|

市場調查報告書

商品編碼

1665315

陸基遙控武器站市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Land-Based Remote Weapon Station Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

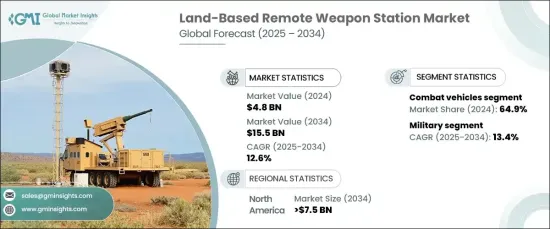

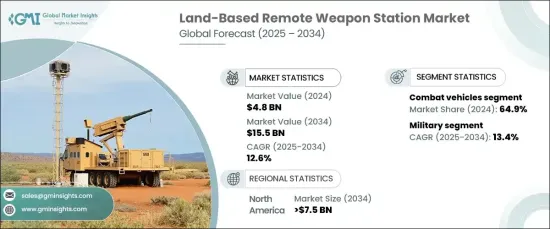

全球陸基遙控武器站市場預計將在 2024 年達到 48 億美元,預計在 2025 年至 2034 年期間將以 12.6% 的強勁複合年成長率成長。隨著各國優先提高戰鬥力和部隊安全,自動化和遙控武器系統的採用正在重塑現代戰爭。這些系統具有卓越的精度,降低了操作員的風險,並在製定作戰策略中發揮至關重要的作用。

市場按平台分類,其中戰鬥車輛佔據主導地位,到 2024 年將佔據 64.9% 的主導佔有率。整合在戰鬥車輛中的遙控武器站 (RCWS) 使操作員能夠安全地待在車內並高精度地攻擊目標。這些系統對於提供進攻和防禦能力至關重要,使其成為現代裝甲平台不可或缺的一部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 48億美元 |

| 預測值 | 155億美元 |

| 複合年成長率 | 12.6% |

從應用方面來看,陸基遙控武器站市場分為軍事領域與國土安全領域。軍事領域是成長最快的領域,預計到 2034 年複合年成長率將達到 13.4%。遙控武器站是裝甲車、國防卡車和固定軍事設施的重要組成部分。這些系統不僅增強了監視和瞄準的準確性,而且還縮短了反應時間,同時最大限度地減少了人員暴露在惡劣環境中的時間。它們的廣泛部署凸顯了它們在提高部隊安全和戰鬥力方面發揮的重要作用。

在北美,陸基遙控武器站市場規模預計到 2034 年將達到 75 億美元。尤其是美國,它正在引領這一潮流,將先進的遙控系統整合到其裝甲車和國防基礎設施中。這些系統中人工智慧和自動化的使用日益增多,進一步推動了創新,增強了定位能力,並提高了營運效率。對自主防禦技術的持續投資正在加強該地區的防禦態勢並應對不斷演變的安全挑戰。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 現代戰爭對精確瞄準的需求不斷增加

- 增加對先進陸基防禦系統的軍事投資

- 遠端作業系統日益被採用以保障士兵安全

- 技術進步增強了武器系統的互通性和效率

- 地緣政治緊張局勢推動先進軍事裝備採購

- 產業陷阱與挑戰

- 先進武器系統的高開發和整合成本

- 影響全球市場機會的監管與出口挑戰

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按平台,2021-2034 年

- 主要趨勢

- 戰鬥車輛

- 主戰坦克

- 步兵戰車

- 裝甲戰車

- 無人地面車輛

- 其他

- 固定結構

第 6 章:市場估計與預測:按武器類型,2021 年至 2034 年

- 主要趨勢

- 致命武器

- 小口徑

- 5.56 毫米

- 7.62 毫米

- 12.7 毫米

- 中口徑

- 20 毫米

- 25 毫米

- 30 毫米

- 40 毫米

- 小口徑

- 非致命武器

第 7 章:市場估計與預測:按移動性,2021 年至 2034 年

- 主要趨勢

- 固定的

- 移動

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 軍隊

- 國土安全

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Aselsan AS

- BAE Systems

- Bharat Electronics Limited (BEL)

- Copenhagen Sensor Technology

- Elbit Systems Ltd.

- EVPU Defense

- FN Herstal

- General Dynamics Corporation

- Hornet

- Israel Aerospace Industries (IAI)

- Kongsberg Gruppen

- Leonardo SpA

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems

- Raytheon Technologies Corporation

- Rheinmetall AG

- Saab AB

- Singapore Technologies Engineering Ltd.

- Thales Group

The Global Land-Based Remote Weapon Station Market is projected to reach USD 4.8 billion in 2024 and is expected to grow at a robust CAGR of 12.6% from 2025 to 2034. The market growth is largely driven by the rising demand for advanced defense systems and the ongoing modernization of military forces. As nations prioritize enhancing combat effectiveness and troop safety, the adoption of automated and remote-controlled weapon systems is reshaping modern warfare. These systems offer superior precision, reduce the risk to operators, and play a crucial role in evolving combat strategies.

The market is categorized by platform, with combat vehicles taking the lead, holding a dominant share of 64.9% in 2024. This segment continues to expand as the need for enhanced firepower, situational awareness, and protection against emerging threats intensifies. Remote-controlled weapon stations (RCWS) integrated into combat vehicles allow operators to engage targets with high accuracy while remaining securely inside the vehicle. These systems are key to providing both offensive and defensive capabilities, making them an indispensable part of modern armored platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.8 billion |

| Forecast Value | $15.5 billion |

| CAGR | 12.6% |

In terms of application, the land-based remote weapon station market is divided into military and homeland security sectors. The military segment is the fastest-growing, expected to increase at a CAGR of 13.4% through 2034. Demand for force protection, precision targeting, and overall operational efficiency is driving this growth. Remote weapon stations are critical components of armored vehicles, defense trucks, and fixed military installations. These systems not only enhance surveillance and targeting accuracy but also improve response times, all while minimizing the exposure of personnel to hostile environments. Their widespread deployment underscores their vital role in enhancing troop safety and combat performance.

In North America, the land-based remote weapon station market is forecasted to reach USD 7.5 billion by 2034. This growth is fueled by significant defense spending and ongoing investments in military modernization. The United States, in particular, is leading the charge by integrating advanced remote-controlled systems into its armored vehicles and defense infrastructure. The increasing use of artificial intelligence and automation in these systems is further driving innovation, boosting targeting capabilities, and improving operational efficiency. Continued investments in autonomous defense technologies are strengthening the region's defense posture and addressing evolving security challenges.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for precision targeting in modern warfare operations

- 3.6.1.2 Increasing military investments in advanced land-based defense systems

- 3.6.1.3 Growing adoption of remote-operated systems for soldier safety

- 3.6.1.4 Technological advancements enhancing weapon system interoperability and efficiency

- 3.6.1.5 Geopolitical tensions driving procurement of advanced military equipment

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High development and integration costs for advanced weapon systems

- 3.6.2.2 Regulatory and export challenges impacting global market opportunities

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Platform, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Combat Vehicles

- 5.2.1 Main battle tanks

- 5.2.2 Infantry fighting vehicles

- 5.2.3 Armored fighting vehicles

- 5.2.4 Unmanned ground vehicles

- 5.2.5 Others

- 5.3 Stationary Structures

Chapter 6 Market Estimates & Forecast, By Weapon Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Lethal Weapons

- 6.2.1 Small Caliber

- 6.2.1.1 5.56mm

- 6.2.1.2 7.62mm

- 6.2.1.3 12.7mm

- 6.2.2 Medium Caliber

- 6.2.3 20mm

- 6.2.4 25mm

- 6.2.5 30mm

- 6.2.6 40mm

- 6.2.1 Small Caliber

- 6.3 Non-lethal Weapons

Chapter 7 Market Estimates & Forecast, By Mobility, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Fixed

- 7.3 Moving

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Military

- 8.3 Homeland Security

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aselsan A.S.

- 10.2 BAE Systems

- 10.3 Bharat Electronics Limited (BEL)

- 10.4 Copenhagen Sensor Technology

- 10.5 Elbit Systems Ltd.

- 10.6 EVPU Defense

- 10.7 FN Herstal

- 10.8 General Dynamics Corporation

- 10.9 Hornet

- 10.10 Israel Aerospace Industries (IAI)

- 10.11 Kongsberg Gruppen

- 10.12 Leonardo S.p.A.

- 10.13 Northrop Grumman Corporation

- 10.14 Rafael Advanced Defense Systems

- 10.15 Raytheon Technologies Corporation

- 10.16 Rheinmetall AG

- 10.17 Saab AB

- 10.18 Singapore Technologies Engineering Ltd.

- 10.19 Thales Group