|

市場調查報告書

商品編碼

1666569

車輛追蹤設備市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Vehicle Tracking Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

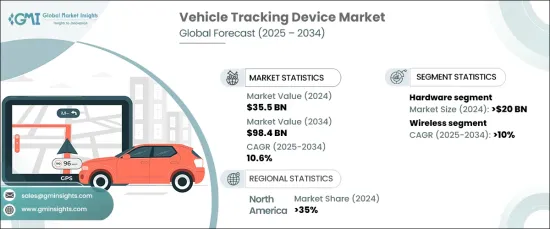

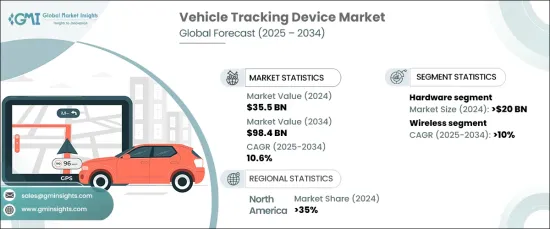

2024 年全球車輛追蹤設備市場價值為 355 億美元,預計 2025 年至 2034 年的複合年成長率為 10.6%。隨著企業不斷優先考慮營運效率、安全性和成本管理,車輛追蹤設備已成為監控資產、最佳化路線和確保車輛和貨物安全不可或缺的工具。事實上,策略夥伴關係正在興起,以提升這些設備的功能。例如,2024年3月,HERE Technologies與Netstar合作,改善澳洲商用車的資產管理與導航服務。

人們對這些解決方案的興趣日益濃厚,這可歸因於聯網設備和物聯網 (IoT) 的激增,這使企業能夠捕獲和分析即時資料,從而做出更明智的決策。這一趨勢在物流等行業尤其重要,因為追蹤系統對於確保貨物及時交付以及公共交通系統發揮至關重要的作用。隨著消費者和企業都認知到車輛追蹤的諸多優勢,例如提高營運效率、安全性和及時交付,市場有望大幅成長。特別是,GPS 追蹤設備預計將推動市場發展,到 2032 年預計收入約為 90 億美元,年成長率將超過 12%。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 355億美元 |

| 預測值 | 984億美元 |

| 複合年成長率 | 10.6% |

車輛追蹤設備市場分為硬體和軟體部分。 2024 年,硬體部分的價值將超過 200 億美元,並繼續快速擴張。隨著企業尋求可靠、高效的資產管理解決方案,對高品質遠端資訊處理系統和 GPS 設備的需求不斷成長,推動了這一成長。值得注意的是,GPS 追蹤技術的進步,例如 Monimoto 於 2024 年 6 月發布的 Monimoto 9,體現了該行業對創新的承諾。此新版本為各種資產提供了增強的保護,包括摩托車、船隻和拖車。

資料,市場按連接性進行分類,預計無線追蹤設備在 2025 年至 2034 年期間的複合年成長率將超過 10%。物聯網應用的不斷發展也是一大驅動力,使企業能夠利用先進的追蹤功能,並透過更好的資料分析和遠端監控最佳化其營運。

2024 年,北美佔據全球車輛追蹤設備市場的 35% 以上。該地區對車隊管理的即時追蹤解決方案的嚴重依賴繼續推動市場需求,各公司整合遠端資訊處理系統以滿足監管要求並提高安全標準。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 組件提供者

- 服務提供者

- 製造商

- 經銷商

- 最終用途

- 利潤率分析

- 技術與創新格局

- 專利分析

- 監管格局

- 成本分析

- 案例研究

- 衝擊力

- 成長動力

- 人們對車輛安全的擔憂日益加劇

- 車輛失竊案數量激增

- 基於人工智慧的事故偵測日益融合

- 車隊管理需求日益增加

- 產業陷阱與挑戰

- 資料和隱私問題

- 初期成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- OBD 設備/追蹤器和高級追蹤器

- 獨立追蹤器

- 軟體

- 車隊管理平台

- 數據分析工具

- 地圖和導航系統

- 即時追蹤軟體

- 其他

第6章:市場估計與預測:依連結性,2021 - 2034 年

- 主要趨勢

- 有線

- 無線的

第 7 章:市場估計與預測:按通訊追蹤器,2021 - 2034 年

- 主要趨勢

- 蜂窩網路

- 衛星

- 雙模式

第 8 章:市場估計與預測:按車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車 (LCV)

- 重型商用車 (HCV)

第 9 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 運輸與物流

- 建造

- 石油和天然氣

- 礦業

- 緊急服務

- 其他

第 10 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- AT&T Intelligence

- ATrack Technology

- CalAmp

- Concox Information Technology

- Continental

- Garmin

- Geotab

- Laipac Technology

- Laird

- Meitrack

- Queclink Wireless Solutions

- Sensata

- Starcom Systems

- Suntech International

- Teletrac Navman

- Teltonika

- TomTom International

- Trackimo

- Vamosys

- Verizon Communications

The Global Vehicle Tracking Device Market was valued at USD 35.5 billion in 2024 and is projected to grow at a CAGR of 10.6% from 2025 to 2034. This rapid expansion is largely driven by the increasing demand for real-time tracking solutions in fleet management, heightened concerns about vehicle theft, and the rising adoption of advanced telematics technologies across a variety of industries. As businesses continue to prioritize operational efficiency, security, and cost management, vehicle tracking devices have become indispensable tools for monitoring assets, optimizing routes, and ensuring the safety of vehicles and goods. In fact, strategic partnerships are emerging to boost the capabilities of these devices. For example, in March 2024, HERE Technologies teamed up with Netstar to improve asset management and navigation services for commercial vehicles in Australia.

The growing interest in these solutions can be attributed to the surge in connected devices and the Internet of Things (IoT), which enable businesses to capture and analyze real-time data to make better-informed decisions. This trend is particularly significant in industries like logistics, where tracking systems play an essential role in ensuring the timely delivery of goods, as well as in public transport systems. With consumers and businesses alike recognizing the numerous advantages of vehicle tracking, such as enhanced operational efficiency, security, and timely deliveries, the market is poised for substantial growth. In particular, GPS tracking devices are expected to fuel the market, with a projected revenue of around USD 9 billion by 2032 and an annual growth rate surpassing 12%.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $35.5 Billion |

| Forecast Value | $98.4 Billion |

| CAGR | 10.6% |

The vehicle tracking device market is segmented into hardware and software components. In 2024, the hardware segment accounted for over USD 20 billion in value and continues to expand rapidly. The increasing demand for high-quality telematics systems and GPS devices is driving this growth as businesses seek reliable, efficient solutions for managing their assets. Notably, advancements in GPS tracking technology, such as Monimoto's release of the Monimoto 9 in June 2024, illustrate the industry's commitment to innovation. This new version provides enhanced protection for various assets, including motorcycles, boats, and trailers.

Additionally, the market is categorized by connectivity, with wireless tracking devices projected to experience a CAGR of over 10% from 2025 to 2034. The wireless segment's growth is mainly due to the ease of installation, scalability, and the real-time data capabilities it offers. The continuous development of IoT applications is also a driving force, enabling businesses to harness advanced tracking functionalities and optimize their operations through better data analytics and remote monitoring.

North America accounted for more than 35% of the global vehicle tracking device market in 2024. This dominance is primarily attributed to stringent regulations and a well-established logistics sector. The region's heavy reliance on real-time tracking solutions for fleet management continues to fuel market demand, with companies integrating telematics systems to meet regulatory requirements and enhance safety standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component providers

- 3.2.2 Service providers

- 3.2.3 Manufacturers

- 3.2.4 Distributors

- 3.2.5 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Cost analysis

- 3.8 Case study

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing concerns over vehicle safety

- 3.9.1.2 Surge in number of vehicle thefts

- 3.9.1.3 Rising integration of AI-based accident detection

- 3.9.1.4 Increasing need for fleet management

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Data and privacy concerns

- 3.9.2.2 High initial cost

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 OBD device/ tracker and advance tracker

- 5.2.2 Standalone tracker

- 5.3 Software

- 5.3.1 Fleet management platforms

- 5.3.2 Data analytics tools

- 5.3.3 Mapping and navigation systems

- 5.3.4 Real-time tracking software

- 5.3.5 Others

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Wired

- 6.3 Wireless

Chapter 7 Market Estimates & Forecast, By Communication Tracker, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Cellular networks

- 7.3 Satellite

- 7.4 Dual mode

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Passenger vehicles

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light Commercial Vehicles (LCV)

- 8.3.2 Heavy Commercial Vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Transportation & logistics

- 9.3 Construction

- 9.4 Oil & gas

- 9.5 Mining

- 9.6 Emergency services

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AT&T Intelligence

- 11.2 ATrack Technology

- 11.3 CalAmp

- 11.4 Concox Information Technology

- 11.5 Continental

- 11.6 Garmin

- 11.7 Geotab

- 11.8 Laipac Technology

- 11.9 Laird

- 11.10 Meitrack

- 11.11 Queclink Wireless Solutions

- 11.12 Sensata

- 11.13 Starcom Systems

- 11.14 Suntech International

- 11.15 Teletrac Navman

- 11.16 Teltonika

- 11.17 TomTom International

- 11.18 Trackimo

- 11.19 Vamosys

- 11.20 Verizon Communications