|

市場調查報告書

商品編碼

1672655

金融科技業市場,按金融科技卡、按解決方案、按技術、按最終用途、按地區Fintech Industry Market, By FinTech Cards, By Solution, By Technology, By End User, By Geography |

||||||

2025 年全球金融科技產業市場規模估計為 3.772 億美元,預計到 2032 年將達到 7.262 億美元,2025 年至 2032 年的複合年成長率為 9.8%。

| 報告範圍 | 報告詳細資訊 | ||

|---|---|---|---|

| 基準年 | 2024 | 2025 年市場規模 | 3.772億美元 |

| 效能資料 | 從 2020 年到 2024 年 | 預測期 | 2025 至 2032 年 |

| 預測期:2025-2032年複合年成長率: | 9.80% | 2032 年價值預測 | 7.262億美元 |

許多因素推動了全球金融科技產業的蓬勃發展,包括數位付款的興起、電子商務產業的成長以及創業投資資金的湧入。人工智慧、機器學習和區塊鏈等先進技術的使用正在改善金融服務的管道並提高效率。然而,安全和隱私問題仍然是該行業持續成長的挑戰。

市場動態:

全球金融科技產業市場的成長受到多種因素的推動。數位化的進步以及人工智慧、機器學習和物聯網等技術的出現推動了創新金融產品和服務的發展。智慧型手機和網際網路普及率的提高以及電子商務行業的成長正在推動數位付款和網路借貸的發展。這正在刺激產品創新和市場擴張。然而,對資料隱私和安全的擔憂帶來了挑戰。此外,標準化和互通性問題也阻礙了無縫操作。然而,金融服務滲透率較低的新興經濟體為金融科技參與者提供了巨大的成長機會。

本研究的主要特點

本報告對全球金融科技行業市場進行了詳細分析,並以 2024 年為基準年,給出了預測期(2025-2032 年)的市場規模和年複合成長率(CAGR%)。

它還強調了各個領域的潛在商機並說明了該市場的有吸引力的投資提案矩陣。

它還提供了對市場促進因素、限制因素、機會、新產品發布和核准、市場趨勢、區域前景以及主要企業採用的競爭策略的重要見解。

全球金融科技市場的主要企業是根據公司亮點、產品系列、關鍵亮點、財務績效和策略等參數進行的分析。

主要公司包括美國運通公司、Square、Stripe、PayPal、Capital One、花旗集團、摩根大通、萬事達卡公司、Visa 公司、Brex、Revolut 和 Pivot Payables。

本報告的見解將使負責人和企業經營團隊能夠就未來產品發布、新興趨勢、市場擴張和行銷策略做出明智的決策。

全球金融科技市場報告迎合了該行業的各個相關人員,包括投資者、供應商、產品製造商、經銷商、新進業者和金融分析師。

相關人員將透過用於分析全球金融科技市場的各種策略矩陣更輕鬆地做出決策。

目錄

第1章 調查目的與前提條件

- 研究目標

- 先決條件

- 簡稱

第2章 市場展望

- 報告描述

- 市場定義和範圍

- 執行摘要

- Coherent Opportunity Map(COM)

第3章市場動態、法規與趨勢分析

- 市場動態

第 4 章 全球金融科技產業市場-冠狀病毒 (COVID-19) 大流行的影響

- 影響全球金融科技產業市場的因素 - COVID-19

- 影響分析

第5章 全球金融科技產業市場按金融科技卡分類(2020-2032 年,(百萬美元))

- 商務卡

- 虛擬卡

6. 2020 年至 2032 年全球金融科技產業市場(按解決方案分類)(百萬美元)

- 付款和轉帳

- 融資解決方案

- 保險及個人理財

- 資產管理

- 數位銀行

- 其他(匯款解決方案、加密解決方案)

7. 2020 年至 2032 年全球金融科技業市場(按技術分類)(百萬美元)

- 應用程式介面 (API)

- 巨量資料分析

- 人工智慧(AI)

- 區塊鏈

- 網路安全

8. 全球金融科技產業市場,依最終用途分類,2025-2032 年(百萬美元)

- 個人消費者

- 商業金融科技

- 企業金融科技

第 9 章。 2020-2032 年全球金融科技產業市場,按地區分類,價值(百萬美元)

- 北美洲

- 拉丁美洲

- 歐洲

- 亞太地區

- 中東

- 非洲

第10章 競爭格局

- American Express Company

- Recent Developments/Updates

- Square

- Recent Developments/Updates

- Stripe

- Recent Developments/Updates

- PayPal

- Recent Developments/Updates

- Capital One

- Recent Developments/Updates

- Citigroup Inc.

- Recent Developments/Updates

- JPMorgan Chase

- Mastercard Inc.

- Visa Inc.

- Brex

- Revolut

- Pivot Payables

第 11 章 分析師建議

- 命運之輪

- 分析師觀點

- 一致的機會地圖

第 12 章參考文獻與調查方法

- 參考

- 調查方法

- 關於出版商

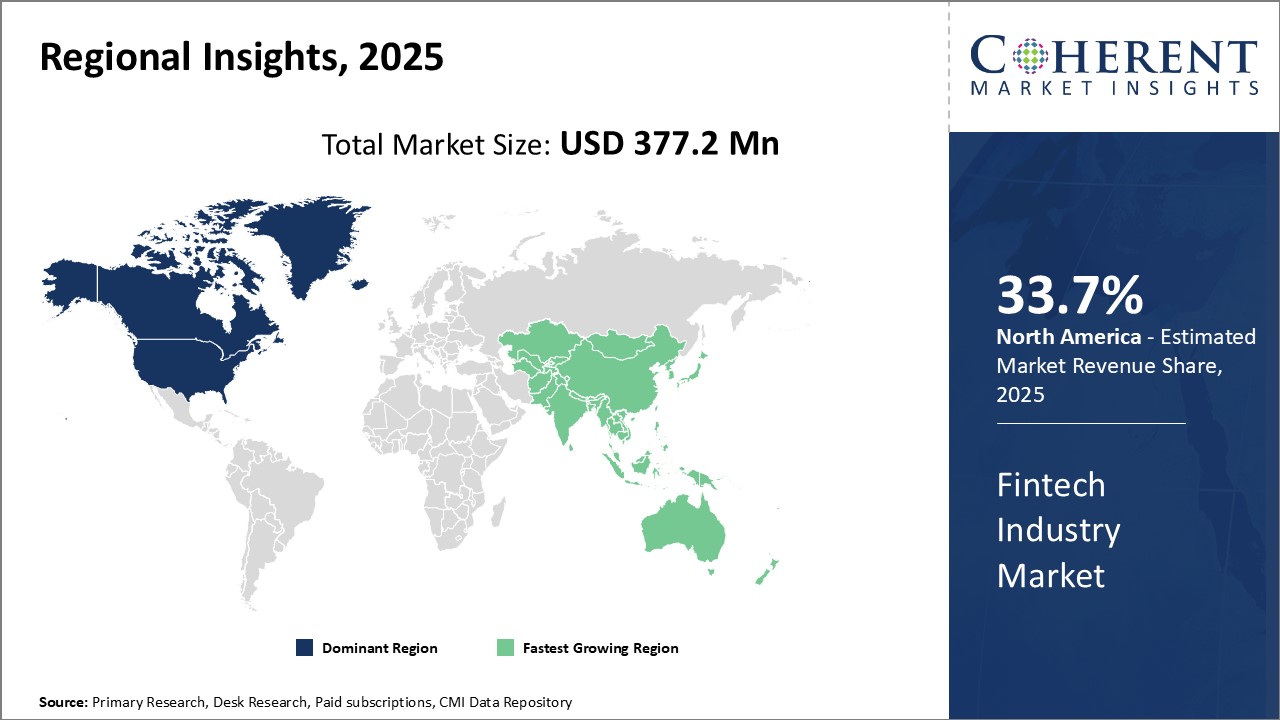

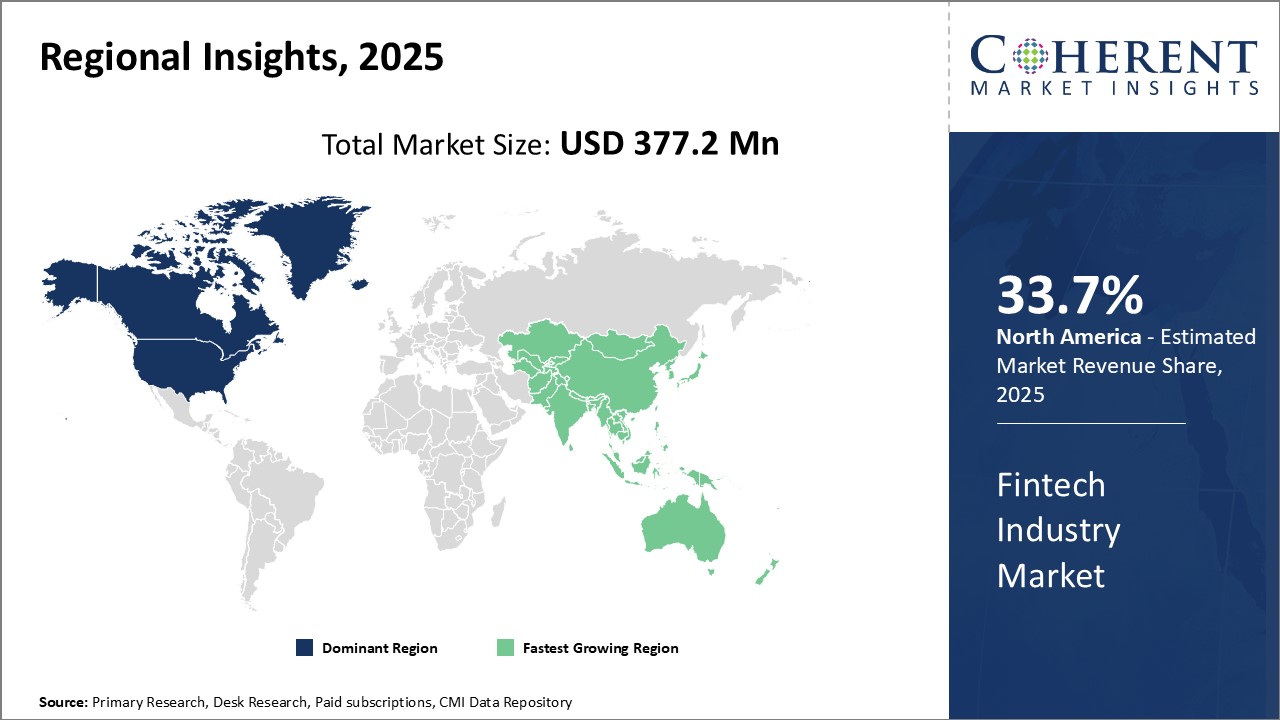

Global Fintech Industry Market is estimated to be valued at USD 377.2 Mn in 2025 and is expected to reach USD 726.2 Mn by 2032, growing at a compound annual growth rate (CAGR) of 9.8% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 377.2 Mn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 9.80% | 2032 Value Projection: | USD 726.2 Mn |

Various factors such as rise of digital payments, growing e-commerce industry, influx of venture capital funding have contributed to the boom in the fintech sector globally. It has increased accessibility of financial services, driven efficiencies through use of advanced technologies like AI, ML and blockchain. However, security and privacy concerns continue to pose challenges for continued growth of the industry.

Market Dynamics:

The growth of the global fintech industry market is driven by several factors. The increasing digitization and emergence of technologies such as AI, ML and IoT have enabled development of innovative financial products and services. Rising smartphone and internet penetration along with growing ecommerce industry has boosted digital payments and online lending. This has fueled product innovation and market expansion. However, data privacy and security concerns pose challenges. Lack of standardization and interoperability issues also challenge seamless operations. Nevertheless, developing economies with underpenetrated financial services present huge opportunities for fintech players for growth.

Key features of the study:

This report provides in-depth analysis of the global fintech industry market, and provides market size (US$ Million) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global fintech market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include American Express Company, Square, Stripe, PayPal, Capital One, Citigroup Inc., JPMorgan Chase, Mastercard Inc., Visa Inc., Brex, Revolut, and Pivot Payables

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global fintech market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global fintech market

Market Segmentation

- FinTech Cards Insights (Revenue, USD, 2019 - 2032)

- Commercial Cards

- Virtual Cards

- Solution Insights (Revenue, USD, 2019 - 2032)

- Payment & Fund Transfer

- Lending Solutions

- Insurance & Personal Finance

- Wealth Management

- Digital Banking

- Others (Remittance Solutions, Crypto Solutions)

- Technology Insights (Revenue, USD, 2019 - 2032)

- Application Programming Interface (API)

- Big Data Analytics

- Artificial Intelligence (AI)

- Blockchain

- Cybersecurity

- End User Insights (Revenue, USD, 2019 - 2032)

- Individual Consumers

- Business FinTech

- Enterprise FinTech

- Regional Insights (Revenue, USD, 2019 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Key Players Insights

- American Express Company

- Square

- Stripe

- PayPal

- Capital One

- Citigroup Inc.

- JPMorgan Chase

- Mastercard Inc.

- Visa Inc.

- Brex

- Revolut

- Pivot Payables

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Fintech Industry Market, By FinTech Cards

- Global Fintech Industry Market, By Solution

- Global Fintech Industry Market, By Technology

- Global Fintech Industry Market, By End User

- Global Fintech Industry Market, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- PEST Analysis

- PORTER's Five Forces Analysis

- Market Opportunities

- Regulatory Scenario

- Recent Developments/Updates

- Industry Trend

4. Global Fintech Industry Market - Impact of Coronavirus (COVID-19) Pandemic

- Overview

- Factors Affecting the Global Fintech Industry Market - COVID-19

- Impact Analysis

5. Global Fintech Industry Market, By FinTech Cards, 2020-2032, (USD MN)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Commercial Cards

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Virtual Cards

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

6. Global Fintech Industry Market, By Solution, 2020-2032, (USD MN)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Payment & Fund Transfer

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Lending Solutions

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Insurance & Personal Finance

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Wealth Management

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Digital Banking

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Others (Remittance Solutions, Crypto Solutions)

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

7. Global Fintech Industry Market, By Technology, 2020-2032, (USD MN)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Application Programming Interface (API)

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Big Data Analytics

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Artificial Intelligence (AI)

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Blockchain

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Cybersecurity

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

8. Global Fintech Industry Market, By End User, 2025-2032, (USD MN)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Individual Consumers

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Business FinTech

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Enterprise FinTech

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

9. Global Fintech Industry Market, By Region, 2020 - 2032, Value (USD MN)

- Introduction

- Market Share Analysis, By Region, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- North America

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- U.S.

- Canada

- Latin America

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- South Africa

- North Africa

- Central Africa

10. Competitive Landscape

- American Express Company

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- Square

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- Stripe

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- PayPal

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- Capital One

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- Citigroup Inc.

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- JPMorgan Chase

- Mastercard Inc.

- Visa Inc.

- Brex

- Revolut

- Pivot Payables

11. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

12. References and Research Methodology

- References

- Research Methodology

- About us