|

市場調查報告書

商品編碼

1665071

汽車智慧門禁系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Smart Access System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

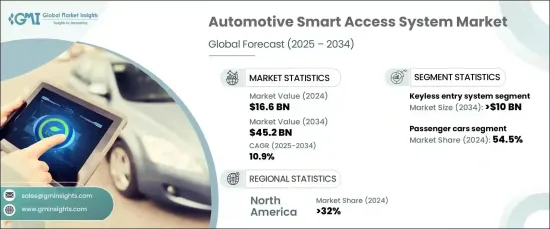

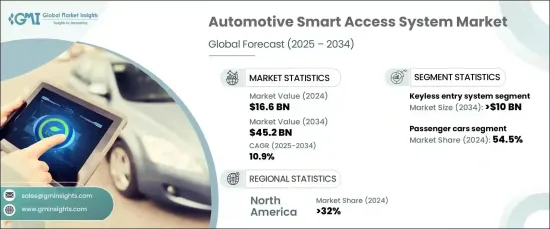

2024 年全球汽車智慧進入系統市場價值為 166 億美元,預計 2025 年至 2034 年期間的複合年成長率將達到 10.9%。作為回應,消費者和汽車製造商都優先考慮先進的安全解決方案來保護車輛及其內容。正在整合生物識別認證、免鑰匙進入和遠端車輛追蹤等尖端技術以加強保護。這些系統採用最先進的加密和身份驗證方法,確保只有授權個人才能存取和操作車輛。

智慧進入系統因其能夠提高車輛的安全性、便利性和用戶體驗而迅速受到關注。物聯網、低功耗藍牙 (BLE)、NFC 和基於雲端的解決方案等先進技術的整合,正在將車輛轉變為高度互聯的智慧設備。生物辨識認證、一鍵啟動、免鑰匙進入和智慧型手機整合等主要功能正在徹底改變駕駛員與車輛互動的方式。這些創新消除了對傳統鑰匙的需求,使用戶可以無縫解鎖、啟動和控制車輛,提供無與倫比的便利性並簡化駕駛體驗。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 166億美元 |

| 預測值 | 452億美元 |

| 複合年成長率 | 10.9% |

市場根據所用技術進行細分,包括按鈕啟動系統、免鑰匙進入系統、生物識別系統、智慧型手機整合、遠端存取和追蹤等。 2024 年,免鑰匙進入系統將佔據市場主導地位,佔據 27% 的佔有率,並產生巨大的發展勢頭。到 2034 年,這一細分市場的規模預計將達到 100 億美元,這得益於這些系統在提供安全性和便利性方面的廣泛應用和有效性。

按車輛類型細分,市場包括乘用車、商用車和非公路用車。由於對先進安全和便利功能的需求激增,乘用車將在 2024 年佔據最大佔有率,達到 54.5%。由於乘用車佔全球汽車總數的大多數,因此免鑰匙進入、一鍵啟動和智慧型手機連接等智慧進入技術正變得越來越標準化,以滿足不斷變化的消費者期望。

受該地區先進的汽車工業和消費者對高階連網汽車的高需求推動,北美汽車智慧進入系統市場到 2024 年將佔據全球佔有率的 32%。隨著人們對車輛安全性和便利性的重視,無鑰匙進入和生物識別存取等功能的採用持續增加。此外,電動車通常整合了最新的智慧技術,其日益普及極大地促進了該地區的市場擴張。

報告內容

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 汽車原廠設備製造商

- 半導體和技術提供者

- 軟體和安全解決方案提供商

- 技術整合商和服務提供者

- 最終用戶

- 利潤率分析

- 技術與創新格局

- 成本明細

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 車輛安全需求不斷成長

- 消費者對便利性和使用者體驗的需求日益增加

- 智慧科技的進步

- 自動駕駛汽車需求不斷成長

- 產業陷阱與挑戰

- 實施成本高

- 網路安全和資料隱私問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 免鑰匙進入系統

- 按鈕啟動系統

- 生物辨識系統

- 智慧型手機整合

- 遠端存取和追蹤

- 其他

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車

- 丙型肝炎病毒

- 越野車

第 7 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 車輛出入

- 車輛點火系統

- 遠端控制功能

- 車隊管理

- 停車輔助和入口控制

第 8 章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Alps Alpine

- Apple Inc

- Bosch

- Continental AG

- Denso Corporation

- Gentex Corporation

- Hella GmbH

- Hyundai

- Infineon Technologies

- Kiekert AG

- Magna International

- Marquardt Management SE

- Microchip Technology Inc.

- Mitsubishi

- NMB Technologies Corporation

- NXP Semiconductor

- Thales Group

- Valeo

The Global Automotive Smart Access System Market was valued at USD 16.6 billion in 2024 and is forecasted to grow at an impressive CAGR of 10.9% from 2025 to 2034. This robust growth is primarily driven by increasing concerns over vehicle break-ins, theft, and unauthorized access. In response, both consumers and automakers are prioritizing advanced security solutions to protect vehicles and their contents. Cutting-edge technologies such as biometric authentication, keyless entry, and remote vehicle tracking are being integrated to enhance protection. These systems employ state-of-the-art encryption and authentication methods, ensuring that only authorized individuals can access and operate vehicles.

Smart access systems are rapidly gaining traction due to their ability to enhance vehicle security, convenience, and user experience. The integration of advanced technologies such as IoT, Bluetooth Low Energy (BLE), NFC, and cloud-based solutions is transforming vehicles into highly connected and intelligent devices. Key features like biometric authentication, push-button start, keyless entry, and smartphone integration are revolutionizing the way drivers interact with their vehicles. These innovations eliminate the need for traditional keys, allowing users to unlock, start, and control their vehicles seamlessly, delivering unparalleled convenience and streamlining the driving experience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.6 Billion |

| Forecast Value | $45.2 Billion |

| CAGR | 10.9% |

The market is segmented by the technology utilized, including push-button start systems, keyless entry systems, biometric systems, smartphone integration, remote access and tracking, and more. In 2024, keyless entry systems dominated the market, capturing 27% of the share and generating significant momentum. By 2034, this segment is projected to reach USD 10 billion, fueled by the widespread adoption and effectiveness of these systems in delivering both security and convenience.

When segmented by vehicle type, the market encompasses passenger cars, commercial vehicles, and off-highway vehicles. Passenger cars held the largest share at 54.5% in 2024, driven by surging demand for advanced security and convenience features. As passenger cars represent the majority of the global vehicle fleet, smart access technologies like keyless entry, push-button start, and smartphone connectivity are becoming increasingly standard, catering to evolving consumer expectations.

The North America automotive smart access system market accounted for 32% of the global share in 2024, propelled by the region's advanced automotive industry and high consumer demand for premium, connected vehicles. With a strong emphasis on vehicle security and convenience, the adoption of features like keyless entry and biometric access continues to rise. Furthermore, the growing popularity of electric vehicles, which often integrate the latest smart technologies, is significantly contributing to market expansion in this region.

Report Content

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Automotive OEMs

- 3.2.2 Semiconductor and technology providers

- 3.2.3 Software and security solution providers

- 3.2.4 Technology integrators and service providers

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Cost breakdown

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for vehicle security

- 3.8.1.2 Increasing consumer demand for convenience and user experience

- 3.8.1.3 Advancements in smart technologies

- 3.8.1.4 Growing autonomous vehicles demand

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High costs of implementation

- 3.8.2.2 Cybersecurity and data privacy concerns

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Keyless entry system

- 5.3 Push-button start system

- 5.4 Biometric system

- 5.5 Smartphone integration

- 5.6 Remote access & tracking

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicle

- 6.3.1 LCV

- 6.3.2 HCV

- 6.4 Off highway vehicle

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Vehicle access

- 7.3 Vehicle ignition system

- 7.4 Remote control features

- 7.5 Fleet management

- 7.6 Parking assistance & entry control

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Alps Alpine

- 10.2 Apple Inc

- 10.3 Bosch

- 10.4 Continental AG

- 10.5 Denso Corporation

- 10.6 Gentex Corporation

- 10.7 Hella GmbH

- 10.8 Hyundai

- 10.9 Infineon Technologies

- 10.10 Kiekert AG

- 10.11 Magna International

- 10.12 Marquardt Management SE

- 10.13 Microchip Technology Inc.

- 10.14 Mitsubishi

- 10.15 NMB Technologies Corporation

- 10.16 NXP Semiconductor

- 10.17 Thales Group

- 10.18 Valeo