|

市場調查報告書

商品編碼

1773218

商業氫氣市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Merchant Hydrogen Generation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

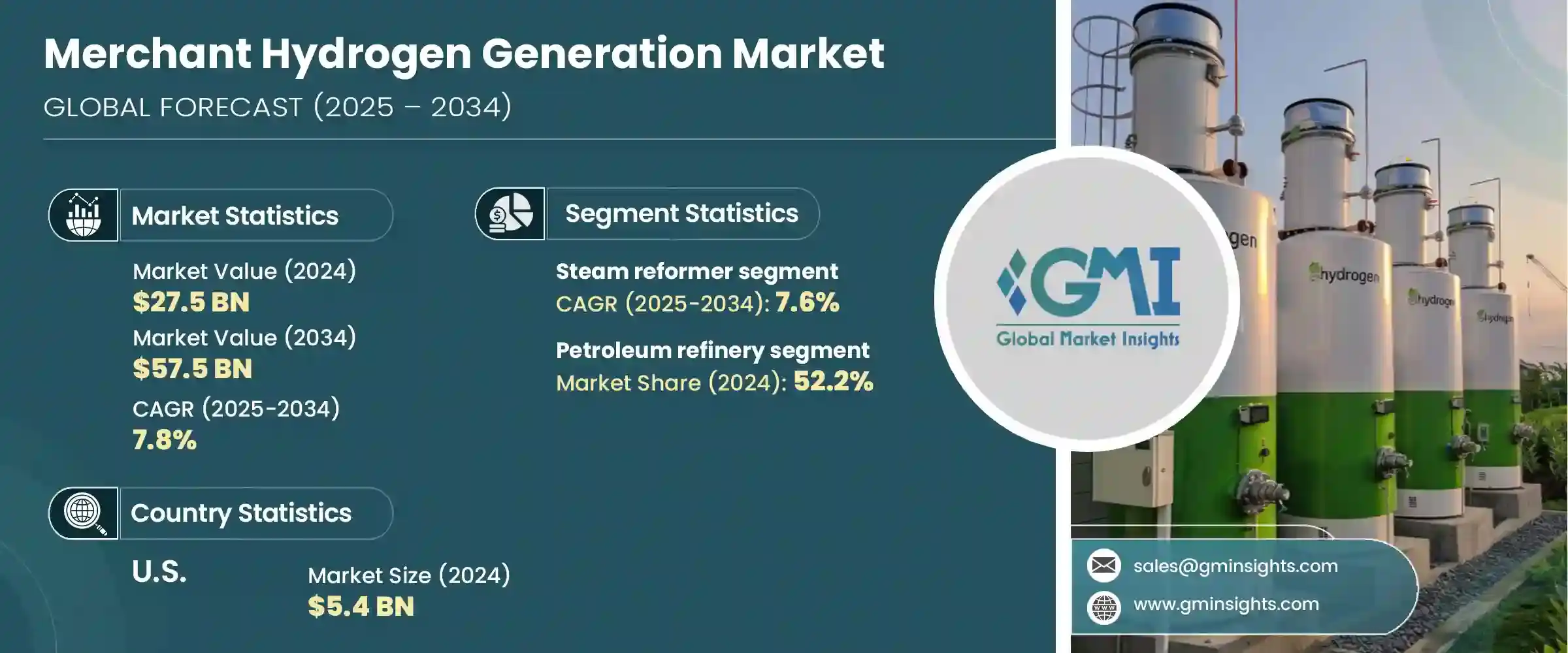

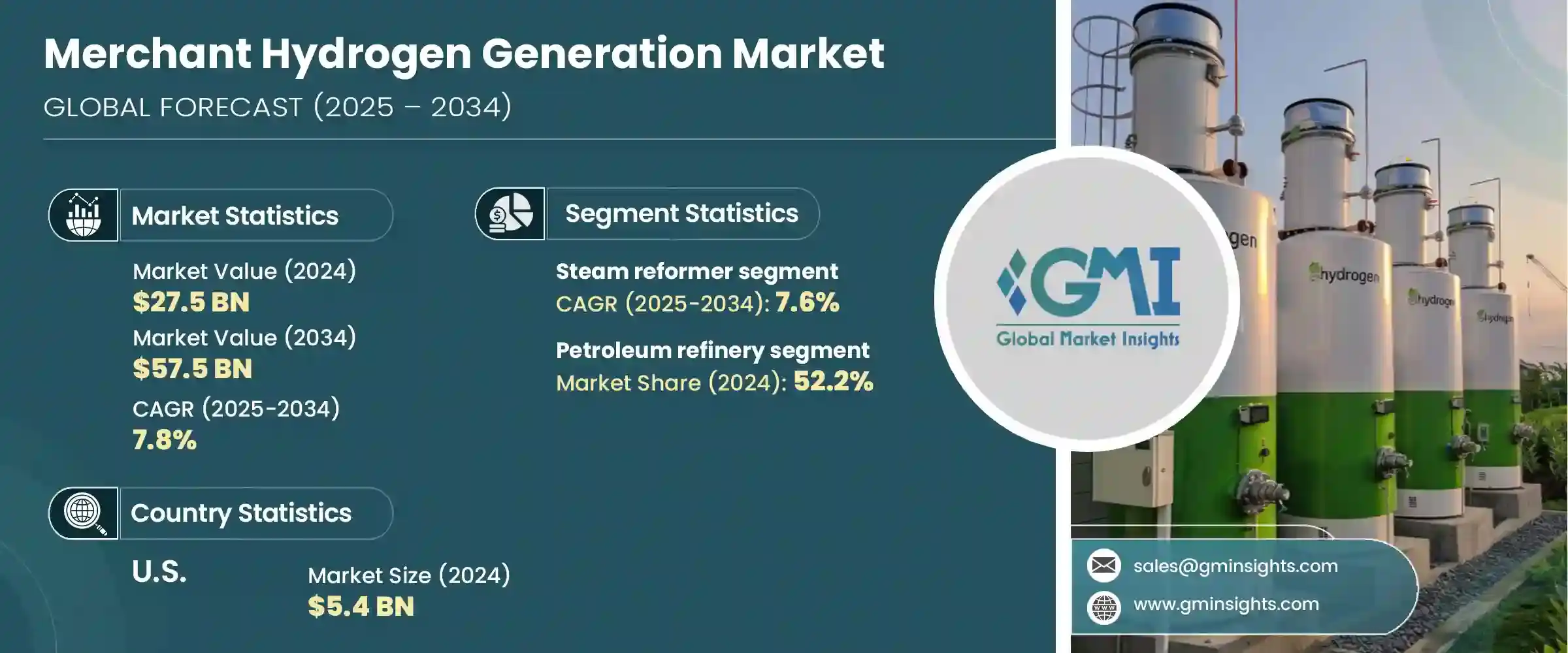

2024年,全球商用氫氣市場規模達275億美元,預計到2034年將以7.8%的複合年成長率成長,達到575億美元。隨著世界各國政府和各行各業更加重視減少碳排放,該市場正呈現穩定成長動能。這種轉變推動了對清潔能源的需求,其中就包括氫能,而氫能已成為全球脫碳議程的關鍵參與者。旨在實現淨零目標的政策,以及各行各業氣候意識的不斷提升,為商用氫氣的擴張創造了有利條件。

主要成長動力之一是再生能源部署規模的不斷擴大,這透過利用剩餘電力與氫氣產生產生了協同效應。隨著能源系統日益多樣化和分散化,氫氣正成為儲能和電網平衡的重要工具。在此背景下,新一代電解技術,例如質子交換膜和固體氧化物電解,正日益受到關注。這些創新技術具有高效率和成本優勢,使氫氣生產在商業規模上更具可行性。各行各業正積極調整其營運以符合永續發展目標,尤其是在鋼鐵、煉油和化工等能源密集產業。這種轉變正在推動逐步轉向以氫為基礎的工藝,這種工藝可以在不影響生產力的情況下降低排放。隨著這些趨勢的融合,商業氫氣市場將在未來十年迎來結構性轉型。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 275億美元 |

| 預測值 | 575億美元 |

| 複合年成長率 | 7.8% |

根據製程類型,預計到2034年,蒸汽重整器類別的複合年成長率將達到7.6%。其持續的相關性在於其成本效益以及與現有天然氣基礎設施的兼容性。儘管新方法日益受到重視,但蒸汽重整因其可擴展性和可靠性,能夠滿足工業氫氣需求,仍被廣泛採用。它與管道網路的無縫整合,進一步增強了其在支援不同應用區域商業氫氣分配方面的作用。

根據應用,市場可分為石油煉製、化學、金屬和其他領域。石油煉製領域在2024年佔了最大的收入佔有率,佔市場佔有率的52.2%。煉油廠擴大採用氫氣來滿足日益嚴格的排放法規,並減少下游作業的環境足跡。對綠色原料和清潔燃料產量的日益追求,促使煉油廠升級工藝,並將氫氣整合到脫硫和加氫裂解裝置中。煉油產業的持續轉型為提供可靠、按需商業氫氣服務的氫氣供應商創造了巨大的機會。

從區域來看,北美商用氫氣市場在2024年佔全球收入的24.3%。在該地區,美國持續成長,市值從2022年的49億美元成長至2024年的54億美元。強而有力的政策框架,加上聯邦機構與私人企業之間日益加強的合作,正在催化全國的氫能生態系統。政府支持的資助計畫和清潔能源激勵措施正在鼓勵基礎設施建設,尤其是在加氫樞紐和加氣走廊周圍。運輸和物流能力的提昇在加速商用氫能解決方案的工業化應用方面發揮關鍵作用。

市場領導者正在大力投資最佳化專案經濟效益和擴大產量,同時遵守低碳認證標準。他們的策略重點是將商業氫能樞紐設在工業群聚和交通樞紐等高需求中心附近,以最大限度地降低運輸成本並提高供應應變能力。這些公司也正在探索數位技術,以簡化營運流程、縮短交貨時間並保持整個氫能供應鏈的即時可視性。將現場發電、連網基礎設施和智慧交付管理系統結合的綜合商業模式正在成為主要參與者的標準做法。

為了獲得競爭優勢,各企業正透過建立策略合作夥伴關係、遵循監管路線圖以及爭取大規模部署所需的資金支持來加強其區域影響力。透過利用這些努力,產業參與者能夠更好地滿足各終端領域對低碳氫化合物日益成長的需求,從而塑造全球能源轉型的未來。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依工藝,2021 - 2034 年

- 主要趨勢

- 蒸氣重整器

- 電解

- 其他

第6章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 石油煉油廠

- 化學

- 金屬

- 其他

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 中東和非洲

- 沙烏地阿拉伯

- 伊朗

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第8章:公司簡介

- Air Liquide

- Axpo Holding

- Air Products and Chemicals

- Cummins

- Coregas

- Linde

- Messer Group

- Nel Hydrogen

- Plug Power

- Sumitomo Corporation

- TotalEnergies

- Uniper

The Global Merchant Hydrogen Generation Market was valued at USD 27.5 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 57.5 billion by 2034. The market is experiencing steady momentum as governments and industries worldwide place greater emphasis on reducing carbon emissions. This shift is driving demand for clean energy sources, including hydrogen, which has emerged as a key player in the global decarbonization agenda. Policies aimed at achieving net-zero goals, along with rising climate awareness across sectors, are creating favorable conditions for the expansion of merchant hydrogen generation.

One of the major growth enablers is the increasing scale of renewable energy deployment, which creates synergies with hydrogen production through surplus power utilization. As energy systems become more diversified and decentralized, hydrogen is becoming an important tool for energy storage and grid balancing. In this landscape, new-generation electrolysis technologies, such as proton exchange membrane and solid oxide electrolysis, are gaining traction. These innovations offer high efficiency and cost advantages, making hydrogen generation more viable at commercial scales. Industries are actively aligning their operations with sustainability targets, particularly in energy-intensive sectors like steel, refining, and chemicals. This transition is encouraging a gradual shift toward hydrogen-based processes that can lower emissions without compromising productivity. As these trends converge, the merchant hydrogen generation market is positioned for structural transformation over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27.5 Billion |

| Forecast Value | $57.5 Billion |

| CAGR | 7.8% |

Based on process type, the steam reformer category is projected to expand at a CAGR of 7.6% through 2034. Its continued relevance lies in its cost efficiency and compatibility with existing natural gas infrastructure. While newer methods are gaining prominence, steam reforming remains widely adopted due to its scalability and reliability for industrial hydrogen needs. Its seamless integration with pipeline networks further strengthens its role in supporting merchant hydrogen distribution across various application zones.

On the basis of application, the market is categorized into petroleum refinery, chemical, metal, and other segments. The petroleum refinery segment accounted for the largest revenue share in 2024, holding 52.2% of the market. Refineries are increasingly adopting hydrogen to meet tightening emission regulations and reduce the environmental footprint of downstream operations. The rising push for green feedstocks and cleaner fuel outputs is prompting refiners to upgrade processes and integrate hydrogen into desulfurization and hydrocracking units. This ongoing transformation within the refining landscape is creating substantial opportunities for hydrogen suppliers offering reliable, on-demand merchant hydrogen services.

Regionally, the North American merchant hydrogen generation market accounted for 24.3% of global revenue in 2024. Within this region, the United States has shown consistent growth, with market values rising from USD 4.9 billion in 2022 to USD 5.4 billion in 2024. A strong policy framework, combined with growing collaboration between federal agencies and private enterprises, is catalyzing the hydrogen ecosystem across the country. Government-backed funding programs and clean energy incentives are encouraging infrastructure buildout, particularly around hydrogen hubs and refueling corridors. The expansion of transportation and logistics capabilities is playing a key role in accelerating industrial-scale adoption of merchant hydrogen solutions.

Market leaders are investing heavily in optimizing project economics and scaling production volumes while complying with low-carbon certification standards. There is a strategic focus on placing merchant hydrogen hubs near high-demand centers like industrial clusters and mobility zones to minimize delivery costs and enhance supply responsiveness. These firms are also exploring digital technologies to streamline operations, improve delivery timelines, and maintain real-time visibility across hydrogen supply chains. Integrated business models that combine on-site generation, networked infrastructure, and smart delivery management systems are becoming standard practice among major players.

To gain a competitive edge, companies are strengthening their regional presence through strategic partnerships, aligning with regulatory roadmaps, and securing funding support for large-scale deployment. By leveraging these efforts, industry participants are well-positioned to meet the growing demand for low-carbon hydrogen across a broad spectrum of end-use sectors, thereby shaping the future of the global energy transition.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Process, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Steam reformer

- 5.3 Electrolysis

- 5.4 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Petroleum refinery

- 6.3 Chemical

- 6.4 Metal

- 6.5 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 Netherlands

- 7.3.4 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 Iran

- 7.5.3 UAE

- 7.5.4 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 Air Liquide

- 8.2 Axpo Holding

- 8.3 Air Products and Chemicals

- 8.4 Cummins

- 8.5 Coregas

- 8.6 Linde

- 8.7 Messer Group

- 8.8 Nel Hydrogen

- 8.9 Plug Power

- 8.10 Sumitomo Corporation

- 8.11 TotalEnergies

- 8.12 Uniper