|

市場調查報告書

商品編碼

1665099

正庚烷市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測n-Heptane Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

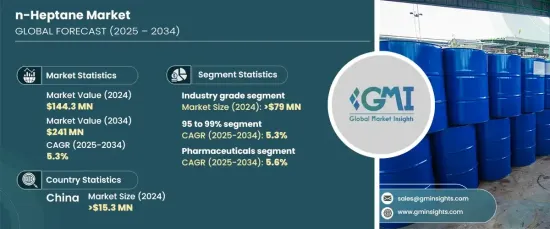

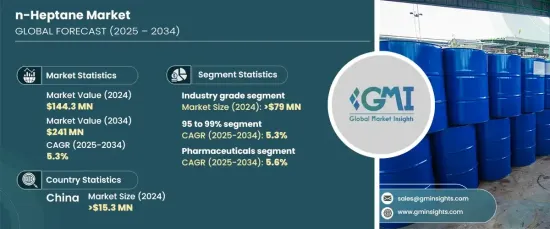

2024 年全球正庚烷市場價值達到 1.443 億美元,預計 2025 年至 2034 年期間將實現強勁成長,複合年成長率為 5.3%。這一成長得益於工業需求的不斷成長、應用範圍的不斷擴大以及汽車、製藥和化學品等各個領域的重大發展。正庚烷用途廣泛,在化學過程和燃料測試中被廣泛用作溶劑,這使其成為眾多行業中不可或缺的材料。隨著主要經濟體的需求不斷成長,市場有望穩步擴張,特別是在工業基礎設施強大的國家。此外,對研究和產品創新的日益關注將有助於市場的發展。隨著產業尋求高效、高性能材料,正庚烷的應用將持續發展,進一步推動市場成長。

2024 年,工業級細分市場引領正庚烷市場,估值達到 7,900 萬美元,預計到 2034 年複合年成長率為 5.1%。工業級正庚烷常用於黏合劑、塗料和燃料測試,可為非關鍵應用提供可靠的性能。此外,它在化學合成和橡膠製造方面發揮關鍵作用,尤其是在工業框架完善的地區。它在這些領域的廣泛應用有助於保持其在市場上的強勢地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.443億美元 |

| 預測值 | 2.41億美元 |

| 複合年成長率 | 5.3% |

2024 年,純度為 95% 至 99% 的市場佔據主導地位,創造了 7,210 萬美元的收入,預計到 2034 年的複合年成長率為 5.3%。它廣泛用於實驗室的分析目的和化學合成,這些場合高精度是至關重要的。此外,它在燃料性能測試和藥物配方中的作用凸顯了其在需要高精度和卓越品質的領域中的重要作用。

中國已成為亞太正庚烷市場的重要參與者,到 2024 年貢獻 1,530 萬美元,預測期內預期成長率為 6.3%。中國強勁的化學工業和汽車工業是需求激增的驅動力。中國快速擴張的工業基礎,加上都市化和基礎設施的改善,鞏固了在全球正庚烷市場的地位。隨著黏合劑、塗料、醫藥等領域的應用不斷增加,中國的市場潛力持續成長。

在工業擴張、產品進步和各類應用對高品質溶劑的需求不斷成長的推動下,正庚烷市場可望大幅成長。隨著產業不斷優先考慮性能,正庚烷在製造和研究過程中的重要性將不斷提高,鞏固其在全球市場的地位。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 實驗室和工業應用對高純度溶劑的需求不斷增加

- 不斷成長的能源需求推動石化測試

- 擴大製藥和黏合劑製造業

- 產業陷阱與挑戰

- 限制使用揮發性有機化合物 (VOC) 的嚴格環境法規

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依等級,2021-2034 年

- 主要趨勢

- 工業級

- 醫藥級

第 6 章:市場估計與預測:按純度,2021-2034 年

- 主要趨勢

- <95%

- 95 至 99%

- ≥99%

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 藥品

- 油漆和塗料

- 電子產品

- 黏合劑和密封劑

- 塑膠和聚合物

- 化學合成

- 其他

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Chevron Phillips Chemical

- Chuzhou Runda Solvents

- DHC Solvent Chemie

- Gadiv Petrochemical Industries

- Haltermann Carless Deutschland

- Hanwha Total Petrochemical

- Henan Haofei Chemical

- Liaoning Yufeng Chemical

- Mehta Petro-Refineries

- Royal Dutch Shell

- Sankyo Chemical

- Shenyang Huifeng Petrochemical

- SK Global Chemical

The Global N-Heptane Market reached a valuation of USD 144.3 million in 2024, and it is expected to experience robust growth with a CAGR of 5.3% from 2025 to 2034. This growth is being fueled by rising industrial demand, an expanding range of applications, and significant developments in various sectors, including automotive, pharmaceuticals, and chemicals. N-heptane's versatility and wide adoption as a solvent in chemical processes and fuel testing make it indispensable across numerous industries. With its growing demand in key economies, the market is positioned for steady expansion, particularly in countries with strong industrial infrastructures. Furthermore, the increasing focus on research and product innovations will contribute to the market development. As industries seek efficient and high-performance materials, n-heptane's applications will continue to evolve, further driving market growth.

In 2024, the industry-grade segment led the n-heptane market, reaching a valuation of USD 79 million, and it is expected to grow at a CAGR of 5.1% through 2034. This segment's dominance is attributed to its cost-effectiveness and suitability for a range of industrial processes. Often utilized in adhesives, coatings, and fuel testing, the industry-grade n-heptane offers reliable performance for non-critical applications. Additionally, it plays a key role in chemical synthesis and rubber manufacturing, especially in regions with a well-established industrial framework. Its broad usage across these sectors helps maintain its strong position in the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $144.3 Million |

| Forecast Value | $241 Million |

| CAGR | 5.3% |

The 95% to 99% purity segment dominated the market in 2024, generating USD 72.1 million in revenue, with a projected CAGR of 5.3% through 2034. N-heptane within this purity range is highly sought after due to its ability to meet the rigorous demands of industries requiring precise formulations. It is widely used in laboratories for analytical purposes and chemical synthesis, where high accuracy is paramount. Furthermore, its role in fuel performance testing and pharmaceutical formulations highlights its essential use in sectors that require high precision and exceptional quality.

China has emerged as a key player in the Asia-Pacific n-heptane market, contributing USD 15.3 million in 2024, with an expected growth rate of 6.3% during the forecast period. The country's robust chemical and automotive industries are the driving force behind this surge in demand. China's rapidly expanding industrial base, coupled with urbanization and improved infrastructure, strengthens its position in the global n-heptane market. With increasing applications in sectors like adhesives, coatings, and pharmaceuticals, China's market potential continues to grow.

The n-heptane market is poised for substantial growth, driven by industrial expansion, product advancements, and the increasing demand for high-quality solvents in various applications. As industries continue to prioritize performance, n-heptane's significance in manufacturing and research processes will continue to rise, solidifying its place in the global marketplace.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for high-purity solvents in laboratories and industrial applications

- 3.6.1.2 Rising energy demands fueling petrochemical testing

- 3.6.1.3 Expansion of the pharmaceutical and adhesive manufacturing industries

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Stringent environmental regulations restricting the use of volatile organic compounds (VOCs)

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Grade, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Industry grade

- 5.3 Pharmaceutical grade

Chapter 6 Market Estimates & Forecast, By Purity, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 <95%

- 6.3 95 to 99%

- 6.4 ≥99%

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Pharmaceuticals

- 7.3 Paints & coatings

- 7.4 Electronics

- 7.5 Adhesives & sealants

- 7.6 Plastic & polymers

- 7.7 Chemical synthesis

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Chevron Phillips Chemical

- 9.2 Chuzhou Runda Solvents

- 9.3 DHC Solvent Chemie

- 9.4 Gadiv Petrochemical Industries

- 9.5 Haltermann Carless Deutschland

- 9.6 Hanwha Total Petrochemical

- 9.7 Henan Haofei Chemical

- 9.8 Liaoning Yufeng Chemical

- 9.9 Mehta Petro-Refineries

- 9.10 Royal Dutch Shell

- 9.11 Sankyo Chemical

- 9.12 Shenyang Huifeng Petrochemical

- 9.13 SK Global Chemical