|

市場調查報告書

商品編碼

1597613

越南焦炭與半焦進口:2024-2033Vietnam Coke & Semi-coke Import Research Report 2024-2033 |

||||||

資訊圖表

越南焦炭和半焦市場規模隨著鋼鐵工業的成長而穩定成長。

世界主要生產國都是中國、印度、俄羅斯、澳洲等煤炭資源豐富的國家,焦炭產業嚴重依賴煤炭資源,因此焦炭往往從這些國家出口。越南雖然擁有煤炭資源,但缺乏優質煉焦煤和先進生產技術,主要依賴進口來滿足國內鋼鐵和工業需求。隨著越南鋼鐵工業的快速擴張,高爐用優質焦炭的需求不斷增加,但由於國內生產困難,越南市場嚴重依賴進口。

2023年,越南焦炭和半焦進口總額達約2.5億美元。2024年1月至8月,越南焦炭和半焦進口額接近2億美元,較去年同期成長約9%。越南焦炭和半焦市場預計將持續成長。

總體而言,隨著越南經濟成長、工業化程度提高以及基礎設施持續發展,預計未來幾年該國對焦炭和半焦的需求將繼續增長。為了滿足這一需求,越南的焦炭和半焦進口預計將增加。

本報告調查了越南焦炭和半焦的進口趨勢,提供了國家概況、進口額、進口量、進口價格等趨勢和預測,對主要進口國進行了詳細分析,並提供了主要進口國的信息。採購商和供應商的主要影響因素進行了總結分析。

目錄

第1章 越南概況

- 區域

- 經濟狀況

- 人口統計

- 國內市場

- 對外國企業進入進口市場的建議

第2章 越南焦炭及半焦進口分析(2021-2024年)

- 進口規模

- 進口金額及數量

- 進口價格

- 消耗

- 進口依賴

- 主要進口來源地

第3章 越南焦炭、半焦主要進口來源分析(2021-2024年)

- 中國

- 進口量及進口額分析

- 平均進口價格分析

- 日本

- 進口量及進口額分析

- 平均進口價格分析

- 新加坡

- 進口量及進口額分析

- 平均進口價格分析

- 印尼

- 香港

- 瑞士

第4章越南焦炭半焦進口市場主要供應商分析(2021-2024年)

- SUMMIT CRM LTD

- DAICHU CORP

- TRAFIGURA PTE LTD

- 其他

- 公司簡介

- 焦炭半焦出口分析

第5章 越南焦炭半焦進口市場主要進口商分析(2021-2024年)

- NHA MAY LUYEN PHOI THEP CHI NHANH CONG TY CO PHAN THEP POMINA

- VIET PHAT IMPORT EXPORT TRADING INVESTMENT JSC

- TRUNG THANH(VN) PTE

- 其他

- 公司簡介

- 焦炭半焦進口分析

第6章 越南焦炭及半焦進口月分析(2021-2024年)

- 每月進口額及進口量分析

- 月平均進口價格預測

第7章 影響越南焦炭、半焦進口的主要因素

- 政策

- 現行進口政策

- 預測進口政策趨勢

- 經濟

- 市價

- 產能成長趨勢

- 技術

第8章越南焦炭與半焦進口預測:2024-2033

Coke and semi-coke are solid carbonaceous products obtained through the carbonization or pyrolysis of coal at high temperatures. Coke is primarily used in the steel industry as a fuel and reducing agent in blast furnaces, while semi-coke is often used in energy production or the chemical industry. Unlike other coal products, coke is valued for its low sulfur content, high fixed carbon, and low volatile matter, which allow it to provide stable heat and excellent mechanical strength at high temperatures.

INFOGRAPHICS

The coke industry relies on upstream sectors such as the extraction and processing of high-quality coking coal, while downstream applications include steelmaking, foundries, and chemical industries. Coke is essential in steelmaking, as it helps reduce iron ore into iron in blast furnaces and is also used in producing chemical products like calcium carbide and syngas. Semi-coke, with lower density and volatile matter, is typically used in power stations as a fuel or in gas production. The coke market fluctuates with changes in global steel demand and energy industry conditions. According to CRI, Vietnam's coke and semi-coke market size has been steadily increasing alongside its growing steel industry.

Major global producers are located in coal-rich countries such as China, India, Russia, and Australia, and exporters often come from these countries due to the coke industry's heavy reliance on coal resources. Although Vietnam has coal resources, it lacks high-quality coking coal and advanced production technology, relying primarily on imports to meet domestic steel and industrial needs. CRI reports that, with Vietnam's rapidly expanding steel industry, there is a growing demand for high-quality metallurgical coke for blast furnace use, which cannot be locally produced, making the Vietnamese market highly dependent on imports.

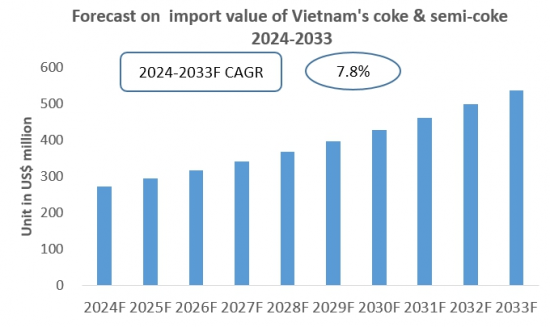

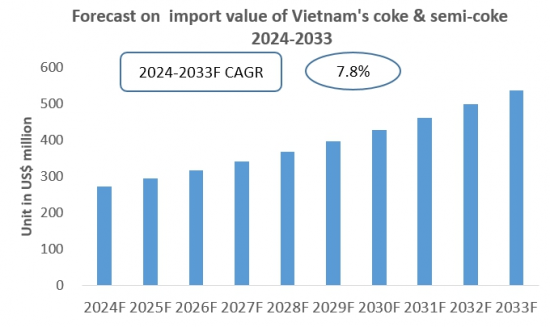

CRI data shows that in 2023, Vietnam's total coke and semi-coke imports reached approximately USD 250 million. From January to August 2024, Vietnam's coke and semi-coke imports had nearly reached USD 200 million, an increase of about 9% over the same period in the previous year. CRI forecasts that Vietnam's coke and semi-coke market will continue growing in the coming years.

Based on CRI analysis, between 2021 and 2024, Vietnam's primary sources for coke and semi-coke imports have included China, Japan, and Singapore, with major suppliers such as Summit CRM Ltd, Daichu Corp, and Trafigura Pte Ltd. The main Vietnamese importers of coke and semi-coke are steel industry manufacturers and distributors, with major companies including Nha may luyen phoi thep (a branch of Pomina Steel Corporation), Viet Phat Import Export Trading Investment JSC, and Trung Thanh (VN) Pte, according to CRI.

Overall, with Vietnam's economic growth, advancing industrialization, and ongoing infrastructure improvements, the country's demand for coke and semi-coke is projected to continue expanding over the next few years. CRI expects Vietnam's imports of coke and semi-coke to increase in response to this demand.

Topics covered:

The Import and Export of Coke & Semi-coke in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Coke & Semi-coke in Vietnam (2021-2024)

Total Import Value and Percentage Change of Coke & Semi-coke in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Coke & Semi-coke in Vietnam (2024)

Total Import Value and Percentage Change of Coke & Semi-coke in Vietnam (2024)

Average Import Price of Coke & Semi-coke in Vietnam (2021-2024)

Top 10 Sources of Coke & Semi-coke Imports in Vietnam and Their Supply Volume

Top 10 Suppliers in the Import Market of Coke & Semi-coke in Vietnam and Their Supply Volume

Top 10 Importers of Coke & Semi-coke in Vietnam and Their Import Volume

How to Find Distributors and End Users of Coke & Semi-coke in Vietnam

How Foreign Enterprises Enter the Coke & Semi-coke Market of Vietnam

Forecast for the Import of Coke & Semi-coke in Vietnam (2024-2033)

Table of Contents

1 Overview of Vietnam

- 1.1 Geography of Vietnam

- 1.2 Economic Condition of Vietnam

- 1.3 Demographics of Vietnam

- 1.4 Domestic Market of Vietnam

- 1.5 Recommendations for Foreign Enterprises Entering the Vietnam Coke & Semi-coke Imports Market

2 Analysis of Coke & Semi-coke Imports in Vietnam (2021-2024)

- 2.1 Import Scale of Coke & Semi-coke in Vietnam

- 2.1.1 Import Value and Volume of Coke & Semi-coke in Vietnam

- 2.1.2 Import Prices of Coke & Semi-coke in Vietnam

- 2.1.3 Apparent Consumption of Coke & Semi-coke in Vietnam

- 2.1.4 Import Dependency of Coke & Semi-coke in Vietnam

- 2.2 Major Sources of Coke & Semi-coke Imports in Vietnam

3 Analysis of Major Sources of Coke & Semi-coke Imports in Vietnam (2021-2024)

- 3.1 China

- 3.1.1 Analysis of Vietnam's Coke & Semi-coke Import Volume and Value from China

- 3.1.2 Analysis of Average Import Price

- 3.2 Japan

- 3.2.1 Analysis of Vietnam's Coke & Semi-coke Import Volume and Value from Japan

- 3.2.2 Analysis of Average Import Price

- 3.3 Singapore

- 3.3.1 Analysis of Vietnam's Coke & Semi-coke Import Volume and Value from Singapore

- 3.3.2 Analysis of Average Import Price

- 3.4 Indonesia

- 3.5 Hong Kong

- 3.6 Switzerland

4 Analysis of Major Suppliers in the Import Market of Coke & Semi-coke in Vietnam (2021-2024)

- 4.1 SUMMIT CRM LTD

- 4.1.1 Company Introduction

- 4.1.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.2 DAICHU CORP

- 4.2.1 Company Introduction

- 4.2.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.3 TRAFIGURA PTE LTD

- 4.3.1 Company Introduction

- 4.3.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.4 Exporter 4

- 4.4.1 Company Introduction

- 4.4.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.5 Exporter 5

- 4.5.1 Company Introduction

- 4.5.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.6 Exporter 6

- 4.6.1 Company Introduction

- 4.6.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.7 Exporter 7

- 4.7.1 Company Introduction

- 4.7.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.8 Exporter 8

- 4.8.1 Company Introduction

- 4.8.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.9 Exporter 9

- 4.9.1 Company Introduction

- 4.9.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.10 Exporter 10

- 4.10.1 Company Introduction

- 4.10.2 Analysis of Coke & Semi-coke Exports to Vietnam

5 Analysis of Major Importers in the Import Market of Coke & Semi-coke in Vietnam (2021-2024)

- 5.1 NHA MAY LUYEN PHOI THEP CHI NHANH CONG TY CO PHAN THEP POMINA

- 5.1.1 Company Introduction

- 5.1.2 Analysis of Coke & Semi-coke Imports

- 5.2 VIET PHAT IMPORT EXPORT TRADING INVESTMENT JSC

- 5.2.1 Company Introduction

- 5.2.2 Analysis of Coke & Semi-coke Imports

- 5.3 TRUNG THANH(VN) PTE

- 5.3.1 Company Introduction

- 5.3.2 Analysis of Coke & Semi-coke Imports

- 5.4 Importer 4

- 5.4.1 Company Introduction

- 5.4.2 Analysis of Coke & Semi-coke Imports

- 5.5 Importer 5

- 5.5.1 Company Introduction

- 5.5.2 Analysis of Coke & Semi-coke Imports

- 5.6 Importer 6

- 5.6.1 Company Introduction

- 5.6.2 Analysis of Coke & Semi-coke Imports

- 5.7 Importer 7

- 5.7.1 Company Introduction

- 5.7.2 Analysis of Coke & Semi-coke Imports

- 5.8 Importer 8

- 5.8.1 Company Introduction

- 5.8.2 Analysis of Coke & Semi-coke Imports

- 5.9 Importer 9

- 5.9.1 Company Introduction

- 5.9.2 Analysis of Coke & Semi-coke Imports

- 5.10 Importer 10

- 5.10.1 Company Introduction

- 5.10.2 Analysis of Coke & Semi-coke Imports

6. Monthly Analysis of Coke & Semi-coke Imports in Vietnam from 2021 to 2024

- 6.1 Analysis of Monthly Import Value and Volume

- 6.2 Forecast of Monthly Average Import Prices

7. Key Factors Affecting Coke & Semi-coke Imports in Vietnam

- 7.1 Policy

- 7.1.1 Current Import Policies

- 7.1.2 Trend Predictions for Import Policies

- 7.2 Economic

- 7.2.1 Market Prices

- 7.2.2 Growth Trends of Coke & Semi-coke Production Capacity in Vietnam

- 7.3 Technology