|

市場調查報告書

商品編碼

1698595

太陽能電池市場機會、成長動力、產業趨勢分析及2025-2034年預測Solar Cells Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

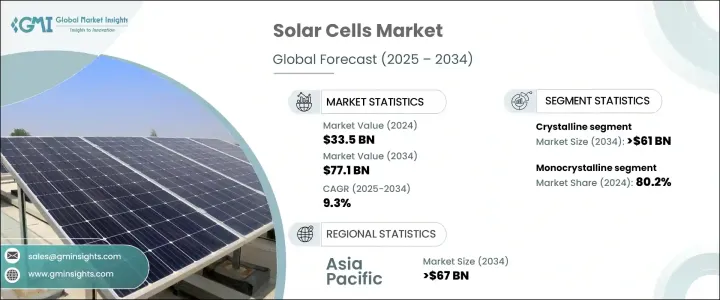

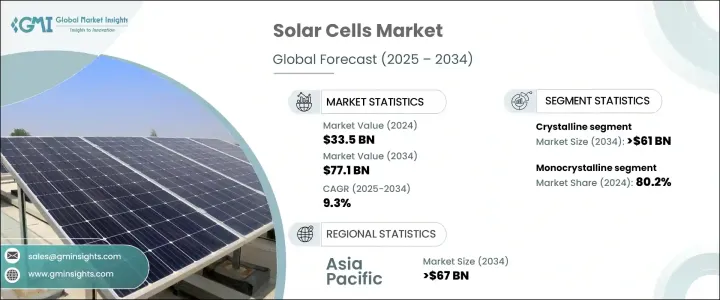

2024 年全球太陽能電池市場價值為 335 億美元,預計 2025 年至 2034 年的複合年成長率為 9.3%。由於技術進步、生產成本下降以及對再生能源解決方案的認知不斷提高,市場正在獲得發展動力。太陽能電池效率的創新和太陽能系統的廣泛應用正在重塑這個產業。政府的支持性政策、淨計量激勵措施以及再生能源授權正在加速擴張。較低的製造費用和日益激烈的競爭進一步促進了高效能太陽能解決方案的發展。偏遠地區離網太陽能應用的日益普及以及太陽能與電池儲存系統的結合也推動了市場需求。此外,增加住宅太陽能發電系統的安裝對於擴大該行業的影響力發揮著至關重要的作用。

受成本效益和卓越效率的推動,晶體太陽能電池領域的規模預計到 2034 年將超過 610 億美元。單晶技術已經成熟,可提供效率超過 20% 的高性能太陽能電池板。鈍化發射極和背面電池 (PERC)、異質結技術 (HJT) 和 N 型矽等先進技術的引入進一步提高了效率水平,使太陽能解決方案更適用於多樣化的應用。單晶矽板的普及率不斷提高,到 2024 年將佔據太陽能電池市場的 80.2%,證明了其可靠性和性能的提升。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 335億美元 |

| 預測值 | 771億美元 |

| 複合年成長率 | 9.3% |

電池技術的進步正在最佳化太陽能利用率、提高能量轉換率並減少電子複合損失。晶體太陽能電池,特別是單晶太陽能電池,由於其耐用性和卓越的能量輸出,繼續佔據市場主導地位。多晶矽、CdTe、非晶矽(A-Si)和銅銦鎵硒(CIGS)技術也在不斷發展,促進了太陽能應用在住宅、商業和工業領域的擴展。

美國太陽能電池市值在 2022 年達到 8.4 億美元,2023 年達到 8.8 億美元,2024 年達到 9.1 億美元。這一成長得益於太陽能發電廠安裝量的增加和可再生能源計劃的擴大。國家對大型太陽能項目的關注和支持性國家政策正在推動公用事業規模、住宅和商業設施的採用。

在政府的強力激勵和高效太陽能技術投資不斷增加的推動下,亞太太陽能電池市場規模預計到 2034 年將超過 670 億美元。新興經濟體的快速城市化和工業化正在增加對可靠和永續能源的需求。農村電氣化計畫的擴大以及集風能和電池儲存於一體的混合太陽能計畫的發展進一步促進了市場的成長。東南亞各國的太陽能裝置容量正在激增,使該地區成為全球太陽能市場的主要貢獻者。

隨著各國努力實現能源獨立和永續發展目標,太陽能的應用預計將加速。隨著太陽能技術的不斷進步和政策支持的不斷增加,未來幾年市場將大幅擴張。

目錄

第1章:方法論與範圍

- 研究設計

- 基礎估算與計算

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與技術格局

第5章:市場規模及預測:依資料,2021 年至 2034 年

- 主要趨勢

- 結晶

- N材料

- P材質

- 薄膜

第6章:市場規模及預測:依技術分類,2021 年至 2034 年

- 主要趨勢

- 單晶矽

- 多晶矽

- 碲化鎘(CDTE)

- 非晶矽(A-Si)

- 銅銦鎵硒 (CIGS)

第7章:市場規模及預測:依產品,2021 年至 2034 年

- 主要趨勢

- BSF

- PERC/PERL/PERT/拓普康

- 異質結技術

- IBC 和 MWT

- 其他

第8章:市場規模及預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 歐洲

- 德國

- 西班牙

- 法國

- 荷蘭

- 亞太地區

- 中國

- 馬來西亞

- 韓國

- 日本

- 台灣

- 印度

- 世界其他地區

第9章:公司簡介

- Canadian Solar

- DuPont

- Hevel

- Hanwha Q Cells

- Jinko Solar

- JINERGY

- JA SOLAR Technology

- Meyer Burger

- MOTECH Industries

- RENESOLA

- REC Solar Holdings

- Silfab Solar

- Singulus Technologies

- SunPower Corporation

- Sunport Power

- AIKO

- Tongwei

- United Renewable Energy

- Vikram Solar

- Wuxi Suntech Power

- Yingli Solar

The Global Solar Cells Market was valued at USD 33.5 billion in 2024 and is projected to grow at a CAGR of 9.3% from 2025 to 2034. The market is gaining traction due to advancements in technology, declining production costs, and increasing awareness of renewable energy solutions. Innovations in solar cell efficiency and the widespread adoption of solar energy systems are reshaping the industry. Supportive government policies, net metering incentives, and renewable energy mandates are accelerating expansion. Lower manufacturing expenses and growing competition are further fostering the development of efficient solar power solutions. The rising adoption of off-grid solar applications in remote regions and the integration of solar power with battery storage systems are also fueling market demand. Additionally, increasing installations of residential solar power systems are playing a crucial role in expanding the industry's footprint.

The crystalline solar cells segment is anticipated to surpass USD 61 billion by 2034, driven by cost-effectiveness and superior efficiency. Monocrystalline technology is well-established, offering high-performance solar panels with efficiency rates exceeding 20%. The introduction of advanced technologies such as Passivated Emitter and Rear Cell (PERC), heterojunction technology (HJT), and N-type silicon has further enhanced efficiency levels, making solar solutions more viable for diverse applications. The growing adoption of monocrystalline panels, which accounted for 80.2% of the solar cells market in 2024, is a testament to their reliability and improved performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $33.5 Billion |

| Forecast Value | $77.1 Billion |

| CAGR | 9.3% |

Advancements in cell technology are optimizing solar energy utilization, improving energy conversion rates, and reducing electron recombination losses. Crystalline solar cells, particularly monocrystalline variants, continue to dominate the market due to their durability and superior energy output. Polycrystalline, CdTe, amorphous silicon (A-Si), and copper indium gallium selenide (CIGS) technologies are also evolving, contributing to the expansion of solar applications across residential, commercial, and industrial sectors.

The US solar cells market recorded values of USD 840 million in 2022, USD 880 million in 2023, and USD 910 million in 2024. The growth is fueled by increasing installations of solar power plants and expanding renewable energy initiatives. The country's focus on large-scale solar projects and supportive state policies is driving adoption across utility-scale, residential, and commercial installations.

The Asia Pacific solar cells market is projected to exceed USD 67 billion by 2034, supported by strong government incentives and rising investments in high-efficiency solar technology. Rapid urbanization and industrialization in emerging economies are increasing the demand for reliable and sustainable energy sources. The expansion of rural electrification programs and the development of hybrid solar projects integrating wind and battery storage are further bolstering market growth. Countries across Southeast Asia are witnessing a surge in solar installations, positioning the region as a key contributor to the global solar market.

The adoption of solar energy is expected to accelerate as nations work toward achieving energy independence and sustainability goals. With ongoing advancements in solar technology and increasing policy support, the market is poised for significant expansion in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 – 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Crystalline

- 5.2.1 N Material

- 5.2.2 P Material

- 5.3 Thin Film

Chapter 6 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Monocrystalline

- 6.3 Polycrystalline

- 6.4 Cadmium Telluride (CDTE)

- 6.5 Amorphous Silicon (A-Si)

- 6.6 Copper Indium Gallium Diselenide (CIGS)

Chapter 7 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 BSF

- 7.3 PERC/PERL/PERT/TOPCON

- 7.4 HJT

- 7.5 IBC & MWT

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Spain

- 8.3.3 France

- 8.3.4 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Malaysia

- 8.4.3 South Korea

- 8.4.4 Japan

- 8.4.5 Taiwan

- 8.4.6 India

- 8.5 Rest of World

Chapter 9 Company Profiles

- 9.1 Canadian Solar

- 9.2 DuPont

- 9.3 Hevel

- 9.4 Hanwha Q Cells

- 9.5 Jinko Solar

- 9.6 JINERGY

- 9.7 JA SOLAR Technology

- 9.8 Meyer Burger

- 9.9 MOTECH Industries

- 9.10 RENESOLA

- 9.11 REC Solar Holdings

- 9.12 Silfab Solar

- 9.13 Singulus Technologies

- 9.14 SunPower Corporation

- 9.15 Sunport Power

- 9.16 AIKO

- 9.17 Tongwei

- 9.18 United Renewable Energy

- 9.19 Vikram Solar

- 9.20 Wuxi Suntech Power

- 9.21 Yingli Solar