|

市場調查報告書

商品編碼

1665328

播種機及撒播機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Seed Drill and Broadcast Seeder Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

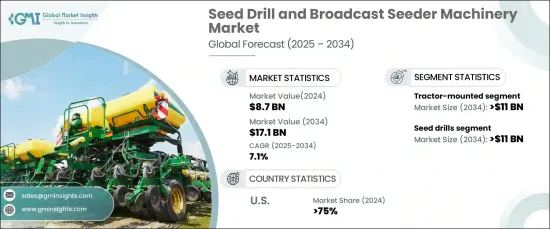

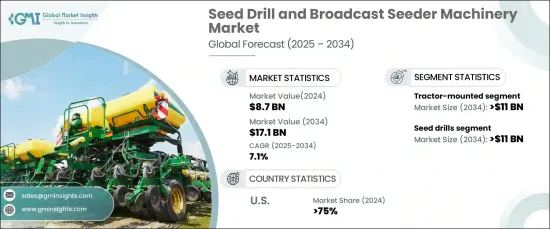

2024 年全球播種機和撒播機機械市場規模將達到 87 億美元,預計 2025 年至 2034 年期間將以 7.1% 的強勁複合年成長率成長。條播機和撒播機是滿足這一需求的重要工具,它們透過提高種植效率、降低成本、最佳化作物產量來滿足不斷成長的糧食需求,從而顯著提高糧食安全。

2024 年,播種機佔據市場主導地位,佔有 65% 以上的佔有率。預計到 2034 年,該領域的規模將達到 110 億美元。變數播種、GPS 導航和即時資料系統等功能正在推動種子放置的改進,根據土壤條件最佳化播種率,並最終提高作物產量。人工智慧感測器進一步增強了深度控制、間距和養分分佈,提供更智慧、更精確的種植解決方案。此外,智慧連接可以實現即時監控、田間測繪和數據驅動的決策,從而創造更有效率、更永續的農業方法。隨著永續發展的推動力不斷加大,對先進、資源高效的播種機的需求持續上升。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 87億美元 |

| 預測值 | 171億美元 |

| 複合年成長率 | 7.1% |

市場還根據推進類型進行細分,選項包括曳引機安裝、手動/手動操作和自走式系統。其中,曳引機搭載市場預計到 2034 年將創造 110 億美元。這些曳引機安裝的系統非常適合免耕和少耕等保護性農業實踐,有助於保持土壤健康並減少侵蝕。該領域的創新重點是輕質材料、節能設計以及與電動和混合動力曳引機的兼容性,符合監管標準並促進永續農業技術。

在美國,播種機和撒播機械市場在 2024 年佔據了 75% 的主導佔有率。新型電動和氫動力模型融合了人工智慧(AI)、電腦視覺和精密 GPS,正在推動種植過程的重大改進。這些先進的機器能夠在播種過程中進行即時調整,最佳化種植效率。機器學習技術正在進一步增強對不同現場條件的適應性,解決勞動力短缺問題,降低營運成本並提高生產力。對尖端農業設備的持續投資正在推動市場成長並激發該領域的創新。

報告內容

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 設備製造商

- 經銷商

- 技術提供者

- 系統整合商

- 最終用戶

- 利潤率分析

- 技術差異化

- GPS 和 GNSS 導航系統

- 變數播種 (VRS)

- 自主播種機

- 即時資料監控

- 其他

- 成本明細分析

- 製造成本

- 原料

- 勞動成本

- 研發費用

- 行銷和分銷成本

- 售後服務費用

- 其他

- 製造成本

- 重要新聞和舉措

- 專利分析

- 監管格局

- 衝擊力

- 成長動力

- 全球糧食安全需求

- 精準農業技術的應用日益廣泛

- 農業設備經濟效率的需求日益成長

- 對永續農業的偏好正在改變

- 產業陷阱與挑戰

- 土壤相容性限制

- 初期投資成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按設備,2021 - 2034 年

- 主要趨勢

- 播種機

- 單碟

- 雙碟

- 空氣種子

- 肥料種子

- 廣播播種機

- 掛載廣播

- 拖曳式

- 自走式

第 6 章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 手動/手操

- 曳引機懸掛

- 自走式

第 7 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 穀物

- 豆類

- 油籽

- 草類

- 覆蓋作物

第 8 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 個體農戶

- 農業承包商

- 政府/研究機構

第 9 章:市場估計與預測:按銷售管道,2021 - 2034 年

- 主要趨勢

- 線上

- 離線

第 10 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- AGCO

- Amazonen Werke

- Bourgault Industries

- BUPL (FieldKing)

- Claas

- CNH Industrial

- Great Plains

- Horsch

- John Deere

- Kubota

- Kuhn

- Kverneland Group

- Landforce

- Lemken

- Mahindra & Mahindra

- Morris Equipment

- National Agro Industries

- Pottinger

- Tume

- Väderstad

- Yanmar

- Zoomlion

The Global Seed Drill And Broadcast Seeder Machinery Market reached USD 8.7 billion in 2024 and is projected to grow at a robust CAGR of 7.1% from 2025 to 2034. The increasing global population, expected to hit 9.7 billion by 2050, is fueling the demand for greater agricultural productivity. Seed drills and broadcast seeders are essential tools in meeting this demand, significantly enhancing food security by improving planting efficiency, lowering costs, and optimizing crop yields to satisfy growing food requirements.

In 2024, seed drills dominated the market, capturing over 65% of the share. This segment is anticipated to reach USD 11 billion by 2034. The rapid advancements in precision agriculture technologies are revolutionizing the seed drill market. Features like variable rate seeding, GPS guidance, and real-time data systems are driving improvements in seed placement, optimizing seeding rates according to soil conditions, and ultimately boosting crop yields. AI-powered sensors further enhance depth control, spacing, and nutrient distribution, offering smarter, more precise planting solutions. Additionally, smart connectivity enables real-time monitoring, field mapping, and data-driven decision-making, creating a more efficient and sustainable farming approach. As the push for sustainability continues to intensify, the demand for advanced, resource-efficient seed drills remains on the rise.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.7 billion |

| Forecast Value | $17.1 billion |

| CAGR | 7.1% |

The market is also segmented by propulsion type, with options including tractor-mounted, manual/hand-operated, and self-propelled systems. Among these, the tractor-mounted segment is expected to generate USD 11 billion by 2034. Manufacturers are prioritizing sustainability by developing seed drills that feature reduced carbon footprints, improved fuel efficiency, and minimized soil impact. These tractor-mounted systems are well-suited for conservation agriculture practices such as no-till and reduced-till farming, helping to preserve soil health and reduce erosion. Innovations in this space focus on lightweight materials, energy-efficient designs, and compatibility with electric and hybrid tractors, aligning with regulatory standards and promoting sustainable farming techniques.

In the U.S., the seed drill and broadcast seeder machinery market held a dominant 75% share in 2024. The country is witnessing a surge in the adoption of autonomous and robotic seed drill technologies. New electric and hydrogen-powered models, integrated with artificial intelligence (AI), computer vision, and precision GPS, are driving significant improvements in the planting process. These advanced machines enable real-time adjustments during seeding, optimizing planting efficiency. Machine learning technologies are further enhancing adaptability to diverse field conditions, addressing labor shortages, reducing operational costs, and increasing productivity. Continued investments in cutting-edge agricultural equipment are fueling market growth and spurring innovation in the sector.

Report Content

Chapter 1 Methodology and Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Equipment manufacturers

- 3.2.2 Distributors

- 3.2.3 Technology providers

- 3.2.4 System integrators

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Technology differentiators

- 3.4.1 GPS and GNSS guidance systems

- 3.4.2 Variable rate seeding (VRS)

- 3.4.3 Autonomous seeding machines

- 3.4.4 Real-time data monitoring

- 3.4.5 Others

- 3.5 Cost breakdown analysis

- 3.5.1 Manufacturing costs

- 3.5.1.1 Raw materials

- 3.5.1.2 Labor costs

- 3.5.2 R & D costs

- 3.5.3 Marketing and distribution costs

- 3.5.4 After-sales service costs

- 3.5.5 Others

- 3.5.1 Manufacturing costs

- 3.6 Key news and initiatives

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Global demand for food security

- 3.9.1.2 Increasing adoption of precision agriculture technologies

- 3.9.1.3 Growing demand for economic efficiency for agriculture equipment

- 3.9.1.4 Changing preferences towards sustainable agriculture

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Soil compatibility constraints

- 3.9.2.2 High initial investment costs

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Seed drills

- 5.2.1 Single-disc

- 5.2.2 Double-disc

- 5.2.3 Air seed

- 5.2.4 Fertilizer seed

- 5.3 Broadcast seeders

- 5.3.1 Mounted-broadcast

- 5.3.2 Tow-behind

- 5.3.3 Self-propelled

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Manual/hand operated

- 6.3 Tractor-mounted

- 6.4 Self-propelled

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Cereals

- 7.3 Legumes

- 7.4 Oil seeds

- 7.5 Grasses

- 7.6 Cover crops

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Individual farmers

- 8.3 Agricultural contractors

- 8.4 Government/research institutes

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Online

- 9.3 Offline

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AGCO

- 11.2 Amazonen Werke

- 11.3 Bourgault Industries

- 11.4 BUPL (FieldKing)

- 11.5 Claas

- 11.6 CNH Industrial

- 11.7 Great Plains

- 11.8 Horsch

- 11.9 John Deere

- 11.10 Kubota

- 11.11 Kuhn

- 11.12 Kverneland Group

- 11.13 Landforce

- 11.14 Lemken

- 11.15 Mahindra & Mahindra

- 11.16 Morris Equipment

- 11.17 National Agro Industries

- 11.18 Pottinger

- 11.19 Tume

- 11.20 Väderstad

- 11.21 Yanmar

- 11.22 Zoomlion