|

市場調查報告書

商品編碼

1500331

全球國防SAR衛星市場(2024-2034)Global Defense SAR Satelites Market 2024-2034 |

||||||

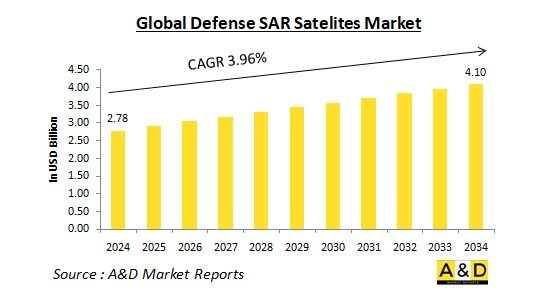

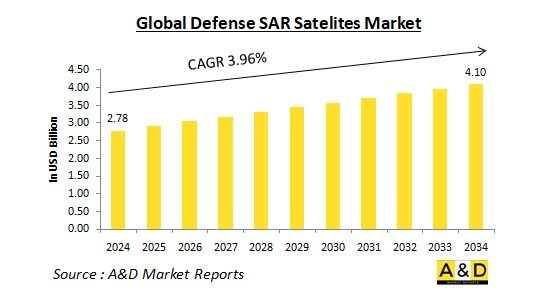

到2034年,全球國防 SAR(合成孔徑雷達)衛星市場規模將達到 41 億美元,預測期內(2024-2034年)年複合成長率(CAGR)為 3.96%。

全球國防SAR衛星市場概況

SAR 衛星配備了特殊的雷達技術,無論天氣或陽光如何,都可以產生地球表面的高解析度影像。與傳統光學成像衛星不同,合成孔徑雷達可以穿透雲層、霧氣,甚至樹葉,揭示對防禦目的重要的隱藏細節。這種能力使得 SAR 衛星在能見度可能受到影響的各種軍事應用中發揮著不可估量的作用。全球國防SAR衛星市場包括幾個關鍵組成部分。衛星星座由多個 SAR 衛星網路組成,這些衛星協同工作以提供對戰略區域的全面、連續的覆蓋。地面部分基礎設施包括負責資料收集、處理和分發給軍事使用者的地面站,使有價值的資訊易於獲取。此外,SAR 資料服務包括提供 SAR 影像分析和解釋的公司,以提取關鍵資訊並提供可行的見解。

科技對國防 SAR 衛星市場的影響

技術進步不斷改變 SAR 衛星的功能,並推動國防 SAR 衛星市場的成長。一個重要趨勢是先進雷達技術的發展。具有更高功率和改進的訊號處理技術的新型雷達系統能夠創造具有卓越解析度和穿透能力的 SAR 衛星。這些增強功能可實現更詳細、更準確的成像,這對於國防應用非常重要。另一個重要趨勢是衛星的小型化。該領域的技術進步使得發射更小、更便宜的 SAR 衛星成為可能。這種小型化有利於更大的星座,可以覆蓋更重要的區域並更頻繁地重新存取它們。這些協同工作的多顆 SAR 衛星組成的星座網路確保了持續監視能力和對戰略區域的持續監控。人工智慧(AI)和機器學習(ML)的整合也徹底改變國防 SAR 衛星市場。人工智慧和機器學習演算法可以更快、更準確地分析 SAR 影像,並即時識別潛在威脅和異常情況。這種能力顯著提高了防禦行動的準備和有效性。此外,利用雲端運算進行資料儲存和處理可以提高國防用戶的可存取性和可擴展性,促進更快的決策並提高營運效率。這些進步促進了更強大、更通用、更有效率的新一代 SAR 衛星的開發。尖端技術的集成為國防機構提供了無與倫比的情報收集能力,提高了他們監控和應對潛在威脅的能力。 SAR衛星技術的不斷發展凸顯了SAR衛星在現代國防戰略中的重要作用。

全球國防SAR衛星市場的關鍵驅動因素

有幾個因素推動全球國防 SAR 衛星市場的成長。其中一個主要因素是地緣政治緊張局勢加劇。全球緊張局勢和區域衝突的加劇增加了對先進監控能力的需求。 SAR 衛星為監視潛在對手和偵測形成的威脅提供了寶貴的工具,為動盪地區提供了關鍵情報。對邊境安全的關注也是一個關鍵驅動因素。確保廣闊海岸線和陸地邊界安全的需求推動軍事和安全機構投資搜尋與援救技術。該技術可有效用於邊境巡邏和非法活動偵測,並增強維護國家安全的能力。隨著威脅的演變,先進情報收集技術的使用也在不斷變化。非對稱戰爭策略的興起和非常規威脅的擴散需要複雜的監視。 SAR 衛星具有探測隱藏武器藏匿處、敵人動向和其他安全問題的獨特能力,使其成為現代防禦戰略不可或缺的一部分。增強海事意識對於監測與海盜、非法人口販運和潛在海軍威脅有關的海事活動非常重要。 SAR 衛星提供了無與倫比的能力,無論天氣如何,都可以追蹤海上船隻。這種能力對於國家安全非常重要,並確保對海域進行全面監視。這些動態,加上持續的技術進步,使 SAR 衛星成為世界各地國防和情報機構日益重要的資產。隨著技術不斷發展,合成孔徑雷達衛星在國防行動中的重要性和實用性將持續增強,其在全球安全工作中的作用也將持續增強。

全球國防SAR衛星市場的區域趨勢

北美和歐洲是處於SAR衛星技術前沿的軍事強國,不斷開發和部署具有先進能力的先進衛星星座。這些地區利用其技術實力和慷慨的國防預算來保持在全球監視和情報收集方面的競爭優勢。在亞太地區,中國、印度等地區大國的崛起和領土爭端的升級推動了對先進SAR衛星的巨大需求。這些國家大力投資衛星技術,以增強其監視能力並維護其在衝突地區的戰略利益。對區域安全和邊境管制的擔憂正促使中東國家投資搜尋與援救技術。這些國家優先考慮獲取先進的監控工具,以在動盪的地緣政治環境中監控其邊界並確保國家安全。在世界其他地方,發展中國家認識到SAR衛星的價值。這些國家探索取得此類衛星能力或與現有航太國家合作的方案,以加強本國的情報收集工作。這一趨勢反映出全球日益認識到先進監控技術的戰略重要性。

國防SAR衛星主要計畫

韓國著名的航空航太和國防公司Hanwha Systems Co.和Korea Aerospace Industries Ltd.,已與政府機構簽署協議,合作開發超緊湊合成孔徑雷達(SAR)衛星。Hanwha Group的專業國防和航空運輸部門Hanwha Systems週四宣布與國營國防研究機構國防發展局(ADD)簽訂了一份價值 679 億韓元(5,100 萬美元)的合約。

DARPA 已根據其分佈式雷達成像形成技術(DRIFT)計劃向四家公司授予合同,以協調編隊部署合成孔徑雷達(SAR)衛星。這些合約於2022年底至2023年初授予Umbra、Terran Orbital 的Preda SAR 部門、Northrop Grumman、Jacobs,將展示從多顆衛星收集SAR 影像和處理資料的創新方法,目的是開發先進演算法該計劃是 DARPA 馬賽克戰爭戰略的一個組成部分,該戰略強調部署大量武器和感測器平台來壓倒對手。

本報告分析了全球國防 SAR 衛星市場,並探討了整體市場規模的前景、依地區和國家劃分的詳細趨勢、關鍵技術概述和市場機會。

目錄

國防 SAR 衛星市場:報告定義

國防SAR衛星市場細分

- 依用途

- 依組件

- 依地區

國防SAR衛星市場分析(未來10年)

國防SAR衛星市場的市場技術

全球國防SAR衛星市場預測

國防SAR衛星市場:區域趨勢與預測

- 北美

- 促進/抑制因素和挑戰

- PEST分析

- 市場預測與情境分析

- 主要公司

- 供應商層級狀況

- 企業基準比較

- 歐洲

- 中東

- 亞太地區

- 南美洲

國防 SAR 衛星市場:國家分析

- 美國

- 防禦規劃

- 最新趨勢

- 專利

- 該市場目前的技術成熟度等級

- 市場預測與情境分析

- 加拿大

- 義大利

- 法國

- 德國

- 荷蘭

- 比利時

- 西班牙

- 瑞典

- 希臘

- 澳洲

- 南非

- 印度

- 中國

- 俄羅斯

- 韓國

- 日本

- 馬來西亞

- 新加坡

- 巴西

國防 SAR 衛星市場:市場機會矩陣

國防 SAR 衛星市場:專家對研究的看法

結論

關於航空和國防市場報告

USD 4.10 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 3.96% over the forecast period 2024-2034.

.Introduction to the Global Defense SAR Satellite Market

SAR satellites are equipped with specialized radar technology that can generate high-resolution images of the Earth's surface, regardless of weather conditions or sunlight availability. Unlike traditional optical imagery satellites, SAR can penetrate cloud cover, fog, and even foliage, revealing hidden details crucial for defense purposes. This capability makes SAR satellites invaluable for a range of military applications where visibility might be compromised. The global defense SAR satellite market encompasses several key components. Satellite constellations consist of networks of SAR satellites working in tandem to provide comprehensive and continuous coverage of strategic areas. Ground segment infrastructure includes ground stations responsible for data acquisition, processing, and distribution to military users, ensuring that valuable intelligence is readily accessible. Additionally, SAR data services involve companies that offer analysis and interpretation of SAR imagery to extract critical information and provide actionable insights.

Technology Impact in the Defense SAR Satellite Market

Technological advancements are continuously transforming the capabilities of SAR satellites and propelling the growth of the defense SAR satellite market. One significant trend is the development of advanced radar technology. New radar systems with higher power outputs and improved signal processing techniques are enabling the creation of SAR satellites with superior resolution and penetration capabilities. These enhancements allow for more detailed and accurate imaging, crucial for defense applications. Another key trend is the miniaturization of satellites. Technological progress in this area allows for the launch of smaller and more affordable SAR satellites. This miniaturization facilitates the creation of larger constellations, providing wider coverage and more frequent revisit times over critical areas. These constellation networks, composed of multiple SAR satellites working in tandem, ensure persistent surveillance capabilities and continuous monitoring of strategic regions. The integration of artificial intelligence (AI) and machine learning (ML) is also revolutionizing the defense SAR satellite market. AI and ML algorithms enable faster and more accurate analysis of SAR imagery, allowing for real-time identification of potential threats and anomalies. This capability significantly enhances the responsiveness and effectiveness of defense operations. Additionally, the utilization of cloud computing for data storage and processing offers greater accessibility and scalability for defense users, facilitating rapid decision-making and improved operational efficiency. These advancements are leading to the development of a new generation of SAR satellites that are more powerful, versatile, and efficient. The integration of cutting-edge technologies is providing defense agencies with unparalleled intelligence gathering capabilities, enhancing their ability to monitor and respond to potential threats. The continuous evolution of SAR satellite technology underscores its critical role in modern defense strategies.

Key Drivers in the Global Defense SAR Satellite Market

Several factors are driving the growth of the global defense SAR satellite market. One major factor is heightened geopolitical tensions. Rising global tensions and regional conflicts are increasing the demand for advanced surveillance capabilities. SAR satellites offer a valuable tool for monitoring potential adversaries and detecting developing threats, providing crucial intelligence in volatile areas. The focus on border security is another significant driver. The need to secure vast coastlines and land borders is prompting military and security agencies to invest in SAR technology. This technology is effective for border patrol and the detection of illegal activities, offering enhanced capabilities for maintaining national security. Evolving threats also necessitate the use of advanced intelligence-gathering methods. The rise of asymmetric warfare tactics and the proliferation of unconventional threats require sophisticated surveillance. SAR satellites are uniquely capable of detecting hidden weapons caches, enemy movements, and other security concerns, making them indispensable for modern defense strategies. Enhanced maritime domain awareness is crucial for monitoring maritime activity related to piracy, illegal trafficking, and potential naval threats. SAR satellites provide unparalleled capabilities for tracking vessels at sea, regardless of weather conditions. This capability is essential for national security and ensures comprehensive surveillance of maritime domains. These drivers, combined with ongoing technological advancements, are making SAR satellites an increasingly vital asset for defense and intelligence agencies worldwide. As technology continues to evolve, the importance and utility of SAR satellites in defense operations will only grow, reinforcing their role in global security efforts. Regional Trends in the Global Defense SAR Satellite Market

Regional Trends in Global Defense SAR Satellite Market

North America and Europe are established military powers at the forefront of SAR satellite technology, continuously developing and deploying advanced constellations with sophisticated capabilities. These regions leverage their technological prowess and robust defense budgets to maintain a competitive edge in global surveillance and intelligence gathering. In the Asia-Pacific region, the rise of regional powers like China and India, coupled with growing territorial disputes, is driving significant demand for advanced SAR satellites. These nations are investing heavily in satellite technology to enhance their surveillance capabilities and assert their strategic interests in contested areas. Concerns about regional security and border control are fueling investment in SAR technology by countries in the Middle East. These nations prioritize acquiring advanced surveillance tools to monitor their borders and ensure national security amidst a volatile geopolitical landscape. In the rest of the world, developing nations are increasingly recognizing the value of SAR satellites. They are exploring options for acquiring these capabilities or partnering with established spacefaring nations to enhance their own intelligence-gathering efforts. This trend reflects a growing global acknowledgment of the strategic importance of advanced surveillance technologies.

Key Defense SAR Satellites Programs

Hanwha Systems Co. and Korea Aerospace Industries Ltd., prominent aerospace and defense firms in Korea, have secured agreements with a government agency to collaborate on the development of ultra-compact synthetic aperture radar (SAR) satellites. Hanwha Systems, a division of Hanwha Group specializing in defense and air mobility, announced on Thursday that its contract with the Agency for Defense Development (ADD), a state-owned defense research institute, amounts to 67.9 billion won ($51 million).

DARPA has granted contracts to four companies under the Distributed Radar Image Formation Technology (DRIFT) program, aimed at deploying synthetic aperture radar (SAR) satellites in coordinated formation. These contracts, awarded to Umbra, Terran Orbital's PredaSAR unit, Northrop Grumman, and Jacobs between late 2022 and early 2023, seek to demonstrate innovative methods for collecting SAR imagery and develop advanced algorithms to process data from multiple satellites. The program is integral to DARPA's Mosaic Warfare strategy, which emphasizes the deployment of numerous weapon and sensor platforms to overwhelm adversaries

Table of Contents

SAR Satellite Market Report Definition

SAR Satellite Market Segmentation

By Application

By Component

By Region

SAR Satellite Market Analysis for next 10 Years

The 10-year SAR satellite market analysis would give a detailed overview of SAR satellite market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of SAR Satellite Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global SAR Satellite Market Forecast

The 10-year SAR satellite market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional SAR satellite Market Trends & Forecast

The regional SAR satellite market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of SAR Satellite Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for SAR Satellite Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on SAR Satellite Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Application, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By Component, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Application, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By Component, 2024-2034

List of Figures

- Figure 1: Global Defense SAR Satellite Market Forecast, 2024-2034

- Figure 2: Global Defense SAR Satellite Market Forecast, By Region, 2024-2034

- Figure 3: Global Defense SAR Satellite Market Forecast, By Application, 2024-2034

- Figure 4: Global Defense SAR Satellite Market Forecast, By Component, 2024-2034

- Figure 5: North America, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 6: Europe, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 8: APAC, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 9: South America, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 10: United States, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 11: United States, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 12: Canada, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 14: Italy, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 16: France, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 17: France, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 18: Germany, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 24: Spain, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 30: Australia, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 32: India, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 33: India, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 34: China, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 35: China, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 40: Japan, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Defense SAR Satellite Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Defense SAR Satellite Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Defense SAR Satellite Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Defense SAR Satellite Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Defense SAR Satellite Market, By Application (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Defense SAR Satellite Market, By Application (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Defense SAR Satellite Market, By Component (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Defense SAR Satellite Market, By Component (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Defense SAR Satellite Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Defense SAR Satellite Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Defense SAR Satellite Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Defense SAR Satellite Market, By Region, 2024-2034

- Figure 58: Scenario 1, Defense SAR Satellite Market, By Application, 2024-2034

- Figure 59: Scenario 1, Defense SAR Satellite Market, By Component, 2024-2034

- Figure 60: Scenario 2, Defense SAR Satellite Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Defense SAR Satellite Market, By Region, 2024-2034

- Figure 62: Scenario 2, Defense SAR Satellite Market, By Application, 2024-2034

- Figure 63: Scenario 2, Defense SAR Satellite Market, By Component, 2024-2034

- Figure 64: Company Benchmark, Defense SAR Satellite Market, 2024-2034