|

市場調查報告書

商品編碼

1797828

針狀焦市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Needle Coke Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

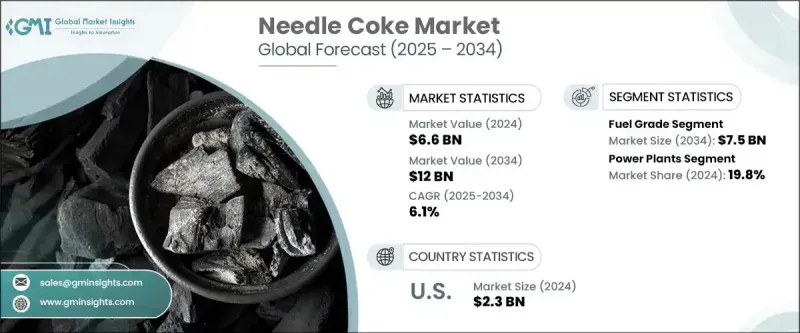

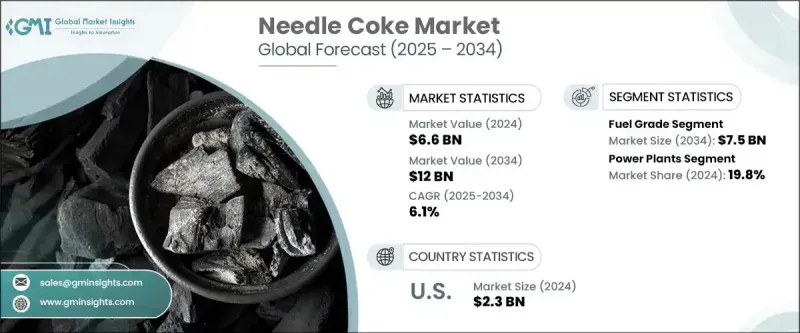

2024 年全球針狀焦市場價值為 66 億美元,預計到 2034 年將以 6.1% 的複合年成長率成長至 120 億美元。該行業的成長在很大程度上受到其在製造電弧爐石墨電極方面的關鍵作用的影響,而電弧爐廣泛用於鋼鐵生產。這種優質石油焦以其針狀結構和低熱膨脹係數而聞名,特別適合需要出色導熱性和導電性的應用。由於電弧爐技術比傳統高爐方法更節能且碳足跡更少,鋼鐵業擴大採用電弧爐技術,對高品質石墨電極的需求持續擴大,從而推動了針狀焦市場的發展。精煉技術的進步、對性能改進的高度重視以及傳統和新興應用中不斷變化的工業要求也塑造了行業動態。

依等級,市場分為燃料等級和煅燒石油焦兩大類。預計到2034年,燃料級市場規模將超過75億美元,同期複合年成長率為6%。該領域的發展受到全球能源需求模式轉變、煉油廠營運趨勢以及環境法規收緊的影響。旨在提高燃燒效率和控制排放的創新技術正在開始重塑採購偏好,許多行業都在尋求既能最大限度地發揮燃料焦的優勢,又能遵守更嚴格的環境標準的解決方案。這為生產商創造了將先進技術融入製造流程以滿足性能和合規性目標的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 66億美元 |

| 預測值 | 120億美元 |

| 複合年成長率 | 6.1% |

從應用角度來看,針狀焦產業分為發電廠、水泥製造、鋼鐵生產、鋁加工和其他工業用途。發電廠領域目前佔最大佔有率,到2024年將佔據19.8%的市場佔有率,預計到2034年將以6.1%的複合年成長率成長。隨著全球能源基礎設施向更高效、更永續的解決方案轉型,針狀焦在發電領域的應用日益成長,尤其是在高溫和先進的儲能系統中。這些發展與能源政策的變化、工業體系的現代化以及材料性能的技術進步密切相關。

從區域來看,北美市場依然佔據主導地位,其中美國佔據主導地位。 2024年,美國佔據該地區約94%的佔有率,創造了23億美元的收入。產業升級、永續發展措施的實施以及創新能源技術的採用,為北美市場的擴張提供了支持。旨在減少進口依賴和加速清潔能源系統部署的政策舉措,進一步促進了積極的市場前景。強勁的國內需求與有針對性的行業政策相結合,為未來的成長奠定了堅實的基礎。

針狀焦市場中的企業正在推行多種策略以鞏固其市場地位。大量資金投入研發,重點在於永續精煉和先進加工技術,以提高產品純度、密度以及電極和電池級應用的性能。企業正在與下游製造商建立策略聯盟,包括合作夥伴關係和合資企業,以確保穩定的長期需求並實現協同產品創新。此外,透過新的生產設施和分銷網路進軍高成長新興市場,正成為尋求多元化全球佈局並挖掘尚未開發的需求潛力的供應商的首要任務。

技術進步、監管調整和策略性產業合作的結合正在重塑競爭環境。市場的成長軌跡不僅反映了鋼鐵業不斷成長的需求,也反映了針狀焦在多個行業各種高性能應用中日益成長的作用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 製造技術分析

- 延遲焦化製程的進步

- 共碳化技術

- 替代原料開發

- 品質增強技術

- 新興生產方法

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 進出口貿易分析

- 價格趨勢分析

- 按年級

- 按地理位置

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略儀表板

- 策略舉措

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依等級,2021-2034

- 主要趨勢

- 燃料等級

- 煅燒石油焦

第6章:市場規模與預測:按應用,2021-2034 年

- 主要趨勢

- 發電廠

- 水泥業

- 鋼鐵業

- 鋁工業

- 其他

第7章:市場規模及預測:依地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 西班牙

- 英國

- 義大利

- 法國

- 德國

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 中東和非洲

- 突尼西亞

- 土耳其

- 摩洛哥

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 墨西哥

第8章:公司簡介

- AMINCO RESOURCES

- Bharat Petroleum Corporation Limited

- BP plc

- Cenovus Inc

- Chevron Corporation

- Cocan graphite

- Exxon Mobil Corporation

- Fangda Carbon New Materials Technology Co., Ltd.

- GrafTech International

- Graphite India Limited

- Indian Oil Corporation

- Marathon Petroleum Corporation

- Mitsubishi Chemical Group Corporation

- Oxbow Corporation

- Reliance Industries Limited

- Rain Carbon Inc.

- Saudi Arabian Oil Company (Saudi Aramco)

- Shamokin Carbons

- Shell Plc

- Valero

The Global Needle Coke Market was valued at USD 6.6 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 12 billion by 2034. Growth in this sector is strongly influenced by its critical role in manufacturing graphite electrodes for electric arc furnaces, which are widely used in steel production. This premium-grade petroleum coke, known for its acicular structure and low coefficient of thermal expansion, is especially suited for applications where exceptional thermal and electrical conductivity is essential. As the steel industry increasingly adopts electric arc furnace technology due to its energy efficiency and reduced carbon footprint compared to conventional blast furnace methods, the demand for high-quality graphite electrodes continues to expand, thereby driving the market for needle coke. Industry dynamics are also shaped by advances in refining technologies, heightened focus on performance improvements, and evolving industrial requirements in both traditional and emerging applications.

Based on grade, the market is split into fuel-grade and calcinated petroleum coke segments. The fuel-grade category is forecast to exceed USD 7.5 billion by 2034, advancing at a CAGR of 6% over the same period. Developments in this segment are influenced by shifting patterns in global energy demand, operational trends within refineries, and the tightening of environmental regulations. New innovations aimed at improving combustion efficiency and controlling emissions are beginning to reshape procurement preferences, with many industries seeking solutions that maximize the benefits of fuel coke while adhering to stricter environmental standards. This has created opportunities for producers to integrate advanced technologies into manufacturing processes to meet both performance and compliance targets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.6 Billion |

| Forecast Value | $12 Billion |

| CAGR | 6.1% |

From an application perspective, the needle coke industry is divided into power plants, cement manufacturing, steel production, aluminum processing, and other industrial uses. The power plant sector currently accounts for the largest share, representing 19.8% of the market in 2024, and is projected to expand at a CAGR of 6.1% through 2034. The use of needle coke in power generation is gaining momentum, particularly in high-temperature and advanced energy storage systems, as global energy infrastructures transition toward more efficient and sustainable solutions. These developments are closely linked to changes in energy policy, the modernization of industrial systems, and technological advancements in material performance.

Regionally, North America remains a prominent market, with the United States holding a dominant position. In 2024, the U.S. accounted for around 94% of the regional share, generating USD 2.3 billion in revenue. Market expansion here is supported by industrial upgrades, the implementation of sustainability measures, and adoption of innovative energy technologies. Policy initiatives aimed at reducing import dependency and accelerating the deployment of clean energy systems have further contributed to the positive market outlook. The combination of robust domestic demand and targeted industry policies has established a strong foundation for future growth.

Companies operating in the needle coke market are pursuing multiple strategies to strengthen their position. Significant investments are being directed toward research and development, with a focus on sustainable refining and advanced processing technologies that enhance product purity, density, and performance for both electrode and battery-grade applications. Strategic alliances, including partnerships and joint ventures with downstream manufacturers, are being formed to secure stable long-term demand and enable collaborative product innovation. Additionally, expansion into high-growth emerging markets through new production facilities and distribution networks is becoming a key priority for suppliers seeking to diversify their global presence and tap into untapped demand potential.

This combination of technological progress, regulatory adaptation, and strategic industry collaboration is reshaping the competitive environment. The market's growth trajectory reflects not only the rising demand from the steel sector but also the expanding role of needle coke in various high-performance applications across multiple industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Grade trends

- 2.1.3 Application trends

- 2.1.4 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Manufacturing technology analysis

- 3.3.1 Delayed coking process advancements

- 3.3.2 Co-carbonization technologies

- 3.3.3 Alternative feedstock development

- 3.3.4 Quality enhancement techniques

- 3.3.5 Emerging production methodologies

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Import/export trade analysis

- 3.6 Price trend analysis

- 3.6.1 By grade

- 3.6.2 By geography

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.8.1 Bargaining power of suppliers

- 3.8.2 Bargaining power of buyers

- 3.8.3 Threat of new entrants

- 3.8.4 Threat of substitutes

- 3.9 PESTEL analysis

- 3.9.1 Political factors

- 3.9.2 Economic factors

- 3.9.3 Social factors

- 3.9.4 Technological factors

- 3.9.5 Environmental factors

- 3.9.6 Legal factors

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategy dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Grade, 2021 - 2034, (MT and USD Billion)

- 5.1 Key trends

- 5.2 Fuel grade

- 5.3 Calcinated petcoke

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034, (MT and USD Billion)

- 6.1 Key trends

- 6.2 Power plants

- 6.3 Cement industry

- 6.4 Steel industry

- 6.5 Aluminum industry

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034, (MT and USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Spain

- 7.3.2 UK

- 7.3.3 Italy

- 7.3.4 France

- 7.3.5 Germany

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 Tunisia

- 7.5.2 Turkey

- 7.5.3 Morocco

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

- 7.6.4 Mexico

Chapter 8 Company Profiles

- 8.1 AMINCO RESOURCES

- 8.2 Bharat Petroleum Corporation Limited

- 8.3 BP plc

- 8.4 Cenovus Inc

- 8.5 Chevron Corporation

- 8.6 Cocan graphite

- 8.7 Exxon Mobil Corporation

- 8.8 Fangda Carbon New Materials Technology Co., Ltd.

- 8.9 GrafTech International

- 8.10 Graphite India Limited

- 8.11 Indian Oil Corporation

- 8.12 Marathon Petroleum Corporation

- 8.13 Mitsubishi Chemical Group Corporation

- 8.14 Oxbow Corporation

- 8.15 Reliance Industries Limited

- 8.16 Rain Carbon Inc.

- 8.17 Saudi Arabian Oil Company (Saudi Aramco)

- 8.18 Shamokin Carbons

- 8.19 Shell Plc

- 8.20 Valero