|

市場調查報告書

商品編碼

1508615

AESA雷達的全球市場 (2024~2034年)Global AESA Radar Market 2024-2034 |

||||||

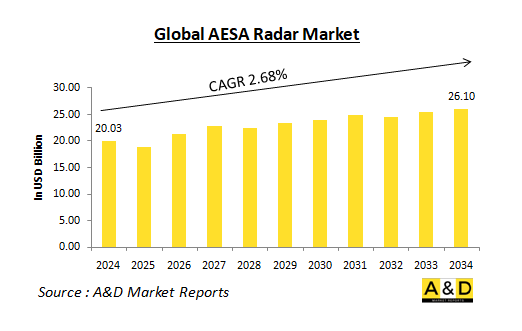

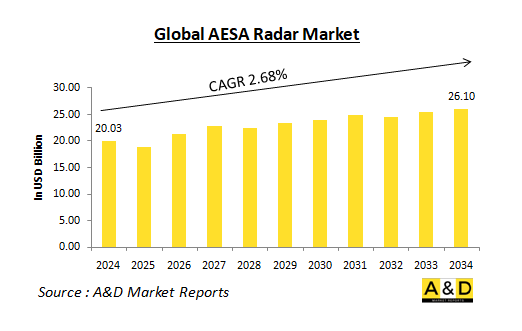

2024年全球AESA(主動電子掃描陣列)雷達市場預計為200.3億美元,在預測期內(2024-2034年)複合年增長率為2.68%,到2034年預計將達到26.1美元十億。

全球 AESA 雷達市場概況

AESA(主動電子掃描陣列)雷達市場是涉及先進雷達系統設計、開發、生產和維護的全球產業,這些系統利用發射和接收模組陣列以電子方式引導和聚焦雷達波束。 AESA 雷達比傳統機械掃描雷達具有顯著優勢,包括更高的可靠性、更快的掃描速度以及增強的目標偵測和追蹤能力。對這些先進雷達系統的需求不斷增長,特別是在國防和航空航天領域,是市場成長的關鍵驅動力。

科技對全球 AESA 雷達市場的影響

技術進步正在推動 AESA 雷達市場的普及。從傳統機械掃描雷達過渡到AESA雷達,性能顯著提高。

重要的優點之一是光束的彈性。 AESA 雷達可以電子控制波束,從而實現更快的掃描速度並能夠同時追蹤多個目標。這提高了戰場態勢感知水平,從而能夠對威脅做出快速反應和有效反應。

可靠性也是一個重要的優勢。 AESA 雷達沒有機械掃描的移動部件,這與具有移動部件的雷達不同。這顯著提高了可靠性並減少了維護要求,從而延長了正常運行時間並降低了成本。

AESA 雷達也擁有優異的靈敏度。與傳統雷達相比,AESA 陣列內的大量發射和接收模組顯著提高了靈敏度。這使得能夠檢測到更小、更隱密的目標,否則這些目標可能會逃避偵測,從而在現代戰爭場景中提供重要優勢。

此外,AESA雷達具有很強的抗干擾能力。動態調整頻率和波束方向圖的能力使其能夠應對電子戰威脅並有效抵禦幹擾企圖。這確保了即使在敵人試圖破壞雷達功能的環境中也能持續運作。

最後,AESA 雷達的模組化設計提供了出色的可擴展性。隨著技術的進步,這種模組化使得更新和合併新功能變得容易。確保 AESA 雷達在未來幾年保持相關性和有效性,證明您對這種先進雷達技術的投資是合理的。

這些累積的進步正在推動 AESA 雷達在各種應用中的廣泛採用。從天空中的戰鬥機到保護關鍵基礎設施的防空系統,再到在廣闊海洋巡邏的海軍平台,AESA 雷達正在改變世界各地的態勢感知和防禦能力。

全球 AESA 雷達市場的關鍵驅動因素

由於幾個關鍵因素,AESA 雷達市場正在經歷顯著成長。主要因素之一是軍事平台的現代化。世界各國正積極以更先進的 AESA 雷達取代老化的機械掃描雷達系統。此次更新將增強戰鬥機、防空系統和艦艇的能力。 AESA 雷達因其在掃描速度、目標追蹤和抗干擾等方面的卓越性能而對現代軍隊極為重要。

此外,軍事開支的增加,特別是在亞太和中東等地區,正在推動 AESA 雷達市場的繁榮。這些預算的增加將促使新的採購活動和現有平台的現代化。各國正大力投資 AESA 雷達系統,為其空軍和海軍艦隊配備最新技術。

推動成長的另一個因素是對提高態勢感知能力的需求。 AESA雷達在這方面有顯著的優勢。以更快的速度掃描、同時追蹤多個目標以及應對電子戰威脅的能力為軍隊提供了先進的戰場感知能力。這使得能夠快速決策並有效應對新出現的威脅。

技術進步也發揮重要作用。發射和接收模組設計、訊號處理和軟體演算法等領域的持續改進為開發更高性能和更具成本效益的 AESA 雷達系統鋪平了道路。這些進步將帶來更廣泛的採用和持續的市場成長。

航空威脅的擴散將進一步增加對AESA雷達的需求。先進飛機、飛彈和無人機系統 (UAS) 的日益普及需要卓越的探測和追蹤能力。 AESA 雷達具有更高的靈敏度和電子波束控制,是應對這些不斷變化的威脅和保護空域的理想選擇。

最後,作為市場趨勢,國內發展備受關注。許多國家都優先考慮AESA雷達的國內設計和生產。這種自給自足的動力旨在減少對進口的依賴並解決與收購外國平台相關的高成本問題。透過獨立開發AESA雷達技術,各國有可能控製成本並客製化雷達系統以滿足本國的國防需求。

全球 AESA 雷達市場的區域趨勢

全球AESA雷達市場呈現不同的區域趨勢,每個區域根據具體需求優先開發和採購。

北美是由美國龐大的軍事預算所驅動的。洛克希德馬丁公司、諾斯羅普格魯曼公司和雷神公司等主要國防公司處於 AESA 雷達技術的前沿。這些公司為軍用飛機和防空系統開發和生產尖端的 AESA 雷達,確保了美國的技術優勢。

在歐洲,我們看到了合作的局面。英國、法國和德國等國家正在集中資源為未來戰鬥機系統開發下一代 AESA 雷達。這種協作方法使我們能夠共享專業知識和資源,並加速 AESA 技術的進步。面對地緣政治情勢加劇,東歐國家也正在投資設備升級。我們正在採購 AESA 雷達,以增強我們的防空能力並提高應對潛在威脅的能力。

亞太地區的 AESA 雷達發展迅速成長,其中中國、印度、日本和韓國成為主要市場。本土發展是該地區的一個重點,各國都在努力生產專門用於應對特定地區安全課題的主動相控陣雷達。為印度本土戰鬥機計畫開發的 AESA 雷達就是這一趨勢的象徵。透過實現 AESA 技術的自給自足,這些國家的目標是減少對外國進口的依賴,並可能降低成本。

中東是一個衝突不斷、彈道飛彈和無人機威脅不斷的地區。沙烏地阿拉伯、阿拉伯聯合大公國和以色列等國家正在大力投資配備 AESA 雷達的防空系統,以應對這些威脅。以色列的鐵穹和大衛吊索系統採用了 AESA 雷達,因其有效性而贏得了全世界的認可。這些系統凸顯了 AESA 雷達在防禦現代機載威脅方面所扮演的重要角色。

拉美地區面積雖小,但巴西有一個值得關注的市場。巴西正積極進行現代化建設,採購配備AESA雷達的平台是加強其防空能力的重要一步。隨著各國優先考慮保護其空域,預計拉丁美洲將繼續採用 AESA 雷達。

AESA雷達主程式

據比利時國防部稱,泰雷茲的 NS50 雷達於 2021 年 1 月在比利時-荷蘭反水雷艦(MCMV)計畫中採用。 NS50是全球首款小型4D AESA雷達,非常適合中小型船舶。除了傳統的任務外,該雷達還旨在防禦無人機和低空、緩慢飛行的威脅。比利時-荷蘭協議價值超過 20 億歐元,由比利時牽頭,計劃在每個國家建立 6 個 MCM 單位。製造和維護 MCMV 的合約於 2019 年授予 BNR(比利時海軍和機器人)財團,其中包括法國 NAVAL GROUP 和 ECA Robotics。比利時的第一台 FOC 系統(六台)計劃於 2024 年交付,荷蘭的第一台(全部六台)將於 2025 年交付,最後一台於 2030 年交付。

SELEX Galileo 和 ATECH 子公司 ATMOS 簽署協議,成為巴西 AESA 雷達卓越中心和機載雷達系統公司。該協議支持巴西國防戰略的目標,即提高其國防工業能力。該協議規定了 ATMOS 的開發、製造、培訓和支援工作,重點關注特定目標計劃,例如用於下一代 "鷹獅" 戰鬥機的 Raven ES-05 AESA。該協議涵蓋 SELEX Galileo 產品組合中的所有雷達,包括 Seaspray 5000E 和 7000E AESA 監視雷達以及 Gabbiano T20 機械掃描 (M-Scan) 監視雷達系統。從長遠來看,將進行先進雷達子系統的共同開發,以充分滿足巴西空軍未來的需求。

本報告提供全球AESA雷達市場相關分析,提供整體市場規模趨勢預測,及各地區·各國詳細趨勢,主要技術的概要,市場機會等資訊。

目錄

AESA雷達市場:報告定義

AESA雷達市場明細

- 各地區

- 各安裝階段 (各安裝階段)

- 各平台

AESA雷達市場分析 (今後10年)

AESA雷達市場市場科技

全球AESA雷達市場預測

AESA雷達市場:各地區的趨勢與預測

- 北美

- 促進·阻礙因素,課題

- PEST分析

- 市場預測與情勢分析

- 主要企業

- 供應商階層的形勢

- 企業的基準

- 歐洲

- 中東

- 亞太地區

- 南美

AESA雷達市場:各國分析

- 美國

- 防衛計劃

- 最新趨勢

- 專利

- 這個市場上目前技術成熟等級

- 市場預測與情勢分析

- 加拿大

- 義大利

- 法國

- 德國

- 荷蘭

- 比利時

- 西班牙

- 瑞典

- 希臘

- 澳洲

- 南非

- 印度

- 中國

- 俄羅斯

- 韓國

- 日本

- 馬來西亞

- 新加坡

- 巴西

AESA雷達市場:市場機會矩陣

AESA雷達市場:調查相關專家的見解

結論

關於Aviation and Defense Market Reports

The global AESA market is estimated at USD 20.03 billion in 2024, projected to grow to USD 26.10 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 2.68% over the forecast period 2024-2034.

Introduction to AESA Radar Market

The AESA (Active Electronically Scanned Array) radar market refers to the global industry involved in the design, development, production, and maintenance of advanced radar systems that utilize an array of transmit/receive modules to electronically steer and focus the radar beam. AESA radars offer significant advantages over traditional mechanically-scanned radars, including improved reliability, faster scanning, and enhanced target detection and tracking capabilities. The growing demand for these advanced radar systems, particularly in the defense and aerospace sectors, is a major driver of market growth.

Technology Impact in AESA Radar Market

Technological advancements have been the driving force behind the AESA radar market's surge in popularity. The transition from traditional mechanically-scanned radars to AESA radars has unlocked a multitude of performance improvements that significantly enhance capabilities.

One key advantage is beam agility. AESA radars can electronically steer their beams, offering much faster scanning speeds and the ability to track multiple targets simultaneously. This translates to a heightened level of situational awareness on the battlefield, allowing for quicker responses and more effective engagement of threats.

Reliability is another crucial benefit. Unlike mechanically-scanned radars with moving parts, AESA radars possess no such components. This makes them significantly more reliable and reduces maintenance requirements, leading to increased operational uptime and cost savings.

AESA radars also boast superior sensitivity. The large number of transmit/receive modules within an AESA array translates to a significant increase in sensitivity compared to traditional radars. This enables the detection of smaller and stealthier targets that might otherwise evade detection, offering a critical advantage in modern warfare scenarios.

Furthermore, AESA radars excel in jamming resistance. Their ability to dynamically adjust their frequency and beam patterns allows them to counter electronic warfare threats and effectively resist jamming attempts. This ensures they remain operational even in environments where adversaries attempt to disrupt radar functionality.

Finally, the modular design of AESA radars offers exceptional scalability. This modularity allows for easy upgrades and the incorporation of new capabilities as technology advances. This future-proofing aspect ensures AESA radars remain relevant and effective for years to come, justifying the investment in this advanced radar technology.

The combination of these advancements has been instrumental in driving the widespread adoption of AESA radars across various applications. From fighter aircraft soaring through the skies to air defense systems safeguarding critical infrastructure, and naval platforms patrolling vast stretches of ocean, AESA radars are transforming situational awareness and defense capabilities around the world.

Key Drivers in AESA Radar Market

The AESA radar market is experiencing significant growth fueled by several key factors. One major driver is the modernization of military platforms. Countries around the globe are actively replacing their aging, mechanically-scanned radar systems with more advanced AESA radars. This upgrade enhances the capabilities of fighter jets, air defense systems, and naval vessels. AESA radars offer superior performance in areas like scanning speed, target tracking, and jamming resistance, making them crucial for modern militaries.

Furthermore, rising military expenditures, particularly in regions like Asia-Pacific and the Middle East, are creating a boom in the AESA radar market. These increased budgets translate to new procurement activities and the modernization of existing platforms. Countries are investing heavily in AESA radar systems to equip their air forces and naval fleets with the latest technology.

Another factor driving growth is the demand for improved situational awareness. AESA radars offer a significant advantage in this area. Their ability to scan at faster rates, track multiple targets simultaneously, and resist electronic warfare threats provides militaries with a heightened level of awareness on the battlefield. This allows for quicker decision-making and more effective responses to emerging threats.

Technological advancements are also playing a crucial role. Continuous improvements in areas like transmit/receive module design, signal processing, and software algorithms are paving the way for the development of even more capable and cost-effective AESA radar systems. These advancements translate to wider adoption and continued market growth.

The proliferation of aerial threats further fuels the demand for AESA radars. The increasing prevalence of advanced aircraft, missiles, and unmanned aerial systems (UAS) necessitates superior detection and tracking capabilities. AESA radars, with their enhanced sensitivity and ability to electronically steer beams, are ideally suited to counter these evolving threats and safeguard airspace.

Finally, a growing trend in the market is the focus on indigenous development. Many countries are prioritizing the domestic design and production of AESA radars. This push for self-sufficiency aims to reduce reliance on imports and address the high costs associated with acquiring foreign platforms. By developing their own AESA radar technology, nations can potentially control costs and tailor their radar systems to meet their specific defense needs.

Regional Trends in AESA Radar Market

The global AESA radar market showcases distinct regional trends, with each area prioritizing development and procurement based on specific needs.

North America reigns supreme, driven by the immense military budget of the United States. Major defense contractors like Lockheed Martin, Northrop Grumman, and Raytheon are at the forefront of AESA radar technology. They develop and produce cutting-edge AESA radars for both military aircraft and air defense systems, ensuring the US maintains a technological edge.

Europe presents a collaborative landscape. Countries like the UK, France, and Germany are pooling resources to develop next-generation AESA radars for their future combat aircraft systems. This collaborative approach allows them to share expertise and resources, accelerating advancements in AESA technology. Eastern European nations, facing a heightened geopolitical climate, are also investing in upgrades. They are procuring AESA radars to bolster their air defense capabilities and enhance their ability to counter potential threats.

The Asia-Pacific region is experiencing a surge in AESA radar development, with China, India, Japan, and South Korea emerging as major markets. Indigenous development is a key focus in this region, with nations striving to build AESA radars tailored to address specific regional security challenges. India's development of an AESA radar for its indigenous fighter aircraft program exemplifies this trend. By achieving self-sufficiency in AESA technology, these nations aim to reduce reliance on foreign imports and potentially cut costs.

The Middle East is a region grappling with ongoing conflicts and the constant threat of ballistic missiles and drones. Countries like Saudi Arabia, the United Arab Emirates, and Israel are heavily investing in AESA radar-equipped air defense systems to counter these threats. Israel's Iron Dome and David's Sling systems, which utilize AESA radars, have garnered global recognition for their effectiveness. These systems highlight the crucial role AESA radars play in defending against modern aerial threats.

Latin America, while a smaller player, has a noteworthy market in Brazil. Brazil is actively pursuing modernization efforts, with the acquisition of AESA radar-equipped platforms a key step in bolstering its air defense capabilities. This trend of AESA radar adoption is expected to continue in Latin America as nations prioritize safeguarding their airspace.

Key AESA Radar Program

The Thales NS50 radar was chosen for the Belgian-Dutch Mine Countermeasure Vessel (MCMV) programme in January 2021, according to the Belgian Ministry of Defense. The NS50 is touted to be the world's first compact 4D Active Electronically Scanned Array (AESA) radar, making it ideal for small and medium-sized naval vessels. It is designed to defend against drones, as well as low-altitude and low-speed flying threats, in addition to its traditional missions. The Belgian-Dutch agreement, worth more than €2 billion and led by Belgium, intends for six MCM units in each country. The contract to manufacture and maintain the MCMVs was given in 2019 to the Belgium Naval and Robotics (BNR) consortium, which includes the French NAVAL GROUP and ECA Robotics. The first Belgian FOC system (of six) is expected to be delivered in 2024, followed by the first Dutch unit (of six) in 2025, and the final vessel in 2030.

SELEX Galileo and ATMOS, a subsidiary of ATECH, have signed an agreement to become the Brazilian AESA Radar Centre of Excellence and Airborne Radar Systems House. The agreement supports the Brazilian Defense Strategy's goal of improving the country's national defence industrial capability. The agreement focuses on specific target programmes, such as the Raven ES-05 AESA for the Gripen Next Generation, and specifies ATMOS' development, manufacture, training, and support efforts. All radars in the SELEX Galileo portfolio are covered by the agreement, including the Seaspray 5000E and 7000E AESA surveillance radars and the Gabbiano T20 mechanically scanned (M-Scan) surveillance radar system. Longer term, cooperative development of advanced radar subsystems will be undertaken to ensure that the Brazilian Air Force's future requirements are adequately satisfied.

Table of Contents

AESA Radar Market Report Definition

AESA Radar Market Segmentation

By Region

By Fit

By Platform

AESA Radar Market Analysis for next 10 Years

The 10-year AESA radar market analysis would give a detailed overview of AESA radar market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of AESA Radar Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global AESA Radar Market Forecast

The 10-year AESA radar market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional AESA Radar Market Trends & Forecast

The regional AESA radar market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of (Market name)

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for AESA Radar Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on AESA Radar Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Fit, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By Platform, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Fit, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2024-2034

List of Figures

- Figure 1: Global AESA radar Market Forecast, 2024-2034

- Figure 2: Global AESA radar Market Forecast, By Region, 2024-2034

- Figure 3: Global AESA radar Market Forecast, By Fit, 2024-2034

- Figure 4: Global AESA radar Market Forecast, By Platform, 2024-2034

- Figure 5: North America, AESA radar Market, Market Forecast, 2024-2034

- Figure 6: Europe, AESA radar Market, Market Forecast, 2024-2034

- Figure 7: Middle East, AESA radar Market, Market Forecast, 2024-2034

- Figure 8: APAC, AESA radar Market, Market Forecast, 2024-2034

- Figure 9: South America, AESA radar Market, Market Forecast, 2024-2034

- Figure 10: United States, AESA radar Market, Technology Maturation, 2024-2034

- Figure 11: United States, AESA radar Market, Market Forecast, 2024-2034

- Figure 12: Canada, AESA radar Market, Technology Maturation, 2024-2034

- Figure 13: Canada, AESA radar Market, Market Forecast, 2024-2034

- Figure 14: Italy, AESA radar Market, Technology Maturation, 2024-2034

- Figure 15: Italy, AESA radar Market, Market Forecast, 2024-2034

- Figure 16: France, AESA radar Market, Technology Maturation, 2024-2034

- Figure 17: France, AESA radar Market, Market Forecast, 2024-2034

- Figure 18: Germany, AESA radar Market, Technology Maturation, 2024-2034

- Figure 19: Germany, AESA radar Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, AESA radar Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, AESA radar Market, Market Forecast, 2024-2034

- Figure 22: Belgium, AESA radar Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, AESA radar Market, Market Forecast, 2024-2034

- Figure 24: Spain, AESA radar Market, Technology Maturation, 2024-2034

- Figure 25: Spain, AESA radar Market, Market Forecast, 2024-2034

- Figure 26: Sweden, AESA radar Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, AESA radar Market, Market Forecast, 2024-2034

- Figure 28: Brazil, AESA radar Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, AESA radar Market, Market Forecast, 2024-2034

- Figure 30: Australia, AESA radar Market, Technology Maturation, 2024-2034

- Figure 31: Australia, AESA radar Market, Market Forecast, 2024-2034

- Figure 32: India, AESA radar Market, Technology Maturation, 2024-2034

- Figure 33: India, AESA radar Market, Market Forecast, 2024-2034

- Figure 34: China, AESA radar Market, Technology Maturation, 2024-2034

- Figure 35: China, AESA radar Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, AESA radar Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, AESA radar Market, Market Forecast, 2024-2034

- Figure 38: South Korea, AESA radar Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, AESA radar Market, Market Forecast, 2024-2034

- Figure 40: Japan, AESA radar Market, Technology Maturation, 2024-2034

- Figure 41: Japan, AESA radar Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, AESA radar Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, AESA radar Market, Market Forecast, 2024-2034

- Figure 44: Singapore, AESA radar Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, AESA radar Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, AESA radar Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, AESA radar Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, AESA radar Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, AESA radar Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, AESA radar Market, By Fit (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, AESA radar Market, By Fit (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, AESA radar Market, By Platform (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, AESA radar Market, By Platform (CAGR), 2024-2034

- Figure 54: Scenario Analysis, AESA radar Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, AESA radar Market, Global Market, 2024-2034

- Figure 56: Scenario 1, AESA radar Market, Total Market, 2024-2034

- Figure 57: Scenario 1, AESA radar Market, By Region, 2024-2034

- Figure 58: Scenario 1, AESA radar Market, By Fit, 2024-2034

- Figure 59: Scenario 1, AESA radar Market, By Platform, 2024-2034

- Figure 60: Scenario 2, AESA radar Market, Total Market, 2024-2034

- Figure 61: Scenario 2, AESA radar Market, By Region, 2024-2034

- Figure 62: Scenario 2, AESA radar Market, By Fit, 2024-2034

- Figure 63: Scenario 2, AESA radar Market, By Platform, 2024-2034

- Figure 64: Company Benchmark, AESA radar Market, 2024-2034