|

市場調查報告書

商品編碼

1493823

全球主動保護系統市場(2024-2034)Global Active Protection System Market 2024-2034 |

||||||

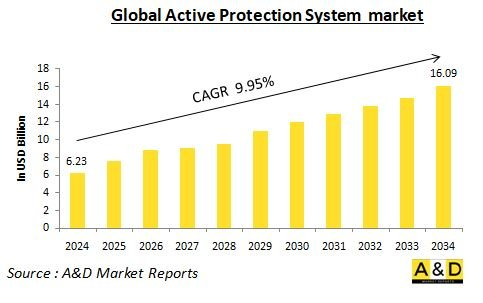

到2024 年,全球主動防護系統市場預計將達到62.3 億美元,在預測期內(2024-2034 年)複合年增長率為9.95%,到2034 年將達到160.9 億美元。 。

主動保護系統市場概覽

主動防護系統 (APS) 市場是國防工業中快速成長的一個領域,受到對先進軍事艦隊不斷增長的需求以及增強態勢感知和防護的需求的推動。主動防護系統旨在偵測和消除來自反坦克飛彈、火箭和其他彈體的威脅。該系統通常安裝在裝甲車、船艦和飛機上,以提高生存能力和戰鬥力。由於地緣政治緊張局勢加劇以及對先進軍事能力的需求,全球 APS 市場預計在未來幾年將大幅成長。

科技對主動防護系統市場的影響

在各個技術領域的不斷進步的推動下,主動保護系統 (APS) 市場正在經歷顯著增長。這些進步直接轉化為 APS 系統功能的增強和效率的提高。

射頻 (RF) 技術在 APS 功能中發揮重要作用。透過利用先進的射頻技術,這些系統可以更準確地偵測和追蹤傳入的威脅。這些改進使得能夠在威脅到達目標之前做出更有效的回應並及時消除威脅。

紅外線(IR)技術是APS技術的另一個基礎。現代紅外線系統更擅長偵測和追蹤傳入威脅的熱特性。這種增強的偵測能力為部署對策提供了寶貴的時間,大大提高了 APS 系統的整體效率。

最後,光電 (EO) 技術允許 APS 系統追蹤傳入威脅的視覺特徵,增加了另一層偵測。 EO 技術的進步提高了影像解析度和處理能力,從而可以更準確地識別威脅並更快地做出回應。 RF、IR 和 EO 技術的綜合功能可針對各種威脅提供強大的保護,鞏固 APS 系統作為現代防禦策略不可或缺的一部分的地位。

主動防護系統市場的主要驅動因素

APS市場的主要驅動因素是對先進軍事艦隊不斷增長的需求。這一需求是由地緣政治緊張局勢加劇以及增強態勢感知和保護的需求所推動的。市場也受到對具有成本效益的解決方案的需求的推動,這些解決方案可以在不影響車輛或平台性能的情況下提供增強的保護。由於幾個關鍵因素,主動保護系統(APS)市場正在經歷快速成長。主要因素之一是戰爭中日益加劇的不對稱性。隨著非國家行為者可以獲得強大的反戰車武器,軍隊需要為其裝甲車提供強有力的保護。乘員安全也是一個重要的驅動因素。現代軍隊將確保其成員的安全放在首位。 APS 顯著提高了裝甲車輛和人員的生存能力,最大限度地減少傷亡並確保任務成功。技術進步也發揮重要作用。隨著 APS 技術的成熟和價格的降低,其採用率預計會增加。小型化和降低功耗等領域的進步可能會使 APS 與更廣泛的平台相容。最後,國防預算的增加正在推動市場成長。地緣政治緊張局勢和區域衝突正在推動全球國防開支的增加。各國政府正在為先進武器和部隊保護措施(包括 APS)分配更多資源。這些因素結合在一起,使得主動防護系統市場蓬勃發展。

主動保護系統市場的區域趨勢

儘管APS市場是一個全球性產業,但也存在主要的區域趨勢。由於中國、印度和韓國等國家軍費開支增加以及對先進軍事能力的需求,預計亞太地區將成為 APS 系統快速成長的市場。歐洲市場預計將受到軍事艦隊現代化和更新計畫的推動,特別是在英國、法國和德國等國家。北美市場預計將受到正在進行的軍事現代化和更新計劃的推動,特別是在美國。中東市場預計將受到沙烏地阿拉伯、阿拉伯聯合大公國和以色列等國持續衝突以及增強軍事能力的需求的推動。

主動防護系統主要程式

義大利Leonardo宣佈成功測試了適用於坦克和裝甲運兵車等軍用車輛的新型尖端主動防護系統 (APS) 解決方案。這種創新策略被稱為 MIPS(模組化整合保護系統),結合了多層電子和物理保護技術,為車輛人員提供了強大的防禦牆。為了響應英國陸軍的伊卡洛斯計劃,與 Abstract Solutions、CGI、Frazer-Nash、Lockheed Martin UK、RBSL、Roke 和 Ultra Electronics 合作創建了新的 MIPS(模組化整合保護系統)。現代戰場武器系統的有效性和複雜性不斷發展,使得陸地裝甲車輛及其人員更容易受到這些危險的影響。

Raphael宣佈英國國防部已為裝甲車採用輕型版 Trophy 主動防護系統 (APS)。 APS將在課題者3的主戰坦克中進行整合和更新。英國國防部對 Trophy MV 的選擇進行了一項研究,這是課題者 3 專案的主要承包商萊茵金屬 BAE 系統土地公司領導的專案更新的一部分。 Trophy MV 現在將安裝在 Challenger 3 上,以進行詳細的整合和系統測試。

本報告分析了全球主動保護系統市場,並探討了整體市場規模的前景、依地區和國家劃分的詳細趨勢、關鍵技術概述以及市場機會。

目錄

主動保護系統市場:報告定義

主動防護系統市場區隔

- 依地區

- 依平台

- 依類型

主動保護系統市場分析(未來10年)

主動防護系統市場的市場技術

全球主動防護系統市場預測

主動保護系統市場:區域趨勢與預測

- 北美

- 促進/抑制因素和課題

- PEST分析

- 市場預測與情境分析

- 主要公司

- 供應商層級狀況

- 企業基準比較

- 歐洲

- 中東

- 亞太地區

- 南美洲

主動保護系統市場:國家分析

- 美國

- 防禦規劃

- 最新趨勢

- 專利

- 該市場目前的技術成熟度水平

- 市場預測與情境分析

- 加拿大

- 義大利

- 法國

- 德國

- 荷蘭

- 比利時

- 西班牙

- 瑞典

- 希臘

- 澳大利亞

- 南非

- 印度

- 中國

- 俄羅斯

- 韓國

- 日本

- 馬來西亞

- 新加坡

- 巴西

主動保護系統市場:市場機會矩陣

主動保護系統市場:專家對研究的看法

結論

關於航空和國防市場報告

The Global Active Protection System market is estimated at USD 6.23 billion in 2024, projected to grow to USD 16.09 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 9.95% over the forecast period 2024-2034.

Introduction to Active Protection System Market

The Active Protection System (APS) market is a rapidly growing sector in the defense industry, driven by the increasing demand for advanced military fleets and the need for enhanced situational awareness and protection. This market report provides an overview of the key trends, drivers, and regional developments in the APS market. Active Protection Systems are designed to detect and neutralize threats from anti-tank missiles, rockets, and other projectiles. These systems are typically installed on armored vehicles, naval ships, and aircraft to enhance their survivability and combat effectiveness. The global APS market is expected to grow significantly over the next few years, driven by the rising geopolitical tensions and the need for advanced military capabilities.

Technology Impact on Active Protection System Market

The Active Protection System (APS) market is experiencing significant growth fueled by continuous advancements in various technological domains. These advancements directly translate into enhanced capabilities and improved effectiveness of APS systems.

Radio Frequency (RF) technology plays a crucial role in APS functionality. By utilizing advanced RF technology, these systems can detect and track incoming threats with greater accuracy. These improvements enable a more effective response, allowing for timely neutralization of threats before they reach their target.

Infrared (IR) technology is another cornerstone of APS technology. Modern IR systems excel at detecting and tracking the heat signatures of incoming threats. This enhanced detection capability provides precious seconds for countermeasures to be deployed, significantly improving the overall effectiveness of APS systems.

Finally, Electro-Optical (EO) technology adds another layer of detection by enabling APS systems to track the visual signatures of incoming threats. Advancements in EO technology have led to improved image resolution and processing capabilities, allowing for more precise threat identification and a faster response. The combined capabilities of RF, IR, and EO technologies create a robust defense against a wide range of threats, solidifying the position of APS systems as a vital component of modern defense strategies.

Key Driver in Active Protection System Market

The key driver in the APS market is the growing demand for advanced military fleets. This demand is driven by the increasing geopolitical tensions and the need for enhanced situational awareness and protection. The market is also driven by the need for cost-effective solutions that can provide enhanced protection without compromising the performance of the vehicle or platform. The active protection system (APS) market is experiencing a surge due to several key drivers. One major factor is the rising asymmetry in warfare. As non-state actors gain access to powerful anti-tank weapons, militaries require robust protection for their armored vehicles. Crew safety is another critical driver. Modern militaries prioritize keeping their personnel safe. APS significantly enhances the survivability of armored vehicles and personnel, minimizing casualties and ensuring mission success. Technological advancements are also playing a significant role. As APS technology matures and becomes more affordable, its adoption rate is expected to rise. Advancements in areas like miniaturization and reduced power consumption will make APS more suitable for a wider range of platforms. Finally, growing defense budgets are fueling market growth. Geopolitical tensions and regional conflicts are driving up defense spending globally. Governments are allocating more resources towards advanced weaponry and force protection measures, including APS. These factors combined are creating a robust market for active protection systems.

Regional Trends in Active Protection System Market

The APS market is a global industry, with significant regional trends and developments. The Asia Pacific region is expected to be the fastest-growing market for APS systems, driven by the increasing military spending and the need for advanced military capabilities in countries such as China, India, and South Korea. The European market is expected to be driven by the modernization and upgrade programs of military fleets, particularly in countries such as the UK, France, and Germany. The North American market is expected to be driven by the ongoing modernization and upgrade programs of military fleets, particularly in the United States. The Middle East market is expected to be driven by the ongoing conflicts and the need for enhanced military capabilities in countries such as Saudi Arabia, the United Arab Emirates, and Israel.

Key Active Protection Systems Program

The Italian business Leonardo has announced that it has successfully tested a cutting-edge new Active Protection System (APS) solution for military vehicles including tanks and armoured personnel carriers. The innovative strategy, known as MIPS (Modular Integration Protective System), combines multiple layers of electronic and physical protection technologies to provide vehicle crews with a strong defensive barrier. In response to the Icarus programme of the British armed forces, the new MIPS (Modular Integration Protection System) is created in partnership with Abstract Solutions, CGI, Frazer-Nash, Lockheed Martin UK, RBSL, Roke, and Ultra Electronics. The effectiveness and sophistication of contemporary battlefield weapon systems are evolving, making Land Armoured Vehicles and their crews more susceptible to these dangers.

Rafael announced that UK MoD has selected the light version of its Trophy Active Protection System (APS) for the armoured vehicles. APS will be integrated and upgraded into challenger 3 main battle tank. The UK MoD conducted a study for the selection of trophy MV which is a part of an programme upgrade which was led by Rheinmetall BAE system land, who is the prime contractor of challenger 3 programme. A detailed integration and system trials will be undergone by Trophy MV variant on Challenger 3.

Table of Contents

Active Protection System Market Report Definition

Active Protection System Market Segmentation

By Region

By Platform

By Type

Active Protection System Market Analysis for next 10 Year

The 10-year active protection system market analysis would give a detailed overview of active protection system market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Active Protection System Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Active Protection System Market Forecast

The 10-year active protection system market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Active Protection System Market Trends & Forecast

The regional active protection system market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Active Protection System Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Active Protection System Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Active Protection System Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By Type, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By Type, 2024-2034

List of Figures

- Figure 1: Global Active Protection Systems Market Forecast, 2024-2034

- Figure 2: Global Active Protection Systems Market Forecast, By Region, 2024-2034

- Figure 3: Global Active Protection Systems Market Forecast, By Platform, 2024-2034

- Figure 4: Global Active Protection Systems Market Forecast, By Type, 2024-2034

- Figure 5: North America, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 6: Europe, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 8: APAC, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 9: South America, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 10: United States, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 11: United States, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 12: Canada, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 14: Italy, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 16: France, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 17: France, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 18: Germany, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 24: Spain, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 30: Australia, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 32: India, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 33: India, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 34: China, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 35: China, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 40: Japan, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Active Protection Systems Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Active Protection Systems Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Active Protection Systems Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Active Protection Systems Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Active Protection Systems Market, By Platform (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Active Protection Systems Market, By Platform (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Active Protection Systems Market, By Type (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Active Protection Systems Market, By Type (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Active Protection Systems Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Active Protection Systems Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Active Protection Systems Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Active Protection Systems Market, By Region, 2024-2034

- Figure 58: Scenario 1, Active Protection Systems Market, By Platform, 2024-2034

- Figure 59: Scenario 1, Active Protection Systems Market, By Type, 2024-2034

- Figure 60: Scenario 2, Active Protection Systems Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Active Protection Systems Market, By Region, 2024-2034

- Figure 62: Scenario 2, Active Protection Systems Market, By Platform, 2024-2034

- Figure 63: Scenario 2, Active Protection Systems Market, By Type, 2024-2034

- Figure 64: Company Benchmark, Active Protection Systems Market, 2024-2034