|

市場調查報告書

商品編碼

1597621

越南蔗糖進口:2024-2033Vietnam Sucrose Import Research Report 2024-2033 |

||||||

隨著技術的進步和健康問題的日益嚴重,蔗糖的用途預計將進一步擴大。 CRI分析稱,蔗糖在全球食品和飲料產業中佔有重要地位,廣泛應用於軟性飲料、果汁、糖果、糕點、冰淇淋和其他加工食品。在越南,經濟成長和人均收入上升正在推動食品和飲料消費,直接推動越南蔗糖市場的成長。

全球主要蔗糖生產國包括巴西、印度、中國、澳洲和泰國,巴西以其生產優勢,成為最大的生產國和出口國,其次是印度和中國。從需求來看,北美、歐洲和亞洲是主要消費地區,而包括越南在內的東南亞新興經濟體正在加大蔗糖市場的成長。

隨著經濟擴張和消費者收入增加,越南作為東南亞主要經濟體,對加工食品和食品飲料的需求持續成長。這種需求是越南蔗糖進口的驅動力。 CRI強調,越南有利的勞動成本和豐富的土地資源吸引了許多國際品牌設立生產基地,間接帶動了越南蔗糖市場的發展。但由於國內蔗糖產量有限,越南依賴進口來滿足市場需求。

2023年越南蔗糖進口額將達到約2.54億美元,預計未來幾年將持續成長。越南蔗糖的主要進口來源包括澳洲、新加坡、泰國、柬埔寨、寮國和緬甸,其中澳洲是最大的進口來源。 2021年至2024年,出口蔗糖到越南的主要國家和地區是澳洲、新加坡、泰國。

整體來看,越南蔗糖市場呈現穩定成長趨勢。隨著越南食品飲料、化學和製藥業的發展,蔗糖市場預計將繼續擴大。然而,鑑於國內蔗糖產能有限,預計未來幾年越南將繼續依賴進口來滿足其蔗糖需求。

本報告調查了越南蔗糖進口趨勢,包括國家概況、進口額、進口量、進口價格等趨勢和預測,主要進口國以及主要買家和供應商的詳細分析總結分析了主要影響因素等。

目錄

第一章越南概況

- 地區

- 經濟情勢

- 人口統計

- 國內市場

- 對外國公司進入進口市場的建議

第二章越南蔗糖進口分析(2021-2024年)

- 進口規模

- 進口價值和數量

- 進口價格

- 消費金額

- 進口依賴

- 主要進口來源

第三章越南蔗糖主要進口來源分析(2021-2024年)

- 澳大利亞

- 進口量與進口額分析

- 平均進口價格分析

- 新加坡

- 進口量與進口額分析

- 平均進口價格分析

- 泰國

- 進口量與進口額分析

- 平均進口價格分析

- 寮國

- 柬埔寨

- 英國

第四章越南蔗糖進口市場主要供應商分析(2021-2024年)

- GLOBAL MIND AGRICULTURE PTE LTD

- WILMAR SUGAR PTE LTD

- MITR LAO SUGAR CO LTD

- 其他

- 公司簡介

- 蔗糖出口分析

第五章越南蔗糖進口市場主要進口商分析(2021-2024年)

- THANH THANH CONG - BIEN HOA JOINT STOCK COMPANY

- BIEN HOA CONSUMER JOINT STOCK COMPANY

- BSJC

- 其他

- 公司簡介

- 蔗糖進口分析

第六章越南蔗糖進口月分析(2021-2024年)

- 每月進口額和進口量分析

- 每月平均進口價格預測

第七章影響越南蔗糖進口的主要因素

- 政策

- 現行進口政策

- 預測進口政策趨勢

- 經濟

- 市場價格

- 產能成長趨勢

- 技術

第八章越南蔗糖進口預測:2024-2033

Sucrose is a widely used natural sugar primarily extracted from sugarcane or sugar beets. As one of the most common sugars globally, sucrose plays an important role across various industries, including food, pharmaceuticals, agriculture, and chemicals.

INFOGRAPHICS

Advances in technology and an increasing focus on health are expected to further expand and deepen sucrose applications. CRI analyzes that sucrose is critical in the global food and beverage industry, where it is extensively used in soft drinks, juices, candies, pastries, ice creams, and other processed foods. In Vietnam, economic growth and rising per capita income are boosting food and beverage consumption, directly driving the growth of Vietnam's sucrose market.

The major global producers of sucrose include Brazil, India, China, Australia, and Thailand, with Brazil leading as the largest producer and exporter due to significant production advantages, followed by India and China. In terms of demand, North America, Europe, and Asia are the major consuming regions, and rising economies in Southeast Asia, including Vietnam, are seeing increasing sucrose market growth.

As a key economy in Southeast Asia, Vietnam's demand for processed foods and beverages continues to grow with economic expansion and increased consumer income. This demand drives Vietnam's sucrose imports. CRI highlights that Vietnam's favorable labor costs and abundant land resources attract many international brands, such as Pepsi and Coca-Cola, to establish production bases there, indirectly fueling Vietnam's sucrose market. However, due to limited domestic sucrose production, Vietnam relies on imports to meet its market needs.

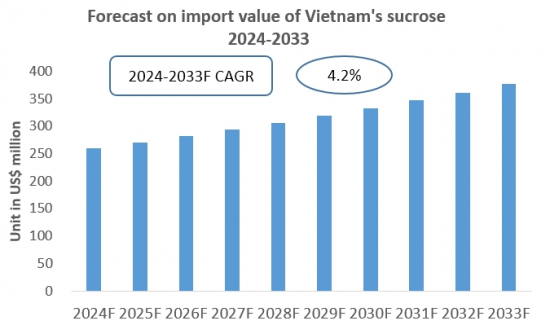

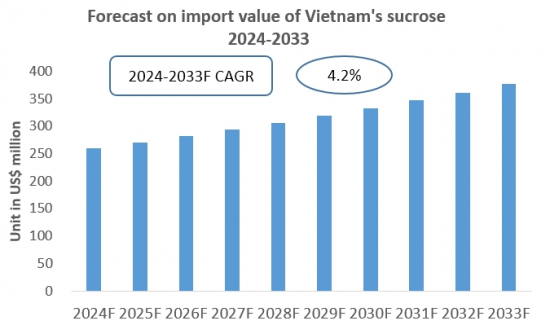

CRI data shows that in 2023, Vietnam's sucrose imports reached approximately USD 254 million, with expectations of sustained growth in the coming years. Key sucrose import sources for Vietnam include Australia, Singapore, Thailand, Cambodia, Laos, and Myanmar, with Australia as the largest source. From 2021 to 2024, the primary countries and regions exporting sucrose to Vietnam were Australia, Singapore, and Thailand. Major exporters to Vietnam include companies like Global Mind Agriculture Pte Ltd, Wilmar Sugar Pte Ltd, and Mitr Lao Sugar Co Ltd. Major importers during this period include Thanh Thanh Cong - Bien Hoa Joint Stock Company, Bien Hoa Consumer Joint Stock Company, and BSJC.

Overall, Vietnam's sucrose market shows a steady growth trend. With the development of Vietnam's food and beverage, chemical, and pharmaceutical industries, the sucrose market is expected to continue expanding. However, given the limited capacity for increased local sucrose production, Vietnam would remain dependent on imports to meet its sucrose demand in the years ahead.

Topics covered:

The Import and Export of Sucrose in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Sucrose in Vietnam (2021-2024)

Total Import Value and Percentage Change of Sucrose in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Sucrose in Vietnam (2024)

Total Import Value and Percentage Change of Sucrose in Vietnam (2024)

Average Import Price of Sucrose in Vietnam (2021-2024)

Top 10 Sources of Sucrose Imports in Vietnam and Their Supply Volume

Top 10 Suppliers in the Import Market of Sucrose in Vietnam and Their Supply Volume

Top 10 Importers of Sucrose in Vietnam and Their Import Volume

How to Find Distributors and End Users of Sucrose in Vietnam

How Foreign Enterprises Enter the Sucrose Market of Vietnam

Forecast for the Import of Sucrose in Vietnam (2024-2033)

Table of Contents

1 Overview of Vietnam

- 1.1 Geography of Vietnam

- 1.2 Economic Condition of Vietnam

- 1.3 Demographics of Vietnam

- 1.4 Domestic Market of Vietnam

- 1.5 Recommendations for Foreign Enterprises Entering the Vietnam Sucrose Imports Market

2 Analysis of Sucrose Imports in Vietnam (2021-2024)

- 2.1 Import Scale of Sucrose in Vietnam

- 2.1.1 Import Value and Volume of Sucrose in Vietnam

- 2.1.2 Import Prices of Sucrose in Vietnam

- 2.1.3 Apparent Consumption of Sucrose in Vietnam

- 2.1.4 Import Dependency of Sucrose in Vietnam

- 2.2 Major Sources of Sucrose Imports in Vietnam

3 Analysis of Major Sources of Sucrose Imports in Vietnam (2021-2024)

- 3.1 Australia

- 3.1.1 Analysis of Vietnam's Sucrose Import Volume and Value from Australia

- 3.1.2 Analysis of Average Import Price

- 3.2 Singapore

- 3.2.1 Analysis of Vietnam's Sucrose Import Volume and Value from Singapore

- 3.2.2 Analysis of Average Import Price

- 3.3 Thailand

- 3.3.1 Analysis of Vietnam's Sucrose Import Volume and Value from Thailand

- 3.3.2 Analysis of Average Import Price

- 3.4 Laos

- 3.5 Cambodia

- 3.6 United Kingdom

4 Analysis of Major Suppliers in the Import Market of Sucrose in Vietnam (2021-2024)

- 4.1 GLOBAL MIND AGRICULTURE PTE LTD

- 4.1.1 Company Introduction

- 4.1.2 Analysis of Sucrose Exports to Vietnam

- 4.2 WILMAR SUGAR PTE LTD

- 4.2.1 Company Introduction

- 4.2.2 Analysis of Sucrose Exports to Vietnam

- 4.3 MITR LAO SUGAR CO LTD

- 4.3.1 Company Introduction

- 4.3.2 Analysis of Sucrose Exports to Vietnam

- 4.4 Exporter 4

- 4.4.1 Company Introduction

- 4.4.2 Analysis of Sucrose Exports to Vietnam

- 4.5 Exporter 5

- 4.5.1 Company Introduction

- 4.5.2 Analysis of Sucrose Exports to Vietnam

- 4.6 Exporter 6

- 4.6.1 Company Introduction

- 4.6.2 Analysis of Sucrose Exports to Vietnam

- 4.7 Exporter 7

- 4.7.1 Company Introduction

- 4.7.2 Analysis of Sucrose Exports to Vietnam

- 4.8 Exporter 8

- 4.8.1 Company Introduction

- 4.8.2 Analysis of Sucrose Exports to Vietnam

- 4.9 Exporter 9

- 4.9.1 Company Introduction

- 4.9.2 Analysis of Sucrose Exports to Vietnam

- 4.10 Exporter 10

- 4.10.1 Company Introduction

- 4.10.2 Analysis of Sucrose Exports to Vietnam

5 Analysis of Major Importers in the Import Market of Sucrose in Vietnam (2021-2024)

- 5.1 THANH THANH CONG - BIEN HOA JOINT STOCK COMPANY

- 5.1.1 Company Introduction

- 5.1.2 Analysis of Sucrose Imports

- 5.2 BIEN HOA CONSUMER JOINT STOCK COMPANY

- 5.2.1 Company Introduction

- 5.2.2 Analysis of Sucrose Imports

- 5.3 BSJC

- 5.3.1 Company Introduction

- 5.3.2 Analysis of Sucrose Imports

- 5.4 Importer 4

- 5.4.1 Company Introduction

- 5.4.2 Analysis of Sucrose Imports

- 5.5 Importer 5

- 5.5.1 Company Introduction

- 5.5.2 Analysis of Sucrose Imports

- 5.6 Importer 6

- 5.6.1 Company Introduction

- 5.6.2 Analysis of Sucrose Imports

- 5.7 Importer 7

- 5.7.1 Company Introduction

- 5.7.2 Analysis of Sucrose Imports

- 5.8 Importer 8

- 5.8.1 Company Introduction

- 5.8.2 Analysis of Sucrose Imports

- 5.9 Importer 9

- 5.9.1 Company Introduction

- 5.9.2 Analysis of Sucrose Imports

- 5.10 Importer 10

- 5.10.1 Company Introduction

- 5.10.2 Analysis of Sucrose Imports

6. Monthly Analysis of Sucrose Imports in Vietnam from 2021 to 2024

- 6.1 Analysis of Monthly Import Value and Volume

- 6.2 Forecast of Monthly Average Import Prices

7. Key Factors Affecting Sucrose Imports in Vietnam

- 7.1 Policy

- 7.1.1 Current Import Policies

- 7.1.2 Trend Predictions for Import Policies

- 7.2 Economic

- 7.2.1 Market Prices

- 7.2.2 Growth Trends of Sucrose Production Capacity in Vietnam

- 7.3 Technology