|

市場調查報告書

商品編碼

1511775

全球地雷探測市場(2024-2034)Global Mine Detection Market 2024-2034 |

||||||

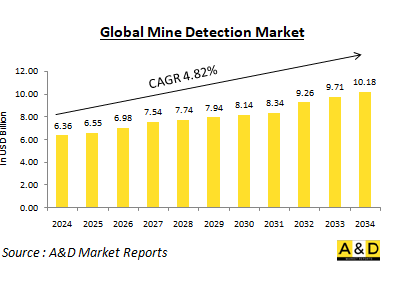

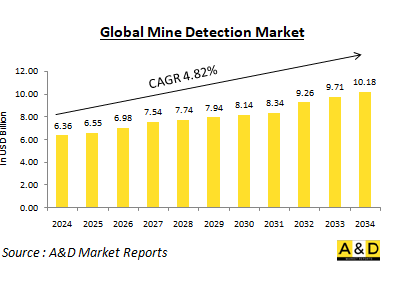

預計2024年全球地雷探測市場規模將達63.6億美元,預計2034年將達101.8億美元,在預測期內(2024-2034年)複合年增長率為4.82%。

全球地雷探測市場概況

地雷對軍事人員和平民都構成重大威脅。這些隱藏的爆炸物可能傷害或殺死手無寸鐵的人,阻礙軍事行動,並減緩衝突後重建工作。防禦性地雷探測包括用於定位和消除這些致命裝置的方法和技術,確保部隊安全通行並促進人道主義排雷行動。

地雷探測是一項複雜且多方面的任務。地雷有多種形式,並採用多種爆炸機制,包括壓力板、絆線和磁力觸發器。地雷埋藏深度不同,進一步增加了難度。傳統的地雷探測方法嚴重依賴體力勞動,常常使士兵面臨危險。然而,技術的進步帶來了更安全、更有效的檢測方法。

國防地雷探測採用各種針對識別和消除埋藏爆炸物的具體課題而客製化的方法:

手動勘探仍然是基本方法,使用金屬探測器和刺針對地面進行物理檢查以查找地雷。這種方法適用於淺層地雷,但它是勞動密集型的,並且存在固有風險,因為它可能會被意外引爆。地雷探測犬利用其高度靈敏的嗅覺在探測爆炸物方面發揮重要作用。特別是在樹木繁茂的地區或能見度有限的崎嶇地形中,經過專門訓練的狗可以提供移動且可靠的檢測能力。

機械排雷方法使用滾雷滾筒、惰輪等專用工具。這些工具施加壓力或產生受控爆炸,以引爆或清除地面上的地雷。這些方法雖然有效,但有時會損壞基礎設施並留下未爆彈,對軍事人員和平民帶來風險。防禦地雷探測的每種方法都響應特定的作戰要求和環境條件,不斷提高安全性、效率和有效性,以應對不同作戰地形中埋藏爆炸物的威脅。

科技對全球探雷市場的影響

國防地雷探測的技術進步正在透過幾種創新方法來改變這些操作的有效性和安全性:現代金屬探測器提高了靈敏度和識別能力,它已經發展到顯著改善埋在地雷中的金屬部件的探測。探地雷達 (GPR) 技術對此進行了補充,透過將電磁脈衝傳輸到地下來檢測非金屬地雷,並分析反射訊號以定位隱藏的威脅。

電磁感應 (EMI) 探測器可根據周圍地形的電導率識別地雷內的金屬成分。此方法透過有效區分埋藏金屬物體與自然環境來增強檢測過程。聲學和地震探測方法使用聲波或振動來識別地下的異常情況,這些異常情況可能表明埋有地雷的存在。這些技術提供了額外的檢測功能,特別是在地形或條件可能使其他方法無效的環境中。

配備先進感測器的無人地面車輛 (UGV) 代表了地雷探測領域的技術飛躍。這些遠端操作車輛可以在危險區域中航行並自主搜索地雷,從而最大限度地減少人類在排雷作業期間面臨的潛在風險。總的來說,這些創新透過提高準確性、擴展檢測能力以涵蓋非金屬威脅以及提高整體操作安全性,正在徹底改變國防地雷檢測。隨著軍方不斷投資和採用這些先進技術,地雷探測行動預計將提高危險環境中的有效性、降低風險並改善結果。

全球地雷探測市場的關鍵驅動因素

新地雷探測技術的發展和採用是由幾個關鍵因素推動的,每個因素都應對現代衝突和衝突後場景中的不同課題和需求。首先,出於人道主義需要,迫切需要有效的地雷探測技術。在敵對行動停止很久之後,地雷仍持續危害受衝突影響地區的平民。創新技術對於加快排雷行動、清除危險區域以及確保當地社區的安全和生計至關重要。

日益複雜的地雷威脅,包括由塑膠和複合材料等非金屬材料製成的地雷,凸顯了對先進檢測方法的需求。僅靠傳統金屬探測器可能不足以探測這些現代地雷,必須開發技術來可靠地識別埋藏在不同地形中的非金屬威脅。對參與排雷行動的軍事人員的安全的擔憂需要能夠最大限度地減少人類直接暴露於危險的技術。無人系統和先進感測器輔助的遠端偵測能力可以實現更安全、更有效率的排雷作業,並降低從事這些危險任務的人員所面臨的風險。成本效益是影響新地雷探測技術採用的另一個極為重要的驅動因素。國防機構和人道主義組織都在尋求解決方案,以優化資源並最大限度地降低與排雷行動相關的營運成本。創新技術可望簡化流程、減少排雷作業所需的時間、減少所需人員數量,最終提高排雷行動的效率和經濟性。隨著技術不斷進步,新的地雷探測技術的開發將有助於滿足人道主義需求,減輕不斷變化的威脅,並在全球消除地雷威脅的努力中提高人員安全,對於實現具有成本效益的解決方案仍然至關重要。

全球地雷探測市場的區域趨勢

由於技術進步程度、預算限制和具體業務需求不同,地雷探測工作的重點因地區而異。美國、歐洲等已開發國家正大力投資尖端探雷技術。這包括配備先進感測器和人工智慧(AI)演算法的無人系統。也著重於開發先進的對抗技術來應對簡易爆炸裝置(IED),這些裝置在現代衝突場景中構成了重大威脅。這些國家優先考慮技術優勢和創新,以提高地雷探測作業的有效性和安全性。

相反,發展中國家經常遇到影響其探雷方法的預算限制。這些國家可能依賴傳統方法和更實惠的技術相結合,例如基本的金屬探測器或簡單的機械清除工具。財務限制強調務實地強調可以利用現有資源實施的具有成本效益的解決方案。此外,這些國家可能會優先考慮培訓拆彈小組安全處理和處置地雷,並強調人員專業知識和當地能力。在衝突後地區,探雷行動的主要目標往往是快速排雷,以促進重建和重新安置。在這種情況下,速度和效率對於消除地雷和未爆炸彈藥造成的直接威脅至關重要。通常使用能夠快速部署和清除的技術,例如機械排雷系統。在這些地區,我們優先清除危險地區,以使流離失所者安全返回並支持長期穩定和發展。

整體而言,已開發國家注重尖端技術和對策,而發展中國家則以務實的方式應對財政困難,衝突後地區則優先考慮出於人道主義恢復目的的快速撤離。這種方法的多樣性反映了與世界各地地雷探測行動相關的複雜課題和優先事項。

主要地雷探測項目

L3 TEchnologies 子公司將為美國陸軍開發一個地雷探測平台,合約預計為期五年,價值 8,390 萬美元。美國國防部週四宣佈,AN/PSS-14 反地雷系統還將獲得 L3 安全和偵測系統部門的支援服務。此固定價格協議有效期限至 2023 年 11 月 20 日。AN/PSS-14 使用地面雷達、金屬探測器、軟體和微處理器陣列軟體來檢測殺傷人員地雷和反坦克地雷。在下達每個任務訂單時,承包活動(陸軍承包司令部)將確定融資和工作地點。

Promoteq 和 Minelab 反地雷部門很高興能夠幫助瑞典武裝部隊提高探測地雷、未爆彈和簡易爆炸裝置的能力。該合約有效期至 2024 年,並授權瑞典武裝部隊、瑞典國防物資管理局和瑞典民事緊急事務局進一步訂購。

本報告分析了全球地雷探測市場,研究了整體市場規模的前景、依地區和國家劃分的詳細趨勢、關鍵技術概述和市場機會。

目錄

地雷探測市場:報告定義

地雷探測市場區隔

- 依地區

- 依平台

- 依類型

地雷探測市場分析(未來10年)

地雷探測市場的市場技術

全球地雷探測市場預測

地雷探測市場:依地區劃分的趨勢和預測

- 北美

- 促進/抑制因素和課題

- PEST分析

- 市場預測與情境分析

- 大公司

- 供應商層級狀況

- 企業標竿管理

- 歐洲

- 中東

- 亞太地區

- 南美洲

地雷探測市場:國家分析

- 美國

- 防禦計劃

- 最新趨勢

- 專利

- 該市場目前的技術成熟度水平

- 市場預測與情境分析

- 加拿大

- 義大利

- 法國

- 德國

- 荷蘭

- 比利時

- 西班牙

- 瑞典

- 希臘

- 澳大利亞

- 南非

- 印度

- 中國

- 俄羅斯

- 韓國

- 日本

- 馬來西亞

- 新加坡

- 巴西

地雷探測市場:市場機會矩陣

地雷探測市場:專家對研究的看法

結論

關於Aviation and Defense Market Reports

The Global Mine Detection market is estimated at USD 6.36 billion in 2024, projected to grow to USD 10.18 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 4.82% over the forecast period 2024-2034.

Introduction to Mine Detection Market:

Landmines pose a significant threat to both military personnel and civilians. These hidden explosives can maim or kill unsuspecting individuals, hindering military operations and delaying reconstruction efforts in post-conflict zones. Defense mine detection encompasses the methods and technologies employed to locate and neutralize these deadly devices, ensuring safe passage for troops and facilitating humanitarian demining activities.

Mine detection is a complex and multifaceted task. Mines come in various forms, employing different detonation mechanisms like pressure plates, tripwires, or magnetic triggers. They can be buried at varying depths, adding another layer of difficulty. Traditional methods of mine detection relied heavily on manual techniques, often putting soldiers at risk. However, advancements in technology have led to a range of safer and more efficient detection methods.

Defense mine detection employs various approaches tailored to the specific challenges of identifying and neutralizing buried explosives:

Manual probing remains a fundamental method, utilizing metal detectors and prodders to physically inspect the ground for mines. Effective for shallow mines, this approach is labor-intensive and carries inherent risks due to the potential for accidental detonation. Mine detection dogs play a crucial role, utilizing their highly sensitive sense of smell to detect explosives. Particularly effective in areas with dense foliage or rugged terrain where visibility is limited, these specially trained dogs provide a mobile and reliable detection capability.

Mechanical mine clearance methods involve the use of specialized equipment such as mine rollers and flailing devices. These tools apply pressure or create controlled explosions to either detonate or clear mines from the ground. While effective, these methods can sometimes damage infrastructure and may leave behind unexploded ordnance, posing risks to both military personnel and civilians. Each approach in defense mine detection addresses specific operational requirements and environmental conditions, reflecting ongoing efforts to enhance safety, efficiency, and effectiveness in countering the threat of buried explosives across diverse operational landscapes.

Technology Impact in Mine Detection Market:

Technological advancements in defense mine detection are transforming the effectiveness and safety of these operations through several innovative approaches: Modern metal detectors have evolved to offer enhanced sensitivity and discrimination capabilities, significantly improving the detection of buried metallic components in mines. Ground penetrating radar (GPR) technology complements this by detecting non-metallic mines through the transmission of electromagnetic pulses into the ground, analyzing the reflected signals to pinpoint hidden threats.

Electromagnetic Induction (EMI) detectors contribute by identifying metallic components within mines based on the electrical conductivity of the surrounding terrain. This method enhances the detection process by effectively distinguishing buried metal objects from the natural environment. Acoustic and seismic detection methods utilize sound waves or vibrations to identify anomalies in the ground that may indicate the presence of buried mines. These techniques provide additional layers of detection capability, particularly in environments where other methods may be less effective due to terrain or conditions.

Unmanned Ground Vehicles (UGVs) equipped with advanced sensors represent a significant technological leap in mine detection. These remotely operated vehicles can navigate hazardous areas and autonomously search for mines, minimizing the exposure of human personnel to potential risks during clearance operations. Collectively, these technological innovations are revolutionizing defense mine detection by improving accuracy, expanding detection capabilities to include non-metallic threats, and enhancing overall operational safety. As military forces continue to invest in and adopt these advanced technologies, the effectiveness of mine detection efforts is expected to increase, mitigating risks and improving outcomes in hazardous environments.

Key Drivers in Defense Mine Detection Market:

The development and adoption of new mine detection technologies are driven by several critical factors, each addressing distinct challenges and imperatives in modern conflict and post-conflict scenarios. Firstly, the humanitarian imperative underscores the urgent need for effective mine detection technologies. Landmines continue to endanger civilian populations in areas affected by conflict long after hostilities cease. Innovative technologies are essential to expedite demining efforts, clear hazardous areas, and ensure the safety and livelihoods of local communities.

Evolving threats from sophisticated mines, including those constructed from non-metallic materials such as plastics and composites, highlight the necessity for advanced detection methods. Traditional metal detectors alone may not suffice in detecting these modern mines, necessitating the development of technologies that can reliably identify non-metallic threats buried in diverse terrain types. Safety concerns for military personnel engaged in mine clearance operations drive the demand for technologies that minimize direct human exposure to risk. Remote detection capabilities, facilitated by unmanned systems and advanced sensors, enable safer and more efficient mine clearance operations, reducing the danger posed to personnel involved in these hazardous tasks. Cost-effectiveness is another pivotal driver influencing the adoption of new mine detection technologies. Defense agencies and humanitarian organizations alike seek solutions that optimize resources and minimize operational costs associated with demining efforts. Innovative technologies promise to streamline processes, reduce the time required for clearance operations, and decrease the manpower needed, ultimately enhancing the efficiency and affordability of demining initiatives. As advancements in technology continue to evolve, the development of new mine detection technologies remains crucial for addressing humanitarian needs, mitigating evolving threats, enhancing safety for personnel, and achieving cost-effective solutions in global efforts to eradicate the threat of landmines.

Regional Trends in Defense Mine Detection Market:

The focus on mine detection efforts varies significantly across different regions, driven by varying levels of technological advancement, budgetary constraints, and specific operational needs. In developed nations such as the United States and countries in Europe, there is a substantial investment in cutting-edge technologies for mine detection. These include unmanned systems equipped with advanced sensors and artificial intelligence (AI) algorithms. The emphasis is also on developing sophisticated countermeasures to address improvised explosive devices (IEDs), which pose a significant threat in modern conflict scenarios. These nations prioritize technological superiority and innovation to enhance the effectiveness and safety of mine detection operations.

Conversely, developing nations often encounter budget limitations that affect their approach to mine detection. These countries may rely on a combination of traditional methods and more affordable technologies, such as basic metal detectors and simple mechanical clearance tools. Due to financial constraints, there is a pragmatic focus on cost-effective solutions that can be implemented with available resources. Additionally, these nations may prioritize the training of bomb disposal teams to safely handle and dispose of mines, emphasizing human expertise and local capabilities. In post-conflict regions, the primary objective of mine detection efforts is often rapid demining to facilitate reconstruction and resettlement initiatives. Speed and efficiency are critical in these scenarios to remove the immediate threat posed by landmines and unexploded ordnance. Technologies that enable quick deployment and clearance, such as mechanical mine clearance systems, are commonly utilized. These regions prioritize clearing hazardous areas to enable the safe return of displaced populations and support long-term stability and development.

Overall, while developed nations focus on cutting-edge technologies and countermeasures, developing nations navigate financial constraints with pragmatic approaches, and post-conflict regions prioritize rapid clearance for humanitarian and reconstruction purposes. The diversity in approaches reflects the complex challenges and priorities associated with mine detection efforts worldwide.

Key Mine Detection Program:

Under a prospective five-year, $83.9M deal, an L3 Technologies subsidiary will create mine detection platforms for the U.S. Army. The AN/PSS-14 countermine system will also receive support services from L3's Security and Detection Systems division, the Department of Defense announced on Thursday. The firm-fixed-price contract will be in effect through November 20, 2023. Antipersonnel and antitank mines are detected by AN/PSS-14 using a ground radar, metal detector, software, and microprocessor array software. At the time each task order is awarded, Army Contracting Command, the contracting activity, will decide on the finances and work sites.

Promoteq and Minelab Countermine Division are happy to help the Swedish Armed Forces improve their capacity for mine, UXO, and IED detection. The agreement, which is valid until 2024, permits further call-off orders from the Swedish Armed Forces, the Swedish Defence Materiel Administration, and the Swedish Civil Contingencies Agency.

Table of Contents

Mine Detection Market Report Definition

Mine Detection Market Segmentation

By Region

By Platform

By Type

Mine Detection Market Analysis for next 10 Years

The 10-year Mine Detection Market analysis would give a detailed overview of Mine Detection Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Mine Detection Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Mine Detection Market Forecast

The 10-year Mine Detection Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Mine Detection Market Trends & Forecast

The regional Mine Detection Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Mine Detection Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Mine Detection Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Mine Detection Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By Type, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By Type, 2024-2034

List of Figures

- Figure 1: Global Mine Detection Market Forecast, 2024-2034

- Figure 2: Global Mine Detection Market Forecast, By Region, 2024-2034

- Figure 3: Global Mine Detection Market Forecast, By Platform, 2024-2034

- Figure 4: Global Mine Detection Market Forecast, By Type, 2024-2034

- Figure 5: North America, Mine Detection Market, Market Forecast, 2024-2034

- Figure 6: Europe, Mine Detection Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Mine Detection Market, Market Forecast, 2024-2034

- Figure 8: APAC, Mine Detection Market, Market Forecast, 2024-2034

- Figure 9: South America, Mine Detection Market, Market Forecast, 2024-2034

- Figure 10: United States, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 11: United States, Mine Detection Market, Market Forecast, 2024-2034

- Figure 12: Canada, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Mine Detection Market, Market Forecast, 2024-2034

- Figure 14: Italy, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Mine Detection Market, Market Forecast, 2024-2034

- Figure 16: France, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 17: France, Mine Detection Market, Market Forecast, 2024-2034

- Figure 18: Germany, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Mine Detection Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Mine Detection Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Mine Detection Market, Market Forecast, 2024-2034

- Figure 24: Spain, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Mine Detection Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Mine Detection Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Mine Detection Market, Market Forecast, 2024-2034

- Figure 30: Australia, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Mine Detection Market, Market Forecast, 2024-2034

- Figure 32: India, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 33: India, Mine Detection Market, Market Forecast, 2024-2034

- Figure 34: China, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 35: China, Mine Detection Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Mine Detection Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Mine Detection Market, Market Forecast, 2024-2034

- Figure 40: Japan, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Mine Detection Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Mine Detection Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Mine Detection Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Mine Detection Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Mine Detection Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Mine Detection Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Mine Detection Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Mine Detection Market, By Platform (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Mine Detection Market, By Platform (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Mine Detection Market, By Type (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Mine Detection Market, By Type (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Mine Detection Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Mine Detection Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Mine Detection Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Mine Detection Market, By Region, 2024-2034

- Figure 58: Scenario 1, Mine Detection Market, By Platform, 2024-2034

- Figure 59: Scenario 1, Mine Detection Market, By Type, 2024-2034

- Figure 60: Scenario 2, Mine Detection Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Mine Detection Market, By Region, 2024-2034

- Figure 62: Scenario 2, Mine Detection Market, By Platform, 2024-2034

- Figure 63: Scenario 2, Mine Detection Market, By Type, 2024-2034

- Figure 64: Company Benchmark, Mine Detection Market, 2024-2034