|

市場調查報告書

商品編碼

1666608

替代燃料汽車 (AFV) 市場機會、成長動力、產業趨勢分析和 2025 - 2034 年預測Alternative Fuel Vehicles (AFV) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

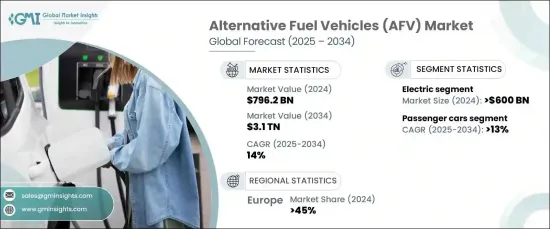

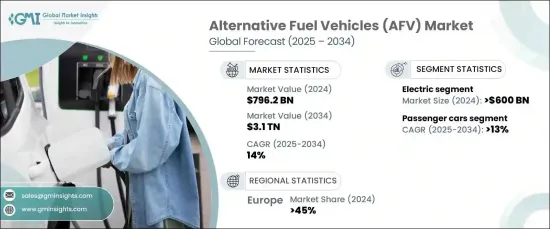

2024 年全球替代燃料汽車市場價值為 7,962 億美元,預計 2025 年至 2034 年期間的複合年成長率為 14%。世界各國政府正在推出旨在減少碳排放並鼓勵綠色替代品轉變的政策。

除了這些政府措施之外,電動車(EV)電池的技術突破和不斷擴大的充電基礎設施也讓消費者更容易轉向電動車。消費者對傳統燃油汽車對環境影響的認知不斷提高,這也推動了市場的成長,促使汽車製造商大力投資開發環保解決方案。隨著世界繼續努力應對氣候變遷和環境惡化,替代燃料汽車被視為解決方案的重要組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7962億美元 |

| 預測值 | 3.1兆美元 |

| 複合年成長率 | 14% |

為了滿足全球碳排放的需要,人們越來越重視減少對化石燃料的依賴,從而導致對電動車(EV)的大量投資。政府補貼、稅收減免和對電動車基礎設施的支持使得電動車對消費者的吸引力越來越大。電池系統技術的快速進步進一步推動了對電動車的需求,提高了行駛里程和充電速度,從而提高了汽車的整體便利性。隨著越來越多充電網路的建立,里程焦慮(電動車普及的一大障礙)正在穩定減少。隨著電動車變得越來越普及且價格越來越便宜,其受歡迎程度必將飆升,為整個市場的擴張做出重大貢獻。

市場按燃料類型細分為電動車、生質燃料和其他替代燃料。光是電動車領域在 2024 年就創造了 6,000 億美元的收入,預計未來幾年將經歷大幅成長。推動這一成長的因素包括環保意識的增強、電池技術的改進以及進一步鼓勵消費者選擇電動車的政府激勵措施。汽車製造商也透過多樣化產品線來滿足這一需求,這將進一步推動市場擴張。

就車輛類型而言,市場分為乘用車和商用車。預計 2025 年至 2034 年期間乘用車市場的複合年成長率為 13%。預計電動和混合動力汽車技術都將在政府舉措和電動車充電基礎設施發展的推動下取得進步,這將使這些汽車更具吸引力。

2024年,歐洲將佔據全球替代燃料汽車市場佔有率的45%,這在很大程度上歸功於該地區雄心勃勃的碳中和目標以及消費者對永續性的日益關注。歐洲各國政府正透過財政激勵、補助金和投資充電網路等方式支持電動車的普及,克服里程焦慮等障礙,促進電動車的廣泛普及。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 技術提供者

- 服務提供者

- 製造商

- 經銷商

- 最終用途

- 利潤率分析

- 技術與創新格局

- 專利分析

- 監管格局

- 成本分析

- 案例研究

- 衝擊力

- 成長動力

- 全球燃料價格上漲

- 在全球擴大充電基礎設施

- 越來越重視電池的成本效率

- 政府激勵措施和監管力道加大

- 產業陷阱與挑戰

- 前期成本高

- 充電基礎設施有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按燃料,2021 - 2034 年

- 主要趨勢

- 電的

- 純電動車 (BEV)

- 混合動力電動車 (HEV)

- 插電式混合動力車 (PHEV)

- 燃料電池電動車 (FCEV)

- 生物燃料

- 其他

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車 (LCV)

- 重型商用車 (HCV)

第 7 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 商業和機隊

- 大眾運輸

- 政府及市政

- 其他

第 8 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- Audi

- BMW

- BYD Company

- Faraday Future

- Fiat Chrysler Automobiles

- Fisker

- Ford Motor

- General Motors

- Honda Motors

- Hyundai Motor

- Kia

- Lucid Motors

- Mercedes-Benz

- Nissan Motor

- Polestar Automotive H

- Rivian Automotive

- Tesla

- Toyota Motor

- Volkswagen

- Volvo

The Global Alternative Fuel Vehicles Market was valued at USD 796.2 billion in 2024 and is projected to expand at a CAGR of 14% between 2025 and 2034. This robust growth is primarily fueled by the increasing demand for sustainable transportation solutions, a shift towards cleaner mobility, and rising concerns over environmental sustainability. Governments across the globe are rolling out policies designed to reduce carbon emissions and encourage the transition to green alternatives.

Along with these government initiatives, technological breakthroughs in electric vehicle (EV) batteries and expanding charging infrastructure are making it easier for consumers to switch to electric options. The market growth is also being propelled by greater consumer awareness about the environmental impact of traditional fuel-driven vehicles, pushing automakers to invest heavily in the development of eco-friendly solutions. As the world continues to grapple with climate change and environmental degradation, alternative fuel vehicles are seen as an essential part of the solution.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $796.2 Billion |

| Forecast Value | $3.1 Trillion |

| CAGR | 14% |

The increasing focus on reducing dependence on fossil fuels, in line with the need to curb global carbon emissions, has led to substantial investments in electric vehicles (EVs). Government subsidies, tax breaks, and support for EV infrastructure are making electric mobility increasingly attractive to consumers. The demand for EVs is further fueled by rapid technological advancements in battery systems, enhancing driving ranges and charging speeds, which contribute to the vehicles' overall convenience. With more extensive charging networks in place, range anxiety, a significant barrier to EV adoption, is steadily diminishing. As electric vehicles become more accessible and affordable, their popularity is set to soar, contributing significantly to the overall market expansion.

The market is segmented by fuel type into electric vehicles, biofuels, and other alternative fuels. The electric vehicle segment alone generated USD 600 billion in 2024, and it is expected to experience substantial growth in the coming years. Factors driving this surge include heightened environmental awareness, improvements in battery technology, and government incentives that further encourage consumers to opt for electric cars. Automakers are also responding to this demand by diversifying their product lines, which will further fuel market expansion.

In terms of vehicle types, the market is divided into passenger cars and commercial vehicles. The passenger car segment is anticipated to experience a CAGR of 13% from 2025 to 2034. The surge in demand for eco-friendly transportation options is primarily driven by consumer preferences shifting toward cleaner, more energy-efficient vehicles. Both electric and hybrid vehicle technologies are expected to witness advancements spurred on by government initiatives and the growth of EV charging infrastructure, which together make these vehicles even more appealing.

In 2024, Europe accounted for 45% of the global market share in alternative fuel vehicles, largely due to the region's ambitious carbon neutrality targets and increased consumer focus on sustainability. European governments are supporting EV adoption through financial incentives, grants, and investment in charging networks, overcoming barriers like range anxiety and contributing to the widespread adoption of electric vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Technology providers

- 3.2.2 Service providers

- 3.2.3 Manufacturers

- 3.2.4 Distributors

- 3.2.5 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Cost analysis

- 3.8 Case study

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing fuel prices worldwide

- 3.9.1.2 Expanding charging infrastructure globally

- 3.9.1.3 Rising emphasis on cost-efficient batteries

- 3.9.1.4 Surge in government incentives and regulations

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High upfront costs

- 3.9.2.2 Limited availability of charging infrastructure

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Electric

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Hybrid Electric Vehicle (HEV)

- 5.2.3 Plug-in Hybrid electric Vehicle (PHEV)

- 5.2.4 Fuel Cell Electric Vehicle (FCEV)

- 5.3 Biofuel

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Commercial & fleet

- 7.3 Public transportation

- 7.4 Government & municipal

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Audi

- 9.2 BMW

- 9.3 BYD Company

- 9.4 Faraday Future

- 9.5 Fiat Chrysler Automobiles

- 9.6 Fisker

- 9.7 Ford Motor

- 9.8 General Motors

- 9.9 Honda Motors

- 9.10 Hyundai Motor

- 9.11 Kia

- 9.12 Lucid Motors

- 9.13 Mercedes-Benz

- 9.14 Nissan Motor

- 9.15 Polestar Automotive H

- 9.16 Rivian Automotive

- 9.17 Tesla

- 9.18 Toyota Motor

- 9.19 Volkswagen

- 9.20 Volvo