|

市場調查報告書

商品編碼

1871292

電動汽車通訊控制器市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Electric Vehicle Communication Controller Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

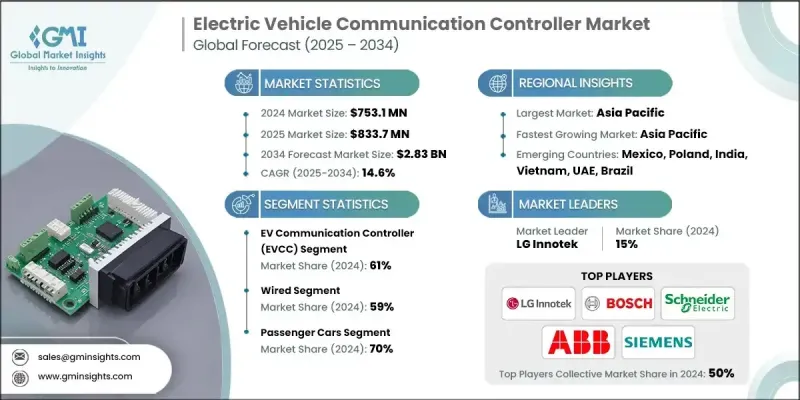

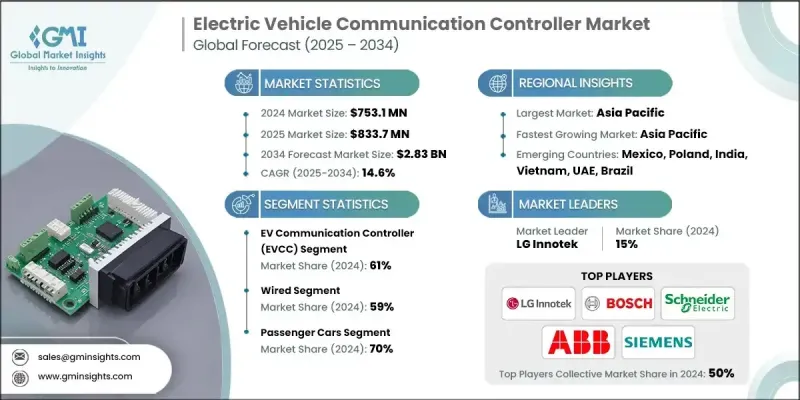

2024 年全球電動車通訊控制器市場價值為 7.531 億美元,預計到 2034 年將以 14.6% 的複合年成長率成長至 28.3 億美元。

全球電動車的普及,以及充電基礎設施、通訊協定和智慧電網整合技術的進步,正在推動對電動車充電樁(EVCC)的需求。這些系統對於實現電動車與充電站之間安全、高效和智慧的通訊至關重要。透過確保電動車、充電器和後端系統的兼容性,EVCC 在建立互聯互通、節能高效的交通網路方面發揮核心作用。全球向碳中和轉型以及公共和私人電動車充電網路的日益普及,進一步加速了 EVCC 的普及。隨著 ISO 15118、OCPP 和 CHAdeMO 等通訊框架的標準化,雙向能量傳輸和智慧充電功能正逐漸成為主流。這些技術提高了電網可靠性,支援動態能源管理,並為電動車車主、電力公司和充電營運商創造了新的經濟機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.531億美元 |

| 預測值 | 28.3億美元 |

| 複合年成長率 | 14.6% |

預計到2024年,電動車通訊控制器市佔率將達到61%,反映出市場對交換器、路由器和閘道等先進網路設備的需求日益成長。這些系統對於實現車網互動至關重要,它允許電力在車輛和電力系統之間雙向流動。這種雙向通訊能夠提高能源效率,支援電網平衡,並促進住宅、商業和車隊應用中的智慧負載管理。透過改善運作控制和最佳化電力使用,這些控制器正成為智慧交通生態系統的基石。

有線通訊領域預計在2024年將佔據59%的市場佔有率,這主要得益於其卓越的可靠性、低延遲和安全的資料傳輸能力。汽車乙太網路在電動車中的應用日益廣泛,用於管理關鍵車輛系統之間的高容量資料傳輸。更高的頻寬支援即時診斷、精準充電管理以及高效利用車聯網(V2X)通訊技術。因此,隨著汽車製造商將先進的資料通訊解決方案整合到其電動車架構中,有線電動車充電樁(EVCC)的重要性日益凸顯。

預計到2024年,美國電動車通訊控制器市場規模將達到1.578億美元。美國憑藉著強力的政府激勵措施、對電力技術的早期應用以及對電動車充電網路的巨額投資,在北美市場佔據領先地位。主要汽車製造商對下一代充電通訊系統的投資進一步鞏固了美國的市場主導地位。這些發展正在為提升全國電動車基礎設施的互通性和可靠性鋪平道路。

全球電動車通訊控制器市場的主要參與者包括施耐德電機、ABB、比亞迪、三菱電機、Vector Informatik、羅伯特·博世、特斯拉、Ficosa Internacional、LG Innotek 和 Efacec Power Solutions。這些企業正致力於實施以創新、標準化和全球擴張為核心的策略。主要參與者正大力投資研發,以提升電動車通訊控制器的互通性、網路安全性和即時通訊性能。與汽車原始設備製造商 (OEM)、能源供應商和充電基礎設施開發商的合作是加強電動車生態系統整合的關鍵。各公司也正在努力使其解決方案符合 ISO 15118 和 OCPP 等國際標準,以確保在全球市場的兼容性。此外,企業也透過併購和合作來擴大生產規模、降低成本並拓展技術組合。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 電動車普及率不斷提高,充電基礎設施不斷擴建

- 整合標準化通訊協定和V2G功能

- 智慧安全電動車充電樁解決方案的技術進步

- 政府政策和區域投資推動電動出行生態系統發展

- 產業陷阱與挑戰

- 先進電動車充電樁整合成本高且複雜

- 網路安全與資料隱私風險

- 市場機遇

- 擴展車網互動(V2G)與智慧充電生態系統

- 快速和超快速充電網路的發展

- 與智慧城市和物聯網基礎設施的整合

- 軟體定義和基於雲端的電動車充電樁解決方案

- 成長促進因素

- 成長潛力分析

- 監管環境

- 全球的

- 網路安全法規(ISO/SAE 21434)

- 各區域的V2X部署策略

- 充電基礎設施標準(ISO 15118)

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 全球的

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 從 CAN 總線遷移到汽車乙太網路以實現高速資料傳輸

- V2X通訊技術路線圖,實現車對車和車對基礎設施的連接

- 新興技術

- 無線充電通訊協定開發

- 邊緣運算整合趨勢,協助即時分析與控制

- 技術採納生命週期分析

- 當前技術趨勢

- 價格趨勢

- 控制器單元經濟性

- 整合和認證成本

- 總擁有成本分析

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 投資與融資分析

- 電動車充電樁解決方案領域的創投與私募股權活動

- 政府為電動車普及提供資金和激勵措施

- 電動汽車通訊技術領域的企業研發投資趨勢

- 市場成熟度與滲透率分析

- 客戶行為與決策分析

- 配銷通路及市場進入策略分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

- 供應商選擇標準

- 競爭性因應策略

第5章:市場估算與預測:依系統分類,2021-2034年

- 主要趨勢

- 電動汽車通訊控制器(EVCC)

- 供電設備通訊控制器(SECC)

第6章:市場估算與預測:以收費方式分類,2021-2034年

- 主要趨勢

- 有線

- 無線的

第7章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 純電動車

- 插電式混合動力汽車

- 燃料電池電動車

- 商用車輛

- 純電動車

- 插電式混合動力汽車

- 燃料電池電動車

第8章:市場估算與預測:依現況、2021年-2034年

- 主要趨勢

- 交流電(AC)

- 直流電 (DC)

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 電動汽車製造商(OEM)

- 充電站營運商

- 公用事業供應商

- 車隊營運商

第10章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 住宅收費

- 商業充電

- 公共收費

第11章:市場估計與預測:按地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 俄羅斯

- 波蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 越南

- 泰國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Global companies

- ABB

- Analog Devices

- Infineon Technologies

- LG Innotek

- Mitsubishi Electric

- NXP Semiconductors

- Qualcomm Technologies

- Schneider Electric

- STMicroelectronics

- Tesla

- Texas Instruments

- Regional companies

- Aptiv

- BYD

- Continental

- Denso

- Ficosa Internacional

- Hyundai Mobis

- Magna International

- Robert Bosch

- Valeo

- ZF Friedrichshafen

- 新興玩家

- Cohda Wireless

- Elektrobit Automotive

- Efacec Power Solutions (or Efacec)

- Vector Informatik

The Global Electric Vehicle Communication Controller Market was valued at USD 753.1 million in 2024 and is estimated to grow at a CAGR of 14.6% to reach USD 2.83 billion by 2034.

The expansion of electric mobility worldwide, combined with advances in charging infrastructure, communication protocols, and smart grid integration, is driving the demand for EVCCs. These systems are essential for enabling secure, efficient, and intelligent communication between electric vehicles and charging stations. By ensuring compatibility across EVs, chargers, and backend systems, EVCCs are central to the development of a connected and energy-optimized transportation network. The global transition toward carbon neutrality and the growing deployment of public and private EV charging networks are further accelerating adoption. With the standardization of communication frameworks such as ISO 15118, OCPP, and CHAdeMO, bidirectional energy transfer and smart charging capabilities are becoming mainstream. These technologies improve grid reliability, support dynamic energy management, and create new economic opportunities for EV owners, utilities, and charging operators.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $753.1 Million |

| Forecast Value | $2.83 Billion |

| CAGR | 14.6% |

The EV communication controller segment held a 61% share in 2024, reflecting the growing need for advanced networking devices like switches, routers, and gateways. These systems are vital in enabling vehicle-to-grid operations, allowing electricity to flow both ways between vehicles and power systems. This bidirectional communication enhances energy efficiency, supports grid balancing, and facilitates intelligent load management across residential, commercial, and fleet applications. By improving operational control and optimizing electricity use, these controllers are becoming a cornerstone of the smart transportation ecosystem.

The wired communication segment held a 59% share in 2024, driven by its superior reliability, low latency, and secure data transfer capabilities. Automotive Ethernet is increasingly being adopted in EVs to manage high-capacity data transmission between critical vehicle systems. The availability of greater bandwidth supports real-time diagnostics, precise charging management, and efficient use of vehicle-to-everything (V2X) communication technologies. As a result, wired EVCCs continue to gain prominence as automakers integrate advanced data communication solutions into their electric vehicle architectures.

United States Electric Vehicle Communication Controller Market reached USD 157.8 million in 2024. The U.S. leads the North American market due to strong government incentives, early adoption of electric power technologies, and substantial investment in EV charging networks. The presence of major automotive manufacturers investing in next-generation charging communication systems has reinforced the country's dominant position. These developments are paving the way for improved interoperability and reliability across the national EV infrastructure.

Key players active in the Global Electric Vehicle Communication Controller Market include Schneider Electric, ABB, BYD, Mitsubishi Electric, Vector Informatik, Robert Bosch, Tesla, Ficosa Internacional, LG Innotek, and Efacec Power Solutions. Companies in the Electric Vehicle Communication Controller Market are implementing strategies focused on innovation, standardization, and global expansion. Major players are heavily investing in R&D to enhance interoperability, cybersecurity, and real-time communication performance of EVCCs. Collaborations with automotive OEMs, energy providers, and charging infrastructure developers are key to strengthening integration across the EV ecosystem. Firms are also aligning their solutions with international standards like ISO 15118 and OCPP to ensure compatibility across global markets. Mergers and partnerships are being leveraged to scale production, reduce costs, and expand technology portfolios.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 System

- 2.2.3 Charging

- 2.2.4 Vehicle

- 2.2.5 Current

- 2.2.6 End use

- 2.2.7 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising EV adoption and expansion of charging infrastructure

- 3.2.1.2 Integration of standardized communication protocols and V2G capabilities

- 3.2.1.3 Technological advancements in intelligent and secure EVCC solutions

- 3.2.1.4 Government policies and regional investments driving e-mobility ecosystems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and complexity of advanced EVCC integration

- 3.2.2.2 Cybersecurity and data privacy risks

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of vehicle-to-grid (V2G) and smart charging ecosystems

- 3.2.3.2 Growth of fast and ultra-fast charging networks

- 3.2.3.3 Integration with smart cities and IoT infrastructure

- 3.2.3.4 Software-defined and cloud-based EVCC solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global

- 3.4.1.1 Cybersecurity regulations (ISO/SAE 21434)

- 3.4.1.2 V2X deployment policies across regions

- 3.4.1.3 Charging infrastructure standards (ISO 15118)

- 3.4.2 North America

- 3.4.3 Europe

- 3.4.4 Asia Pacific

- 3.4.5 Latin America

- 3.4.6 Middle East & Africa

- 3.4.1 Global

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Migration from CAN to automotive Ethernet for high-speed data transfer

- 3.7.1.2 V2X communication technology roadmap enabling vehicle-to-vehicle and vehicle-to-infrastructure connectivity

- 3.7.2 Emerging technologies

- 3.7.2.1 Wireless charging communication protocols development

- 3.7.2.2 Edge computing integration trends for real-time analytics and control

- 3.7.3 Technology adoption lifecycle analysis

- 3.7.1 Current technological trends

- 3.8 Price trends

- 3.8.1 Controller unit economics

- 3.8.2 Integration and certification costs

- 3.8.3 Total cost of ownership analysis

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Investment & funding analysis

- 3.13.1 Venture capital and private equity activity in EVCC solutions

- 3.13.2 Government funding and incentives for EV adoption

- 3.13.3 Corporate R&D investment trends in EV communication technologies

- 3.14 Market maturity & penetration analysis

- 3.15 Customer behavior & decision-making analysis

- 3.16 Distribution channel & go-to-market analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Vendor selection criteria

- 4.8 Competitive response strategies

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 EV communication controller (EVCC)

- 5.3 Supply equipment communication controller (SECC)

Chapter 6 Market Estimates & Forecast, By Charging, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Wired

- 6.3 Wireless

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 BEV

- 7.2.2 PHEV

- 7.2.3 FCEV

- 7.3 Commercial vehicles

- 7.3.1 BEV

- 7.3.2 PHEV

- 7.3.3 FCEV

Chapter 8 Market Estimates & Forecast, By Current, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Alternating current (AC)

- 8.3 Direct current (DC)

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Electric vehicle manufacturers (OEM)

- 9.3 Charging station operators

- 9.4 Utility providers

- 9.5 Fleet operators

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 Residential charging

- 10.3 Commercial charging

- 10.4 Public charging

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Nordics

- 11.3.7 Russia

- 11.3.8 Poland

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Vietnam

- 11.4.7 Thailand

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global companies

- 12.1.1 ABB

- 12.1.2 Analog Devices

- 12.1.3 Infineon Technologies

- 12.1.4 LG Innotek

- 12.1.5 Mitsubishi Electric

- 12.1.6 NXP Semiconductors

- 12.1.7 Qualcomm Technologies

- 12.1.8 Schneider Electric

- 12.1.9 STMicroelectronics

- 12.1.10 Tesla

- 12.1.11 Texas Instruments

- 12.2 Regional companies

- 12.2.1 Aptiv

- 12.2.2 BYD

- 12.2.3 Continental

- 12.2.4 Denso

- 12.2.5 Ficosa Internacional

- 12.2.6 Hyundai Mobis

- 12.2.7 Magna International

- 12.2.8 Robert Bosch

- 12.2.9 Valeo

- 12.2.10 ZF Friedrichshafen

- 12.3 Emerging players

- 12.3.1 Cohda Wireless

- 12.3.2 Elektrobit Automotive

- 12.3.3 Efacec Power Solutions (or Efacec)

- 12.3.4 Vector Informatik