|

市場調查報告書

商品編碼

1490824

世界裝甲車市場(2024-2034)Global Armored vehicles market 2024-2034 |

||||||

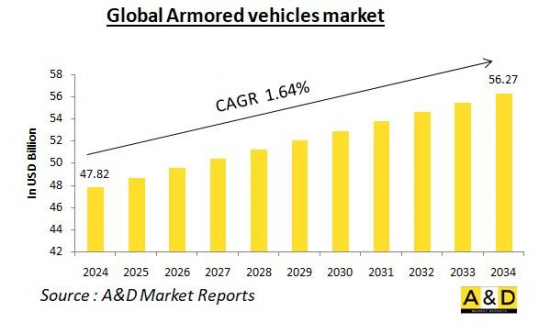

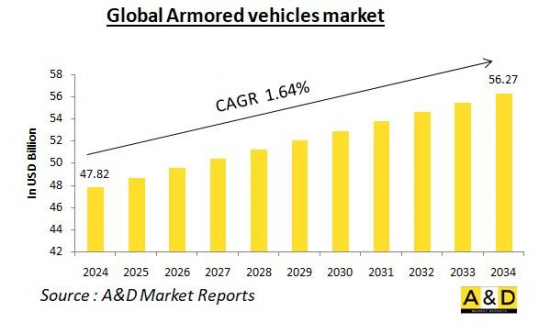

根據預測,2024年全球裝甲車市場規模為478.2億美元,到2034年將成長至562.7億美元,2024-2034年預測期間複合年增長率(CAGR)為1.64%。

裝甲車市場概況

近年來,在全球安全疑慮加劇和地緣政治緊張局勢的背景下,全球裝甲車市場經歷了顯著增長。裝甲車輛包括坦克、步兵戰車、裝甲運兵車、防雷防伏車輛等,在現代軍事行動和執法中發揮重要作用。這些車輛旨在為軍事和安全人員提供增強的保護、機動性和火力,使其在各種衝突和高風險場景中發揮重要作用。對先進國防裝備的需求不斷增長以及各國政府對其軍事武庫現代化的持續努力推動了市場擴張。

科技對裝甲車市場的影響

技術進步正在對裝甲車市場產生重大影響,重塑裝甲車的設計、功能和作戰能力。現代裝甲車越來越多地採用主動防護系統(APS)、自動駕駛能力和先進通訊系統等尖端技術。主動保護系統透過在威脅影響車輛之前檢測並消除它們來提高車輛的生存能力。自動駕駛技術,包括半自動和全自動駕駛系統,可提高操作效率並降低危險環境中人員的風險。此外,先進通訊和資料共享系統的整合可確保戰場上的無縫協調和態勢感知,從而顯著提高軍事行動的有效性。

裝甲車市場的關鍵驅動因素

幾個主要驅動因素正在推動全球裝甲車市場的成長。關鍵驅動因素之一是主要國家為滿足加強國家安全和國防能力的需求而增加國防預算。美國、中國和俄羅斯等國正在大力投資以實現其軍事武庫的現代化,包括購買先進的裝甲車。此外,不對稱戰爭和恐怖主義的興起增加了世界各地執法機構和軍隊對裝甲車的需求。對能夠在不同地形和條件下有效運行的車輛的需求,加上對士兵保護和生存能力的日益重視,正在進一步推動市場擴張。此外,國際維和行動和人道主義幹預的增加需要部署裝甲車以確保這些行動的安全和成功。

裝甲車市場的區域趨勢

裝甲車市場的地區趨勢差異很大,反映了每個地區獨特的安全問題、防禦策略和經濟實力。在北美,美國佔據市場主導地位,大力投資國防技術並專注於維持軍事優勢。美國國防部繼續優先考慮先進裝甲車的開發和採購,以應對新出現的威脅並加強戰備。受北約成員國國防開支增加以及德國、法國和英國等主要國家正在進行的現代化計劃的推動,歐洲也是一個重要的市場。這些國家正在投資下一代裝甲車,以取代老化車輛並增強防禦能力。

在亞太地區,由於中國、印度和韓國等國家國防開支增加,裝甲車市場正經歷快速成長。該地區的戰略競爭,特別是南海和朝鮮半島的領土爭端,促使人們對軍事準備和購買先進防禦裝備的興趣日益濃厚。特別是,作為更廣泛的軍事現代化努力的一部分,中國正在擴大其裝甲車隊伍。同樣,印度正在投資對其裝甲車進行現代化改造,以加強其邊境安全和反恐能力。

中東和非洲也是裝甲車的重要市場,受到持續衝突、國內安全課題以及打擊叛亂和恐怖主義的需要的影響。沙烏地阿拉伯、阿聯酋和以色列等國家是中東市場的主要參與者,正在投資先進裝甲車以增強其防禦能力。在非洲,解決區域衝突、叛亂和維和任務的需求推動了對裝甲車的需求。這些地區的政府和安全部隊越來越依賴裝甲車來確保人員安全和在動盪環境中的行動成功。

全球裝甲車市場的特點是動態成長和顯著的地區差異,受到技術進步、防禦戰略和安全課題的影響。隨著各國繼續優先考慮國家安全和軍事現代化,對先進裝甲車的需求預計將保持強勁,進一步刺激這一關鍵領域的創新和發展。

裝甲車市場的關鍵項目

BAE Systems 已獲得價值 7.54 億美元的合同,繼續生產美國陸軍的多用途裝甲車 (AMPV),全面生產進入第二階段。

Battelle 已被 SOCOM(美國特種作戰司令部)選中,根據價值高達 3.5 億美元的新七年合約繼續供應非標準商用車輛 (NSCV)。這項獨家綜合協議允許SOCOM向Battelle訂購裝甲車。

本報告分析了全球裝甲車市場,研究了整體市場規模的趨勢、依地區和國家劃分的詳細趨勢、關鍵技術概述和市場機會。

目錄

裝甲車市場:報告定義

裝甲車市場細分

- 依地區

- 依類型

- 依流動性

- 依組件

裝甲車市場分析(未來10年)

裝甲車市場的市場技術

全球裝甲車市場預測

裝甲車市場:依地區劃分的趨勢和預測

- 北美

- 促進/抑制因素和課題

- PEST分析

- 市場預測與情境分析

- 大公司

- 供應商層級狀況

- 企業標竿管理

- 歐洲

- 中東

- 亞太地區

- 南美洲

裝甲車市場:國家分析

- 美國

- 防禦計劃

- 最新趨勢

- 專利

- 該市場目前的技術成熟度水平

- 市場預測與情境分析

- 加拿大

- 義大利

- 法國

- 德國

- 荷蘭

- 比利時

- 西班牙

- 瑞典

- 希臘

- 澳大利亞

- 南非

- 印度

- 中國

- 俄羅斯

- 韓國

- 日本

- 馬來西亞

- 新加坡

- 巴西

裝甲車市場:市場機會矩陣

裝甲車市場:專家分析觀點

結論

關於Aviation and Defense Market Reports

The global Armored Vehicles market is estimated at USD 47.82 billion in 2024, projected to grow to USD 56.27 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 1.64% over the forecast period 2024-2034.

Introduction to Armored Vehicles Market

The global armored vehicles market has witnessed significant growth in recent years, driven by increasing security concerns and geopolitical tensions worldwide. Armored vehicles, which include tanks, infantry fighting vehicles, armored personnel carriers, and mine-resistant ambush-protected vehicles, play a crucial role in modern military operations and law enforcement. These vehicles are designed to provide enhanced protection, mobility, and firepower to troops and security personnel, making them indispensable in various conflict and high-risk scenarios. The market's expansion is fueled by the rising demand for advanced defense equipment and the continuous efforts by governments to modernize their military forces.

Technology impact in Armored Vehicles Market

Technological advancements have had a profound impact on the armored vehicles market, reshaping the design, functionality, and operational capabilities of these machines. Modern armored vehicles are increasingly incorporating cutting-edge technologies such as active protection systems (APS), autonomous driving capabilities, and advanced communication systems. Active protection systems enhance vehicle survivability by detecting and neutralizing incoming threats before they impact the vehicle. Autonomous driving technologies, including semi-autonomous and fully autonomous systems, improve operational efficiency and reduce the risk to personnel in hazardous environments. Moreover, the integration of sophisticated communication and data-sharing systems ensures seamless coordination and situational awareness in the battlefield, significantly enhancing the effectiveness of military operations.

Key Drivers in Armored Vehicles Market

Several key drivers are propelling the growth of the global armored vehicles market. One of the primary drivers is the escalating defense budgets of major economies, driven by the need to enhance national security and defense capabilities. Countries such as the United States, China, and Russia are heavily investing in the modernization of their military fleets, including the acquisition of advanced armored vehicles. Additionally, the increasing incidence of asymmetric warfare and terrorism has heightened the demand for armored vehicles among law enforcement agencies and military forces worldwide. The need for vehicles that can operate effectively in diverse terrains and conditions, coupled with the growing emphasis on soldier protection and survivability, further drives the market's expansion. Furthermore, the rise in international peacekeeping missions and humanitarian interventions necessitates the deployment of armored vehicles to ensure the safety and success of these operations.

Regional Trends in Armored Vehicles Market

Regional trends in the armored vehicles market vary significantly, reflecting the unique security concerns, defense strategies, and economic capabilities of different regions. In North America, the United States dominates the market, with substantial investments in defense technology and a strong focus on maintaining military superiority. The U.S. Department of Defense continues to prioritize the development and procurement of advanced armored vehicles to address emerging threats and enhance combat readiness. Europe also represents a significant market, driven by increased defense spending among NATO members and the ongoing modernization programs of key countries like Germany, France, and the United Kingdom. These nations are investing in next-generation armored vehicles to replace aging fleets and strengthen their defense capabilities.

In the Asia-Pacific region, the armored vehicles market is experiencing rapid growth, driven by the rising defense expenditures of countries such as China, India, and South Korea. The strategic competition in the region, particularly the territorial disputes in the South China Sea and the Korean Peninsula, has led to a heightened focus on military preparedness and the acquisition of advanced defense equipment. China, in particular, has been expanding its armored vehicle fleet as part of its broader military modernization efforts. Similarly, India is investing in modernizing its armored vehicles to enhance its border security and counter-terrorism capabilities.

The Middle East and Africa also represent important markets for armored vehicles, influenced by ongoing conflicts, internal security challenges, and the need to counter insurgencies and terrorism. Countries such as Saudi Arabia, the United Arab Emirates, and Israel are key players in the Middle Eastern market, investing in advanced armored vehicles to bolster their defense capabilities. In Africa, the demand for armored vehicles is driven by the need to address regional conflicts, insurgencies, and peacekeeping missions. Governments and security forces in these regions are increasingly relying on armored vehicles to ensure the safety of personnel and the success of operations in volatile environments.

The global armored vehicles market is characterized by dynamic growth and significant regional variations, influenced by technological advancements, defense strategies, and security challenges. As countries continue to prioritize national security and military modernization, the demand for advanced armored vehicles is expected to remain robust, driving further innovation and development in this critical sector.

Key Armored Vehicles Market Programs

BAE Systems has secured a $754-million contract to continue producing the US Army's Armored Multi-Purpose Vehicles (AMPVs), moving the full-rate production into its second phase.

Battelle has been chosen by SOCOM to continue supplying Non-Standard Commercial Vehicles (NSCVs) under a new seven-year contract with a $350 million cap. This exclusive overarching contract permits SOCOM to place armored vehicle orders with Battelle.

Table of Contents

Armored Vehicle Market Report Definition

Armored Vehicle Market Segmentation

By Region

By Type

By Mobility

By Components

Armored Vehicle Market Analysis for next 10 Years

The 10-year armored vehicle market analysis would give a detailed overview of armored vehicle market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Armored Vehicle Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Armored Vehicle Market Forecast

The 10-year armored vehicle market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Armored Vehicle Market Trends & Forecast

The regional armored vehicle market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Armored Vehicle Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Armored Vehicle Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Armored Vehicle Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Type, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Mobility, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By Components, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Type, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Mobility, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By Components, 2022-2032

List of Figures

- Figure 1: Global Armored Vehicle Forecast, 2022-2032

- Figure 2: Global Armored Vehicle Forecast, By Region, 2022-2032

- Figure 3: Global Armored Vehicle Forecast, By Type, 2022-2032

- Figure 4: Global Armored Vehicle Forecast, By Mobility, 2022-2032

- Figure 5: Global Armored Vehicle Forecast, By Components, 2022-2032

- Figure 6: North America, Armored Vehicle, Market Forecast, 2022-2032

- Figure 7: Europe, Armored Vehicle, Market Forecast, 2022-2032

- Figure 8: Middle East, Armored Vehicle, Market Forecast, 2022-2032

- Figure 9: APAC, Armored Vehicle, Market Forecast, 2022-2032

- Figure 10: South America, Armored Vehicle, Market Forecast, 2022-2032

- Figure 11: United States, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 12: United States, Armored Vehicle, Market Forecast, 2022-2032

- Figure 13: Canada, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 14: Canada, Armored Vehicle, Market Forecast, 2022-2032

- Figure 15: Italy, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 16: Italy, Armored Vehicle, Market Forecast, 2022-2032

- Figure 17: France, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 18: France, Armored Vehicle, Market Forecast, 2022-2032

- Figure 19: Germany, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 20: Germany, Armored Vehicle, Market Forecast, 2022-2032

- Figure 21: Netherlands, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Armored Vehicle, Market Forecast, 2022-2032

- Figure 23: Belgium, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 24: Belgium, Armored Vehicle, Market Forecast, 2022-2032

- Figure 25: Spain, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 26: Spain, Armored Vehicle, Market Forecast, 2022-2032

- Figure 27: Sweden, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 28: Sweden, Armored Vehicle, Market Forecast, 2022-2032

- Figure 29: Brazil, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 30: Brazil, Armored Vehicle, Market Forecast, 2022-2032

- Figure 31: Australia, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 32: Australia, Armored Vehicle, Market Forecast, 2022-2032

- Figure 33: India, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 34: India, Armored Vehicle, Market Forecast, 2022-2032

- Figure 35: China, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 36: China, Armored Vehicle, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Armored Vehicle, Market Forecast, 2022-2032

- Figure 39: South Korea, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 40: South Korea, Armored Vehicle, Market Forecast, 2022-2032

- Figure 41: Japan, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 42: Japan, Armored Vehicle, Market Forecast, 2022-2032

- Figure 43: Malaysia, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Armored Vehicle, Market Forecast, 2022-2032

- Figure 45: Singapore, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 46: Singapore, Armored Vehicle, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Armored Vehicle, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Armored Vehicle, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Armored Vehicle, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Armored Vehicle, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Armored Vehicle, By Type (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Armored Vehicle, By Type (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Armored Vehicle, By Mobility (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Armored Vehicle, By Mobility (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Armored Vehicle, By Components (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Armored Vehicle, By Components (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Armored Vehicle, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Armored Vehicle, Global Market, 2022-2032

- Figure 59: Scenario 1, Armored Vehicle, Total Market, 2022-2032

- Figure 60: Scenario 1, Armored Vehicle, By Region, 2022-2032

- Figure 61: Scenario 1, Armored Vehicle, By Type, 2022-2032

- Figure 62: Scenario 1, Armored Vehicle, By Mobility, 2022-2032

- Figure 63: Scenario 1, Armored Vehicle, By Components, 2022-2032

- Figure 64: Scenario 2, Armored Vehicle, Total Market, 2022-2032

- Figure 65: Scenario 2, Armored Vehicle, By Region, 2022-2032

- Figure 66: Scenario 2, Armored Vehicle, By Type, 2022-2032

- Figure 67: Scenario 2, Armored Vehicle, By Mobility, 2022-2032

- Figure 68: Scenario 2, Armored Vehicle, By Components, 2022-2032

- Figure 69: Company Benchmark, Armored Vehicle, 2022-2032