|

市場調查報告書

商品編碼

1665098

電動車低壓驅動系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測EV Low Voltage Drive System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

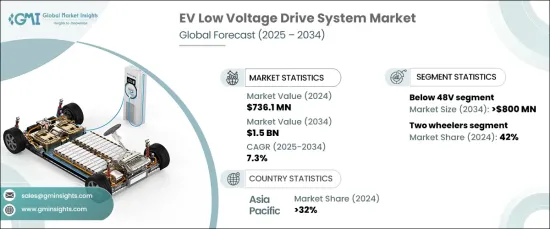

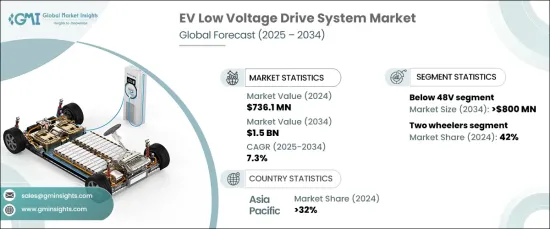

2024 年全球電動車低壓驅動系統市場價值為 7.361 億美元,預計 2025 年至 2034 年期間的複合年成長率為 7.3%。技術創新大大提高了逆變器、馬達控制器和電池管理系統(BMS)等關鍵零件的效率,使其更加緊湊、經濟高效、功能強大。這些改進提高了車輛性能、能源效率和行駛里程,而這些品質正是消費者在選擇電動車 (EV) 時越來越優先考慮的。

此外,隨著低壓驅動系統變得越來越經濟,製造商可以提供更多永續和節能的選擇,進一步推動市場擴張。由於環境法規越來越嚴格以及對綠色交通解決方案的需求日益成長,因此推廣電動車已成為多個地區的優先事項。隨著能源效率成為消費者關注的重點,電動車低壓驅動系統市場持續成長,為產業利害關係人帶來了新的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.361 億美元 |

| 預測值 | 15億美元 |

| 複合年成長率 | 7.3% |

市場依電壓分為三類:48V 以下、48V 至 60V 和 60V 以上。 2024 年,48V 以下市場佔據 57% 的主導佔有率,預計到 2034 年將創造 8 億美元的產值。 該市場因其成本效益而受到青睞,使其成為二輪車和輕度混合動力汽車等小型電動車的理想選擇。 48V 系統在電動二輪車(包括電動滑板車和電動自行車)中的廣泛使用對於保持該領域的市場領先地位起著關鍵作用,尤其是在成本敏感的城市交通解決方案中。

從車輛類型來看,市場分為乘用車、商用車、二輪車和非公路用車。 2024 年,二輪車市場將佔據 42% 的強勁佔有率,這一趨勢是由對環保、經濟、高效的交通解決方案日益成長的需求所推動的。都市化進程的加速,尤其是在新興經濟體,導致人們對電動二輪車的偏好增加,而電動二輪車被視為傳統內燃機車的實用替代品。這些車輛不僅有助於環境的永續發展,而且還有助於減少人口稠密城市的交通堵塞和污染。

亞太地區是電動車低壓驅動系統市場的領先地區,到 2024 年將佔據 32% 的市場佔有率。政府推動電動車發展的激勵措施,加上對永續發展的日益重視,進一步推動了電動車基礎設施的擴張。尤其是向電動二輪車的轉變,成為該地區成長的重要推動力,使其成為全球市場的重要參與者。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 原物料供應商

- 零件製造商

- 物流和配送供應商

- 最終用戶

- 利潤率分析

- 技術與創新格局

- 重要新聞及舉措

- 監管格局

- 定價分析

- 衝擊力

- 成長動力

- 電動車的普及率不斷上升

- 電力電子技術進步

- 越來越關注永續性和環境議題

- 成本效益和經濟效益

- 產業陷阱與挑戰

- 缺乏消費者意識

- 來自高壓系統的競爭

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按電壓,2021 - 2034 年

- 主要趨勢

- 低於48V

- 48V 至 60V

- 60V以上

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車

- 丙型肝炎病毒

- 二輪車

- 越野車

第7章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 逆變器

- 電池管理系統

- DC-DC 轉換器

- 電壓調節器

- 電力電子

- 其他

第 8 章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 純電動車 (BEV)

- 插電式混合動力車 (PHEV)

- 油電混合車 (HEV)

- 燃料電池電動車(FCEV)

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- ABB

- Allegro Microsystems

- Analog Devices

- Borgwarner

- Continental

- Delphi Technologies

- Eaton

- Infineon

- Lear

- Mahle

- Microchip Technology

- nanoFlowcell

- Renesas Electronics

- Semiconductor Components

- Sensata Technologies

- Valeo

- ZF Friedrichshafen

The Global EV Low Voltage Drive System Market was valued at USD 736.1 million in 2024 and is projected to grow at a CAGR of 7.3% from 2025 to 2034. This robust growth can be attributed to several key factors, notably the ongoing advancements in power electronics. Technological innovations have greatly enhanced the efficiency of critical components such as inverters, motor controllers, and battery management systems (BMS), making them more compact, cost-effective, and powerful. These improvements have resulted in better vehicle performance, increased energy efficiency, and longer driving ranges-qualities that consumers increasingly prioritize when choosing electric vehicles (EVs).

Additionally, as low-voltage drive systems become more affordable, manufacturers can offer more sustainable and energy-efficient options, further driving market expansion. EV adoption has become a priority in several regions due to stricter environmental regulations and the growing demand for green transportation solutions. As energy efficiency becomes a major focal point for consumers, the market for low-voltage drive systems in electric vehicles continues to grow, presenting new opportunities for stakeholders in the industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $736.1 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 7.3% |

The market is segmented by voltage into three categories: below 48V, 48V to 60V, and above 60V. In 2024, the below 48V segment held a dominant 57% market share and is expected to generate USD 800 million by 2034. This segment is favored for its cost-effectiveness, making it ideal for smaller electric vehicles such as two-wheelers and mild hybrid vehicles. The widespread use of 48V systems in electric two-wheelers, including e-scooters and e-bikes, plays a pivotal role in maintaining the segment's market leadership, especially in cost-sensitive urban transport solutions.

Looking at vehicle types, the market is divided into passenger cars, commercial vehicles, two-wheelers, and off-highway vehicles. In 2024, the two-wheeler segment held a strong 42% share, a trend driven by the growing demand for eco-friendly, affordable, and efficient transportation solutions. The rise of urbanization, particularly in emerging economies, has led to an increased preference for electric two-wheelers, which are seen as a practical alternative to traditional internal combustion engine vehicles. These vehicles not only contribute to environmental sustainability but also help reduce traffic congestion and pollution in densely populated cities.

Asia-Pacific is the leading region in the EV low voltage drive system market, accounting for 32% of the market share in 2024. The region's dominance in EV production and adoption is largely due to the strong growth of electric two-wheelers and smaller electric vehicles. Government incentives promoting electric mobility, coupled with a growing commitment to sustainability, have further fueled the expansion of EV infrastructure. The shift toward electric two-wheelers, in particular, has been a significant driver of growth in this region, making it a key player in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturer

- 3.2.3 Logistics and distribution providers

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising adoption of EVs

- 3.8.1.2 Technological advancements in power electronics

- 3.8.1.3 Growing focus on sustainability and environmental concerns

- 3.8.1.4 Cost efficiency and economic benefits

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Lack of consumer awareness

- 3.8.2.2 Competition from high-voltage systems

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Voltage, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Below 48V

- 5.3 48V to 60V

- 5.4 Above 60V

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicle

- 6.3.1 LCV

- 6.3.2 HCV

- 6.4 Two wheeler

- 6.5 Off highway vehicle

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Inverter

- 7.3 Battery management system

- 7.4 DC-DC converters

- 7.5 Voltage regulators

- 7.6 Power electronics

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Battery electric vehicles (BEV)

- 8.3 Plug-in hybrid electric vehicles (PHEV)

- 8.4 Hybrid electric vehicles (HEV)

- 8.5 Fuel cell electric vehicles (FCEV)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Allegro Microsystems

- 10.3 Analog Devices

- 10.4 Borgwarner

- 10.5 Continental

- 10.6 Delphi Technologies

- 10.7 Eaton

- 10.8 Infineon

- 10.9 Lear

- 10.10 Mahle

- 10.11 Microchip Technology

- 10.12 nanoFlowcell

- 10.13 Renesas Electronics

- 10.14 Semiconductor Components

- 10.15 Sensata Technologies

- 10.16 Valeo

- 10.17 ZF Friedrichshafen