|

市場調查報告書

商品編碼

1698581

牙科植體市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Dental Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

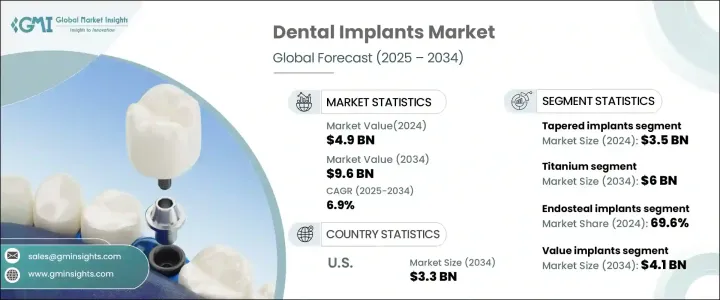

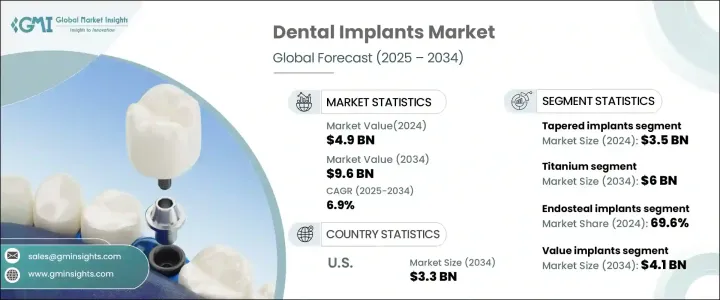

2024 年全球植牙體市場價值為 49 億美元,預計 2025 年至 2034 年的複合年成長率為 6.9%。牙植體需求的不斷成長主要是由於人口老化,人口老化更容易導致牙齦疾病、蛀牙和口腔損傷等疾病。由於多年的磨損和糖尿病等先前存在的健康狀況,牙齒脫落在老年人中尤為普遍,而糖尿病會加速牙周病的發生。不良的口腔衛生和飲食習慣也導致牙齒問題發生率上升,刺激了對植入物的需求。生活方式的改變和含糖食物消費的增加進一步加劇了牙齒疾病,從而對長期修復解決方案產生了強勁的市場需求。

市場根據產品、材料、類型、價格和最終用途進行細分。錐形植入物在 2024 年的市場規模為 35 億美元,預計複合年成長率為 7.3%。它們的圓錐形確保了出色的骨接觸,使其適用於諸如窄脊之類的複雜情況。這些植入物可立即負重,從而實現更快的恢復並減少治療時間。研究表明,它們的兩年內成功率約為 98.7%,特別是在骨量低或立即植入的情況下,這使其成為牙科專業人士的首選。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 49億美元 |

| 預測值 | 96億美元 |

| 複合年成長率 | 6.9% |

鈦植入物在 2024 年佔據市場主導地位,收入佔有率為 62%,預計到 2034 年將達到 60 億美元。其耐腐蝕性能使其在口腔環境中具有高度耐用性,最大限度地降低了植入物退化的風險並減少了修復手術的需要。鈦形成一層保護性氧化層,可防止與生物體液相互作用,確保長期穩定性。它的生物相容性和低過敏性進一步增強了它的吸引力,使其成為對其他金屬可能產生過敏反應的患者的安全選擇。

2024 年,骨內植入物佔據市場主導地位,佔有 69.6% 的佔有率。與傳統的牙橋不同,它們不需要相鄰牙齒的支撐,從而保持了天然牙齒的完整性。這些植入物具有更自然的外觀,並可防止拔牙後常見的骨質流失。骨內植體的成功率約為 95%,是長期牙齒修復的首選,因此得到了廣泛應用。

以價格計算,價值植入物是最大的細分市場,2024 年佔 42.7% 的佔有率,預計到 2034 年將達到 41 億美元。其價格實惠且品質上乘,使更廣泛的患者群體能夠接受。不斷成長的中產階級人口進一步推動了對具有成本效益的牙科解決方案的需求,從而促進了該領域的成長。價值植入物具有耐用性和先進的功能,確保了可負擔性和功能性之間的平衡。

2024 年,醫院佔了 23% 的市場佔有率,預計到 2034 年將達到 23 億美元。醫院處理複雜牙科手術和大量患者的能力使其成為市場擴張的重要推動力。在技術進步和專業牙科專業人士不斷增加的推動下,美國牙科植入物市場預計到 2034 年將成長到 33 億美元。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球老齡人口不斷增加

- 全球牙科疾病盛行率不斷上升

- 牙醫旅遊興起

- 已開發國家種植技術的進步

- 美容牙科需求不斷成長

- 產業陷阱與挑戰

- 有限的報銷政策

- 植牙治療費用高昂

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 定價分析

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 錐形植入物

- 平行壁植入物

第6章:市場估計與預測:按材料,2021 年至 2034 年

- 主要趨勢

- 鈦

- 鋯

第7章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 骨內植入物

- 骨膜下植入物

- 跨骨植入物

- 黏膜內植入物

第8章:市場估計與預測:按價格,2021 年至 2034 年

- 主要趨勢

- 優質植入物

- 價值植入

- 折扣植入物

第9章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 牙醫診所

- 牙科服務組織

- 其他最終用途

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- AB Dental Devices

- Adin Dental Implant Systems

- AVINENT Implant System

- Bicon

- Cortex Dental Implants Industries

- Dentsply Sirona

- Envista Holdings Corporation

- Glidewell

- Henry Schein

- Mega'gen Implant

- MIS Implants Technologies

- NucleOSS

- Osstem Implant

- Straumann Holding

- ZimVie

The Global Dental Implants Market was valued at USD 4.9 billion in 2024 and is projected to grow at a CAGR of 6.9% from 2025 to 2034. The increasing demand for dental implants is largely driven by the aging population, which is more prone to conditions like gum disease, tooth decay, and oral injuries. Tooth loss is especially prevalent among older adults due to years of wear and pre-existing health conditions like diabetes, which accelerates periodontal disease. Poor oral hygiene and dietary habits also contribute to the rising incidence of dental issues, fueling the demand for implants. Changing lifestyles and greater consumption of sugary foods further exacerbate dental diseases, creating a strong market demand for long-term restorative solutions.

The market is segmented based on product, material, type, price, and end use. Tapered implants accounted for USD 3.5 billion in 2024 and are expected to grow at a CAGR of 7.3%. Their conical shape ensures superior bone contact, making them suitable for complex cases like narrow ridges. These implants allow for immediate loading, enabling quicker restoration and reducing treatment time. Research indicates their success rate is about 98.7% within two years, particularly in cases with low bone volume or immediate placement, making them a preferred choice for dental professionals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $9.6 Billion |

| CAGR | 6.9% |

Titanium implants dominated the market in 2024 with a 62% revenue share and are anticipated to reach USD 6 billion by 2034. Their corrosion-resistant properties make them highly durable in oral environments, minimizing the risk of implant degradation and reducing the need for revision surgeries. Titanium forms a protective oxide layer that prevents interactions with biological fluids, ensuring long-term stability. Its biocompatibility and hypoallergenic nature further enhance its appeal, making it a safe choice for patients who may have allergic reactions to other metals.

Endosteal implants led the market in 2024 with a 69.6% share. Unlike traditional bridgework, they do not require support from adjacent teeth, preserving the integrity of natural teeth. These implants provide a more natural appearance and prevent bone loss, which is common after tooth extraction. With a success rate of approximately 95%, endosteal implants are a preferred option for long-term dental restoration, driving their widespread adoption.

Value implants were the largest segment by price, holding a 42.7% share in 2024 and projected to reach USD 4.1 billion by 2034. Their affordability and high-quality performance make them accessible to a broader patient base. The growing middle-class population is further boosting demand for cost-effective dental solutions, reinforcing the segment's growth. Value implants offer durability and advanced features, ensuring a balance between affordability and functionality.

Hospitals accounted for 23% of the market in 2024 and are expected to reach USD 2.3 billion by 2034. Their ability to handle complex dental procedures and a high volume of patients makes them a significant driver of market expansion. The U.S. dental implants market is expected to grow to USD 3.3 billion by 2034, supported by technological advancements and an increasing number of specialized dental professionals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing elderly population worldwide

- 3.2.1.2 Growing prevalence of dental disorders across the globe

- 3.2.1.3 Rising dental tourism

- 3.2.1.4 Advancements in implant technologies in developed countries

- 3.2.1.5 Rising demand for cosmetic dentistry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited reimbursement policies

- 3.2.2.2 High cost of dental implant treatment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Pricing analysis

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Tapered implants

- 5.3 Parallel-walled implants

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Titanium

- 6.3 Zirconium

Chapter 7 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Endosteal implants

- 7.3 Subperiosteal implants

- 7.4 Transosteal implants

- 7.5 Intramucosal implants

Chapter 8 Market Estimates and Forecast, By Price, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Premium implants

- 8.3 Value implants

- 8.4 Discounted implants

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Dental clinics

- 9.4 Dental service organization

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 A.B. Dental Devices

- 11.2 Adin Dental Implant Systems

- 11.3 AVINENT Implant System

- 11.4 Bicon

- 11.5 Cortex Dental Implants Industries

- 11.6 Dentsply Sirona

- 11.7 Envista Holdings Corporation

- 11.8 Glidewell

- 11.9 Henry Schein

- 11.10 Mega’gen Implant

- 11.11 MIS Implants Technologies

- 11.12 NucleOSS

- 11.13 Osstem Implant

- 11.14 Straumann Holding

- 11.15 ZimVie