|

市場調查報告書

商品編碼

1665236

女性健康應用市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Women's Health App Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

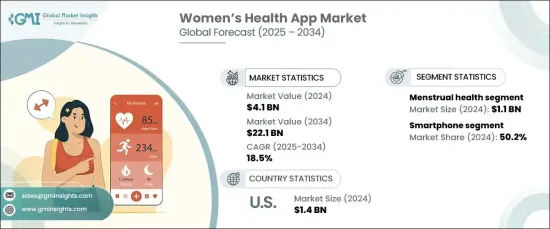

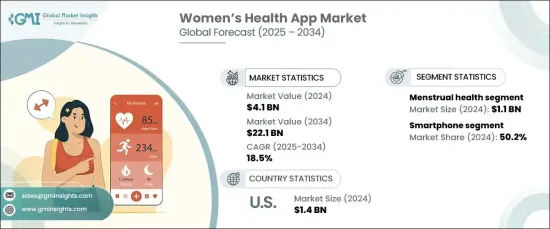

2024 年全球女性健康應用市場價值為 41 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 18.5%。這些應用程式提供廣泛的功能,包括追蹤月經週期、管理生殖健康、支持產後護理、監測懷孕、健身、營養、更年期和疾病管理的工具。隨著世界越來越注重健康,女性健康應用程式已成為追蹤和改善整體健康狀況的重要工具。

人們對女性健康的認知不斷提高,對女性健康應用市場的成長起著關鍵作用。隨著社會越來越重視預防性醫療保健並減少圍繞女性健康主題的恥辱感,越來越多的女性開始轉向數位平台來管理自己的健康。這些應用程式的可訪問性、便利性和個人化使其成為希望掌控自己健康的女性的一個有吸引力的選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 41億美元 |

| 預測值 | 221億美元 |

| 複合年成長率 | 18.5% |

在市場區隔方面,女性健康應用市場分為幾個關鍵領域,包括疾病管理、月經健康、懷孕追蹤和產後護理、健身和營養、更年期等。其中,月經健康領域在 2024 年引領市場,創造了 11 億美元的收入。預計該部分在整個預測期內將繼續保持強勁成長。月經健康應用程式滿足了女性有效管理月經週期的基本需求。這些應用程式允許使用者追蹤她們的月經週期,預測排卵期,並檢測異常情況,所有這些對於生殖健康至關重要。人們對月經健康認知的不斷增強,加上對主動健康管理的日益關注,導致使用這些應用程式的用戶數量激增。

就模式而言,市場分為平板電腦、智慧型手機和其他設備。智慧型手機市場在 2024 年佔據 50.2% 的市場佔有率,預計將繼續保持上升趨勢。智慧型手機因其廣泛的使用和無與倫比的便利性而主導著女性健康應用市場。隨著智慧型手機的普及,它們為健康管理提供了高度便攜和多功能的平台。用戶可以輕鬆存取設定的提醒和健康見解,接收即時通知,並將健康管理無縫融入日常生活。

在美國,女性健康應用市場在 2024 年創造了 14 億美元的產值,預計未來幾年將經歷顯著成長。人們對女性健康問題(如荷爾蒙失調、骨關節炎、貧血和其他慢性病)的認知不斷提高,推動了該地區對健康應用程式的需求。智慧型手機的廣泛普及加上技術的進步也促進了市場的擴張。隨著越來越多的美國女性轉向數位工具進行健康管理,市場將繼續快速成長,並為改善女性健康和保健提供更多創新解決方案。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 增強健康意識

- 智慧型手機普及率不斷上升

- 技術進步

- 越來越重視預防性醫療保健

- 產業陷阱與挑戰

- 資料隱私和安全問題

- 成長動力

- 成長潛力分析

- 監管格局

- 美國

- 歐洲

- 技術格局

- 未來市場趨勢

- 重要新聞和舉措

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 月經健康

- 健身與營養

- 懷孕追蹤和產後護理

- 停經

- 疾病管理

- 其他類型

第 6 章:市場估計與預測:按模式,2021 年至 2034 年

- 主要趨勢

- 智慧型手機

- 藥片

- 其他方式

第 7 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Apple

- Clue

- Fitbit

- Flo Health

- Glow

- GP International

- Grace Health

- Kegg

- LactApp

- Natural Cycles USA

- Ovia Health

- Tia

- Wildflower Health

- Withings

The Global Womens Health App Market was valued at USD 4.1 billion in 2024 and is projected to grow at an impressive CAGR of 18.5% from 2025 to 2034. Womens health apps are specialized software applications designed to enhance various aspects of women's health and well-being. These apps offer a wide range of features, including tools for tracking menstrual cycles, managing reproductive health, supporting postpartum care, monitoring pregnancy, fitness, nutrition, menopause, and disease management. As the world shifts towards a more health-conscious mindset, women's health apps have become a vital tool for tracking and improving overall wellness.

The rising awareness about womens health is playing a pivotal role in the growth of the womens health app market. As society places more importance on preventive healthcare and reduces the stigma surrounding women's health topics, increasing numbers of women are turning to digital platforms to manage their health. The accessibility, convenience, and personalization of these apps make them an attractive option for women looking to take charge of their well-being.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $22.1 Billion |

| CAGR | 18.5% |

In terms of market segmentation, the womens health app market is categorized into several key areas, including disease management, menstrual health, pregnancy tracking and postpartum care, fitness and nutrition, menopause, and others. Among these, the menstrual health segment led the market in 2024, generating USD 1.1 billion in revenue. This segment is expected to continue experiencing strong growth throughout the forecast period. Menstrual health apps address an essential need for women to manage menstrual cycles effectively. These apps allow users to track their periods, predict ovulation, and detect irregularities, all of which are critical for reproductive health. Growing awareness of menstrual health, coupled with an increased focus on proactive health management, has led to a surge in the number of users turning to these apps.

When it comes to modality, the market is divided into tablet, smartphone, and other devices. The smartphone segment, which held a dominant 50.2% share of the market in 2024, is expected to continue its upward trajectory. Smartphones dominate the womens health app market due to their widespread use and unmatched convenience. With smartphones being universally accessible, they provide a highly portable and multifunctional platform for health management. Users can easily access set reminders and health insights, receive real-time notifications, and seamlessly integrate health management into their everyday lives.

In the U.S., the womens health app market generated USD 1.4 billion in 2024 and is forecast to experience significant growth over the coming years. Increased awareness of women's health issues, such as hormonal imbalances, osteoarthritis, anemia, and other chronic conditions, is driving demand for health apps in the region. The widespread adoption of smartphones, coupled with advancements in technology, is also contributing to the market's expansion. As more women in the U.S. turn to digital tools for health management, the market is set to continue its rapid growth, offering even more innovative solutions for improving women's health and wellness.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased health awareness

- 3.2.1.2 Rising smartphone adoption

- 3.2.1.3 Technological advancements

- 3.2.1.4 Rising focus on preventive healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy and security concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Key news and initiatives

- 3.8 Gap analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Menstrual health

- 5.3 Fitness and nutrition

- 5.4 Pregnancy tracking and postpartum care

- 5.5 Menopause

- 5.6 Disease management

- 5.7 Other types

Chapter 6 Market Estimates and Forecast, By Modality, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Smartphone

- 6.3 Tablet

- 6.4 Other modalities

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Apple

- 8.2 Clue

- 8.3 Fitbit

- 8.4 Flo Health

- 8.5 Glow

- 8.6 Google

- 8.7 GP International

- 8.8 Grace Health

- 8.9 Kegg

- 8.10 LactApp

- 8.11 Natural Cycles USA

- 8.12 Ovia Health

- 8.13 Tia

- 8.14 Wildflower Health

- 8.15 Withings