|

市場調查報告書

商品編碼

1730126

歐洲的廚房家具市場The European Market for Kitchen Furniture |

||||||

本報告全面概述了歐洲廚房家具市場,並結合CSIL對最新趨勢的評估,提供了深入的分析和見解。報告架構如下:

第一章案例分析:本章借助表格和圖表,概述了歐洲廚房家具市場。本章分析了歐洲整體及各目標國家廚房家具的生產、消費和國際貿易數據,涵蓋價值和數量、總體產業和價格區間。此外,本報告還概述了歐洲主要企業集團及其市場佔有率。本章最後,對2025-2027年的廚房家具消費量進行了預測。

第二章業務表現:本章提供過去六年廚房家具統計數據和關鍵宏觀經濟指標,用於分析整體及目標國家/地區的表現。此外,還包含 2025-2027 年的預測。

第三章國際貿易:本章提供過去六年 30 個國家/地區廚房家具進出口的詳細表格,並按目的地/原產國/地區和地理區域分類。

第四章供應結構:本章分析了歐洲廚房家具製造商的產品類型,包括各細分市場主要公司的表格和資訊。產品依櫃門材質、款式、顏色、漆面類型及檯面材質分類。

第五章通路:本章概述了歐洲廚房家具市場的主要分銷管道,包括整個歐洲市場以及目標國家/地區的市場。

第六章競爭體系:分析了不同價格區間以及國內外公司的市場狀況。詳細表格提供了主要廚房家具公司的銷售數據和市場佔有率,並簡要介紹了主要參與者。本章最後重點介紹了歐洲以外地區的廚房家具出口情況及其各地區(北美、中美和南美、亞太地區、中東和非洲)的市場佔有率。

本報告中提及的公司名單

調查地區:

|

|

|

主要企業

本報告介紹的公司:Agata Meble, Alvic, Aran, Armony, Arredo3, Arrital, Artego, Aster, Ballingslov, Ballerina, Bauformat, Boffi, Bruynzeel, BRW, Bulthaup, Colombini, Dan, Decodom, Delta Cocinas, Discac, Eggo, Ekipa, Elkjop, Euromobil, Fournier, Freda, Gama Decor, Haecker, Hanak, Howdens Joinery, Ikea, Leicht, Lube, Mandemaakers,Menuiseries du Centre, Mob Cozinhas, Mondo Convenienza, Nikolidakis, Nobia, Nobilia, Nolte, Omega, Puustelli, Rempp, Rotpunkt, Sanitas Troesch, Santos, Scavolini, Snaidero, Symphony, Schmidt, Siko, Snaidero, Stosa, Strai, TCM, Tom Howley, Turi Group, Valcucine, Vedum, Veneta Cucine, WFM Kitchen, Wren Kitchens

亮點

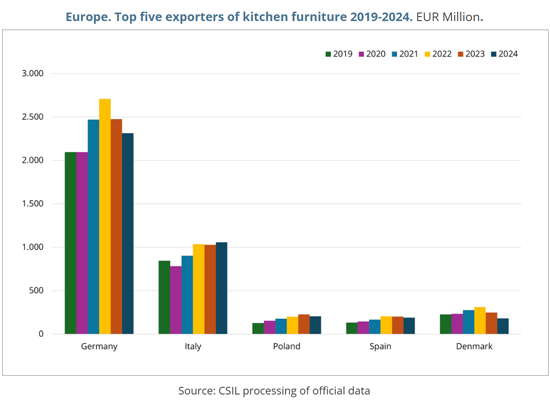

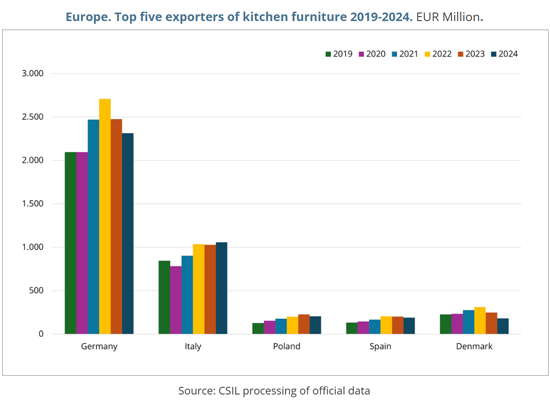

根據CSIL估計,歐洲廚房家具產值約180億歐元。從貿易趨勢來看,廚房家具產業保持結構性貿易順差。儘管該行業的開放度仍低於整個家具業的平均水平,但出口占生產佔有率和進口占消費佔有率正在逐步提升。歐洲廚房家具出口主要銷往歐洲,但也有一些出口到北美、亞太和中東等海外市場。

目錄

目錄的摘要

調查手法

- 調查工具和用語,目錄

摘要整理

第1章 情勢:各國的趨勢,市場區隔,數值

- 各國市場趨勢與數值

- 各市場區隔的生產明細

- 各市場區隔的消費明細

- 歐洲的主要群組和那個市場佔有率

- 目前趨勢與預測

第2章 商務效能:各國基礎資料和宏觀經濟指標

- 北歐州(丹麥,芬蘭,挪威,瑞典)

- 西歐(比利時/盧森堡,法國,愛爾蘭,荷蘭,英國)

- 中歐(DACH:奧地利,德國,瑞士)

- 南歐(希臘,義大利,葡萄牙,西班牙)

- 中東歐(保加利亞,克羅埃西亞,賽普勒斯,捷克,愛沙尼亞,匈牙利,立陶宛,拉脫維亞,馬爾他,波蘭,羅馬尼亞,斯洛維尼亞,斯洛伐克)

第3章 國際貿易

- 貿易收支,出口,進口的轉變

- 按各國及目的地/原產地的進出口

- 特定家電產品的各國進出口

第4章 供應結構

- 供應細分:依櫥櫃門材料

- 供應細分:依櫥櫃門風格

- 供應細分:依櫃門顏色和油漆類型

- 供應細分:依檯面材質

- 供應細分:依佈局類型

- 鉸鍊和抽屜

- 嵌入式照明

- 智慧財產權

第5章 流通管道

- 概覽:廚房專家、家具店、家具連鎖店、建築貿易、合約、DIY、電子商務、直銷

- 按分銷管道細分部分國家和地區(中歐和東歐)的銷售額

- 嵌入式電器

- 永續性

競爭體系

- 歐洲主要公司及其市場佔有率(消費和生產)

- 歐洲競爭體系:按細分市場

- 依國家劃分的競爭體系

- 歐洲出口至歐洲以外市場及海外市場

附錄

- 附錄 1.財務分析:120 家製造商的關鍵財務指標及就業分析

- 附錄 2.主要廚房家具公司名單

CSIL's Report "The European Market for Kitchen Furniture" offers a comprehensive picture of the kitchen furniture sector in Europe, an extensive analysis which is introduced by CSIL's assessment of the latest trends and insights and is structured as follows:

Chapter 1. Scenario presents an overview of the European kitchen furniture sector through tables and graphs, data on kitchen furniture production, consumption and international trade are analysed, at the European level as a whole and for each country considered, both in value and in volume, for the total sector and by price range. A panorama of the leading European groups and their market shares is also provided. The chapter closes with the kitchen consumption forecasts for the years 2025-2027.

Chapter 2. Business performance offers kitchen furniture statistics and the main macroeconomic indicators necessary to analyse the performance of the sector for the last 6 years (2019-2024), together with forecasts for 2025-2027, at a European level as a whole and for each country considered.

Chapter 3. International trade provides detailed tables on the kitchen furniture exports and imports in the 30 European Countries considered, for the last 6 years, broken down by country and by geographical area of destination/origin.

Chapter 4. Supply structure offers an analysis of the types of products manufactured by the European kitchen furniture manufacturers, in addition to tables and information on the key players operating in each segment. Production is broken down by cabinet door material, by cabinet door style, by cabinet door colour, by lacquered cabinet door type and by worktop material.

Chapter 5. Distribution channels gives an overview of the main distribution channels active on the European kitchen furniture market, at the European level as a whole and for each country considered.

Chapter 6. The competitive system: sales by price range and by country offers an insight into the leading local and foreign players present in each European country and in each price range segment considered. Detailed tables show sales data and market shares of the top kitchen furniture companies; short profiles of the main players in the kitchen furniture industry are also available. At the end of this chapter, there is a focus on European kitchen furniture exports and market shares outside Europe, by area of destination (North and Central-South America, Asia and Pacific, and Middle East and Africa).

Financial Analysis builds on a sample of 120 European kitchen furniture manufacturers, a study of their main profitability ratios (ROA, ROE and EBITDA) and measures their employee ratios.

List of mentioned companies in this report.

GEOGRAPHICAL COVERAGE:

|

|

|

Selected companies:

Among the companies mentioned in the Report: Agata Meble, Alvic, Aran, Armony, Arredo3, Arrital, Artego, Aster, Ballingslov, Ballerina, Bauformat, Boffi, Bruynzeel, BRW, Bulthaup, Colombini, Dan, Decodom, Delta Cocinas, Discac, Eggo, Ekipa, Elkjop, Euromobil, Fournier, Freda, Gama Decor, Haecker, Hanak, Howdens Joinery, Ikea, Leicht, Lube, Mandemaakers, Menuiseries du Centre, Mob Cozinhas, Mondo Convenienza, Nikolidakis, Nobia, Nobilia, Nolte, Omega, Puustelli, Rempp, Rotpunkt, Sanitas Troesch, Santos, Scavolini, Snaidero, Symphony, Schmidt, Siko, Snaidero, Stosa, Strai, TCM, Tom Howley, Turi Group, Valcucine, Vedum, Veneta Cucine, WFM Kitchen, Wren Kitchens.

Highlights:

According to CSIL, the European kitchen furniture production is valued at approximately EUR 18 billion. As far as trade dynamics are concerned, the kitchen furniture segment has a structurally positive trade balance. The sector's openness still remains well below the average of the furniture industry as a whole, but the share of exports on production and the share of imports on consumption have progressively increased. Most European kitchen furniture exports are destined within Europe, with the remainder going overseas, mainly to North America, Asia-Pacific, and the Middle East.

Table of Contents

Abstract of table of contents

Methodology

- Research tools and terminology, Contents

Executive summary

1. Scenario: Trends, market segment and figures by country

- 1.1. Market evolution and figures by country

- 1.2. Production breakdown by market segment

- 1.3. Consumption breakdown by market segment

- 1.4. Leading groups in Europe and their market shares

- 1.5. Current trends and forecasts for 2025-2027

2. Business performance: basic data and macroeconomic indicators by country

- 2.1. Northern Europe (Denmark, Finland, Norway and Sweden)

- 2.2. Western Europe (Belgium/Luxembourg, France, Ireland, Netherlands, the UK)

- 2.3. Central Europe (DACH: Austria, Germany, Switzerland)

- 2.4. Southern Europe (Greece, Italy, Portugal, Spain)

- 2.5. Central-Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovenia, Slovakia)

3. International trade

- 3.1. Trade balance, exports, imports evolution

- 3.2. Exports and imports by country and by geographical area of destination/origin

- 3.3. Exports and imports by country for selected household appliances

4. Supply structure

- 4.1. Breakdown of supply by cabinet door material

- 4.2. Breakdown of supply by cabinet door style

- 4.3. Breakdown of supply by cabinet door colour and lacquered type

- 4.5. Breakdown of supply by worktop material

- 4.6. Breakdown of supply by kind of lay-out

- 4.7. Hinges and drawers

- 4.8. Embedded lighting

- 4.9. Intellectual Property

5. Distribution channels

- Overview: Kitchen specialists, Furniture shops, Furniture chains, Building trade, Contract, DIY, E-commerce, Direct sales

- Breakdown of sales by distribution channels in selected countries and geographic region (Central-Eastern Europe)

- Built-in appliances

- Sustainability

The competitive system

- 6.1. Leading players in Europe and market shares (consumption and production)

- 6.2. The European competitive system by market segment (luxury, upper-end, upper-middle, middle, middle-low, lower-end)

- 6.3. The competitive system by country

- 6.4. Exports from Europe to Extra-European markets and Overseas

Annex

- Annex 1. Financial Analysis Key financial indicators and Employment analysis in a sample of 120 manufacturers

- Annex 2. List of selected kitchen furniture companies