|

市場調查報告書

商品編碼

1546373

遠距離操縱武器站 (ROWS) 的全球市場 (2024~2034年)Global Remotely Operated Weapon Stations Market 2024-2034 |

||||||

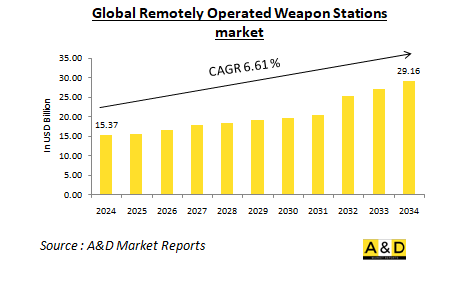

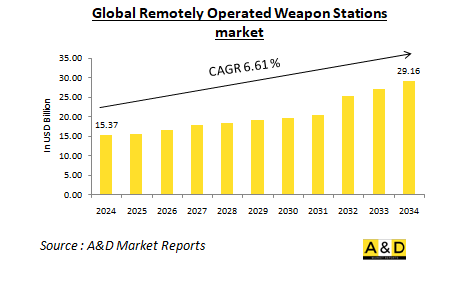

全球遠端操作武器站(ROWS)市場預計將在2024年增長至153.7億美元,2034年增長至291.6億美元,預測期內(2024-2034年)複合年增長率(CAGR)為6.61 % 。

遠距離操縱武器站市場概要

遠端操作武器站 (ROWS) 市場是國防和安全產業的重要組成部分,反映了向先進技術驅動的軍事解決方案的日益轉變。 ROWS 是一種允許操作員從安全距離控制武器的系統,通常是在車輛內或安全指揮中心內,而無需實際出現在武器所在位置。該技術透過減少暴露在敵對環境中並提供精確瞄準能力來提高軍事人員的作戰效率和安全性。由於國防預算增加、現代戰爭日益複雜以及加強安全措施的需要,ROWS 市場正在不斷擴大。改進 ROWS 功能和多功能性的先進技術的整合也促進了這種擴展。

科技對遠端操作武器站市場的影響:

技術進步對 ROWS 市場產生重大影響,推動創新,提高這些系統的功能和可靠性。關鍵技術影響包括先進感測器、高清攝影機和即時數據傳輸系統的集成,這些系統共同提高了瞄準精度和作戰效率。 ROWS系統中人工智慧(AI)和機器學習演算法的使用可以實現自主目標識別和跟踪,減少人類操作員的認知負擔,並提高系統在戰鬥情況下的反應能力。此外,安全衛星鏈路和加密網路等通訊技術的進步使遠端控制系統更加可靠和安全。更緊湊、更輕的組件的開發也有助於將ROWS部署在從陸地車輛到船隻的更廣泛的平台上,增加其多功能性和在各個軍事領域的應用。

遠端操作武器站市場的主要推動因素:

幾個關鍵推動因素正在推動 ROWS 市場的成長。首先,全球地緣政治緊張局勢和不斷升級的區域衝突增加了對提供卓越防護和作戰能力的先進防禦系統的需求。政府和軍事組織越來越多地投資 ROWS,以增強防禦和進攻能力,同時降低人員風險。其次,越來越重視部隊保護和盡量減少士兵的戰鬥暴露正在加速 ROWS 的採用。此外,正在進行的軍事艦隊現代化以及將新技術整合到現有平台中,對 ROWS 市場的成長做出了重大貢獻。國防和軍事研究的預算分配以及國防承包商和技術公司之間的合作夥伴關係對於推動創新和擴大 ROWS 市場也至關重要。最後,非國家行為體的擴散和不對稱戰爭策略產生了對更具適應性和敏捷性的武器系統的需求,進一步推動了對 ROWS 解決方案的需求。

遙控武器站市場的區域趨勢:

ROWS市場呈現不同的區域趨勢,反映了國防優先事項、技術能力和地緣政治動態的差異。在北美,尤其是美國,由於龐大的國防預算和對維持技術優勢的承諾,人們非常關注先進的 ROWS 技術。美國軍方對自主系統和下一代作戰平台的投資證實了該地區在 ROWS 創新和部署方面的領導地位。在歐洲,各國越來越重視其防禦系統的現代化,一些北約成員國正在投資 ROWS,以提高作戰能力和互通性。該地區對聯合防禦計劃和聯合作戰的重視也刺激了 ROWS 技術的進步。在亞太地區,中國和印度等國家國防開支的增加正在推動對ROWS的需求。該地區的重點是加強軍事能力,以應對區域安全挑戰和領土爭端,從而有助於擴大 ROWS 市場。此外,中東地區的戰略重點是反恐和邊境安全,ROWS 的採用越來越多,作為加強安全和國防基礎設施的更廣泛努力的一部分。總體而言,ROWS 市場受到技術進步、地緣政治因素和區域防禦優先事項複雜相互作用的影響。隨著世界各國軍隊不斷尋求先進的解決方案來應對不斷變化的威脅和作戰挑戰,遠端操作武器站市場有望持續成長和創新。

主要遙控武器站計畫:

康斯伯格獲得了一份價值 15 億美元的合同,為美國陸軍提供遠程控制武器站。根據這份為期五年的無限期交付/無限期數量合同,康斯伯格的國防和航空航天部門將繼續為陸軍裝甲車配備目標識別和交戰系統。該合約旨在交付 CROWS(通用遠端操作武器站),它是康斯伯格 Protector 系列遠端操作武器站的一部分。 CROWS 利用先進的火控軟體和一整套感測器來幫助士兵識別戰車內的目標並與之交戰。

美國陸軍已從康斯伯格防務與航空航太公司額外訂購了 409 架 CROWS。這份價值 9,400 萬美元的合約將透過交付這些先進系統來增強陸軍的目標捕獲和交戰能力。康斯伯格表示,該交易是 2022 年 10 月簽署的 15 億美元框架協議的一部分。

目錄

遠距離操縱武器站市場:報告定義

遠距離操縱武器站市場明細

- 各地區

- 各平台

- 各技術

遠距離操縱武器站市場分析 (今後10年)

遠距離操縱武器站市場市場科技

全球遠距離操縱武器站市場預測

遠距離操縱武器站市場:各國分析

- 美國

- 國防計劃

- 最新趨勢

- 專利

- 這個市場上目前技術成熟等級

- 市場預測與情勢分析

- 加拿大

- 義大利

- 法國

- 德國

- 荷蘭

- 比利時

- 西班牙

- 瑞典

- 希臘

- 澳洲

- 南非

- 印度

- 中國

- 俄羅斯

- 韓國

- 日本

- 馬來西亞

- 新加坡

- 巴西

遠距離操縱武器站市場:市場機會矩陣

遠距離操縱武器站市場:調查相關專家的見解

結論

關於Aviation and Defense Market Reports

The Global Remotely Operated Weapon Stations market is estimated at USD 15.37 billion in 2024, projected to grow to USD 29.16 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 6.61% over the forecast period 2024-2034

Introduction to the Remotely Operated Weapon Stations Market:

The Remotely Operated Weapon Stations (ROWS) market represents a critical segment of the defense and security industry, reflecting a growing shift towards advanced, technology-driven military solutions. ROWS are systems that allow operators to control weaponry from a safe distance, typically within a vehicle or a secure command post, without being physically present at the weapon's location. This technology enhances the operational effectiveness and safety of military personnel by mitigating exposure to hostile environments and providing precision targeting capabilities. The market for ROWS is expanding due to increasing defense budgets, the rising complexity of modern warfare, and the need for enhanced security measures. This expansion is also driven by the integration of sophisticated technologies that improve the functionality and versatility of ROWS.

Technology Impact in the Remotely Operated Weapon Stations Market:

Technological advancements have significantly influenced the ROWS market, driving innovations that enhance the capabilities and reliability of these systems. Key technological impacts include the integration of advanced sensors, high-definition cameras, and real-time data transmission systems, which collectively improve targeting accuracy and operational effectiveness. The use of artificial intelligence (AI) and machine learning algorithms in ROWS systems enables autonomous target recognition and tracking, reducing the cognitive load on human operators and increasing the system's responsiveness in combat situations. Furthermore, advancements in communication technologies, such as secure satellite links and encrypted networks, have bolstered the reliability and security of remote control systems. The development of more compact and lightweight components has also contributed to the deployment of ROWS on a wider range of platforms, from land vehicles to naval vessels, enhancing their versatility and application across different military domains.

Key Drivers in the Remotely Operated Weapon Stations Market:

Several key drivers are fueling the growth of the ROWS market. Firstly, the escalating geopolitical tensions and regional conflicts globally have heightened the demand for advanced defense systems that offer superior protection and operational capability. Governments and military organizations are increasingly investing in ROWS to enhance their defensive and offensive capabilities while reducing the risk to personnel. Secondly, the growing emphasis on force protection and minimizing combat exposure for soldiers has accelerated the adoption of ROWS, as these systems allow for safe engagement from a distance. Additionally, the ongoing modernization of military fleets and the integration of new technologies into existing platforms are significant contributors to the ROWS market growth. Budget allocations for defense and military research, along with partnerships between defense contractors and technology firms, are also pivotal in driving innovations and expanding the ROWS market. Lastly, the proliferation of non-state actors and asymmetric warfare tactics has created a need for more adaptable and agile weapon systems, further boosting the demand for ROWS solutions.

Regional Trends in the Remotely Operated Weapon Stations Market:

The ROWS market exhibits varied regional trends, reflecting differences in defense priorities, technological capabilities, and geopolitical dynamics. In North America, particularly the United States, there is a substantial focus on advanced ROWS technologies, driven by significant defense budgets and a commitment to maintaining technological superiority. The U.S. military's investment in autonomous systems and next-generation combat platforms underscores the region's leadership in ROWS innovation and deployment. In Europe, countries are increasingly prioritizing the modernization of their defense systems, with several NATO members investing in ROWS to enhance their operational capabilities and interoperability. The region's emphasis on collaborative defense initiatives and joint operations has also spurred advancements in ROWS technologies. In Asia-Pacific, the growing defense spending by countries such as China and India is driving demand for ROWS. The region's focus on strengthening military capabilities in response to regional security challenges and territorial disputes is contributing to the expansion of the ROWS market. Additionally, the Middle East, with its strategic focus on counterterrorism and border security, is witnessing increased adoption of ROWS as part of broader efforts to enhance security and defense infrastructure. Overall, the ROWS market is influenced by a complex interplay of technological advancements, geopolitical factors, and regional defense priorities. As military forces globally continue to seek advanced solutions to address evolving threats and operational challenges, the market for Remotely Operated Weapon Stations is expected to see sustained growth and innovation.

Key Remotely Operated Weapon Station Program:

Kongsberg has secured a $1.5 billion contract to supply the U.S. Army with remote weapon stations. Under this five-year indefinite-delivery/indefinite-quantity contract, Kongsberg's defense and aerospace division will continue to equip the Army's armored vehicles with systems for target identification and engagement. The contract involves delivering the Common Remotely Operated Weapon Station (CROWS), which is part of Kongsberg's Protector series of remote weapon stations. CROWS utilizes advanced fire control software and a comprehensive sensor suite to assist soldiers in identifying and engaging targets from within their combat vehicles.

The US Army has placed an order with Kongsberg Defence & Aerospace for 409 additional Common Remotely Operated Weapon Stations (CROWS). This $94 million contract will enhance the Army's target acquisition and engagement capabilities with the delivery of these advanced systems. The deal also includes the provision of spare parts and essential support services.Kongsberg notes that this order is part of a broader $1.5 billion framework agreement established in October 2022.

Table of Contents

Remotely Operated Weapon Stations Market Report Definition

Remotely Operated Weapon Stations Market Segmentation

By Region

By Platform

By Technology

Remotely Operated Weapon Stations Market Analysis for next 10 Years

The 10-year remotely operated weapon stations market analysis would give a detailed overview of remotely operated weapon stations market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Remotely Operated Weapon Stations Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Remotely Operated Weapon Stations Market Forecast

The 10-year remotely operated weapon stations market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Remotely Operated Weapon Stations Market Trends & Forecast

The regional remotely operated weapon stations market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Remotely Operated Weapon Stations Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Remotely Operated Weapon Stations Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Remotely Operated Weapon Stations Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By Technology, 2024-2034

List of Figures

- Figure 1: Global Remotely Operated Weapon Stations Market Forecast, 2024-2034

- Figure 2: Global Remotely Operated Weapon Stations Market Forecast, By Region, 2024-2034

- Figure 3: Global Remotely Operated Weapon Stations Market Forecast, By Platform, 2024-2034

- Figure 4: Global Remotely Operated Weapon Stations Market Forecast, By Technology, 2024-2034

- Figure 5: North America, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 6: Europe, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 8: APAC, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 9: South America, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 10: United States, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 11: United States, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 12: Canada, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 14: Italy, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 16: France, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 17: France, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 18: Germany, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 24: Spain, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 30: Australia, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 32: India, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 33: India, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 34: China, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 35: China, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 40: Japan, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Remotely Operated Weapon Stations Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Remotely Operated Weapon Stations Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Remotely Operated Weapon Stations Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Remotely Operated Weapon Stations Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Remotely Operated Weapon Stations Market, By Technology (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Remotely Operated Weapon Stations Market, By Technology (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Remotely Operated Weapon Stations Market, By Application (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Remotely Operated Weapon Stations Market, By Application (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Remotely Operated Weapon Stations Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Remotely Operated Weapon Stations Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Remotely Operated Weapon Stations Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Remotely Operated Weapon Stations Market, By Region, 2024-2034

- Figure 58: Scenario 1, Remotely Operated Weapon Stations Market, By Platform, 2024-2034

- Figure 59: Scenario 1, Remotely Operated Weapon Stations Market, By Technology, 2024-2034

- Figure 60: Scenario 2, Remotely Operated Weapon Stations Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Remotely Operated Weapon Stations Market, By Region, 2024-2034

- Figure 62: Scenario 2, Remotely Operated Weapon Stations Market, By Platform, 2024-2034

- Figure 63: Scenario 2, Remotely Operated Weapon Stations Market, By Technology, 2024-2034

- Figure 64: Company Benchmark, Remotely Operated Weapon Stations Market, 2024-2034