|

市場調查報告書

商品編碼

1502722

歐洲的辦公室家具市場:2024年The European Market for Office Furniture 2024 |

|||||||

歐洲辦公家具市場規模超過 90 億歐元,已大幅恢復至 COVID-19 之前的水準。企業客戶仍然是製造商的首要目標,其次是中小企業和政府機構。現在家庭辦公室的價值是五年前的兩倍多。

Highlights:

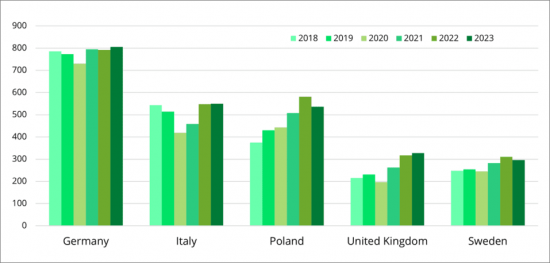

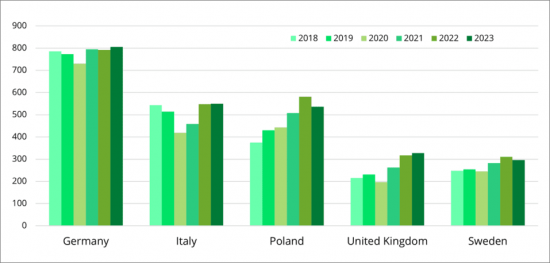

歐洲的辦公室家具出口前五名公司 (2018-2023年)

一百萬歐元

出處CSIL

本報告提供歐洲的辦公室家具的市場調查,彙整歐洲整體及主要國家的製造·消費,國際貿易趨勢的轉變·預測,各產品類型等各市場區隔的明細,競爭情形,主要廠商的市場佔有率等資料。

刊載企業

Ahrend,Assmann,Boss Design,Estel,Flokk,Framery,Haworth,MillerKnoll,Interstuhl,Isku,Kinnarps,Konig+Neurath,Las Mobili,Martela,Narbutas,Nowy Styl,Quadrifoglio,Sedus Stoll,Senator,Sokoa,Steelcase,Topstar-Wagner,Unifor,USM,Vitra,Wilkhahn

目錄 (摘要)

調查手法·定義·註解

執行摘要:推動歐洲辦公家具產業的關鍵因素

第1章 市場情勢:各國的趨勢·產品類型·數值

- 各國市場趨勢·資料 數值:辦公室家具的製造額·價格·消費·國際貿易

- 需求的推進因素

- 歐洲的主要群組·市場佔有率

- 目前趨勢·2024年及2025年的市場預測

第2章 商務效能:各地各國的基本資料及宏觀經濟指標

- 北歐州 (丹麥·芬蘭·挪威·瑞典)

- 西歐 (比利時·法國·愛爾蘭·荷蘭·英國)

- 中歐 (DACH:奧地利·德國·瑞士)

- 南歐 (希臘·義大利·葡萄牙·西班牙)

- 中東歐 (保加利亞·克羅埃西亞·賽普勒斯·捷克·愛沙尼亞·匈牙利·立陶宛·拉脫維亞·馬爾他·波蘭、羅馬尼亞·斯洛維尼亞·斯洛伐克)

第3章 辦公室家具的國際貿易

- 貿易收支:各市場區隔

- 出口:國家·各市場區隔

- 歐洲以外的目的地

- 進口:國家·各市場區隔

- 主要供給國

第 4 章供應架構/產品細分

- 產品細分:歐洲及主要國家的辦公家具

- 辦公椅:製造價值、按類型/椅套細分、按類型供應

- 辦公桌:獨立式和麵板式辦公桌製造價值、獨立式和麵板式辦公桌供應

- 行政家具:製造價值

- 歸檔系統:製造數量、按類型細分、按類型供應

- 牆壁、隔間和聲學產品:製造價值、隔間牆類型和供應類型

- 會議室和公共區域家具:製造價值和按類型細分

焦點

- 歐洲電話酒和音響盒:按類型劃分的製造價值、平均價格、按發布年份劃分的品牌和產品樣本、價格範圍

- 歐洲高度可調桌子 (HAT):按主要國家/地區劃分的坐立式辦公桌產量以及固定式和高度可調式辦公桌供應的細分

- 就業/投資活動

- 永續性/再利用

第5章 市場與流通:辦公室家具的銷售:各流通管道

- 歐洲的旋轉椅:銷售數和品牌的地位

競爭情形

- 主要製造商的銷售額·市場佔有率:各產品類型

- 主要製造商的銷售額·市場佔有率:主要不同製造商

附錄1:國際貿易表

附錄2:企業清單

The CSIL Report "The European Market for Office Furniture" offers an extensive analysis of the office furniture sector in Europe across 30 countries, through the historical series of key indicators and market prospects, delving into the performance of the leading manufacturers, the product categories and the distribution channels.

MARKET EVOLUTION AND FIGURES BY COUNTRY

The report provides office furniture demand drivers, production and price trends, macroeconomic indicators, workforce statistics, and 2018-2023 values of office furniture production, consumption, imports, and exports and 2024 and 2025 office furniture consumption forecasts for Europe as a whole and by country.

The international trade of office furniture is thoroughly examined, providing a breakdown of European office furniture imports and exports by country and product type (office furniture and office seating), alongside key trading partners.

COMPETITION: KEY PLAYERS IN THE EUROPEAN OFFICE FURNITURE SECTOR

The study presents sales data and market shares (including trends), significant events in the competitive landscape, and mergers and acquisitions involving the leading European office furniture manufacturers .

Sales of the largest European office furniture manufacturers and their market share are provided on both a country level and for specific sub-segments, with brief profiles of selected firms.

Extra-European business: Office furniture sales Extra-EU and Russia, Middle East, Asia Pacific, North America, Central-South America, and Africa are provided for a sample of European companies.

Additionally, the report includes the addresses of around 300 office furniture companies.

SUPPLY STRUCTURE, TYPES OF PRODUCTS AND TRENDS

European office furniture production is broken down by type of products (Seating, Operative Desking, Partitions / Acoustic Filing / Storage, Communal Areas, and Executive Furniture). For each one the report includes production values for the time series 2018-2023. The values of Office furniture by segment are also provided for selected countries (Germany, Italy, France, United Kingdom, Sweden, Spain, Poland, and the Czech Republic)- Office Seating: production values, breakdown by type and by covering and supply by type in a sample of companies with a FOCUS ON: Swivel Chairs. A detailed analysis of office seating volumes and brand positioning. Brand positioning by average net price and total units sold are given on a European level. The number and the performance of swivel chairs sold in the time series 2020-2023 are also provided for the major countries (Germany, France, United Kingdom, Italy, Spain, Poland, and Sweden). Values include both products manufactured in Europe and products imported from extra-European countries.

- Operative Desking: production values, the breakdown between freestanding and panel-based desking, and supply by freestanding and panel-based desking in a sample of companies, with a FOCUS ON: Height Adjustable Tables (HAT) , production of sit-standing desks by the main country/region (Scandinavia, DACH, Benelux, Italy, France, United Kingdom, Spain & Portugal, Poland, Other) and breakdown of desking supply between fixed and height adjustable, in a sample of companies.

- Executive Furniture: production values.

- Filing Systems: production values, breakdown by type and supply by type in a sample of companies

- Walls, Partitions and Acoustic Products: production values, partition walls by type, supply by type in a sample of companies, with a FOCUS ON: Phone Booths and Acoustic Pods , values of production of phone booths and acoustic pods, phone booths and acoustic pods by kind, average list prices, a sample of brand and products by year of launch, and price segment.

- Furniture for Meeting Rooms and Communal Areas: production values and breakdown by type.

MARKET AND DISTRIBUTION

The analysis of office furniture distribution channels covers Direct sales, Specialist dealers, Non-specialists, and E-commerce, with the incidence in the major European markets. A breakdown of office furniture sales by distribution channel is available for the top companies.

GEOGRAPHICAL COVERAGE:

- Northern Europe: Denmark (DK), Finland (FI), Norway (NO), and Sweden (SE);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL), and the United Kingdom (UK). Unless otherwise specified, figures for Belgium include those for Luxembourg;

- Central Europe (DACH): Germany (DE), Austria (AT), and Switzerland (CH);

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT), and Spain (ES);

- Central-Eastern Europe: Poland (PL), Czech Republic (CZ), Slovakia (SK), Hungary (HU) and Romania (RO), Slovenia (SL), Croatia (HR), Bulgaria (BG), Cyprus (CY), Malta (MT), Estonia (EE), Latvia (LV), Lithuania (LT)

SELECTED COMPANIES

Among the considered companies: Ahrend, Assmann, Boss Design, Estel, Flokk, Framery, Haworth, MillerKnoll, Interstuhl, Isku, Kinnarps, Konig + Neurath, Las Mobili, Martela, Narbutas, Nowy Styl, Quadrifoglio, Sedus Stoll, Senator, Sokoa, Steelcase, Topstar-Wagner, Unifor, USM, Vitra, Wilkhahn

Highlights:

Europe. Top five exporters of office furniture, 2018-2023.

EUR Million

Source: CSIL

The European market for office furniture exceeds a value of EUR 9 billion, re-aligning substantially to pre-pandemic levels. Recovery has been conditioned by rising prices, meaning that growth in volumes remained subdued in the last five years.

The office environment is experiencing a structural transformation process and real estate portfolios have become more fluid and multi-format. Corporate customers remain the main target for manufacturers, followed by small businesses and government offices. However, fast development has been registered by office-related destinations, especially Education and Contract. Home office, which has been declining since the peak of the pandemic, today shows a market value more than double that five years ago.

TABLE OF CONTENTS (ABSTRACT)

METHODOLOGY, DEFINITIONS AND NOTES

EXECUTIVE SUMMARY: KEY FACTORS DRIVING THE OFFICE FURNITURE INDUSTRY IN EUROPE

1. MARKET SCENARIO: Trends, product types and figures by country

- 1.1. Market evolution and figures by country 2018-2023: Office furniture production values and prices, consumption and international trade

- 1.2. Demand drivers

- 1.3. Leading groups in Europe and their market shares

- 1.4. Current trends and market forecasts for 2024 and 2025

2. BUSINESS PERFORMANCE: Basic data e and macroeconomic indicators by region and by country

- 2.1. Northern Europe (Denmark, Finland, Norway and Sweden)

- 2.2. Western Europe (Belgium, France, Ireland, Netherlands, the UK)

- 2.3. Central Europe (DACH: Austria, Germany, Switzerland)

- 2.4. Southern Europe (Greece, Italy, Portugal, Spain)

- 2.5. Central-Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovenia, Slovakia)

3. THE INTERNATIONAL TRADE OF OFFICE FURNITURE

- 3.1 Trade balance by segment

- 3.2. Exports: by country and segments

- 3.3. Extra-European destinations

- 3.4. Imports: by country and segments

- 3.5. Leading supplying countries

4. SUPPLY STRUCTURE AND PRODUCT SEGMENTS

- 4.1. Product segments: Office furniture by segment in Europe and in selected countries

- Office seating: production values, breakdown by type and covering and supply by type in a sample of companies

- Operative desking: production values, freestanding and panel-based desking, supply by freestanding and panel-based desking in a sample of companies

- Executive furniture: production values

- Filing systems: production values, breakdown by type, supply by type in a sample of companies

- Walls, partitions and acoustic products: production values, partition walls by type, supply by type in a sample of companies

- Furniture for meeting rooms and communal areas: production values and breakdown by type

FOCUS ON

- 4.2. Phone booths and acoustic pods in Europe: values of production of phone booths and acoustic pods, phone booths and acoustic pods by kind, average list prices, a sample of brand and products by year of launch, and price segment.

- 4.3. Height Adjustable Tables (HAT) in Europe:production of sit-standing desks by the main country/region and breakdown of desking supply between fixed and height adjustable, in a sample of companies

- 4.4. Employment and investment activity

- 4.5. Sustainability and reuse

5. MARKET AND DISTRIBUTION: Office furniture Sales by distribution channel

- 5.1. Swivel chairs in Europe: volumes and brand positioning

THE COMPETITIVE LANDSCAPE

- Sales and market shares of the leading manufacturers by product category

- Sales and market shares of the leading manufacturers by major markets