|

市場調查報告書

商品編碼

1538938

越南硫酸鹽紙漿進口:2024-2033Vietnam Sulphate Pulp Import Research Report 2024-2033 |

||||||

資訊圖表

硫酸鹽紙漿因其優異的物理和化學性能在全球製漿造紙工業中佔有重要地位,尤其適用於需要高紙張強度和耐久性的應用。亞太地區的主要生產商包括Chenming Paper、Asia Pacific Resources International Limited (APRIL) ,而全球生產商包括UPM、Stora Enso、International Paper、Canfor Pulp。越南硫酸鹽紙漿產能有限,每年需要大量進口。

近期趨勢顯示,越南製造業發展迅速,造紙業及其包裝、印刷、廣告等下游領域具有市場拓展潛力。根據CRI統計,越南每年消耗紙張超過300萬噸,其中包裝紙佔60%以上。未來幾年,隨著越南經濟和製造業的發展,各類紙張尤其是包裝紙的需求將持續成長,導致硫酸鹽紙漿進口量增加。

根據中國國際廣播電台報道,越南面臨國內造紙原料嚴重短缺,且高度依賴進口。越南大部分造紙廠需要進口紙漿以滿足生產需求,越南每年進口紙漿超過50萬噸。根據CRI資料,2023年越南硫酸鹽紙漿進口總額約3億美元。此外,根據相同資料,2024年1月至5月進口總額超過1億美元,市場需求持續成長。

本報告調查了越南硫酸鹽紙漿的進口趨勢,包括國家概況、進口額、進口量、進口價格趨勢和預測、主要進口國的詳細分析以及主要買家和供應商,硫酸鹽紙漿出口的主要影響因素分析。

目錄

第1章 越南概況

- 地區

- 經濟情勢

- 人口統計

- 國內市場

- 對外國公司進入紙漿、紙張和紙製品市場的建議

第2章 越南硫酸鹽紙漿進口分析(2021-2024年)

- 進口規模

- 進口金額/量

- 進口價格

- 消費金額

- 進口依賴

- 主要進口來源地

第3章 越南硫酸鹽紙漿主要供應國分析(2021-2024年)

- 印尼

- 進口金額/量分析

- 平均進口價格分析

- 美國

- 進口金額/量分析

- 平均進口價格分析

- 香港

- 進口金額/量分析

- 平均進口價格分析

- 加拿大

- 巴西

- 日本

第4章 越南硫酸鹽紙漿進口市場主要供應商分析(2021-2024年)

- Asia Pulp & Paper (APP)

- EKMAN PULP AND PAPER LIMITED

- APRIL Group

第5章 越南硫酸鹽紙漿進口市場主要進口商分析(2021-2024年)

- BACGIANG IMPORT - EXPORT JOINT STOCK COMPANY

- NITTOKU VIETNAM CO, LTD.

- IMEXCO BACGIANG

第6章 越南硫酸鹽紙漿進口月分析(2021-2024年)

- 每月進口額和進口量分析

- 每月平均進口價格預測

第7章 影響越南硫酸鹽紙漿進口的主要因素

- 政策

- 現行進口政策

- 預測進口政策趨勢

- 經濟

- 市場價格

- 硫酸鹽紙漿產能成長趨勢

- 技術

第8章 越南硫酸鹽紙漿進口預測(2024-2033年)

Sulphate pulp, also known as kraft pulp, is a type of chemical pulp produced using the Sulphate process. It is the most widely used and highest-yielding pulp globally. Sulphate pulp is characterized by its high strength, durability, resistance to aging, bleachability, and strong chemical resistance, as well as its wide range of raw material sources. It is used to manufacture high-strength and high-requirement paper products, including kraft paper, paper bags, packaging paper, corrugated cardboard, and cultural paper.

INFOGRAPHICS

Due to its superior physical and chemical properties, sulphate pulp holds a significant position in the global pulp and paper industry, especially for applications requiring high paper strength and durability. Major producers in the Asia-Pacific region include companies such as Chenming Paper and Asia Pacific Resources International Limited (APRIL), while global producers include UPM, Stora Enso, International Paper, and Canfor Pulp. Vietnam has limited sulphate pulp production capacity and needs to import large quantities annually.

In recent years, Vietnam's manufacturing industry has developed rapidly, with the paper industry and its downstream sectors, such as packaging, printing, and advertising, showing considerable market expansion potential. According to CRI, Vietnam consumes over 3 million tons of paper annually, with packaging paper accounting for more than 60%. In the coming years, with the development of Vietnam's economy and manufacturing sectors, the demand for various types of paper, especially packaging paper, will continue to grow, leading to an increase in the import volume of sulphate pulp.

According to CRI, Vietnam faces a significant shortage of domestic raw materials for papermaking, heavily relying on imports. Most paper mills in Vietnam need to import pulp to meet production needs, leading to Vietnam importing more than 500,000 tons of pulp annually. The data of CRI indicates that in 2023, Vietnam's total import value of Sulphate pulp was about US$ 300 million. CRI data also shows that from January to May 2024, Vietnam's total import value of Sulphate pulp has exceeded US$ 100 million, with market demand continuing to grow.

CRI concludes that the main sources of Vietnam's Sulphate pulp imports from 2021 to 2024 include Indonesia, the United States, and Hong Kong. Key exporters of Sulphate pulp to Vietnam include Asia Pulp & Paper (APP), EKMAN PULP AND PAPER LIMITED, and APRIL Group.

The primary importers of sulphate pulp in Vietnam are paper and paper product manufacturers, distributors, and foreign trading companies, primarily foreign-invested enterprises. Many are subsidiaries of multinational companies in the paper industry. CRI identifies that major importer of sulphate pulp in Vietnam includes BACGIANG IMPORT - EXPORT JOINT STOCK COMPANY, NITTOKU VIETNAM CO, LTD., and IMEXCO BACGIANG.

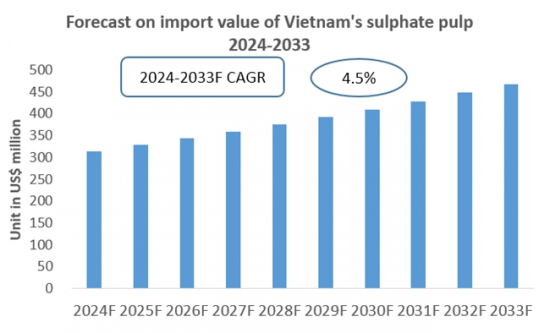

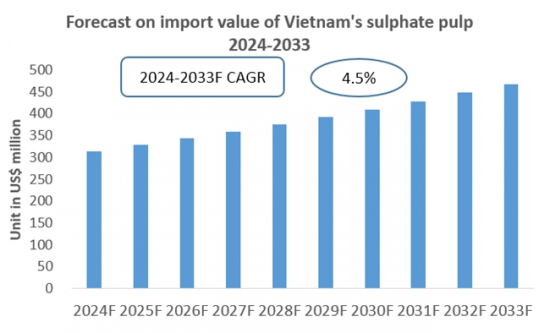

Overall, with Vietnam's population growth and continued advancement of related manufacturing industries, the consumption of sulphate pulp in Vietnam will continue to increase. CRI suggests that in the long term, reducing plastic waste is becoming a global trend, especially in major economies. The sustainable and environmentally friendly trend of replacing plastic waste and plastic bags with paper packaging is growing across all age groups, particularly among young people. Therefore, the market demand for the global and Asian paper and paper products industry is expected to grow continuously. In the coming years, the import of sulphate pulp in Vietnam is expected to maintain its growth trend.

Topics covered:

The Import and Export of Sulphate Pulp in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Sulphate Pulp in Vietnam (2021-2024)

Total Import Value and Percentage Change of Sulphate Pulp in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Sulphate Pulp in Vietnam (January-May 2024)

Total Import Value and Percentage Change of Sulphate Pulp in Vietnam (January-May 2024)

Average Import Price of Sulphate Pulp in Vietnam (2021-2024)

Top 10 Sources of Sulphate Pulp Imports in Vietnam and Their Supply Volume

Top 10 Suppliers in the Import Market of Sulphate Pulp in Vietnam and Their Supply Volume

Top 10 Importers of Sulphate Pulp in Vietnam and Their Import Volume

How to Find Distributors and End Users of Sulphate Pulp in Vietnam

How Foreign Enterprises Enter the Pulp, Paper and Paper Products Market of Vietnam

Forecast for the Import of Sulphate Pulp in Vietnam (2024-2033)

Table of Contents

1 Overview of Vietnam

- 1.1 Geography of Vietnam

- 1.2 Economic Condition of Vietnam

- 1.3 Demographics of Vietnam

- 1.4 Domestic Market of Vietnam

- 1.5 Recommendations for Foreign Enterprises Entering the Vietnam Pulp, Paper and Paper Products Market

2 Analysis of Sulphate Pulp Imports in Vietnam (2021-2024)

- 2.1 Import Scale of Sulphate Pulp in Vietnam

- 2.1.1 Import Value and Volume of Sulphate Pulp in Vietnam

- 2.1.2 Import Prices of Sulphate Pulp in Vietnam

- 2.1.3 Apparent Consumption of Sulphate Pulp in Vietnam

- 2.1.4 Import Dependency of Sulphate Pulp in Vietnam

- 2.2 Major Sources of Sulphate Pulp Imports in Vietnam

3 Analysis of Major Sources of Sulphate Pulp Imports in Vietnam (2021-2024)

- 3.1 Indonesia

- 3.1.1 Analysis of Import Value and Volume

- 3.1.2 Analysis of Average Import Price

- 3.2 United States

- 3.2.1 Analysis of Import Value and Volume

- 3.2.2 Analysis of Average Import Price

- 3.3 Hong Kong

- 3.3.1 Analysis of Import Value and Volume

- 3.3.2 Analysis of Average Import Price

- 3.4 Canada

- 3.5 Brazil

- 3.6 Japan

4 Analysis of Major Suppliers in the Import Market of Sulphate Pulp in Vietnam (2021-2024)

- 4.1 Asia Pulp & Paper (APP)

- 4.1.1 Company Introduction

- 4.1.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.2 EKMAN PULP AND PAPER LIMITED

- 4.2.1 Company Introduction

- 4.2.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.3 APRIL Group

- 4.3.1 Company Introduction

- 4.3.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.4 Exporter 4

- 4.4.1 Company Introduction

- 4.4.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.5 Exporter 5

- 4.5.1 Company Introduction

- 4.5.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.6 Exporter 6

- 4.6.1 Company Introduction

- 4.6.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.7 Exporter 7

- 4.7.1 Company Introduction

- 4.7.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.8 Exporter 8

- 4.8.1 Company Introduction

- 4.8.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.9 Exporter 9

- 4.9.1 Company Introduction

- 4.9.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.10 Exporter 10

- 4.10.1 Company Introduction

- 4.10.2 Analysis of Sulphate Pulp Exports to Vietnam

5 Analysis of Major Importers in the Import Market of Sulphate Pulp in Vietnam (2021-2024)

- 5.1 BACGIANG IMPORT - EXPORT JOINT STOCK COMPANY

- 5.1.1 Company Introduction

- 5.1.2 Analysis of Sulphate Pulp Imports

- 5.2 NITTOKU VIETNAM CO, LTD.

- 5.2.1 Company Introduction

- 5.2.2 Analysis of Sulphate Pulp Imports

- 5.3 IMEXCO BACGIANG

- 5.3.1 Company Introduction

- 5.3.2 Analysis of Sulphate Pulp Imports

- 5.4 Importer 4

- 5.4.1 Company Introduction

- 5.4.2 Analysis of Sulphate Pulp Imports

- 5.5 Importer 5

- 5.5.1 Company Introduction

- 5.5.2 Analysis of Sulphate Pulp Imports

- 5.6 Importer 6

- 5.6.1 Company Introduction

- 5.6.2 Analysis of Sulphate Pulp Imports

- 5.7 Importer 7

- 5.7.1 Company Introduction

- 5.7.2 Analysis of Sulphate Pulp Imports

- 5.8 Importer 8

- 5.8.1 Company Introduction

- 5.8.2 Analysis of Sulphate Pulp Imports

- 5.9 Importer 9

- 5.9.1 Company Introduction

- 5.9.2 Analysis of Sulphate Pulp Imports

- 5.10 Importer 10

- 5.10.1 Company Introduction

- 5.10.2 Analysis of Sulphate Pulp Imports

6. Monthly Analysis of Sulphate Pulp Imports in Vietnam from 2021 to 2024

- 6.1 Analysis of Monthly Import Value and Volume

- 6.2 Forecast of Monthly Average Import Prices

7. Key Factors Affecting Sulphate Pulp Imports in Vietnam

- 7.1 Policy

- 7.1.1 Current Import Policies

- 7.1.2 Trend Predictions for Import Policies

- 7.2 Economic

- 7.2.1 Market Prices

- 7.2.2 Growth Trends of Sulphate Pulp Production Capacity in Vietnam

- 7.3 Technology

8. Forecast for the Import of Sulphate Pulp in Vietnam, 2024-2033

Disclaimer

Service Guarantees

List of Charts

- Chart 2021-2024 Import Value and Volume of Sulphate Pulp in Vietnam

- Chart 2021-2024 Average Import Price of Sulphate Pulp in Vietnam

- Chart 2021-2024 Import Dependency of Sulphate Pulp in Vietnam

- Chart Top 10 Import Sources of Sulphate Pulp in Vietnam (2021-2024)

- Chart Top 10 Import Sources of Sulphate Pulp in Vietnam (2022)

- Chart Top 10 Import Sources of Sulphate Pulp in Vietnam (2023)

- Chart Top 10 Import Sources of Sulphate Pulp in Vietnam (2024)

- Chart Top 10 Suppliers of Sulphate Pulp Imports in Vietnam (2021-2024)

- Chart Top 10 Suppliers of Sulphate Pulp Imports in Vietnam (2022)

- Chart Top 10 Suppliers of Sulphate Pulp Imports in Vietnam (2023)

- Chart Top 10 Suppliers of Sulphate Pulp Imports in Vietnam (2024)

- Chart Value and Volume of Sulphate Pulp Imported from Indonesia to Vietnam (2021-2024)

- Chart Value and Volume of Sulphate Pulp Imported from United States to Vietnam (2021-2024)

- Chart Value and Volume of Sulphate Pulp Imported from Canada to Vietnam (2021-2024)

- Chart Value and Volume of Sulphate Pulp Imported from Hong Kong to Vietnam (2021-2024)

- Chart Top 10 Importers of Sulphate Pulp in Vietnam (2021-2024)

- Chart Top 10 Importers of Sulphate Pulp in Vietnam (2022)

- Chart Top 10 Importers of Sulphate Pulp in Vietnam (2023)

- Chart Top 10 Importers of Sulphate Pulp in Vietnam (2024)

- Chart Forecast for the Import of Sulphate Pulp in Vietnam (2024-2033)