|

市場調查報告書

商品編碼

1665269

肌肉強化設備市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Muscle Strengthening Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

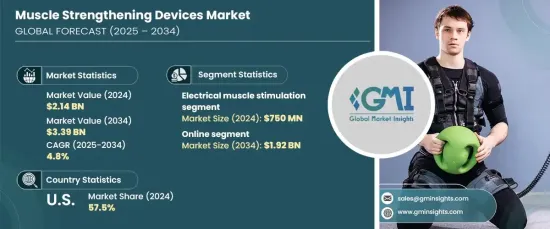

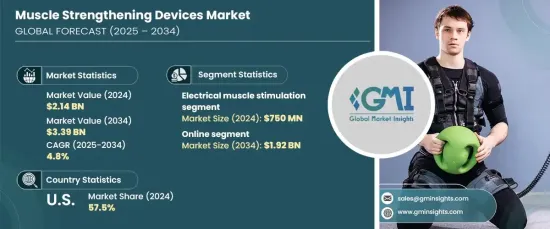

2024 年全球肌肉強化設備市場價值為 21.4 億美元,預計將經歷強勁成長,2025 年至 2034 年的複合年成長率為 4.8%。人們越來越注重健康生活,健身器材的技術進步也隨之提高,同時人們越來越關注居家運動解決方案,所有這些都促進了市場穩步上升。

在各種設備類型中,市場分為電肌肉刺激 (EMS)、振動機、阻力帶和其他設備。 EMS 設備在 2024 年以 7.5 億美元的估值引領市場,預計到 2034 年將達到 12.2 億美元。 EMS 設備透過使用電脈衝來誘發肌肉收縮,模擬傳統肌力訓練的效果。它們節省時間、易於使用和適應性強,成為尋求高效鍛鍊替代方案的使用者的首選解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 21.4億美元 |

| 預測值 | 33.9 億美元 |

| 複合年成長率 | 4.8% |

市場也根據分銷管道進行細分,其中線上和線下部分佔據了相當大的佔有率。 2024 年,線上銷售佔據了 54.49% 的市場佔有率,預計到 2034 年將成長到 19.2 億美元。向電子商務的轉變清晰地反映了消費者習慣的不斷演變,提供了輕鬆的購買體驗並提高了產品的可及性。此外,誘人的配送方式和促銷折扣也推動了網路銷售的主導地位,鞏固了其作為肌肉強化器材首選配銷通路的地位。

在美國,肌肉強化設備市場在 2024 年佔據 57.5% 的佔有率,預計在預測期內以 5.4% 的複合年成長率成長。這種成長是由人們對健身、身體調理和整體身體表現的高度關注所推動的。美國受益於高度重視健康和健身的文化,擁有大量的運動員、健身愛好者和復健患者,推動了對先進訓練工具的需求。此外,老年人擴大採用這些設備來保持肌肉健康和恢復,這呈現出明顯的趨勢,進一步反映了人口結構向積極老化的轉變。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 提高健康和健身意識

- 居家體適能解決方案日益普及

- 健身器材的技術進步

- 產業陷阱與挑戰

- 缺乏認知和教育

- 來自傳統運動方式的競爭

- 成長動力

- 成長潛力分析

- 消費者行為分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按設備,2021 年至 2034 年

- 主要趨勢

- 電肌肉刺激 (EMS)

- 振動機

- 阻力帶

- 其他

第6章:市場估計與預測:按價格 2021-2034

- 主要趨勢

- 低的

- 中等的

- 高的

第 7 章:市場估計與預測:按應用 2021-2034

- 主要趨勢

- 肌肉強化與調理

- 康復和恢復

- 預防傷害

- 減脂塑身

- 改善姿勢

- 提升運動表現

- 其他

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 健身愛好者

- 運動員和運動專業人士

- 復健患者

- 老年人或長者

- 其他

第 9 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 大賣場/超市

- 專賣店

- 其他

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Bowflex

- Cybex

- Dick's Sporting Goods

- Hibbett Sports

- Life Fitness

- Marcy

- Matrix Fitness

- NordicTrack

- Peloton

- Precor

- ProForm

- Sole Fitness

- Spirit Fitness

- Technogym

- Torque Fitness

The Global Muscle Strengthening Devices Market was valued at USD 2.14 billion in 2024 and is projected to experience robust growth, expanding at a CAGR of 4.8% from 2025 to 2034. As awareness of the importance of health and fitness continues to rise, more consumers are prioritizing strength training and muscle conditioning as essential components of overall wellness and rehabilitation. This surge in health-conscious living is complemented by technological advancements in fitness devices, alongside a growing focus on home-based exercise solutions, all contributing to the market's steady upward trajectory.

Among the various device types, the market is categorized into electrical muscle stimulation (EMS), vibration machines, resistance bands, and other devices. EMS devices led the market with a valuation of USD 750 million in 2024 and are forecasted to reach USD 1.22 billion by 2034. These devices are particularly popular due to their effectiveness, versatility, and ability to provide targeted muscle stimulation, making them a top choice for both fitness enthusiasts and rehabilitation programs. EMS devices work by using electrical impulses to induce muscle contractions, simulating the effects of traditional strength training exercises. Their time-saving nature, ease of use, and adaptability have positioned them as a preferred solution for users seeking efficient workout alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.14 Billion |

| Forecast Value | $3.39 Billion |

| CAGR | 4.8% |

The market is also segmented based on distribution channels, with online and offline segments capturing significant shares. In 2024, online sales accounted for 54.49% of the market share and are expected to grow to USD 1.92 billion by 2034. The increasing preference for online shopping has played a pivotal role in this growth, offering customers unmatched convenience, the ability to compare products easily, and access to comprehensive customer reviews. This shift towards e-commerce is a clear reflection of evolving consumer habits, providing an effortless purchasing experience and increasing product accessibility. Moreover, attractive delivery options and promotional discounts have contributed to online sales' dominance, solidifying its role as the preferred distribution channel for muscle strengthening devices.

In the United States, the muscle strengthening devices market accounted for a 57.5% share in 2024 and is anticipated to grow at a CAGR of 5.4% during the forecast period. This growth is driven by a heightened focus on fitness, body toning, and overall physical performance. The U.S. benefits from a culture that highly values health and fitness, with a strong base of athletes, fitness aficionados, and rehabilitation patients fueling demand for advanced training tools. Additionally, there is a noticeable trend among older adults increasingly adopting these devices to maintain muscle health and recovery, further reflecting the broader demographic shift toward active aging.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier Landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing health and fitness awareness

- 3.6.1.2 Rising popularity of home fitness solution

- 3.6.1.3 Technological advancements in fitness devices

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Lack of awareness and education

- 3.6.2.2 Competition from traditional exercise methods

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Consumer behavior analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Device, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Electrical muscle stimulation (EMS)

- 5.3 Vibration machines

- 5.4 Resistance bands

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Price 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By Application 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Muscle strengthening and conditioning

- 7.3 Rehabilitation and recovery

- 7.4 Injury prevention

- 7.5 Fat loss and body toning

- 7.6 Posture improvement

- 7.7 Sports performance enhancement

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Fitness enthusiasts

- 8.3 Athletes and sports professionals

- 8.4 Rehabilitation patients

- 8.5 Elderly or seniors

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company website

- 9.3 Offline

- 9.3.1 Hypermarket/supermarket

- 9.3.2 Specialty stores

- 9.3.3 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 United States

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 United Kingdom

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East & Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 United Arab Emirates

Chapter 11 Company Profiles

- 11.1 Bowflex

- 11.2 Cybex

- 11.3 Dick's Sporting Goods

- 11.4 Hibbett Sports

- 11.5 Life Fitness

- 11.6 Marcy

- 11.7 Matrix Fitness

- 11.8 NordicTrack

- 11.9 Peloton

- 11.10 Precor

- 11.11 ProForm

- 11.12 Sole Fitness

- 11.13 Spirit Fitness

- 11.14 Technogym

- 11.15 Torque Fitness