|

市場調查報告書

商品編碼

1665194

汽車電動壓縮機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive E-Compressor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

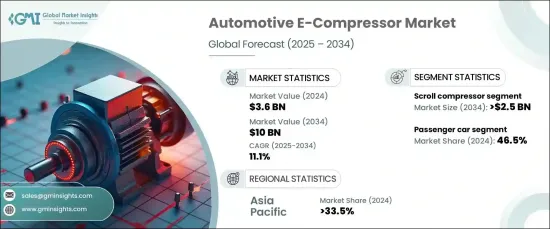

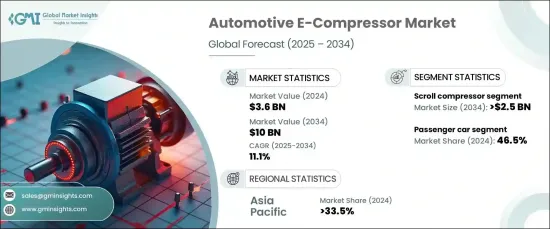

2024 年全球汽車電動壓縮機市場價值為 36 億美元,將經歷顯著成長,預計 2025 年至 2034 年的複合年成長率為 11.1%。 這一成長主要得益於對先進熱管理系統日益成長的需求,而熱管理系統正成為現代電動汽車 (EV) 和混合動力汽車的重要組成部分。隨著這些車輛的不斷發展,管理電池、電動馬達、駕駛室和電力電子設備等關鍵零件的溫度對於實現最佳性能變得越來越重要。汽車電動壓縮機在該系統中發揮關鍵作用,因其能源效率以及顯著減少對內燃機 (ICE) 驅動的傳統機械壓縮機的依賴的能力而受到高度重視。這種技術轉變與汽車產業對永續和節能解決方案的更廣泛推動相一致,進一步加速了市場成長。

汽車電動壓縮機市場按壓縮機類型細分,包括渦旋式、旋轉式、往復式、螺桿式等。 2024 年,渦旋壓縮機佔據了 33% 的市場佔有率,預計到 2034 年將創造 25 億美元的產值。這些特性使它們特別適合用於空間效率和性能至關重要的電動和混合動力汽車。渦旋壓縮機背後的技術涉及兩個螺旋形渦旋,其中一個保持靜止,而另一個以圓週運動移動以壓縮冷媒。這個過程可確保高效率和降低噪音水平,這是提高電動車和混合動力車的舒適性和功能性的關鍵因素。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 36億美元 |

| 預測值 | 100億美元 |

| 複合年成長率 | 11.1% |

從車型角度來看,汽車電子壓縮機市場分為乘用車、商用車和非公路用車。 2024 年,乘用車佔據最大的市場佔有率,為 46.5%。這種主導地位很大程度上是由於電動和混合動力汽車越來越受歡迎,其中乘用車引領了向更環保的交通解決方案的轉變。在這些車輛中,電子壓縮機比傳統的皮帶驅動壓縮機更節能,可確保更好的熱管理,同時最大限度地降低能耗。與內燃機汽車(由引擎驅動空調)不同,電動車依靠由車輛電池和電動馬達供電的電子壓縮機。

受該地區電動車產業快速擴張的推動,亞太地區將在 2024 年佔據全球汽車電動壓縮機市場的 33.5%。尤其是在中國,在政府補貼、稅收優惠和減少碳排放政策等強力措施的支持下,中國已成為最大的電動車生產國和消費國。隨著比亞迪、蔚來、小鵬、吉利等中國主要汽車製造商在電動車開發和銷售方面處於領先地位,該地區的汽車電動壓縮機市場將在未來幾年繼續成長。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 原物料供應商

- 零件製造商

- 技術提供者

- 最終用戶

- 利潤率分析

- 技術與創新格局

- 成本明細

- 重要新聞及舉措

- 監管格局

- 定價分析

- 衝擊力

- 成長動力

- 電動車普及率激增

- 壓縮機技術的進步

- 消費者對高階功能的需求

- 更加關注熱管理系統

- 產業陷阱與挑戰

- 電動壓縮機的初始成本高

- 技術和整合挑戰

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按壓縮機,2021 - 2034 年

- 主要趨勢

- 捲動

- 旋轉

- 往復式

- 擰緊

- 其他

第 6 章:市場估計與預測:按冷凍能力,2021 - 2034 年

- 主要趨勢

- 低容量(5kW以下)

- 中等容量(5-10 kW)

- 高容量(10kW以上)

第 7 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 客艙空調

- 電池熱管理

- 動力傳動系統冷卻

- 電動傳動系統冷卻

- 其他

第 8 章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 電的

- 混合

第 9 章:市場估計與預測:按車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 越野車

- 掀背車

- 商用車

- 輕型商用車

- 丙型肝炎病毒

- 越野車

第 10 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Bosch

- Boyard Compressor

- Denso

- Elgi Equipment

- Gardner Denver

- Garrett

- Guchen Industry

- Hanon Systems

- Highly Marelli

- Infineon

- Mahle

- Mitsubishi

- Novosense

- Sanden

- Siroco

- TCCI

- Toyota

- Valeo

- Vikas Group

- ZF Friedrichshafen

The Global Automotive E-Compressor Market, valued at USD 3.6 billion in 2024, is set to experience remarkable growth, with an expected CAGR of 11.1% from 2025 to 2034. This growth is largely driven by the increasing demand for advanced thermal management systems, which are becoming an essential component in modern electric vehicles (EVs) and hybrids. As these vehicles continue to evolve, managing the temperature of critical components such as batteries, electric motors, cabins, and power electronics has become increasingly important for optimal performance. Automotive e-compressors, which play a pivotal role in this system, are highly valued for their energy efficiency and their ability to significantly reduce reliance on traditional mechanical compressors powered by internal combustion engines (ICEs). This shift in technology aligns with the broader push towards sustainable and energy-efficient solutions in the automotive industry, further accelerating market growth.

The market for automotive e-compressors is segmented by compressor type, including scroll, rotary, reciprocating, screw, and others. In 2024, the scroll compressor segment commanded a substantial 33% market share and is projected to generate USD 2.5 billion by 2034. Scroll compressors are particularly favored for their reliability, quiet operation, and compact design, making them ideal for modern automotive applications. These features make them especially suitable for use in electric and hybrid vehicles, where space efficiency and performance are paramount. The technology behind scroll compressors involves two spiral-shaped scrolls, one of which remains stationary while the other moves in a circular motion to compress refrigerant. This process ensures high efficiency and reduced noise levels, critical factors for improving the comfort and functionality of EVs and hybrids.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $10 Billion |

| CAGR | 11.1% |

Looking at the market from a vehicle type perspective, the automotive e-compressor market is divided into passenger cars, commercial vehicles, and off-highway vehicles. In 2024, passenger cars represented the largest segment with a 46.5% market share. This dominance is largely due to the increasing popularity of electric and hybrid vehicles, with passenger cars leading the transition to more eco-friendly transportation solutions. In these vehicles, e-compressors offer a more energy-efficient alternative to traditional belt-driven compressors, ensuring better thermal management while minimizing energy consumption. Unlike ICE-powered vehicles, where the engine drives the air conditioning, electric vehicles rely on e-compressors powered by the vehicle's battery and electric motor.

Asia Pacific held a 33.5% share of the global automotive e-compressor market in 2024, driven by rapid expansion in the region's electric vehicle industry. China, in particular, has become the largest producer and consumer of electric vehicles, supported by strong government initiatives including subsidies, tax incentives, and policies aimed at reducing carbon emissions. With major Chinese automakers like BYD, NIO, XPeng, and Geely leading the charge in EV development and sales, the region's automotive e-compressor market is poised for continued growth in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360º synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Technology providers

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Cost breakdown

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Pricing analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Surge in EV adoption

- 3.9.1.2 Advancements in compressor technology

- 3.9.1.3 Consumer demand for advanced features

- 3.9.1.4 Increased focus on thermal management systems

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial cost of electric compressors

- 3.9.2.2 Technological and integration challenges

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Compressor, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Scroll

- 5.3 Rotary

- 5.4 Reciprocating

- 5.5 Screw

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Cooling Capacity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Low capacity (Below 5 kW)

- 6.3 Medium capacity (5-10 kW)

- 6.4 High capacity (Above 10 kW)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Cabin air conditioning

- 7.3 Battery thermal management

- 7.4 Powertrain cooling

- 7.5 Electric drivetrain cooling

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Electric

- 8.3 Hybrid

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Passenger cars

- 9.2.1 Sedan

- 9.2.2 SUV

- 9.2.3 Hatchback

- 9.3 Commercial vehicle

- 9.3.1 LCV

- 9.3.2 HCV

- 9.4 Off highway vehicle

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Bosch

- 11.2 Boyard Compressor

- 11.3 Denso

- 11.4 Elgi Equipment

- 11.5 Gardner Denver

- 11.6 Garrett

- 11.7 Guchen Industry

- 11.8 Hanon Systems

- 11.9 Highly Marelli

- 11.10 Infineon

- 11.11 Mahle

- 11.12 Mitsubishi

- 11.13 Novosense

- 11.14 Sanden

- 11.15 Siroco

- 11.16 TCCI

- 11.17 Toyota

- 11.18 Valeo

- 11.19 Vikas Group

- 11.20 ZF Friedrichshafen