|

市場調查報告書

商品編碼

1578766

越南稀土永磁出口:2024-2033Vietnam Rare Earth Permanent Magnets Export Research Report 2024-2033 |

||||||

資訊圖表

根據CRI,稀土永磁上游部門主要包括稀土礦開採和加工,特別是釹、釤、鈷等稀土金屬的冶煉和精煉。下游領域應用領域廣泛,包括電子設備、汽車、風力發電、醫療設備、家電等。在電動車、風力發電領域,稀土永磁體是顯著提高馬達效率、降低能耗的重要零件。此外,智慧型手機和筆記型電腦等現代電子消費產品需要稀土永磁體來實現更輕、更緊湊的設計。

在工業中,稀土永磁體廣泛應用於各種電動機和發電機,特別是電動車、風力渦輪機和工業自動化設備等,電能和動能的高效轉換非常重要。它們也用於磁浮、機器人和航太等高科技領域,以及揚聲器和核磁共振機等消費和醫療設備。由於其高性能和多功能性,稀土永久磁鐵已成為許多主要技術設備的重要組成部分。

雖然越南稀土永磁產業不如中國和日本發達,但由於其豐富的礦產資源和高性價比的勞動力,正逐漸成為稀土磁體的出口國。 CRI分析表示,越南稀土資源估計為2,200萬噸,佔全球已知儲量的19%,為該國稀土永磁產業提供了充足的原料。此外,越南政府正積極吸引外資、推動高新技術產業發展,為越南稀土永磁體生產創造了良好的政策環境。由此,越南正逐漸成為全球重要的稀土資源供應國,同時也出口大量稀土加工原料。

此外,越南與其他國家的自由貿易協定有助於擴大其出口市場,降低出口關稅,使越南產品在國際市場上更具競爭力。據CRI表示,越南有利的政策環境、強大的生產能力和靈活的出口策略使越南稀土永磁產業在全球電力和電子供應鏈中發揮越來越重要的作用。

根據CRI資料,2023年越南稀土永磁體出口總額將達約3.7億美元,並呈現上升趨勢。2024年1月至7月稀土永磁體出口額已突破2億美元。

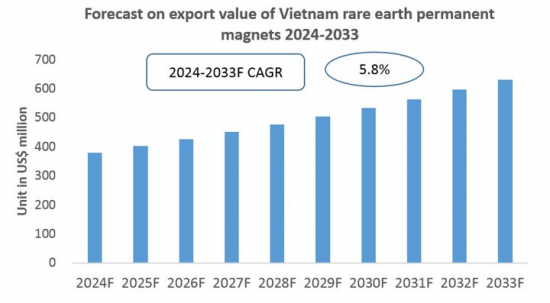

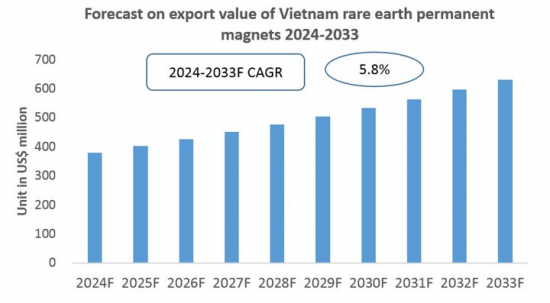

整體來看,全球稀土永磁產業發展前景廣闊,特別是隨著再生能源產業的快速成長。電動車和風力發電機的需求將進一步推動永磁體市場的擴張。 CRI預測,隨著越南稀土永磁產業的發展,未來幾年越南的出口將持續成長。

本報告調查了越南稀土永磁體出口趨勢,提供了國家概況、進出口額、出口量、出口價格等趨勢和預測,詳細分析了主要出口目的地國家和主要出口國買家和供應商分析,以及主要影響因素分析。

目錄

第1章 越南概況

- 地區

- 經濟情勢

- 人口統計

- 國內市場

- 對國外企業進入稀土永磁體出口市場的建議

第2章 越南稀土永磁體出口分析(2021-2024年)

- 出口規模

- 出口金額

- 出口價格

- 出口量

- 越南對稀土永磁體出口的依賴

- 稀土永磁體主要出口目的地

第3章 越南稀土永磁體主要出口目的地分析(2021-2024年)

- 日本

- 出口額/出口量分析

- 平均出口價格分析

- 菲律賓

- 出口額/出口量分析

- 平均出口價格分析

- 馬來西亞

- 出口額/出口量分析

- 平均出口價格分析

- 中國

- 德國

- 泰國

第4章 越南稀土永磁體出口市場主要買家分析(2021-2024年)

- SHIN-ETSU CHEMICAL CO, LTD

- UNION MATERIALS CORPORATION

- KOREA MIKASA CORPORATION

- 其他

- 公司簡介

- 稀土永磁進口情形分析

第5章 越南稀土永磁體出口市場主要供應商分析(2021-2024年)

- SHIN-ETSU VIETNAM

- MAGTRON VINA

- UNION MATERIALS VIETNAM

- 其他

- 公司簡介

- 稀土永磁體出口分析

第6章 越南稀土永磁體出口月分析(2021-2024年)

- 每月出口額與出口量分析

- 每月平均出口價格預測

第7章 影響越南稀土永磁體出口的主要因素

- 政策

- 當前出口政策

- 預測出口政策趨勢

- 經濟

- 市場價格

- 產能成長趨勢

- 技術

第8章 越南稀土永磁體出口預測(2024-2033年)

免責聲明

服務保障

Rare earth permanent magnets are high-performance magnetic materials made from rare earth elements, characterized by their extremely strong magnetism and excellent resistance to demagnetization. They are among the most important permanent magnet materials globally and are widely used in modern industry.

INFOGRAPHICS

According to CRI, the upstream sectors of rare earth permanent magnets primarily include the mining and processing of rare earth ores, especially the smelting and purification of rare earth metals such as neodymium, samarium, and cobalt. Downstream sectors encompass a wide range of application fields, including electronic devices, automobiles, wind power generation, medical equipment, and household appliances. In the electric vehicle and wind power generation sectors, rare earth permanent magnets are key components that can significantly improve motor efficiency and reduce energy consumption. Modern electronic consumer products such as smartphones and laptops also require rare earth permanent magnets to achieve lighter and more compact designs.

In industry, rare earth permanent magnets are widely used in various electric motors and generators, particularly in electric vehicles, wind turbines, and industrial automation equipment, where efficient conversion of electrical and kinetic energy is essential. Additionally, they are used in high-tech fields including maglev trains, robotics, and aerospace, as well as in consumer and medical devices like speakers and MRI machines. Due to their high performance and versatility, rare earth permanent magnets have become indispensable components in many key technological devices.

According to CRI, the major global producers of rare earth permanent magnets include China's JL MAG, Ningbo Yunsheng, and Zhong Ke San Huan, as well as Japan's Hitachi Metals and TDK.

Although Vietnam's rare earth permanent magnet industry is not as developed as that of China or Japan, Vietnam is gradually becoming an exporter of rare earth magnets due to its abundant mineral resources and cost-effective labor. CRI has analyzed that Vietnam has an estimated 22 million tons of rare earth resources, accounting for 19% of the world's known reserves, providing ample raw materials for the country's rare earth permanent magnet industry. Additionally, the Vietnamese government actively attracts foreign investment and promotes the development of high-tech industries, creating a favorable policy environment for the production of rare earth permanent magnets in Vietnam. As a result, Vietnam is gradually becoming an important global supplier of rare earth resources and is also exporting a large amount of processed rare earth materials.

Furthermore, Vietnam's free trade agreements with other countries help expand its export markets, reduce export tariffs, and increase the competitiveness of its products in the international market. According to CRI, due to its favorable policy environment, strong production capacity, and flexible export strategies, Vietnam's rare earth permanent magnet industry is becoming an increasingly important part of the global power and electronics supply chain.

CRI data shows that in 2023, Vietnam's total export value of rare earth permanent magnets reached approximately USD 370 million, with a growing trend. From January to July 2024, the export value of rare earth permanent magnets from Vietnam had already exceeded USD 200 million.

According to CRI, between 2021 and 2024, the main export destinations for Vietnam's rare earth permanent magnets were Japan, the Philippines, and Malaysia. Major companies importing rare earth permanent magnets from Vietnam include SHIN-ETSU CHEMICAL CO, LTD and its subsidiaries or partner logistics companies, UNION MATERIALS CORPORATION, and KOREA MIKASA CORPORATION.

Among Vietnam's rare earth permanent magnet exporters, foreign-invested companies dominate, especially subsidiaries of international electronics or chemical companies established in Vietnam. Key exporters of rare earth permanent magnets in Vietnam include SHIN-ETSU VIETNAM, MAGTRON VINA, and UNION MATERIALS VIETNAM.

Overall, the global rare earth permanent magnet industry has broad development prospects, particularly with the rapid growth of the renewable energy sector. The demand for electric vehicles and wind turbines will further drive the expansion of the permanent magnet market. CRI predicts that with the development of Vietnam's rare earth permanent magnet industry, exports from Vietnam are expected to continue growing in the coming years.

Topics covered:

The Import and Export of Rare Earth Permanent Magnets in Vietnam (2021-2024)

Total Export Volume and Percentage Change of Rare Earth Permanent Magnets in Vietnam (2021-2024)

Total Export Value and Percentage Change of Rare Earth Permanent Magnets in Vietnam (2021-2024)

Total Export Volume and Percentage Change of Rare Earth Permanent Magnets in Vietnam (January-July 2024)

Total Export Value and Percentage Change of Rare Earth Permanent Magnets in Vietnam (January-July 2024)

Average Export Price of Rare Earth Permanent Magnets in Vietnam (2021-2024)

Top 10 Export Destinations for Vietnam Rare Earth Permanent Magnets and Their Import Volume

Top 10 Suppliers in the Export Market of Rare Earth Permanent Magnets in Vietnam and Their Export Volume

Top 10 Buyers in the Export Market of Rare Earth Permanent Magnets in Vietnam and Their Import Volume

How to Find International Distributors and End Users of Rare Earth Permanent Magnets in Vietnam

How Foreign Enterprises Enter the Rare Earth Permanent Magnets Export Market of Vietnam

Forecast for the Export of Rare Earth Permanent Magnets in Vietnam (2024-2033)

Table of Contents

1 Overview of Vietnam

- 1.1 Geography of Vietnam

- 1.2 Economic Condition of Vietnam

- 1.3 Demographics of Vietnam

- 1.4 Domestic Market of Vietnam

- 1.5 Recommendations for Foreign Enterprises Entering the Vietnam Rare Earth Permanent Magnets Export Market

2 Analysis of Rare Earth Permanent Magnets Exports in Vietnam (2021-2024)

- 2.1 Export Scale of Rare Earth Permanent Magnets in Vietnam

- 2.1.1 Export Value of Rare Earth Permanent Magnets in Vietnam

- 2.1.2 Export Prices of Rare Earth Permanent Magnets in Vietnam

- 2.1.3 Export Volume of Rare Earth Permanent Magnets in Vietnam

- 2.1.4 Export Dependency of Rare Earth Permanent Magnets in Vietnam

- 2.2 Major Destination for Rare Earth Permanent Magnets Exports in Vietnam

3 Analysis of Major Destination for Rare Earth Permanent Magnets Exports in Vietnam (2021-2024)

- 3.1 Japan

- 3.1.1 Analysis of Vietnam's Rare Earth Permanent Magnets Export Value and Volume to Japan

- 3.1.2 Analysis of Average Export Price

- 3.2 the Philippines

- 3.2.1 Analysis of Vietnam's Rare Earth Permanent Magnets Export Value and Volume to the Philippines

- 3.2.2 Analysis of Average Export Price

- 3.3 Malaysia

- 3.3.1 Analysis of Vietnam's Rare Earth Permanent Magnets Export Value and Volume to Malaysia

- 3.3.2 Analysis of Average Export Price

- 3.4 China

- 3.5 Germany

- 3.6 Thailand

4 Analysis of Major Buyer in the Export Market of Rare Earth Permanent Magnets in Vietnam (2021-2024)

- 4.1 SHIN-ETSU CHEMICAL CO, LTD

- 4.1.1 Company Introduction

- 4.1.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.2 UNION MATERIALS CORPORATION

- 4.2.1 Company Introduction

- 4.2.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.3 KOREA MIKASA CORPORATION

- 4.3.1 Company Introduction

- 4.3.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.4 Importer 4

- 4.4.1 Company Introduction

- 4.4.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.5 Importer 5

- 4.5.1 Company Introduction

- 4.5.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.6 Importer 6

- 4.6.1 Company Introduction

- 4.6.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.7 Importer 7

- 4.7.1 Company Introduction

- 4.7.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.8 Importer 8

- 4.8.1 Company Introduction

- 4.8.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.9 Importer 9

- 4.9.1 Company Introduction

- 4.9.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.10 Importer 10

- 4.10.1 Company Introduction

- 4.10.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

5 Analysis of Major Suppliers in the Export Market of Rare Earth Permanent Magnets in Vietnam (2021-2024)

- 5.1 SHIN-ETSU VIETNAM

- 5.1.1 Company Introduction

- 5.1.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.2 MAGTRON VINA

- 5.2.1 Company Introduction

- 5.2.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.3 UNION MATERIALS VIETNAM

- 5.3.1 Company Introduction

- 5.3.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.4 Exporter 4

- 5.4.1 Company Introduction

- 5.4.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.5 Exporter 5

- 5.5.1 Company Introduction

- 5.5.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.6 Exporter 6

- 5.6.1 Company Introduction

- 5.6.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.7 Exporter 7

- 5.7.1 Company Introduction

- 5.7.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.8 Exporter 8

- 5.8.1 Company Introduction

- 5.8.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.9 Exporter 9

- 5.9.1 Company Introduction

- 5.9.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.10 Exporter 10

- 5.10.1 Company Introduction

- 5.10.2 Analysis of Rare Earth Permanent Magnets Exports

6. Monthly Analysis of Rare Earth Permanent Magnets Exports in Vietnam from 2021 to 2024

- 6.1 Analysis of Monthly Export Value and Volume

- 6.2 Forecast of Monthly Average Export Prices

7. Key Factors Affecting Rare Earth Permanent Magnets Exports in Vietnam

- 7.1 Policy

- 7.1.1 Current Export Policies

- 7.1.2 Trend Predictions for Export Policies

- 7.2 Economic

- 7.2.1 Market Prices

- 7.2.2 Growth Trends of Rare Earth Permanent Magnets Production Capacity in Vietnam

- 7.3 Technology

8. Forecast for the Export of Rare Earth Permanent Magnets in Vietnam, 2024-2033

Disclaimer

Service Guarantees

List of Charts

- Chart 2021-2024 Export Value and Volume of Rare Earth Permanent Magnets in Vietnam

- Chart 2021-2024 Average Export Price of Rare Earth Permanent Magnets in Vietnam

- Chart 2021-2024 Export Dependency of Rare Earth Permanent Magnets in Vietnam

- Chart Top 10 Export Destinations for Rare Earth Permanent Magnets in Vietnam (2021-2024)

- Chart Top 10 Export Destinations for Rare Earth Permanent Magnets in Vietnam (2022)

- Chart Top 10 Export Destinations for Rare Earth Permanent Magnets in Vietnam (2023)

- Chart Top 10 Export Destinations for Rare Earth Permanent Magnets in Vietnam (2024)

- Chart Top 10 Buyers of Rare Earth Permanent Magnets Exports from Vietnam (2021-2024)

- Chart Top 10 Buyers of Rare Earth Permanent Magnets Exports from Vietnam (2022)

- Chart Top 10 Buyers of Rare Earth Permanent Magnets Exports from Vietnam (2023)

- Chart Top 10 Buyers of Rare Earth Permanent Magnets Exports from Vietnam (2024)

- Chart Volume and Value of Rare Earth Permanent Magnets Exports from Vietnam to Japan (2021-2024)

- Chart Volume and Value of Rare Earth Permanent Magnets Exports from Vietnam to the Philippines (2021-2024)

- Chart Volume and Value of Rare Earth Permanent Magnets Exports from Vietnam to Malaysia (2021-2024)

- Chart Volume and Value of Rare Earth Permanent Magnets Exports from Vietnam to China (2021-2024)

- Chart Top 10 Exporters of Rare Earth Permanent Magnets in Vietnam (2021-2024)

- Chart Top 10 Exporters of Rare Earth Permanent Magnets in Vietnam (2022)

- Chart Top 10 Exporters of Rare Earth Permanent Magnets in Vietnam (2023)

- Chart Top 10 Exporters of Rare Earth Permanent Magnets in Vietnam (2024)

- Chart Forecast for the Export of Rare Earth Permanent Magnets in Vietnam (2024-2033)