|

市場調查報告書

商品編碼

1546376

天線·轉換器·天線罩的全球市場 (2024~2034年)Global Antenna, Transducer and Radome Market 2024-2034 |

||||||

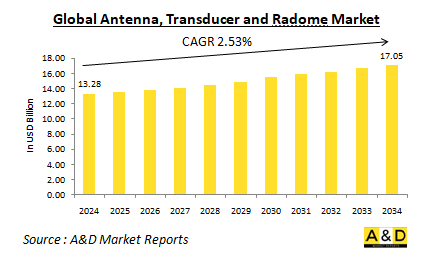

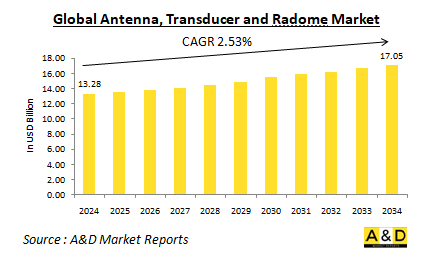

預計2024年全球天線換能器天線罩市場規模為132.6億美元,預計2034年將成長至170.5億美元,複合年增長率(CAGR)為2.53%。

全球天線·轉換器·天線罩市場概要

天線換能器雷達罩 (ATR) 技術是現代通訊和監視系統的關鍵組成部分。天線是將電能轉換為無線電波的裝置,反之亦然。另一方面,感測器是將一種形式的能量轉換為另一種形式的能量的裝置,在訊號處理和傳輸中發揮重要作用。天線罩是一種保護外殼,可保護天線免受環境因素的影響,同時允許無線電波以最小的干擾通過。 ATR 市場服務多個領域,包括航空航太和國防、通訊和汽車行業,這些組件對於有效通訊、導航和資料傳輸至關重要。市場擴張與 5G、物聯網 (IoT) 和自治系統等無線通訊技術的普及密切相關。這些技術嚴重依賴天線和感測器來確保無縫連接和高效的訊號傳輸。此外,國防和海事應用對先進雷達和聲納系統的需求不斷增長,凸顯了高性能 ATR 組件在提高作戰能力方面的重要性。

科技對全球天線、換能器和天線罩市場的影響

技術進步對 ATR 市場產生重大影響,推動創新和性能改進。先進材料和製造技術的整合正在開發更高效、更緊湊的天線、換能器和天線罩。例如,超材料的使用使得製造具有改進性能特徵的天線成為可能,例如增加頻寬和改進輻射方向圖。此外,微加工技術的進步使得製造適合各種應用(例如行動裝置和穿戴式裝置)的小型天線變得更加容易。可以動態調整方向和焦點以優化訊號接收的智慧天線的出現進一步改變了市場。這些天線可以提高通訊可靠性並減少干擾,使其在具有多個訊號源的環境中特別有用。此外,人工智慧 (AI) 和機器學習演算法與訊號處理的整合正在徹底改變數據分析和利用的方式,從而在關鍵應用中實現更快、更準確的決策。在國防部門,相控陣雷達和合成孔徑雷達等先進雷達系統的發展正在增強監視和偵察能力。這些系統依靠先進的天線和感測器來提供現代軍事行動所需的高解析度成像和目標偵測。隨著技術的不斷發展,ATR 市場預計將出現進一步的創新,以提高這些關鍵組件的性能和功能。

全球天線換能器天線罩市場的關鍵推動因素

無線通訊技術的快速採用,尤其是 5G 網路的推出,正在顯著推動對天線和感測器的需求。隨著高速資料傳輸和低延遲的需求在各種應用(包括智慧城市、連網設備和其他無線系統)中變得越來越重要,這些組件的市場持續成長。這種快速增長是由對現代通訊基礎設施更大的連接性和更高的性能的日益增長的需求所推動的。

ATR 市場成長的主要貢獻者是國防和航空航太領域。這些產業嚴重依賴先進的通訊、導航和監視系統,而這些系統需要先進的 ATR 組件。世界各國政府正在投資軍隊現代化,包括更新雷達和通訊系統。對國防技術和航空航天創新的持續投資推動了對高性能 ATR 解決方案的持續需求。

物聯網(IoT)的不斷增長的應用也是影響市場成長的關鍵因素。隨著物聯網設備在醫療保健、交通和農業等各個領域變得越來越普遍,對可靠天線和感測器的需求也在增加。這些組件對於實現大量互連設備之間的無縫連接和高效數據交換至關重要,從而支援更廣泛的物聯網生態系統。材料科學和製造流程的技術進步有助於開發更有效率、更通用的 ATR 組件。 3D 列印和奈米技術等創新正在提高天線和天線罩的性能,同時縮小其尺寸。這些進步使得 ATR 組件的生產能夠提供改進的功能和適應性,進一步推動市場成長。對汽車和無人機等自主系統的需求不斷增長,推動了對先進通訊和導航技術的需求。 ATR 組件在使這些自主系統能夠在複雜和動態的環境中有效運作方面發揮關鍵作用。人們對自主技術日益增長的興趣強調了對支援其功能和可靠性的可靠、高效能 ATR 解決方案的需求。

全球天線、換能器和天線罩市場的區域趨勢

天線換能器天線罩 (ATR) 市場呈現出由技術採用、國防支出和市場需求等多種因素影響的獨特區域趨勢。

在北美,ATR市場佔有最大佔有率,這主要是由於大型國防公司和先進技術公司的存在。美國政府龐大的國防預算,加上對軍事能力現代化的關注,在推動市場成長方面發揮關鍵作用。此外,5G技術在城市地區的快速採用將進一步刺激對先進天線和感測器的需求。這些技術對於支援高速、低延遲通訊網路至關重要。歐洲 ATR 市場的特點是重點關注國防和航空航天應用。英國、德國和法國等主要國家正大力投資升級其軍事能力,包括加強雷達和通訊系統。此外,對互聯設備和物聯網 (IoT) 應用的需求不斷增長也促進了該地區的市場成長。隨著歐洲國家對先進技術和基礎設施的投資,對先進 ATR 組件的需求持續成長。預計亞太地區的 ATR 市場成長率最高。中國和印度等國家正在大幅增加國防預算並投資於先進技術。這一增長是由這些國家的快速城市化和數位化推動的,這推動了對無線通訊解決方案的需求。該地區充滿活力的經濟發展和技術進步正在推動市場向前發展,反映出對 ATR 零件的強勁購買興趣。在中東和非洲,ATR 市場受到持續衝突和安全問題的嚴重影響。該地區國家正在投資先進的監視和通訊技術,以加強其軍事能力並應對安全挑戰。此外,隨著各國尋求改善基礎設施和連接性,通訊和運輸等商業應用對 ATR 組件的需求也在增加。在拉丁美洲,ATR 市場與其他地區相比相對較小,人們越來越意識到需要加強通訊和監控能力。對改善基礎設施和連接性的日益關注正在推動各個領域對天線和感測器的需求。隨著拉丁美洲國家不斷改善其技術和國防基礎設施,ATR零件市場預計將擴大。總體而言,由於技術進步、無線通訊需求的增加以及國防支出的增加,ATR 市場有望顯著成長。隨著行業的發展和適應新技術,ATR 市場將在各種應用中實現有效通訊和導航方面發揮關鍵作用。

天線、換能器和天線罩的主要程式

為了防止網路電磁活動 (CEMA),NovAtel 宣布其 GAMT(GPS 抗干擾技術)天線已被選用於加拿大陸軍的裝甲戰鬥支援車 (ACSV)。由於 CEMA,GAJT 天線的定位、導航和授時 (PNT) 風險得以降低。

Celestia TTI 與西班牙 NGWS/FCAS 計畫國家工業協調員 Indra 簽署了合作協議。兩家公司將共同製造下一代天線並為 FCAS 專案創建創新的通訊系統。

Raytheon 是一家 RTX 營運公司,設計、製造和測試兩種高功率微波天線系統,這些系統使用定向能量以光速擊敗空中威脅。系統便攜且堅固,適合一線部署。作為 DEFEND(定向能量前線電磁中和和缺陷)計劃的一部分,Raothon 獲得了海軍水面作戰中心達爾格倫分部一份為期三年、價值 3130 萬美元的合同,為美國海軍和空軍提供原型系統。

目錄

天線·轉換器·天線罩市場:報告定義

天線·轉換器·天線罩市場明細

- 各產品

- 各地區

- 各終端用戶

天線·轉換器·天線罩市場:各地區的趨勢與預測

- 北美

- 促進·阻礙因素,課題

- PEST分析

- 市場預測與情勢分析

- 主要企業

- 供應商階層的形勢

- 企業的基準

- 歐洲

- 中東

- 亞太地區

- 南美

天線·轉換器·天線罩市場:各國分析

- 美國

- 國防計劃

- 最新趨勢

- 專利

- 這個市場上目前技術成熟等級

- 市場預測與情勢分析

- 加拿大

- 義大利

- 法國

- 德國

- 荷蘭

- 比利時

- 西班牙

- 瑞典

- 希臘

- 澳洲

- 南非

- 印度

- 中國

- 俄羅斯

- 韓國

- 日本

- 馬來西亞

- 新加坡

- 巴西

天線·轉換器·天線罩市場:市場機會矩陣

天線·轉換器·天線罩市場:調查相關專家的見解

結論

關於Aviation and Defense Market Reports

The Global Antenna, Transducer, and Radome market is estimated at USD 13.26 billion in 2024, projected to grow to USD 17.05 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 2.53% over the forecast period 2024-2034

Introduction to the Antenna, Transducer, and Radome Market:

Antenna, transducer, and radome technologies are critical components in modern communication and surveillance systems. An antenna is a device that converts electrical energy into radio waves and vice versa, enabling wireless communication. Transducers, on the other hand, are devices that convert one form of energy into another, playing a crucial role in signal processing and transmission. Radomes are protective enclosures that shield antennas from environmental factors while allowing radio waves to pass through with minimal interference. The ATR market serves various sectors, including aerospace, defense, telecommunications, and automotive industries, where these components are integral for effective communication, navigation, and data transmission. The market's expansion is closely linked to the proliferation of wireless communication technologies, such as 5G, the Internet of Things (IoT), and autonomous systems. These technologies rely heavily on antennas and transducers to ensure seamless connectivity and efficient signal transmission. Furthermore, the growing demand for advanced radar and sonar systems in defense and maritime applications underscores the importance of high-performance ATR components in enhancing operational capabilities.

Technology Impact in the Antenna, Transducer, and Radome Market:

Technological advancements have significantly impacted the ATR market, driving innovation and improving performance. The integration of advanced materials and manufacturing techniques has led to the development of more efficient and compact antennas, transducers, and radomes. For instance, the use of metamaterials has enabled the creation of antennas with enhanced performance characteristics, such as increased bandwidth and improved radiation patterns. Additionally, advancements in microfabrication techniques have facilitated the production of miniaturized antennas suitable for various applications, including mobile devices and wearables. The emergence of smart antennas, which can dynamically adjust their direction and focus to optimize signal reception, has further transformed the market. These antennas are particularly beneficial in environments with multiple signal sources, as they can enhance communication reliability and reduce interference. Moreover, the integration of artificial intelligence (AI) and machine learning algorithms in signal processing is revolutionizing how data is analyzed and utilized, enabling faster and more accurate decision-making in critical applications. In the defense sector, the development of advanced radar systems, including phased array radars and synthetic aperture radars, has enhanced surveillance and reconnaissance capabilities. These systems rely on sophisticated antennas and transducers to provide high-resolution imaging and target detection, which are vital for modern military operations. As technology continues to evolve, the ATR market is expected to witness further innovations that will enhance the performance and capabilities of these critical components.

Key Drivers in the Antenna, Transducer, and Radome Market:

The rapid adoption of wireless communication technologies, particularly the rollout of 5G networks, has significantly boosted the demand for antennas and transducers. As the need for high-speed data transmission and low latency becomes critical across various applications-such as in smart cities, connected devices, and other wireless systems-the market for these components continues to expand. This surge is fueled by the growing desire for enhanced connectivity and improved performance in modern communication infrastructures.

The defense and aerospace sectors are major contributors to the ATR market's growth. These industries rely heavily on advanced communication, navigation, and surveillance systems, which in turn require sophisticated ATR components. Governments around the world are investing in the modernization of their military capabilities, which includes upgrading their radar and communication systems. This ongoing investment in defense technology and aerospace innovation drives consistent demand for high-performance ATR solutions.

The expansion of Internet of Things (IoT) applications is another significant factor influencing market growth. As IoT devices proliferate across diverse sectors-such as healthcare, transportation, and agriculture-the need for reliable antennas and transducers becomes increasingly important. These components are essential for enabling seamless connectivity and efficient data exchange among a multitude of interconnected devices, thereby supporting the broader IoT ecosystem. Technological advancements in materials science and manufacturing processes are contributing to the development of more efficient and versatile ATR components. Innovations such as 3D printing and nanotechnology are enhancing the performance of antennas and radomes while simultaneously reducing their size. These advancements enable the production of ATR components that offer improved capabilities and adaptability, further driving market growth. The rising demand for autonomous systems, including vehicles and drones, is fueling the need for advanced communication and navigation technologies. ATR components play a crucial role in ensuring that these autonomous systems can operate effectively within complex and dynamic environments. The growing interest in autonomous technologies underscores the necessity for reliable and high-performance ATR solutions to support their functionality and reliability.

Regional Trends in the Antenna, Transducer, and Radome Market:

The Antennas, Transducers, and Radomes (ATR) market demonstrates distinct regional trends shaped by a range of factors including technological adoption, defense spending, and market demand.

In North America, the ATR market holds the largest share, largely due to the presence of major defense contractors and advanced technology companies. The significant defense budget of the U.S. government, coupled with its focus on modernizing military capabilities, plays a crucial role in driving market growth. Additionally, the rapid adoption of 5G technology in urban areas further stimulates the demand for advanced antennas and transducers, as these technologies are integral to supporting high-speed, low-latency communication networks. Europe's ATR market is marked by a strong emphasis on defense and aerospace applications. Key countries such as the UK, Germany, and France are making substantial investments in upgrading their military capabilities, which includes enhancing radar and communication systems. Moreover, the growing demand for connected devices and Internet of Things (IoT) applications is also contributing to market growth in this region. As European nations invest in advanced technologies and infrastructure, the need for sophisticated ATR components continues to rise. The Asia-Pacific region is projected to experience the highest growth rate in the ATR market. Countries like China and India are notably increasing their defense budgets and investing in advanced technologies. This growth is driven by rapid urbanization and digital transformation within these nations, which is fueling the demand for wireless communication solutions. The region's dynamic economic development and technological advancements are propelling the market forward, reflecting a robust appetite for ATR components. In the Middle East and Africa, the ATR market is significantly influenced by ongoing conflicts and security concerns. Countries within this region are investing in advanced surveillance and communication technologies to enhance their military capabilities and address security challenges. Additionally, there is a rising demand for ATR components in commercial applications, such as telecommunications and transportation, as nations seek to improve infrastructure and connectivity. In Latin America, while the ATR market is relatively smaller compared to other regions, there is a growing recognition of the need for enhanced communication and surveillance capabilities. The increasing focus on improving infrastructure and connectivity is driving demand for antennas and transducers across various sectors. As Latin American countries continue to develop their technological and defense infrastructures, the market for ATR components is expected to expand. Overall, the ATR market is poised for significant growth, driven by technological advancements, increasing demand for wireless communication, and rising defense expenditures. As industries evolve and adapt to new technologies, the ATR market will play a crucial role in enabling effective communication and navigation across diverse applications.

Key Antenna, Transducer, Radome Market Program:

In order to defend against cyber electromagnetic activities (CEMA), NovAtel announced that their GPS Anti-Jam Technology (GAJT) antennas have been chosen for use on

armored combat support vehicles (ACSVs) being constructed for the Canadian Army. Positioning, navigation, and timing (PNT) risks will be lessened by the GAJT antennas thanks to CEMA.

A collaboration agreement has been established between Celestia TTI and Indra, the national industrial coordinator of the NGWS/FCAS program in Spain. Together,

they will build next-generation antennas, which will allow them to construct innovative communications systems for the FCAS program.

Raytheon, an RTX business, will design, build and test two high-power microwave antenna systems that will use directed energy to defeat airborne threats at the speed

of light. For front-line deployment, the systems are made to be portable and robust.As part of the Directed Energy Front-line Electromagnetic Neutralization and Defeat (DEFEND) program, Raytheon will supply prototype systems to the U.S. Navy and Air Force under a three-year, $31.3 million contract from the Naval Surface Warfare Center Dahlgren Division.

Table of Contents

Antenna, Transducer and Radome Market Report Definition

Antenna, Transducer and Radome Market Segmentation

By Product

By Region

By End-User

Antenna, Transducer and Radome Market Analysis for next 10 Years

The 10-year Antenna, Transducer and Radome Market analysis would give a detailed overview of Antenna, Transducer and Radome Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Antenna, Transducer and Radome Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Antenna, Transducer and Radome Market Forecast

The 10-year Antenna, Transducer and Radome Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Antenna, Transducer and Radome Market Trends & Forecast

The regional Antenna, Transducer and Radome Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Antenna, Transducer and Radome Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Antenna, Transducer and Radome Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Antenna, Transducer and Radome Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Product, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By End User, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Product, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By End User, 2024-2034

List of Figures

- Figure 1: Global Antenna, Transducer and Radome Market Forecast, 2024-2034

- Figure 2: Global Antenna, Transducer and Radome Market Forecast, By Region, 2024-2034

- Figure 3: Global Antenna, Transducer and Radome Market Forecast, By Product, 2024-2034

- Figure 4: Global Antenna, Transducer and Radome Market Forecast, By End User, 2024-2034

- Figure 5: North America, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 6: Europe, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 8: APAC, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 9: South America, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 10: United States, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 11: United States, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 12: Canada, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 14: Italy, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 16: France, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 17: France, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 18: Germany, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 24: Spain, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 30: Australia, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 32: India, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 33: India, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 34: China, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 35: China, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 40: Japan, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Antenna, Transducer and Radome Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Antenna, Transducer and Radome Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Antenna, Transducer and Radome Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Antenna, Transducer and Radome Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Antenna, Transducer and Radome Market, By Product (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Antenna, Transducer and Radome Market, By Product (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Antenna, Transducer and Radome Market, By End User (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Antenna, Transducer and Radome Market, By End User (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Antenna, Transducer and Radome Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Antenna, Transducer and Radome Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Antenna, Transducer and Radome Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Antenna, Transducer and Radome Market, By Region, 2024-2034

- Figure 58: Scenario 1, Antenna, Transducer and Radome Market, By Product, 2024-2034

- Figure 59: Scenario 1, Antenna, Transducer and Radome Market, By End User, 2024-2034

- Figure 60: Scenario 2, Antenna, Transducer and Radome Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Antenna, Transducer and Radome Market, By Region, 2024-2034

- Figure 62: Scenario 2, Antenna, Transducer and Radome Market, By Product, 2024-2034

- Figure 63: Scenario 2, Antenna, Transducer and Radome Market, By End User, 2024-2034

- Figure 64: Company Benchmark, Antenna, Transducer and Radome Market, 2024-2034