|

市場調查報告書

商品編碼

1567236

自動駕駛汽車晶片市場:按晶片類型、按應用、按最終用戶、按地區Autonomous Vehicle Chips Market, By Type of Chip, By Application, By End User, By Geography |

||||||

預計2024年全球自動駕駛汽車晶片市場規模為236.4億美元,預計2031年將達418.7億美元,2024年至2031年複合年成長率為8.5%。

| 報告範圍 | 報告詳情 | ||

|---|---|---|---|

| 基準年 | 2023年 | 2024年市場規模 | 236.4億美元 |

| 實際資料 | 2019年至2023年 | 預測期 | 從2024年到2031年 |

| 預測 2024-2031 年複合年成長率: | 8.50% | 2031年價值預測 | 418.7億美元 |

近年來,自動駕駛汽車的推出在全球加速。主要汽車製造商和科技公司正在大力投資自動駕駛汽車的開發,預計將徹底改變交通運輸業。自動駕駛汽車需要強大的處理能力來處理大量感測器資料並做出即時駕駛決策。這推動了對支援 ADAS(高級駕駛輔助系統)和自動駕駛功能的高性能自動駕駛汽車晶片的需求。由於車輛自動化程度不斷提高以及消費者對先進行動解決方案的偏好不斷增加,全球自動駕駛汽車晶片市場預計在未來幾年將大幅成長。

市場動態:

全球自動駕駛汽車晶片市場預計將在未來十年快速成長。市場成長的主要促進因素包括對節能和環保汽車的需求增加、政府對道路安全的重視以及汽車製造商對開發自動駕駛汽車的投資增加。然而,自動駕駛技術的研發成本高昂以及新興國家缺乏必要的基礎設施是限制市場的挑戰。從積極的一面來看,人工智慧、影像處理和ADAS(高級駕駛輔助系統)領域的持續創新預計將為自動駕駛汽車晶片製造商提供利潤豐厚的機會。虛擬駕駛平台的標準化也是塑造自動駕駛解決方案未來的正面趨勢。

本研究的主要特點

本報告對全球自動駕駛汽車晶片市場進行了詳細分析,並提供了以2023年為基準年的2024-2031年預測期的市場規模和年複合成長率(CAGR%)。

它還闡明了各個細分市場的潛在商機,並說明了該市場有吸引力的投資提案矩陣。

它還提供了有關市場促進因素、限制因素、機會、新產品發布和核准、市場趨勢、區域前景、主要企業採取的競爭策略等的重要見解。

它根據公司亮點、產品系列、主要亮點、財務表現和策略等參數,介紹了全球自動駕駛汽車晶片市場的主要企業。

本研究涵蓋的主要企業包括 ABB Ltd、英飛凌科技股份公司、英特爾公司、MobilEye(英特爾公司)、NVIDIA 公司、高通公司、瑞薩電子公司、三星電子有限公司、西門子公司、德州儀器 (TI) 、Tesla, Inc.、Waymo LLC、Xilinx, Inc.、Aptiv PLC 和Aurora Innovation, Inc.。

該報告的見解使負責人和公司經營團隊能夠就未來的產品發布、類型升級、市場擴張和行銷策略做出明智的決策。

全球自動駕駛汽車晶片市場報告迎合了該行業的各個相關人員,如投資者、供應商、產品製造商、經銷商、新進業者和財務分析師。

透過用於分析全球自動駕駛汽車晶片市場的各種策略矩陣,將有助於相關人員做出決策。

目錄

第1章 研究目的與前提

- 研究目的

- 先決條件

- 簡稱

第2章 市場展望

- 報告說明

- 市場定義和範圍

- 執行摘要

第3章市場動態、法規及趨勢分析

- 市場動態

- 促進因素

- 抑制因素

- 市場機會

- 監管場景

- 產業動態

- 併購

- 新系統的引入/核准

- COVID-19 大流行的影響

第4章2019-2031年全球自動駕駛汽車晶片市場(依晶片類型)

- 處理器

- 微控制器

- FPGA(現場可程式化閘陣列)

- GPU(圖形處理單元)

第5章2019-2031年全球自動駕駛汽車晶片市場(按應用)

- 客車

- 商用車

- 防禦車輛

- 大眾交通工具

第6章 全球自動駕駛汽車晶片市場(依最終用戶分類),2019-2031 年

- 車

- 物流/運輸

- 防禦

- 其他

第7章2019-2031年全球自動駕駛汽車晶片市場(分地區)

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東

- 非洲

第8章 競爭格局

- 公司簡介

- ABB Ltd

- Infineon Technologies AG

- Intel Corporation

- MobilEye(an Intel company)

- NVIDIA Corporation

- Qualcomm Incorporated

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- Siemens AG

- Texas Instruments(TI)

- Tesla, Inc.

- Waymo LLC

- Xilinx, Inc.

- Aptiv PLC

- Aurora Innovation, Inc.

第9章 分析師建議

第10章調查方法

- 參考

- 調查方法

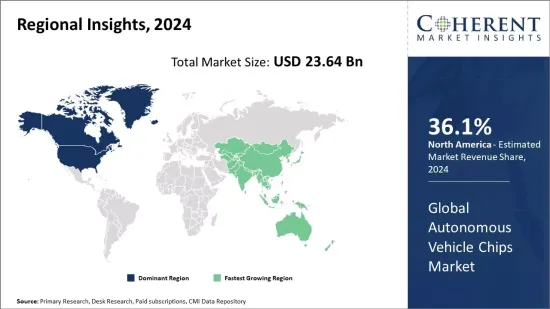

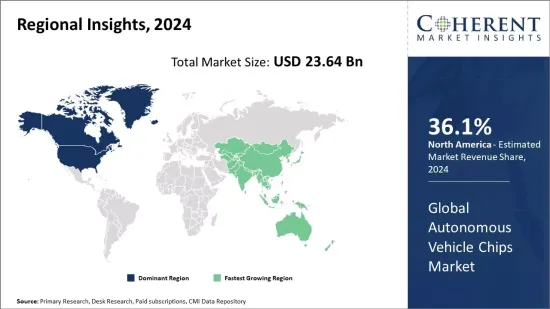

Global autonomous vehicle chips market is estimated to be valued at USD 23.64 Bn in 2024 and is expected to reach USD 41.87 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 8.5% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2024: | US$ 23.64 Bn |

| Historical Data for: | 2019 To 2023 | Forecast Period: | 2024 To 2031 |

| Forecast Period 2024 to 2031 CAGR: | 8.50% | 2031 Value Projection: | US$ 41.87 Bn |

The adoption of autonomous vehicles has picked up pace globally in the recent past. Leading automakers and technology companies are investing heavily in developing self-driving vehicles, which is expected to revolutionize the transportation industry. Autonomous vehicles require robust processing capabilities to handle huge volumes of sensor data and make real-time driving decisions. This is driving the demand for high-performance autonomous vehicle chips that can support Advanced Driver Assistance Systems (ADAS) and autonomous driving functionalities. The global autonomous vehicle chips market is poised to grow significantly in the coming years due to the increasing automation of automobiles and rising consumer preference for advanced mobility solutions.

Market Dynamics:

The global autonomous vehicle chips market is expected to witness rapid growth over the next decade. The key drivers contributing to the market growth include rising demand for fuel-efficient and eco-friendly vehicles, increasing government emphasis on road safety, and growing investment by automakers towards developing self-driving cars. However, high R&D costs associated with autonomous driving technologies and lack of required infrastructure in emerging nations are some challenges restraining the market. On the positive side, continuous technological innovations in the fields of artificial intelligence, image processing, and advanced driver assistance systems are expected to create lucrative opportunities for autonomous vehicle chip manufacturers. Standardization of virtual driving platforms is another positive trend shaping the future of autonomous mobility solutions.

Key Features of the Study:

This report provides in-depth analysis of the global autonomous vehicle chips market and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period 2024-2031, considering 2023 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global autonomous vehicle chips market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include ABB Ltd, Infineon Technologies AG, Intel Corporation, MobilEye (an Intel company), NVIDIA Corporation, Qualcomm Incorporated, Renesas Electronics Corporation, Samsung Electronics Co., Ltd., Siemens AG, Texas Instruments (TI), Tesla, Inc., Waymo LLC, Xilinx, Inc., Aptiv PLC, and Aurora Innovation, Inc.

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global autonomous vehicle chips market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global autonomous vehicle chips market.

Detailed Segmentation-

- By Type of Chip Insights (Revenue, USD Bn, 2019 - 2031)

- Processors

- Microcontrollers

- FPGAs (Field-Programmable Gate Arrays)

- GPUs (Graphics Processing Units)

- By Application Insights (Revenue, USD Bn, 2019 - 2031)

- Passenger Vehicles

- Commercial Vehicles

- Defense Vehicles

- Public Transport Vehicles

- By End User Insights (Revenue, USD Bn, 2019 - 2031)

- Automotive

- Logistics and Transportation

- Defense

- Others

- By Regional Insights (Revenue, USD Bn, 2019 - 2031)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Key Players Insights

- ABB Ltd

- Infineon Technologies AG

- Intel Corporation

- MobilEye (an Intel company)

- NVIDIA Corporation

- Qualcomm Incorporated

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- Siemens AG

- Texas Instruments (TI)

- Tesla, Inc.

- Waymo LLC

- Xilinx, Inc.

- Aptiv PLC

- Aurora Innovation, Inc.

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Type of Chip

- Market Snippet, By Application

- Market Snippet, By End User

- Market Snippet, By Region

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New System Launches/Approvals

- Impact of COVID-19 Pandemic

4. Global Autonomous Vehicle Chips Market, By Type of Chip, 2019-2031, (USD Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020-2031

- Segment Trends

- Processors

- Introduction

- Market Size and Forecast, 2019-2031, (USD Bn)

- Microcontrollers

- Introduction

- Market Size and Forecast, 2019-2031, (USD Bn)

- FPGAs (Field-Programmable Gate Arrays)

- Introduction

- Market Size and Forecast, 2019-2031, (USD Bn)

- GPUs (Graphics Processing Units)

- Introduction

- Market Size and Forecast, 2019-2031, (USD Bn)

5. Global Autonomous Vehicle Chips Market, By Application, 2019-2031, (USD Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020-2031

- Segment Trends

- Passenger Cars

- Introduction

- Market Size and Forecast, 2019-2031, (USD Bn)

- Commercial Vehicles

- Introduction

- Market Size and Forecast, 2019-2031, (USD Bn)

- Defense Vehicles

- Introduction

- Market Size and Forecast, 2019-2031, (USD Bn)

- Public Transport Vehicles

- Introduction

- Market Size and Forecast, 2019-2031, (USD Bn)

6. Global Autonomous Vehicle Chips Market, By End User, 2019-2031, (USD Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020-2031

- Segment Trends

- Automotive

- Introduction

- Market Size and Forecast, 2019-2031, (USD Bn)

- Logistics and Transportation

- Introduction

- Market Size and Forecast, 2019-2031, (USD Bn)

- Defense

- Introduction

- Market Size and Forecast, 2019-2031, (USD Bn)

- Others

- Introduction

- Market Size and Forecast, 2019-2031, (USD Bn)

7. Global Autonomous Vehicle Chips Market, By Region, 2019-2031, (USD Bn)

- Introduction

- Market Share Analysis, By Region, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020-2031

- North America

- Regional Trends

- Market Size and Forecast, By Type of Chip, 2019-2031, (USD Bn)

- Market Size and Forecast, By Application, 2019-2031, (USD Bn)

- Market Size and Forecast, By End User, 2019-2031, (USD Bn)

- Market Size and Forecast, By Country, 2019-2031, (USD Bn)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Type of Chip, 2019-2031, (USD Bn)

- Market Size and Forecast, By Application, 2019-2031, (USD Bn)

- Market Size and Forecast, By End User, 2019-2031, (USD Bn)

- Market Size and Forecast, By Country, 2019-2031, (USD Bn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Type of Chip, 2019-2031, (USD Bn)

- Market Size and Forecast, By Application, 2019-2031, (USD Bn)

- Market Size and Forecast, By End User, 2019-2031, (USD Bn)

- Market Size and Forecast, By Country, 2019-2031, (USD Bn)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Type of Chip, 2019-2031, (USD Bn)

- Market Size and Forecast, By Application, 2019-2031, (USD Bn)

- Market Size and Forecast, By End User, 2019-2031, (USD Bn)

- Market Size and Forecast, By Country, 2019-2031, (USD Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East

- Regional Trends

- Market Size and Forecast, By Type of Chip, 2019-2031, (USD Bn)

- Market Size and Forecast, By Application, 2019-2031, (USD Bn)

- Market Size and Forecast, By End User, 2019-2031, (USD Bn)

- Market Size and Forecast, By Country, 2019-2031, (USD Bn)

- South Africa

- Israel

- GCC Countries

- Rest of the Middle East

- Africa

- Regional Trends

- Market Size and Forecast, By Type of Chip, 2019-2031, (USD Bn)

- Market Size and Forecast, By Application, 2019-2031, (USD Bn)

- Market Size and Forecast, By End User, 2019-2031, (USD Bn)

- Market Size and Forecast, By Country, 2019-2031, (USD Bn)

- South Africa

- North Africa

- Central Africa

8. Competitive Landscape

- Company Profiles

- ABB Ltd

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Infineon Technologies AG

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Intel Corporation

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- MobilEye (an Intel company)

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- NVIDIA Corporation

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Qualcomm Incorporated

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- Siemens AG

- Texas Instruments (TI)

- Tesla, Inc.

- Waymo LLC

- Xilinx, Inc.

- Aptiv PLC

- Aurora Innovation, Inc.

- ABB Ltd

9. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

10. Research Methodology

- References

- Research Methodology

- About us and Sales Contact