|

市場調查報告書

商品編碼

1665025

汽車煞車增壓器和主缸市場機會、成長動力、產業趨勢分析和預測 2025 - 2034Automotive Brake Booster and Master Cylinder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

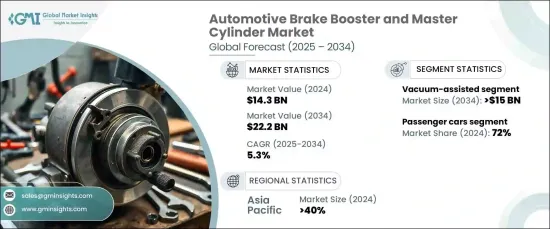

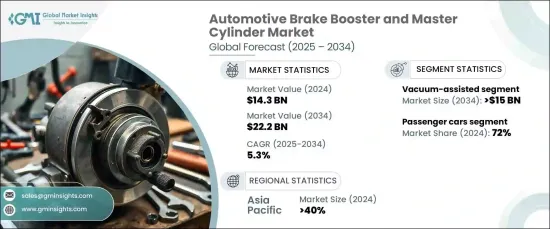

2024 年全球汽車煞車輔助器和主缸市場價值為 143 億美元,預計將經歷顯著成長,預計從 2025 年到 2034 年的複合年成長率為 5.3%。電動車(EV)導致電動煞車輔助器的需求激增,因為傳統煞車系統依賴引擎真空,而這是電動車所不具備的功能。

同時,世界各國政府正在加強安全法規,這進一步增加了對複雜煞車解決方案的需求。這些法規正在推動新車和改裝車型中先進煞車系統的整合,以提高安全性、減少事故並最大限度地減少人員死亡。北美、歐洲和亞太部分地區等主要地區對法規合規性的重視是推動這些技術採用的主要因素,從而推動市場成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 143億美元 |

| 預測值 | 222億美元 |

| 複合年成長率 | 5.3% |

市場主要分為三種煞車輔助器技術:真空輔助、液壓輔助和電子煞車輔助器。真空輔助煞車助力器在 2024 年佔據最大佔有率,佔 65% 的市場。預計到2034年該技術的價值將達到150億美元。透過利用引擎的真空來增強制動力,這些助推器具有可靠性和與內燃機的兼容性,是傳統車型的理想選擇。

從車型來看,乘用車在汽車煞車增壓器和主缸市場佔據主導地位,到 2024 年將佔據總市場佔有率的 72%。乘用車領域包括各種私人車輛,包括轎車、SUV 和掀背車,所有這些車輛都在市場的整體成長中發揮著至關重要的作用。

2024 年,亞太地區佔了 40% 的市場佔有率,預計到 2034 年將創造 95 億美元的市場規模。 中國作為該地區的領先國家,預計到 2034 年將為市場貢獻 40 億美元。隨著中國和亞太地區汽車市場的擴大,對高品質、高效煞車系統的需求將持續成長。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 原物料供應商

- 零件製造商

- 煞車助力器和主缸製造商

- 一級汽車供應商

- 原始設備製造商 (OEM)

- 利潤率分析

- 成本明細分析

- 技術與創新格局

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 電動車和自動駕駛汽車的普及率不斷提高

- 道路安全意識不斷增強,先進煞車系統的監管要求也不斷提高

- 電動煞車輔助器等創新技術進步

- 新興市場汽車產量不斷成長

- 產業陷阱與挑戰

- 先進技術成本高

- 已開發經濟體的市場飽和

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 煞車增壓器

- 真空煞車增壓器

- 液壓煞車增壓器

- 主缸

- 串聯主缸

- 單主缸

第 6 章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 冰

- 電動車

- 純電動車 (BEV)

- 插電式混合動力車 (PHEV)

- 油電混合車 (HEV)

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車 (LCV)

- 重型商用車 (HCV)

第 8 章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 真空輔助

- 油壓輔助

- 電子煞車輔助器

第 9 章:市場估計與預測:按銷售管道,2021 - 2034 年

- 主要趨勢

- 原始設備製造商

- 售後市場

第 10 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- ADVICS Co.

- Aisin

- Akebono Brake Industry

- Brembo

- Cardone Industries

- Continental

- DENSO

- Federal-Mogul Holdings Corporation

- Haldex

- Hitachi Astemo

- Hyundai Mobis

- Knorr-Bremse

- KYB

- Magneti Marelli

- Mando

- Nissin Kogyo

- Robert Bosch

- Tenneco

- TRW Automotive

- ZF Friedrichshafen

The Global Automotive Brake Booster And Master Cylinder Market was valued at USD 14.3 billion in 2024 and is expected to experience significant growth, projected to expand at a CAGR of 5.3% from 2025 to 2034. This market growth is largely driven by the increasing adoption of electric and autonomous vehicles, which require advanced braking systems. Electric vehicles (EVs) are contributing to a surge in demand for electric brake boosters, as traditional braking systems rely on engine vacuum-a feature that EVs do not have.

At the same time, governments worldwide are tightening safety regulations, which is further boosting the demand for sophisticated braking solutions. These regulations are pushing the integration of advanced braking systems in both new vehicles and retrofitted models to enhance safety, reduce accidents, and minimize fatalities. The emphasis on regulatory compliance in key regions such as North America, Europe, and parts of Asia-Pacific is a major factor driving the adoption of these technologies, thereby fueling market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.3 Billion |

| Forecast Value | $22.2 Billion |

| CAGR | 5.3% |

The market is divided into three primary brake booster technologies: vacuum-assisted, hydraulic-assisted, and electronic brake boosters. Vacuum-assisted brake boosters held the largest share in 2024, accounting for 65% of the market. This technology is expected to reach USD 15 billion by 2034. Vacuum-assisted boosters are the preferred choice for passenger and light commercial vehicles due to their cost-effectiveness and efficiency. By utilizing the engine's vacuum to enhance braking force, these boosters offer reliability and compatibility with internal combustion engines, making them an ideal option for traditional vehicle models.

In terms of vehicle type, passenger cars dominate the automotive brake booster and master cylinder market, representing 72% of the total market share in 2024. This leadership is attributed to the high production and sales volumes of passenger vehicles globally. The passenger car segment includes a wide range of personal vehicles, including sedans, SUVs, and hatchbacks, all of which play a vital role in the market's overall growth.

The Asia-Pacific region accounted for 40% of the market share in 2024 and is expected to generate USD 9.5 billion by 2034. China, as the leading country in this region, is forecast to contribute USD 4 billion to the market by 2034. China's dominant role in the global automotive industry, with its vast production and consumption of both passenger and commercial vehicles, continues to drive substantial demand for advanced braking technologies. As the automotive market in China and the Asia-Pacific region expands, the need for high-quality, efficient braking systems will only continue to grow.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Brake booster and master cylinder manufacturers

- 3.2.4 Tier-1 automotive suppliers

- 3.2.5 Original equipment manufacturers (OEMs)

- 3.3 Profit margin analysis

- 3.4 Cost breakdown analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 The rising adoption of EVs and autonomous vehicles

- 3.8.1.2 Growing awareness about road safety and regulatory mandates for advanced braking systems

- 3.8.1.3 Technological advancements in innovations such as electric brake boosters

- 3.8.1.4 Growing vehicle production in emerging markets

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High cost of advanced technologies

- 3.8.2.2 Market saturation in developed economies

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Brake booster

- 5.2.1 Vacuum brake booster

- 5.2.2 Hydraulic brake booster

- 5.3 Master cylinder

- 5.3.1 Tandem master cylinder

- 5.3.2 Single master cylinder

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 ICE

- 6.3 Electric vehicles

- 6.3.1 Battery electric vehicles (BEV)

- 6.3.2 Plug-in hybrid electric vehicles (PHEV)

- 6.3.3 Hybrid electric vehicles (HEV)

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Heavy commercial vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Vacuum-assisted

- 8.3 Hydraulic-assisted

- 8.4 Electronic brake boosters

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 ADVICS Co.

- 11.2 Aisin

- 11.3 Akebono Brake Industry

- 11.4 Brembo

- 11.5 Cardone Industries

- 11.6 Continental

- 11.7 DENSO

- 11.8 Federal-Mogul Holdings Corporation

- 11.9 Haldex

- 11.10 Hitachi Astemo

- 11.11 Hyundai Mobis

- 11.12 Knorr-Bremse

- 11.13 KYB

- 11.14 Magneti Marelli

- 11.15 Mando

- 11.16 Nissin Kogyo

- 11.17 Robert Bosch

- 11.18 Tenneco

- 11.19 TRW Automotive

- 11.20 ZF Friedrichshafen