|

市場調查報告書

商品編碼

1755350

低壓數位變電站市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Low Voltage Digital Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

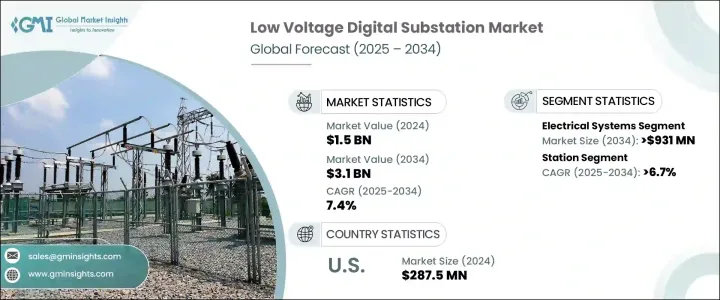

2024年,全球低壓數位變電站市場規模達15億美元,預計2034年將以7.4%的複合年成長率成長,達到31億美元。這得歸功於物聯網、人工智慧和下一代通訊系統的廣泛整合,這些技術正在將傳統變電站轉變為智慧自動化節點。這些數位系統提供即時效能洞察、主動維護能力和增強的營運控制。隨著能源產業持續向再生能源轉型,先進的電網基礎設施在管理可變能源投入方面的作用變得至關重要。全球對電網升級的投資正在不斷增加,以支持替代能源的可靠整合。

此外,數位孿生解決方案、安全的雲端監控以及與 SCADA 和 EMS 平台的先進介面等技術創新正在提升變電站的效能。這些發展正在降低設備的生命週期成本並提高資產利用率。公用事業公司正在積極擁抱這項轉型,以改善故障回應、提升自動化水準並減少計畫外停電。這些變電站內的預測分析和自動化決策有助於簡化營運,同時降低維護費用並提高能源分配效率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 15億美元 |

| 預測值 | 31億美元 |

| 複合年成長率 | 7.4% |

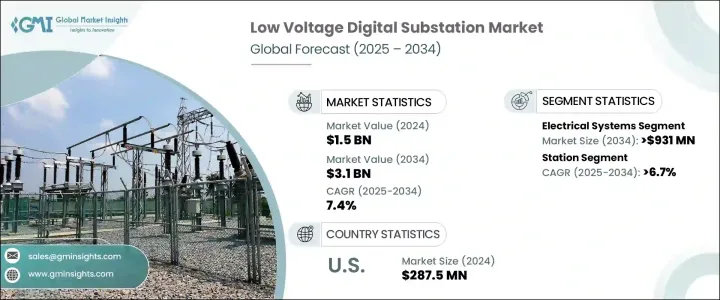

預計到2034年,電力系統領域將創造9.31億美元的市場規模,這得益於對先進保護、控制和監控技術日益成長的需求,這些技術旨在確保現代電網的無縫運作。隨著公用事業公司面臨管理分散式能源(尤其是再生能源)日益複雜的局面,迫切需要能夠提供即時可視性和響應能力的智慧電氣元件。增強型繼電器系統、智慧開關設備和精密計量工具正日益整合,以滿足這些不斷發展的營運標準。這些系統對於在能源輸入波動的環境中確保電網穩定性和性能至關重要。

2024年,間隔層佔32.8%,凸顯了其在數位化變電站架構中的基礎性作用。其貢獻在於提供高度模組化的配置,可快速調整以滿足不斷變化的能源需求。間隔層自動化可以更快定位故障,簡化維護流程,並提高系統可用性。這些功能降低了營運風險,並增強了電網彈性。透過間隔層數位化,公用事業公司可以在不造成重大中斷的情況下擴展或修改變電站容量,使其成為可擴展且面向未來的電網設計的核心組成部分。

2024年,美國低壓數位化變電站市場規模達2.875億美元,這得益於聯邦政府和各州為加強能源基礎設施和提升電網智慧化而進行的大規模投資。美國在再生能源部署方面持續保持領先地位,並積極推進脫碳和能源效率目標,這推動公用事業公司採用尖端數位化技術。這種環境為低壓數位化變電站在城鄉電網的廣泛應用奠定了堅實的基礎。

市場的主要參與者包括施耐德電氣、鮑威爾工業、思科系統公司、西門子、通用電氣、伊頓公司、日立能源、ABB、東芝能源系統與解決方案公司、Larson & Toubro Limited、Hubbell、Netcontrol Group、WEG 和 WAGO。為了鞏固市場地位,各公司正在部署各種策略,例如投資智慧電網研發、推出模組化和可互通的數位變電站解決方案以及擴展數位服務產品。與公用事業和政府機構的合作有助於推出試點計畫並確保大規模部署。各公司也正在增強其產品的網路安全功能,以解決人們對數位基礎設施安全日益成長的擔憂。此外,擴大在新興市場的影響力並加強售後服務網路有助於參與者提供完整的數位變電站解決方案,確保長期客戶保留和市場擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依組件分類,2021 - 2034 年

- 主要趨勢

- 變電所自動化系統

- 通訊網路

- 電氣系統

- 監控系統

- 其他

第6章:市場規模及預測:依架構,2021 - 2034

- 主要趨勢

- 過程

- 灣

- 車站

第7章:市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 公用事業

- 工業的

第 8 章:市場規模與預測:按安裝量,2021 年至 2034 年

- 主要趨勢

- 新的

- 翻新

第9章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第10章:公司簡介

- ABB

- Cisco Systems, Inc.

- Eaton Corporation

- General Electric

- Hitachi Energy

- Hubbell

- Larsen & Toubro Limited

- Netcontrol Group

- Powell Industries

- Schneider Electric

- Siemens

- Toshiba Energy Systems & Solutions Corporation

- WEG

- WAGO

The Global Low Voltage Digital Substation Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 3.1 billion by 2034, driven by the widespread integration of IoT, artificial intelligence, and next-generation communication systems that are transforming traditional substations into intelligent, automated nodes. These digital systems offer real-time performance insights, proactive maintenance capabilities, and enhanced operational control. As the energy sector continues to shift toward renewables, the role of advanced grid infrastructure in managing variable energy inputs has become critical. Global investments in grid upgrades are increasing to support the reliable integration of alternative energy sources.

Additionally, technological innovations such as digital twin solutions, secure cloud-based monitoring, and advanced interfacing with SCADA and EMS platforms are elevating substation performance. These developments are reducing the lifecycle costs of equipment and improving asset utilization. Utilities are embracing this transformation to improve fault response, boost automation, and reduce unplanned outages. Predictive analytics and automated decision-making within these substations help streamline operations while lowering maintenance expenses and improving energy distribution efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 7.4% |

The electrical systems segment is projected to generate USD 931 million by 2034, driven by the rising demand for advanced protection, control, and monitoring technologies that ensure the seamless operation of modern power networks. As utilities face the growing complexity of managing distributed energy resources, especially from renewable sources, there is a pressing need for intelligent electrical components that offer real-time visibility and response. Enhanced relay systems, smart switchgear, and precision metering tools are increasingly being integrated to meet these evolving operational standards. These systems are critical for ensuring grid stability and performance in an environment of fluctuating energy input.

The bay segment held a 32.8% share in 2024, underscoring its fundamental role in digital substation architecture. Its contribution lies in offering highly modular configurations that can be adapted quickly to meet changing energy demands. Bay-level automation allows for faster fault localization, streamlined maintenance, and improved system availability. These functions reduce operational risks and enhance grid resilience. By digitizing the bay level, utilities expand or modify substation capacity without causing major disruptions, making it a core component in scalable and future-proof grid designs.

United States Low Voltage Digital Substation Market was valued at USD 287.5 million in 2024 fueled by extensive federal and state investments aimed at reinforcing energy infrastructure and improving grid intelligence. The country's continued leadership in renewable energy deployment, combined with aggressive targets for decarbonization and energy efficiency, is pushing utilities to adopt cutting-edge digital technologies. This environment creates a strong foundation for the widespread implementation of low-voltage digital substations across urban and rural grid networks.

Key players in the market include Schneider Electric, Powell Industries, Cisco Systems, Inc., Siemens, General Electric, Eaton Corporation, Hitachi Energy, ABB, Toshiba Energy Systems & Solutions Corporation, Larson & Toubro Limited, Hubbell, Netcontrol Group, WEG, and WAGO. To strengthen their market position, companies are deploying strategies such as investing in smart grid R&D, launching modular and interoperable digital substation solutions, and expanding digital service offerings. Partnerships with utilities and government bodies are helping to roll out pilot programs and secure large-scale deployments. Companies are also enhancing cybersecurity features in their products to address growing concerns over digital infrastructure safety. Further, expanding their presence in emerging markets and reinforcing after-sales service networks help players deliver complete digital substation solutions, ensuring long-term client retention and market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Substation automation system

- 5.3 Communication network

- 5.4 Electrical system

- 5.5 Monitoring & control system

- 5.6 Others

Chapter 6 Market Size and Forecast, By Architecture, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Process

- 6.3 Bay

- 6.4 Station

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Utility

- 7.3 Industrial

Chapter 8 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 New

- 8.3 Refurbished

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Turkey

- 9.5.4 South Africa

- 9.5.5 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Cisco Systems, Inc.

- 10.3 Eaton Corporation

- 10.4 General Electric

- 10.5 Hitachi Energy

- 10.6 Hubbell

- 10.7 Larsen & Toubro Limited

- 10.8 Netcontrol Group

- 10.9 Powell Industries

- 10.10 Schneider Electric

- 10.11 Siemens

- 10.12 Toshiba Energy Systems & Solutions Corporation

- 10.13 WEG

- 10.14 WAGO