|

市場調查報告書

商品編碼

1461396

水洗矽砂市場,依產品種類、依應用、依地理位置Washed Silica Sand Market, By Product Type, By Application, By Geography |

||||||

預計2024年水洗矽砂市值為185.6億美元,預計到2031年將達到272.5億美元,2024年至2031年年複合成長率(CAGR)為5.6%。

| 報告範圍 | 報告詳情 | ||

|---|---|---|---|

| 基準年: | 2023年 | 2023/2024 年市場規模: | 185.6 億美元 |

| 歷史數據: | 2019年至2023年 | 預測期: | 2024年至2031年 |

| 預測期間 2023/2024 至 2030/2031 年複合成長率: | 5.60% | 2030/2031 價值預測: | 272.5 億美元 |

水洗矽砂是一種高純度矽砂,透過清洗和加工天然存在的砂沉積物以去除不需要的塗層和雜質而產生。矽砂沉積物是天然存在的顆粒材料,主要由二氧化矽 (SiO2) 組成,二氧化矽是製造玻璃、鑄造、水力壓裂、磨料和各種工業應用所必需的化合物。隨著全球玻璃、鑄造、水力壓裂和磨料製造業的擴張,水洗矽砂市場也不斷成長。隨著基礎設施開發活動的不斷增加和城市化的快速發展,預計未來幾年對水洗矽砂的需求將大幅增加。

市場動態:.

全球水洗矽砂市場是由玻璃、鑄造、水力壓裂和磨料等關鍵最終用途行業的強勁成長所推動的。建築活動的擴大和汽車產量的增加刺激了玻璃需求,進一步促進了市場成長。此外,透過水力壓裂方法增加頁岩氣探勘也加劇了消費。然而,與採礦和加工活動有關的嚴格環境法規可能會阻礙市場擴張。另一方面,再生能源領域的新興應用為市場參與者帶來了新的機會。

研究的主要特點:

- 該報告對全球水洗矽砂市場進行了深入分析,並提供了預測期(2024-2031年,以2023年為基準年)的市場規模和年複合成長率(CAGR%)。

- 它闡明了不同區隔市場的潛在收入成長機會,並解釋了該市場有吸引力的投資主張矩陣。

- 這項研究還提供了有關市場促進因素、限制因素、機會、新產品發布或批准、市場趨勢、區域前景以及主要參與者採取的競爭策略的重要見解。

- 它根據以下參數介紹了全球水洗矽砂市場的主要參與者——公司亮點、產品組合、主要亮點、財務表現和策略。

- 該報告的見解將使行銷人員和公司管理當局能夠就未來的產品發布、類型升級、市場擴張和行銷策略做出明智的決策。

- 全球水洗矽砂市場報告迎合了該行業的各個利益相關者,包括投資者、供應商、產品製造商、分銷商、新進業者和財務分析師。

- 利害關係人可以透過用於分析全球水洗矽砂市場的各種策略矩陣輕鬆做出決策。

目錄

第1章:研究目標與假設

- 研究目標

- 假設

第 2 章:市場概述

- 報告說明

- 市場定義和範圍

- 執行摘要

- 市場機會圖

第 3 章:關鍵見解

- 市場動態

- 促進要素

- 限制

- 機會

- 主要市場趨勢

- 市場動態影響分析

- 透過 PESTEL 分析進行市場評估

- 波特分析

- 監管場景

- 市場吸引力分析

- 增量機會評估

第 4 章:全球水洗矽砂市場,依鐵含量分類,2019 - 2031 年

- 介紹

- 大於0.01%

- 小於0.01%

第 5 章:全球水洗矽砂市場,依應用分類,2019 - 2031 年

- 介紹

- 玻璃

- 鑄造廠

- 油井水泥

- 陶瓷及耐火材料

- 磨料

- 冶金

- 其他(過濾等)

第 6 章:全球水洗矽砂市場(依地區),2019 - 2031 年

- 介紹

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 義大利

- 法國

- 西班牙

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東協

- 亞太其他地區

- 中東和非洲

- 海灣合作理事會

- 以色列

- 中東其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

第 7 章:公司簡介 - 全球水洗矽砂市場

- Unimin Corporation

- 公司簡介

- 產品/服務組合

- 財務績效

- 最新動態/更新

- 戰略概覽

- Fairmount Minerals

- US Silica Holdings, Inc.

- Emerge Energy Services LP

- Badger Mining Corp

- Hi-Crush Partners

- Preferred Sands

- Premier Silica

- Pattison Sand

- Sibelco

- Minerali Industriali

- Quarzwerke Group

- Aggregate Industries & WOLFF & MULLER

- VRX Silica Limited

- Australian Silica Quartz Group Ltd

- Adwan Chemical Industries Company

- Refcast Corporation

- Zillion Sawa Minerals Pvt. Ltd.

- TMM India

- Srinath Enterprises

第 8 章:參考文獻與研究方法

- 參考

- 研究方法論

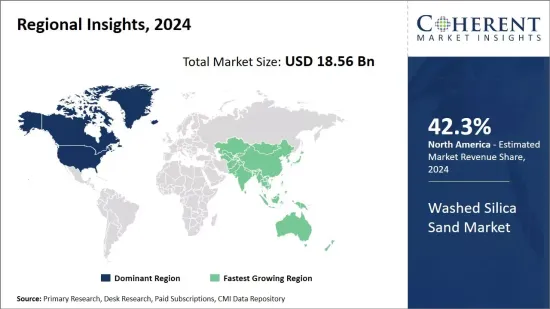

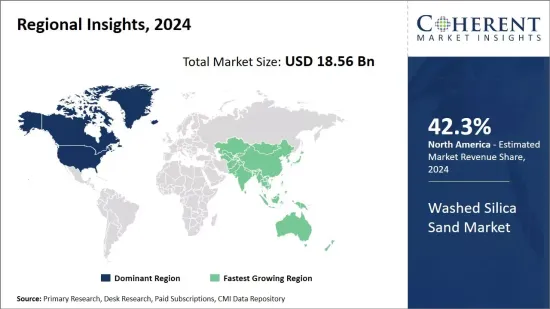

The washed silica sand market is estimated to be valued at USD 18.56 Bn in 2024 and is expected to reach USD 27.25 Bn by 2031, growing at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2023/2024: | US$ 18.56 Bn |

| Historical Data for: | 2019 to 2023 | Forecast Period: | 2024 to 2031 |

| Forecast Period 2023/2024 to 2030/2031 CAGR: | 5.60% | 2030/2031 Value Projection: | US$ 27.25 Bn |

Washed silica sand is a high-purity form of silica sand produced through washing and processing naturally occurring sand deposits to remove unwanted coatings and impurities. Silica sand deposits are naturally occurring granular materials comprised mainly of silicon dioxide (SiO2), a compound essential for manufacturing glass, foundry casting, hydraulic fracturing (fracking), abrasives, and various industrial applications. The washed silica sand market has been growing in tandem with the expansion of the glass, foundry, hydraulic fracturing, and abrasive manufacturing industries globally. With the rising infrastructure development activities and rapid urbanization, the demand for washed silica sand is expected to increase substantially in the coming years.

Market Dynamics:

The global washed silica sand market is driven by robust growth in the key end-use industries such as glass, foundry casting, hydraulic fracturing, and abrasives. Expanding construction activities and rising automobile production have boosted the demand for glass, further augmenting the market growth. Additionally, increasing shale gas exploration through hydraulic fracturing methods is fueling consumption. However, stringent environmental regulations pertaining to mining and processing activities may hamper market expansion. On the other hand, emerging applications in the renewable energy sector open up new opportunities for market participants.

Key Features of the Study:

- This report provides an in-depth analysis of the global washed silica sand market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2024-2031, considering 2023 as the base year.

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the global washed silica sand market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include a shortlist of key companies operating in the washed silica sand market such as Unimin Corporation, Fairmount Minerals, US Silica Holdings, Inc., Emerge Energy Services LP, Badger Mining Corp, Hi-Crush Partners, Preferred Sands, Premier Silica, Pattison Sand, Sibelco, Minerali Industriali, Quarzwerke Group, Aggregate Industries & WOLFF & MULLER, VRX Silica Limited, Australian Silica Quartz Group Ltd, Adwan Chemical Industries Company, Refcast Corporation, Zillion Sawa Minerals Pvt. Ltd., TMM India, and Srinath Enterprises.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- The global washed silica sand market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global washed silica sand market.

Market Segmentation

- Product Type:

- Greater Than 0.01%

- Less Than 0.01%

- Application:

- Glass

- Foundry

- Oil Well Cement

- Ceramic & Refractories

- Abrasive

- Metallurgy

- Others (Filtration, etc.)

- Regional:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Company Profiles:

- Unimin Corporation

- Fairmount Minerals

- US Silica Holdings, Inc.

- Emerge Energy Services LP

- Badger Mining Corp

- Hi-Crush Partners

- Preferred Sands

- Premier Silica

- Pattison Sand

- Sibelco

- Minerali Industriali

- Quarzwerke Group

- Aggregate Industries & WOLFF & MULLER

- VRX Silica Limited

- Australian Silica Quartz Group Ltd

- Adwan Chemical Industries Company

- Refcast Corporation

- Zillion Sawa Minerals Pvt. Ltd.

- TMM India

- Srinath Enterprises

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

2. Market Overview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snapshot By Fe Content

- Market Snapshot By Application

- Market Snapshot By Region

- Market Scenario - Conservative, Like, Opportunistic

- Market Opportunity Map

3. Key Insights

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Key Market Trends

- Impact Analysis of Market Dynamics

- Market Assessment By PESTEL Analysis

- PORTER Analysis

- Regulatory Scenario

- Market Attractiveness Analysis

- Incremental $ Opportunity Assessment

4. Global Washed Silica Sand Market, By Fe Content, 2019 - 2031 (US$ Bn) & Volume (KT)

- Introduction

- Market Share (%) Analysis, 2024, 2027 & 2031

- Market Y-o-Y Growth Comparison (%), 2019 - 2031

- Segment Trends

- Greater Than 0.01%, 2019 - 2031(US$ Bn) & Volume (KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn) & Volume (KT)

- Less Than 0.01%, 2019 - 2031(US$ Bn) & Volume (KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn) & Volume (KT)

5. Global Washed Silica Sand Market, By Application, 2019 - 2031 (US$ Bn) & Volume (KT)

- Introduction

- Market Share (%) Analysis, 2024, 2027 & 2031

- Market Y-o-Y Growth Comparison (%), 2019 - 2031

- Segment Trends

- Glass, 2019 - 2031(US$ Bn) & Volume (KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn) & Volume (KT)

- Foundry, 2019 - 2031(US$ Bn) & Volume (KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn) & Volume (KT)

- Oil Well Cement, 2019 - 2031(US$ Bn) & Volume (KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn) & Volume (KT)

- Ceramic & Refractories, 2019 - 2031(US$ Bn) & Volume (KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn) & Volume (KT)

- Abrasive, 2019 - 2031(US$ Bn) & Volume (KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn) & Volume (KT)

- Metallurgy, 2019 - 2031(US$ Bn) & Volume (KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn) & Volume (KT)

- Others (Filtration, etc.), 2019 - 2031(US$ Bn) & Volume (KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn) & Volume (KT)

6. Global Washed Silica Sand Market, By Region, 2019 - 2031 (US$ Bn) & Volume (KT)

- Introduction

- Market Share (%) Analysis, 2024, 2027 & 2031, (US$ Bn)

- Market Y-o-Y Growth Comparison (%), 2024 - 2031, (US$ Bn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Fe Content, 2019 - 2031, (US$ Bn) & Volume (KT)

- Market Size and Forecast, By Application, 2019 - 2031, (US$ Bn) & Volume (KT)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Bn) & Volume (KT)

- U.S.

- Canada

- Europe

- Introduction

- Market Size and Forecast, By Fe Content, 2019 - 2031, (US$ Bn) & Volume (KT)

- Market Size and Forecast, By Application, 2019 - 2031, (US$ Bn) & Volume (KT)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Bn) & Volume (KT)

- U.K.

- Germany

- Italy

- France

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Fe Content, 2019 - 2031, (US$ Bn) & Volume (KT)

- Market Size and Forecast, By Application, 2019 - 2031, (US$ Bn) & Volume (KT)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Bn) & Volume (KT)

- China

- India

- Japan

- Australia

- South Korea

- Asean

- Rest Of Asia Pacific

- Middle East & Africa

- Introduction

- Market Size and Forecast, By Fe Content, 2019 - 2031, (US$ Bn) & Volume (KT)

- Market Size and Forecast, By Application, 2019 - 2031, (US$ Bn) & Volume (KT)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Bn) & Volume (KT)

- GCC

- Israel

- Rest Of Middle East

- Latin America

- Introduction

- Market Size and Forecast, By Fe Content, 2019 - 2031, (US$ Bn) & Volume (KT)

- Market Size and Forecast, By Application, 2019 - 2031, (US$ Bn) & Volume (KT)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Bn) & Volume (KT)

- Brazil

- Mexico

- Argentina

7. Company Profiles - Global Washed Silica Sand Market

- Unimin Corporation

- Company Overview

- Product/Service Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- Fairmount Minerals

- US Silica Holdings, Inc.

- Emerge Energy Services LP

- Badger Mining Corp

- Hi-Crush Partners

- Preferred Sands

- Premier Silica

- Pattison Sand

- Sibelco

- Minerali Industriali

- Quarzwerke Group

- Aggregate Industries & WOLFF & MULLER

- VRX Silica Limited

- Australian Silica Quartz Group Ltd

- Adwan Chemical Industries Company

- Refcast Corporation

- Zillion Sawa Minerals Pvt. Ltd.

- TMM India

- Srinath Enterprises

8. References and Research Methodology

- References

- Research Methodology

- About us and Sales Contact