|

市場調查報告書

商品編碼

1477230

B2B支付交易市場,依支付類型,依支付方式,依企業類型,依行業,依地域B2B Payments Transaction Market, By Payment Type, By Payment Method, By Enterprise Type, By Industry, By Geography |

||||||

B2B支付交易市場預計2024年價值為15766.1億美元,預計到2031年將達到30212.5億美元,2024年至2031年年複合成長率(CAGR)為9.7%。

| 報告範圍 | 報告詳情 | ||

|---|---|---|---|

| 基準年: | 2023年 | 2024 年市場規模: | 15,766.1 億美元 |

| 歷史數據: | 2019年至2023年 | 預測期: | 2024年至2031年 |

| 預測 2024 年至 2031 年複合年成長率: | 9.70% | 2031 年價值預測: | 30,212.5 億美元 |

B2B支付交易市場是指從大型企業到中小企業之間進行的金融交易。這包括從其他公司購買商品和服務的所有付款方式。 B2B 支付的關鍵面向包括商業卡、直接借記、商業支票以及電匯和自動清算所 (ACH) 交易等電子支付。全球疫情加速了各產業數位轉型的趨勢,加速了向數位化、遠端B2B交易模式的轉變。隨著企業尋求便利、安全且經濟高效的支付解決方案,這推動了電子 B2B 支付市場的成長。

市場動態:

B2B支付交易市場的推動因素包括日益重視簡化工作流程、企業對即時支付功能和彈性支付選項的需求。市場看到遺留系統的限制阻礙了向新技術的遷移。然而,機會在於支援數位交易的 B2B 基礎設施現代化。 COVID-19 的疫情為非接觸式和數位 B2B 商務帶來了強大的推動力,增加了對自動支付方式的需求。人工智慧和區塊鏈等領域的創新也有望顛覆傳統模式,並為安全、無縫和可追蹤的 B2B 傳輸打造新途徑。

研究的主要特點:

- 該報告對全球B2B支付交易市場進行了深入分析,並提供了預測期(2024-2031年,以2023年為基準年)的市場規模和年複合成長率(CAGR%)。

- 它闡明了不同區隔市場的潛在收入成長機會,並解釋了該市場有吸引力的投資主張矩陣。

- 這項研究還提供了有關市場促進因素、限制因素、機會、新產品發布或批准、市場趨勢、區域前景以及主要參與者採取的競爭策略的重要見解。

- 它根據以下參數對全球 B2B 支付交易市場的主要參與者進行了介紹:公司亮點、產品組合、主要亮點、財務表現和策略。

- 該報告的見解將使行銷人員和公司管理當局能夠就未來的產品發布、類型升級、市場擴張和行銷策略做出明智的決策。

- 全球 B2B 支付交易市場報告迎合了該行業的各個利益相關者,包括投資者、供應商、產品製造商、分銷商、新進業者和金融分析師。

- 利害關係人可以透過用於分析全球 B2B 支付交易市場的各種策略矩陣輕鬆做出決策。

目錄

第1章:研究目標與假設

- 研究目標

- 假設

- 縮寫

第 2 章:市場範圍

- 報告說明

- 市場定義和範圍

- 執行摘要

- Coherent Opportunity Map (COM)

第 3 章:市場動態、法規與趨勢分析

- 市場動態

- 促進要素

- 限制

- 機會

- 監管場景

- 產業動態

- 併購

- 新系統啟動/批准

- COVID-19 大流行的影響

第 4 章:2019-2031 年全球 B2B 支付交易市場(依支付類型)

- 介紹

- 國內支付

- 跨境支付

第 5 章:2019-2031 年全球 B2B 支付交易市場(以支付方式)

- 介紹

- 銀行轉帳

- 牌

- 網上支付

第 6 章:2019-2031 年全球 B2B 支付交易市場(依企業類型)

- 介紹

- 中小企業

- 大型企業

第 7 章:2019-2031 年全球 B2B 支付交易市場(依產業)

- 介紹

- 政府

- 製造業

- BFSI

- 金屬與礦業

- 資訊科技與電信

- 零售與電子商務

- 其他(醫療保健、能源和公用事業)

第 8 章:2019-2031 年全球 B2B 支付交易市場(依地區)

- 介紹

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 義大利

- 法國

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 東協

- 澳洲

- 韓國

- 日本

- 亞太地區其他地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 海灣合作理事會國家

- 南非

- 中東和非洲其他地區

第 9 章:競爭格局

- 公司簡介

- Mastercard Inc.

- FIS

- Stripe, Inc.

- Paystand, Inc.

- Flywire

- Squareup Pte. Ltd

- Edenred Payment Solutions

- Payoneer Inc.

- American Express

- Visa Inc.

- JPMorgan & Chase

- Adyen NV

- Billtrust

- Coupa Software Inc.

- Dwolla, Inc.

- Earthport PLC

- FLEETCOR Technologies, Inc.

- Intuit Inc.

- Nvoicepay, Inc.

- Optal Limited

- Paytm Mobile Solutions Private Limited

- PayPal Holdings, Inc.

- TransferWise Ltd.

第 10 章:分析師建議

- 命運之輪

- 分析師觀點

- 連貫的機會圖

第 11 章:研究方法

- 參考

- 研究方法論

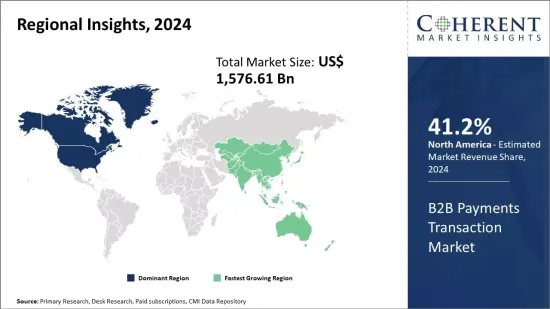

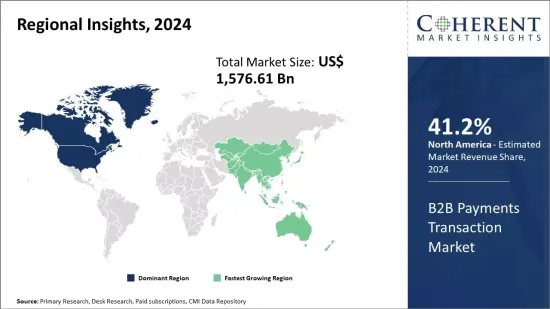

The B2B payments transaction market is estimated to be valued at US$ 1,576.61 Bn in 2024 and is expected to reach US$ 3,021.25 Bn by 2031, growing at a compound annual growth rate (CAGR) of 9.7% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2024: | US$ 1,576.61 Bn |

| Historical Data for: | 2019 To 2023 | Forecast Period: | 2024 To 2031 |

| Forecast Period 2024 to 2031 CAGR: | 9.70% | 2031 Value Projection: | US$ 3,021.25 Bn |

The B2B payments transaction market refers to financial transactions conducted between businesses, from large enterprises to small and medium-sized businesses. This includes all methods of payment for purchasing goods and services from other companies. Key aspects of B2B payments include commercial cards, direct debits, business checks, and electronic payments like wire transfers and automated clearing house (ACH) transactions. The global pandemic has accelerated the trend of digital transformation across industries and the shift towards digital and remote B2B transaction models. This has propelled growth in the market for electronic B2B payments as businesses seek convenient, secure and cost-effective payment solutions.

Market Dynamics:

The B2B payments transaction market is driven by factors such as the growing emphasis on streamlining workflows, the need for real-time payment capabilities and flexible payment options among enterprises. The market sees restraints from legacy systems that hamper the migration to new technologies. However, opportunities lie in the modernization of B2B infrastructure to support digital transactions. The COVID-19 outbreak has created a strong impetus for contactless and digital B2B commerce, augmenting the demand for automated payment methods. Innovations in fields like AI and blockchain also promise to disrupt traditional models and forge new pathways for secured, seamless and traceable B2B transfers.

Key features of the study:

- This report provides an in-depth analysis of the global B2B Payments Transaction market, and provides market size (US$ Billion) and compound annual growth rate (CAGR%) for the forecast period (2024-2031, considering 2023 as the base year.

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the global B2B Payments Transaction market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include Mastercard Inc., FIS , Stripe, Inc. , Paystand, Inc., Flywire , Squareup Pte. Ltd, Edenred Payment Solutions , Payoneer Inc. , American Express , Visa Inc. , JPMorgan & Chase, Adyen N.V., Billtrust, Coupa Software Inc., Dwolla, Inc., Earthport PLC, FLEETCOR Technologies, Inc., Intuit Inc., Nvoicepay, Inc., Optal Limited, Paytm Mobile Solutions Private Limited, PayPal Holdings, Inc., TransferWise Ltd. (Now known as Wise), and Scoot and Ride.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- The global B2B Payments Transaction market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global B2B Payments Transaction market.

Market Segmentation

- By Payment Type

- Domestic Payments

- Cross Border Payments

- By Payment Method

- Bank Transfer

- Cards

- Online Payments

- By Enterprise Type

- Small & Medium Enterprises

- Large Enterprises

- By Industry

- Government

- Manufacturing

- BFSI

- Metal & Mining

- IT & Telecom

- Retail & E-commerce

- Others (Healthcare, Energy & Utilities)

- By Regional

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

- Key Players:

- Mastercard Inc.

- FIS

- Stripe, Inc.

- Paystand, Inc.

- Flywire

- Squareup Pte. Ltd

- Edenred Payment Solutions

- Payoneer Inc.

- American Express

- Visa Inc.

- JPMorgan & Chase

- Adyen N.V.

- Billtrust

- Coupa Software Inc.

- Dwolla, Inc.

- Earthport PLC

- FLEETCOR Technologies, Inc.

- Intuit Inc.

- Nvoicepay, Inc.

- Optal Limited

- Paytm Mobile Solutions Private Limited

- PayPal Holdings, Inc.

- TransferWise Ltd. (Now known as Wise)

- Scoot and Ride

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Payment Type

- Market Snippet, By Payment Method

- Market Snippet, By Enterprise Type

- Market Snippet, By Industry

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New system Launches/Approvals

- Impact of the COVID-19 Pandemic

4. Global B2B Payments Transaction Market, By Payment Type, 2019-2031 (US$ Billion)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2019-2031

- Segment Trends

- Domestic Payments

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- Cross Border Payments

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

5. Global B2B Payments Transaction Market, By Payment Method, 2019-2031 (US$ Billion)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2019-2031

- Segment Trends

- Bank Transfer

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- Cards

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- Online Payments

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

6. Global B2B Payments Transaction Market, By Enterprise Type, 2019-2031 (US$ Billion)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Segment Trends

- Small & Medium Enterprises

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- Large Enterprises

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

7. Global B2B Payments Transaction Market, By Industry, 2019-2031 (US$ Billion)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2019-2031

- Segment Trends

- Government

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- Manufacturing

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- BFSI

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- Metal & Mining

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- IT & Telecom

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- Retail & E-commerce

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- Others (Healthcare, Energy & Utilities)

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

8. Global B2B Payments Transaction Market, By Region, 2019-2031 (US$ Billion)

- Introduction

- Market Share Analysis, By Region, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2019-2031

- North America

- Regional Trends

- Market Size and Forecast, By Payment Type, 2019-2031 (US$ Billion)

- Market Size and Forecast, By Payment Method, 2019-2031 (US$ Billion)

- Market Size and Forecast, By Enterprise Type, 2019-2031 (US$ Billion)

- Market Size and Forecast, By Industry, 2019-2031 (US$ Billion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Payment Type, 2019-2031 (US$ Billion)

- Market Size and Forecast, By Payment Method, 2019-2031 (US$ Billion)

- Market Size and Forecast, By Enterprise Type, 2019-2031 (US$ Billion)

- Market Size and Forecast, By Industry, 2019-2031 (US$ Billion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- U.K.

- Germany

- Italy

- France

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Payment Type, 2019-2031 (US$ Billion)

- Market Size and Forecast, By Payment Method, 2019-2031 (US$ Billion)

- Market Size and Forecast, By Enterprise Type, 2019-2031 (US$ Billion)

- Market Size and Forecast, By Industry, 2019-2031 (US$ Billion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- China

- India

- ASEAN

- Australia

- South Korea

- Japan

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Payment Type, 2019-2031 (US$ Billion)

- Market Size and Forecast, By Payment Method, 2019-2031 (US$ Billion)

- Market Size and Forecast, By Enterprise Type, 2019-2031 (US$ Billion)

- Market Size and Forecast, By Industry, 2019-2031 (US$ Billion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East and Africa

- Regional Trends

- Market Size and Forecast, By Payment Type, 2019-2031 (US$ Billion)

- Market Size and Forecast, By Payment Method, 2019-2031 (US$ Billion)

- Market Size and Forecast, By Enterprise Type, 2019-2031 (US$ Billion)

- Market Size and Forecast, By Industry, 2019-2031 (US$ Billion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- GCC Countries

- South Africa

- Rest of the Middle East & Africa

9. Competitive Landscape

- Company Profiles

- Mastercard Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- FIS

- Stripe, Inc.

- Paystand, Inc.

- Flywire

- Squareup Pte. Ltd

- Edenred Payment Solutions

- Payoneer Inc.

- American Express

- Visa Inc.

- JPMorgan & Chase

- Adyen N.V.

- Billtrust

- Coupa Software Inc.

- Dwolla, Inc.

- Earthport PLC

- FLEETCOR Technologies, Inc.

- Intuit Inc.

- Nvoicepay, Inc.

- Optal Limited

- Paytm Mobile Solutions Private Limited

- PayPal Holdings, Inc.

- TransferWise Ltd.

10. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

11. Research Methodology

- References

- Research Methodology

- About us and Sales Contact