|

市場調查報告書

商品編碼

1831821

雷達的全球市場(2025年~2035年)Global Radar Market 2025-2035 |

||||||

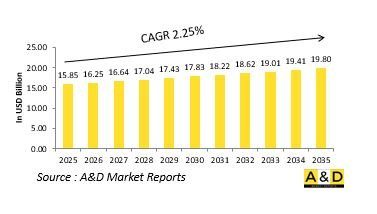

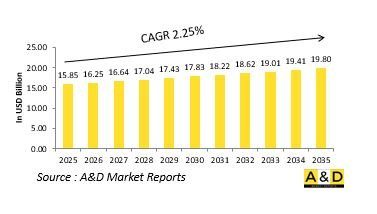

預計 2025 年全球雷達市場規模將達到 158.5 億美元,到 2035 年將達到 198 億美元,2025 年至 2035 年的複合年增長率為 2.25%。

科技對雷達市場的影響

技術創新正在顯著改變國防雷達格局,增強探測能力、適應性和彈性。主動電子掃描陣列 (AESA) 技術的進步徹底改變了雷達性能,使其能夠更快地捕捉目標、提高追蹤精度,並在單一系統中實現多任務能力。數位波束成形和軟體定義架構支援即時重構,使操作員能夠靈活地適應不斷變化的威脅和作戰需求。人工智慧和機器學習的整合進一步增強了雷達系統,使其能夠進行預測分析、自動目標分類並減輕操作員的工作量。量子雷達和被動探測技術也正在被研究,以對抗隱形平台和電子對抗 (ECM)。網路化和感測器融合使雷達能夠協同運行,形成提供全面戰場感知的綜合監視網格。此外,訊號處理技術的進步正在提高對隱形高速目標的偵測能力。這些技術發展不僅提升了雷達系統的戰略價值,而且將其轉變為高度適應性、多用途的工具,成為現代國防戰略和綜合指揮控製網路的核心。

雷達市場的關鍵推動因素

國防雷達市場的成長和發展受到多種因素的推動,主要推動力是現代威脅日益複雜以及對態勢感知的日益重視。隱形飛機、高超音速武器和無人機系統的普及,推動了對更靈敏、更通用的雷達解決方案的需求,這些解決方案能夠探測和追蹤難以捉摸的目標。地緣政治緊張局勢、領土爭端以及空中和海上監視領域的不斷擴大,促使國防部隊投資於遠程高解析度雷達系統。現代戰爭向多域作戰的轉變也推動了支持聯合指揮結構和即時資料共享的綜合雷達網路的發展。此外,飛彈防禦計畫和反無人機戰略的興起,正在將雷達的應用擴展到傳統防空領域之外。政府對現代化項目的投資和不斷增加的國防預算,進一步加速了採購和研發活動。對國土安全、邊境監視和太空領域感知的重視也推動了對先進雷達能力的需求。這些推動因素凸顯了雷達作為國防、預警系統以及常規戰爭和混合戰爭中作戰決策的基本組成部分的持續戰略重要性。

雷達市場的區域趨勢

國防雷達市場的區域動態反映了不同的戰略重點、技術能力和安全課題。北美由於重視綜合防空反導、天基監視以及傳統雷達系統的現代化,仍保持領先地位。歐洲優先透過國防聯盟和聯合計畫進行聯合雷達研發,以加強區域安全並提高互通性。隨著各國投資雷達技術以因應不斷升級的領土爭端、海上安全問題和空域防禦需求,亞太地區呈現快速成長態勢。在地區不穩定因素日益加劇的背景下,中東國家正專注於反導防禦和邊境安全的雷達解決方案。在拉丁美洲和非洲,由於空域監測、沿海監視和反走私的需求,雷達投資正在逐步增加。在所有地區,政府與產業的合作關係正在加強供應鏈並加速技術轉移。國內雷達生產和研發專案的趨勢也在增強,這反映了加強自力更生能力的戰略努力。這些區域發展凸顯了雷達在現代國防體系中的全球重要性,在不斷變化的安全形勢下,它是戰略威懾、作戰感知和協同反應的關鍵推動者。

本報告研究並分析了全球雷達市場,提供了成長動力、10 年展望以及區域市場趨勢和預測。

目錄

雷達市場報告定義

雷達市場區隔

各地區

各零件

各平台

今後10年的雷達市場分析

雷達市場技術

全球雷達市場預測

地區的雷達的市場趨勢與預測

北美

促進因素,阻礙因素,課題

PEST

市場預測與Scenario分析

主要企業

供應商層級格局

企業基準

歐洲

中東

亞太地區

南美

雷達市場國的分析

美國

防衛計劃

最新消息

專利

該市場目前的技術成熟度

市場預測與Scenario分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

雷達市場機會矩陣

雷達市場報告相關專家的意見

結論

關於Aviation and Defense Market Reports

The Global Radar market is estimated at USD 15.85 billion in 2025, projected to grow to USD 19.80 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 2.25% over the forecast period 2025-2035.

Introduction to Radar Market:

The defense radar market is a cornerstone of modern military capability, providing critical situational awareness, threat detection, and surveillance functions across air, land, sea, and space domains. Radar systems serve as the eyes of defense forces, enabling early warning, target tracking, fire control, navigation, and airspace management. They are essential for monitoring hostile aircraft, missiles, naval vessels, and ground movements, as well as for supporting integrated command-and-control operations. As modern conflicts evolve to include stealth technologies, hypersonic weapons, and electronic warfare, the role of radar has become increasingly strategic. Militaries are prioritizing the deployment of advanced radar networks capable of multi-domain operation, enhanced range, and real-time data fusion. Additionally, the growing complexity of joint and coalition operations demands radar systems that can seamlessly share information across platforms and forces. The defense radar market is expanding beyond traditional applications to include missile defense, counter-drone operations, and space domain awareness. With radar forming the backbone of layered defense architectures, continuous innovation and modernization are critical to maintaining operational superiority, strategic deterrence, and rapid decision-making in complex and dynamic threat environments.

Technology Impact in Radar Market:

Technological innovation is profoundly reshaping the defense radar landscape, enhancing detection capabilities, adaptability, and resilience. Advances in active electronically scanned array (AESA) technology have revolutionized radar performance, enabling faster target acquisition, improved tracking precision, and multi-mission functionality within a single system. Digital beamforming and software-defined architectures allow for real-time reconfiguration, giving operators the flexibility to adapt to evolving threats and mission requirements. The integration of artificial intelligence and machine learning is further enhancing radar systems by enabling predictive analytics, automated target classification, and reduced operator workload. Emerging materials and compact designs are improving mobility and deployability, while quantum radar and passive detection technologies are being explored to counter stealth platforms and electronic countermeasures. Networking and sensor fusion are enabling radars to operate collaboratively, forming integrated surveillance grids that provide comprehensive battlespace awareness. Additionally, advances in signal processing are enhancing the ability to detect low-observable and high-speed targets. These technological developments are not only increasing the strategic value of radar systems but also transforming them into highly adaptive, multi-role tools central to modern defense strategies and integrated command-and-control networks.

Key Drivers in Radar Market:

Multiple factors are fueling the growth and evolution of the defense radar market, driven primarily by the rising complexity of modern threats and the increasing emphasis on situational awareness. The proliferation of stealth aircraft, hypersonic weapons, and unmanned aerial systems has heightened the need for more sensitive and versatile radar solutions capable of detecting and tracking elusive targets. Geopolitical tensions, territorial disputes, and the expansion of aerial and maritime surveillance zones are pushing defense forces to invest in long-range, high-resolution radar systems. Modern warfare's shift toward multi-domain operations is also promoting the development of integrated radar networks that support joint command structures and real-time data sharing. Additionally, the rise of missile defense initiatives and counter-drone strategies is expanding radar applications beyond conventional air defense. Government investments in modernization programs and increasing defense budgets are further accelerating procurement and R&D activities. The growing emphasis on homeland security, border surveillance, and space domain awareness is also driving demand for advanced radar capabilities. Together, these drivers underscore radar's enduring strategic importance as a fundamental component of national defense, early warning systems, and operational decision-making in both conventional and hybrid warfare scenarios.

Regional Trends in Radar Market:

Regional dynamics in the defense radar market reflect varying strategic priorities, technological capacities, and security challenges. North America remains a leader due to its focus on integrated air and missile defense, space-based surveillance, and modernization of legacy radar systems. Europe is prioritizing collaborative radar development through defense alliances and joint programs to strengthen regional security and enhance interoperability. The Asia-Pacific region is experiencing rapid growth as nations invest in radar technologies to address rising territorial disputes, maritime security concerns, and airspace defense requirements. Middle Eastern countries are focusing on radar solutions for counter-missile defense and border protection amid ongoing regional instability. In Latin America and Africa, radar investments are increasing gradually, driven by the need for airspace monitoring, coastal surveillance, and counter-smuggling operations. Across all regions, partnerships between governments and industry players are strengthening supply chains and accelerating technology transfer. The trend toward domestic radar production and indigenous development programs is also growing, reflecting strategic efforts to enhance self-reliance. These regional developments highlight radar's global significance in modern defense architectures, serving as a critical enabler of strategic deterrence, operational awareness, and coordinated response in evolving security landscapes.

Key Radar Program:

On Wednesday, March 12, 2025, the Union Ministry of Defence (MoD) signed a ₹2,906 crore contract with Bharat Electronics Limited (BEL), Ghaziabad, for the procurement of the Low-Level Transportable Radar (LLTR) system, Ashwini. According to the MoD, Ashwini is an active electronically scanned phased array radar built using advanced solid-state technology. The radar can track a wide range of aerial targets, from high-speed fighter jets to slow-moving objects such as helicopters and unmanned aerial vehicles. Its induction will greatly strengthen the operational readiness of the Indian Air Force.

Table of Contents

Radar Market - Table of Contents

Radar Market Report Definition

Radar Market Segmentation

By Region

By Component

By Platform

Radar Market Analysis for next 10 Years

The 10-year Radar Market analysis would give a detailed overview of radar market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Radar Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Radar Market Forecast

The 10-year radar market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Radar Market Trends & Forecast

The regional radar market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Radar Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Radar Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Radar Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Component, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Component, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2025-2035

List of Figures

- Figure 1: Global Radar Market Forecast, 2025-2035

- Figure 2: Global Radar Market Forecast, By Region, 2025-2035

- Figure 3: Global Radar Market Forecast, By Component, 2025-2035

- Figure 4: Global Radar Market Forecast, By Platform, 2025-2035

- Figure 5: North America, Radar Market, Market Forecast, 2025-2035

- Figure 6: Europe, Radar Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Radar Market, Market Forecast, 2025-2035

- Figure 8: APAC, Radar Market, Market Forecast, 2025-2035

- Figure 9: South America, Radar Market, Market Forecast, 2025-2035

- Figure 10: United States, Radar Market, Technology Maturation, 2025-2035

- Figure 11: United States, Radar Market, Market Forecast, 2025-2035

- Figure 12: Canada, Radar Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Radar Market, Market Forecast, 2025-2035

- Figure 14: Italy, Radar Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Radar Market, Market Forecast, 2025-2035

- Figure 16: France, Radar Market, Technology Maturation, 2025-2035

- Figure 17: France, Radar Market, Market Forecast, 2025-2035

- Figure 18: Germany, Radar Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Radar Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Radar Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Radar Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Radar Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Radar Market, Market Forecast, 2025-2035

- Figure 24: Spain, Radar Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Radar Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Radar Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Radar Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Radar Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Radar Market, Market Forecast, 2025-2035

- Figure 30: Australia, Radar Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Radar Market, Market Forecast, 2025-2035

- Figure 32: India, Radar Market, Technology Maturation, 2025-2035

- Figure 33: India, Radar Market, Market Forecast, 2025-2035

- Figure 34: China, Radar Market, Technology Maturation, 2025-2035

- Figure 35: China, Radar Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Radar Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Radar Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Radar Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Radar Market, Market Forecast, 2025-2035

- Figure 40: Japan, Radar Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Radar Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Radar Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Radar Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Radar Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Radar Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Radar Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Radar Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Radar Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Radar Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Radar Market, By Component (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Radar Market, By Component (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Radar Market, By Platform (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Radar Market, By Platform (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Radar Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Radar Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Radar Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Radar Market, By Region, 2025-2035

- Figure 58: Scenario 1, Radar Market, By Component, 2025-2035

- Figure 59: Scenario 1, Radar Market, By Platform, 2025-2035

- Figure 60: Scenario 2, Radar Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Radar Market, By Region, 2025-2035

- Figure 62: Scenario 2, Radar Market, By Component, 2025-2035

- Figure 63: Scenario 2, Radar Market, By Platform, 2025-2035

- Figure 64: Company Benchmark, Radar Market, 2025-2035