|

市場調查報告書

商品編碼

1664869

汽車起動馬達市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Starter Motor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

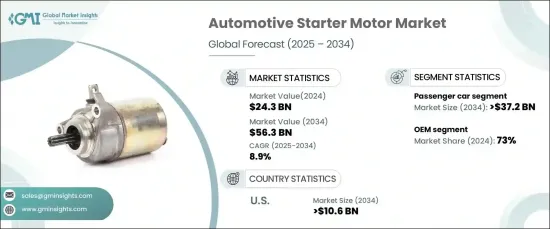

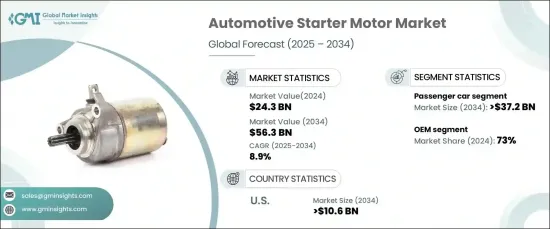

2024 年全球汽車起動馬達市場價值 243 億美元,預計將實現顯著成長,預計 2025 年至 2034 年的複合年成長率將達到 8.9%。這些創新不僅提高了效率,還降低了能耗並改善了車輛性能,符合汽車產業對燃油效率和減少排放的日益重視。

市場分為乘用車和商用車,其中乘用車將在 2024 年佔據 67% 的市場佔有率。推動這一成長的關鍵因素包括個人流動需求的不斷成長、快速的城市化以及更高的可支配收入,尤其是在新興市場。此外,為提高燃油效率和符合嚴格的排放標準而設計的啟動/停止系統的進步主要整合在乘用車中。這種持續的需求凸顯了先進耐用的起動馬達在現代汽車解決方案中的關鍵作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 243億美元 |

| 預測值 | 563億美元 |

| 複合年成長率 | 8.9% |

市場也分為原始設備製造商 (OEM) 和售後市場,其中 OEM 到 2024 年將佔據 73% 的市場佔有率。汽車製造商透過批量採購起動馬達和利用最佳化的供應鏈來提高成本效率。此外,滿足嚴格的性能和監管基準的需求進一步鞏固了 OEM 作為最先進起動馬達解決方案提供者的主導地位。

2024 年,美國汽車起動馬達市場佔有 85% 的佔有率,預計到 2034 年將達到 106 億美元。促進燃油效率的監管措施加速了節能起動馬達的採用。此外,領先汽車製造商和零件製造商的存在,加上強大的供應鏈網路,鞏固了美國市場的領導地位。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 技術提供者

- 零件供應商

- 製造商

- 原始設備製造商

- 供應商概況

- 利潤率分析

- 技術與創新格局

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 汽車產銷量上升

- 起動馬達技術的進步

- 電動和混合動力汽車的成長

- 更加重視燃油效率和排放控制

- 產業陷阱與挑戰

- 實施成本高

- 嚴格的規定

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按起動電機,2021 - 2034 年

- 主要趨勢

- 電動啟動馬達

- 氣動啟動馬達

- 液壓啟動馬達

- 其他

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 商用車

第7章:市場估計與預測:依實力評級,2021 - 2034 年

- 主要趨勢

- 1.5千瓦以下

- 1.5–2.5 千瓦

- 2.5千瓦以上

第 8 章:市場估計與預測:按銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- BorgWarner Inc.

- Bosch

- Delco Remy

- DENSO

- Dongfeng Motor Parts and Components Group Co., Ltd.

- GDST Auto Parts

- Hella KGaA Hueck & Co.

- Hitachi Automotive Systems

- Lucas Electrical

- Magneti Marelli

- MITSUBA Corporation

- Mitsubishi Electric Corporation

- Nikko Electric Industry Co., Ltd.

- Prestolite Electric

- Remy International

- Sawafuji Electric Co., Ltd.

- TYK Automotive Electric Co., Ltd.

- Unitech Automotive Electrical Appliance Co., Ltd.

- Valeo

- WAI Global

The Global Automotive Starter Motor Market, valued at USD 24.3 billion in 2024, is poised for remarkable growth, with a projected robust CAGR of 8.9% from 2025 to 2034. This surge is fueled by cutting-edge advancements in starter motor technologies, such as gear reduction mechanisms and lightweight designs. These innovations not only enhance efficiency but also reduce energy consumption and improve vehicle performance, aligning with the automotive industry's increasing emphasis on fuel efficiency and emissions reduction.

The market is segmented into passenger cars and commercial vehicles, with passenger cars dominating at 67% of the market share in 2024. By 2034, this segment is projected to generate an impressive USD 37.2 billion. Key factors propelling this growth include rising demand for personal mobility, rapid urbanization, and higher disposable incomes, especially in emerging markets. Furthermore, advancements in start-stop systems, designed to boost fuel efficiency and comply with stringent emission standards, are predominantly integrated into passenger vehicles. This sustained demand underscores the pivotal role of advanced and durable starter motors in modern automotive solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.3 billion |

| Forecast Value | $56.3 billion |

| CAGR | 8.9% |

The market is also divided between original equipment manufacturers (OEMs) and the aftermarket, with OEMs commanding a significant 73% market share in 2024. Their direct involvement in vehicle production ensures seamless integration, superior quality, and enhanced reliability. Automakers leverage cost efficiencies by sourcing starter motors in bulk and utilizing optimized supply chains. Additionally, the need to meet stringent performance and regulatory benchmarks further solidifies OEMs' dominance as providers of state-of-the-art starter motor solutions.

The U.S. automotive starter motor market held an 85% share in 2024 and is forecasted to reach USD 10.6 billion by 2034. The nation's dominance can be attributed to its well-established automotive manufacturing ecosystem and high demand for vehicles equipped with advanced technologies like start-stop systems. Regulatory measures promoting fuel efficiency have accelerated the adoption of energy-efficient starter motors. Furthermore, the presence of leading automakers and component manufacturers, coupled with robust supply chain networks, reinforces the U.S. market's leadership.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Technology providers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 OEMs

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising vehicle production and sales

- 3.7.1.2 Advancements in starter motor technology

- 3.7.1.3 Growth in electric and hybrid vehicles

- 3.7.1.4 Increased focus on fuel efficiency and emissions control

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High implementation costs

- 3.7.2.2 Stringent regulations

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Starter Motor, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Electric starter motor

- 5.3 Pneumatic starter motor

- 5.4 Hydraulic starter motor

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger car

- 6.3 Commercial vehicle

Chapter 7 Market Estimates & Forecast, By Power Rating, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Below 1.5 kW

- 7.3 1.5–2.5 kW

- 7.4 Above 2.5 kW

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 BorgWarner Inc.

- 10.2 Bosch

- 10.3 Delco Remy

- 10.4 DENSO

- 10.5 Dongfeng Motor Parts and Components Group Co., Ltd.

- 10.6 GDST Auto Parts

- 10.7 Hella KGaA Hueck & Co.

- 10.8 Hitachi Automotive Systems

- 10.9 Lucas Electrical

- 10.10 Magneti Marelli

- 10.11 MITSUBA Corporation

- 10.12 Mitsubishi Electric Corporation

- 10.13 Nikko Electric Industry Co., Ltd.

- 10.14 Prestolite Electric

- 10.15 Remy International

- 10.16 Sawafuji Electric Co., Ltd.

- 10.17 TYK Automotive Electric Co., Ltd.

- 10.18 Unitech Automotive Electrical Appliance Co., Ltd.

- 10.19 Valeo

- 10.20 WAI Global