, and disembarkation of ammunition and other materials to naval ships, both at jetties and in outer harbours.

Table of Contents

Naval Ammunition Market - Table of Contents

Naval Ammunition Market Report Definition

Naval Ammunition Market Segmentation

By Type

By Technology

By Region

By Caliber

Naval Ammunition Market Analysis for next 10 Years

The 10-year naval ammunition market analysis would give a detailed overview of naval ammunition market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Naval Ammunition Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Naval Ammunition Market Forecast

The 10-year naval ammunition market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Naval Ammunition Market Trends & Forecast

The regional naval ammunition market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Naval Ammunition Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Naval Ammunition Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Naval Ammunition Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Caliber, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Caliber, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Naval Ammunition Market Forecast, 2025-2035

- Figure 2: Global Naval Ammunition Market Forecast, By Region, 2025-2035

- Figure 3: Global Naval Ammunition Market Forecast, By Caliber, 2025-2035

- Figure 4: Global Naval Ammunition Market Forecast, By Type, 2025-2035

- Figure 5: North America, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 6: Europe, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 8: APAC, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 9: South America, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 10: United States, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 11: United States, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 12: Canada, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 14: Italy, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 16: France, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 17: France, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 18: Germany, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 24: Spain, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 30: Australia, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 32: India, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 33: India, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 34: China, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 35: China, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 40: Japan, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Naval Ammunition Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Naval Ammunition Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Naval Ammunition Market, By Caliber (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Naval Ammunition Market, By Caliber (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Naval Ammunition Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Naval Ammunition Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Naval Ammunition Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Naval Ammunition Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Naval Ammunition Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Naval Ammunition Market, By Region, 2025-2035

- Figure 58: Scenario 1, Naval Ammunition Market, By Caliber, 2025-2035

- Figure 59: Scenario 1, Naval Ammunition Market, By Type, 2025-2035

- Figure 60: Scenario 2, Naval Ammunition Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Naval Ammunition Market, By Region, 2025-2035

- Figure 62: Scenario 2, Naval Ammunition Market, By Caliber, 2025-2035

- Figure 63: Scenario 2, Naval Ammunition Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Naval Ammunition Market, 2025-2035