|

市場調查報告書

商品編碼

1665188

藥物發現資訊學市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Drug Discovery Informatics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

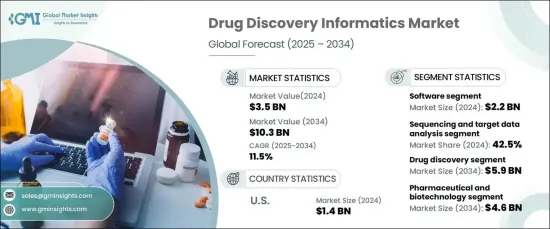

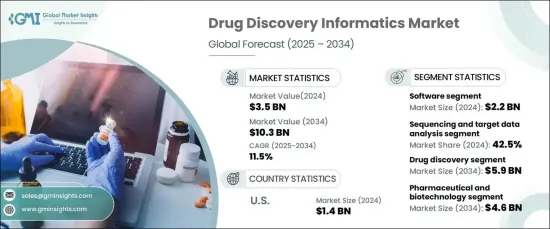

2024 年全球藥物發現資訊學市場價值為 35 億美元,預計 2025 年至 2034 年期間的複合年成長率將達到驚人的 11.5%。

慢性病發病率的上升和對精準醫療的日益重視,推動了創新資訊工具的採用,以簡化藥物發現流程、提高效率並促進突破性治療。在基因和分子分析技術進步的推動下,個人化治療方法的轉變進一步增加了對複雜資訊學解決方案的需求。這些技術在識別生物標記、實現患者分層和提高藥物開發成果方面發揮關鍵作用。隨著製藥業繼續優先考慮效率和創新,預計市場將保持強勁的成長軌跡。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 35億美元 |

| 預測值 | 103億美元 |

| 複合年成長率 | 11.5% |

研發方面的投資大大促進了旨在最佳化藥物研發工作流程的資訊平台的採用。隨著製藥公司投入大量資源開發尖端療法,資訊工具在管理目標識別、先導最佳化和臨床資料整合等複雜流程中變得不可或缺。這些平台分析大型資料集、整合多組學資料和支持精準醫療計劃的能力正在改變藥物發現的模式。這些進步促進了針對特定患者的治療方法的發展,滿足了全球對個人化醫療解決方案日益成長的需求。

市場按產品類型細分為軟體和服務,其中軟體部分占主導地位,到 2024 年將達到 22 億美元。它們在支持精準醫療方面發揮關鍵作用,精準醫療需要詳細的基因組學、蛋白質組學和臨床資料分析,這凸顯了它們日益成長的重要性。這些工具使研究人員能夠發現針對患者的具體見解並加速創新療法的開發,從而進一步推動市場成長。

依照功能,市場包括定序和目標資料分析、對接、分子建模等。 2024年,定序和目標資料分析佔據了42.5%的市場佔有率,突顯了其對基因組學和表觀基因組學研究的變革性影響。下一代定序 (NGS) 和高通量技術徹底改變了基因變異的識別,為新型藥物標靶提供了關鍵見解。這些進步提高了藥物開發的效率,為更精準、更有效的治療鋪平了道路。

美國仍然是藥物發現資訊學市場的主導者,到 2024 年其市場規模將達到 14 億美元。政府措施和強勁的私人資金正在推動個人化醫療、基因組學和生物製劑的進步。根據個人基因特徵制定治療方案的重點繼續推動對先進資訊學工具的需求,鞏固了美國作為藥物研發進步中心的地位。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 個人化醫療需求日益成長

- 藥物研發方面的研發投入不斷增加

- 慢性病盛行率不斷上升

- 雲端運算和人工智慧的技術進步

- 產業陷阱與挑戰

- 資訊學工具和實施成本高昂

- 資料整合和管理的複雜性

- 成長動力

- 成長潛力分析

- 監管格局

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按產品類型,2021 年至 2034 年

- 主要趨勢

- 軟體

- 服務

第6章:市場估計與預測:按功能,2021 – 2034 年

- 主要趨勢

- 定序和目標資料分析

- 對接

- 分子建模

- 其他功能

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 藥物研發

- 藥物開發

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 製藥和生物技術公司

- 合約研究組織 (CRO)

- 學術和研究機構

- 其他最終用戶

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Accenture

- Agilent Technologies

- Albany Molecular Research

- Boehringer Ingelheim International

- Charles River Laboratories

- Collaborative Drug Discovery

- Eurofins Scientific

- Illumina

- Jubilant Life Sciences

- Novo Informatics

- Oracle Corporation

- Selvita

The Global Drug Discovery Informatics Market, valued at USD 3.5 billion in 2024, is projected to grow at an impressive CAGR of 11.5% between 2025 and 2034. This rapid expansion is fueled by escalating investments in research and development across pharmaceutical and biotechnology sectors, with a particular focus on advancing treatments in oncology, infectious diseases, and personalized medicine.

The rising prevalence of chronic conditions and the increasing emphasis on precision medicine are driving the adoption of innovative informatics tools that streamline drug discovery processes, improve efficiency, and facilitate groundbreaking therapies. The shift toward personalized treatment approaches, underpinned by advancements in genetic and molecular profiling, is further amplifying the demand for sophisticated informatics solutions. These technologies play a pivotal role in identifying biomarkers, enabling patient stratification, and enhancing outcomes in drug development. As the pharmaceutical industry continues to prioritize efficiency and innovation, the market is expected to maintain a robust growth trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $10.3 Billion |

| CAGR | 11.5% |

Investments in R&D have significantly boosted the adoption of informatics platforms designed to optimize workflows in drug discovery. With pharmaceutical companies channeling substantial resources into developing cutting-edge therapies, informatics tools are becoming indispensable in managing complex processes such as target identification, lead optimization, and clinical data integration. The ability of these platforms to analyze large datasets, integrate multi-omics data, and support precision medicine initiatives is transforming the drug discovery landscape. These advancements enable the development of patient-specific treatments, addressing the growing global demand for personalized healthcare solutions.

The market is segmented by product type into software and services, with the software segment dominating at USD 2.2 billion in 2024. Software solutions are integral to modern drug discovery, managing intricate processes, and analyzing extensive datasets. Their critical role in supporting precision medicine, which requires detailed genomic, proteomic, and clinical data analysis, underscores their growing importance. These tools empower researchers to uncover patient-specific insights and accelerate the development of innovative therapies, further driving market growth.

By functionality, the market includes sequencing and target data analysis, docking, molecular modeling, and others. In 2024, sequencing and target data analysis captured 42.5% of the market share, highlighting its transformative impact on genomic and epigenomic research. Next-generation sequencing (NGS) and high-throughput technologies have revolutionized the identification of genetic variations, offering critical insights into novel drug targets. These advancements are enhancing the efficiency of drug development and paving the way for more precise and effective treatments.

The United States remains a dominant player in the drug discovery informatics market, achieving USD 1.4 billion in 2024. The country's leadership stems from its high prevalence of chronic diseases and extensive investments in drug discovery innovation. Government initiatives and robust private funding are propelling advancements in personalized medicine, genomics, and biologics. The focus on tailoring treatments to individual genetic profiles continues to drive demand for advanced informatics tools, solidifying the US as a hub for drug discovery advancements.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for personalized medicine

- 3.2.1.2 Rising research and development investments in drug discovery

- 3.2.1.3 Growing prevalence of chronic disease

- 3.2.1.4 Technological advancement in cloud computing and AI

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of informatics tools and implementation

- 3.2.2.2 Complexity of data integration and management

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

Chapter 6 Market Estimates and Forecast, By Functionality, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Sequencing and target data analysis

- 6.3 Docking

- 6.4 Molecular modeling

- 6.5 Other functionalities

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Drug discovery

- 7.3 Drug development

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 Contract research organizations (CROs)

- 8.4 Academic and research institutes

- 8.5 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Accenture

- 10.2 Agilent Technologies

- 10.3 Albany Molecular Research

- 10.4 Boehringer Ingelheim International

- 10.5 Charles River Laboratories

- 10.6 Collaborative Drug Discovery

- 10.7 Eurofins Scientific

- 10.8 Illumina

- 10.9 Jubilant Life Sciences

- 10.10 Novo Informatics

- 10.11 Oracle Corporation

- 10.12 Selvita