|

市場調查報告書

商品編碼

1665365

車身膠帶市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Body Tape Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

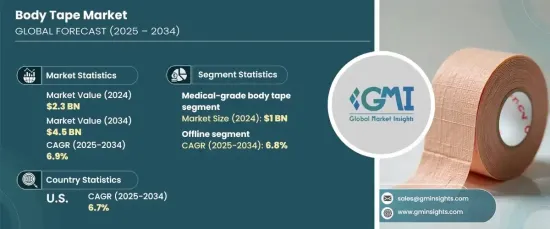

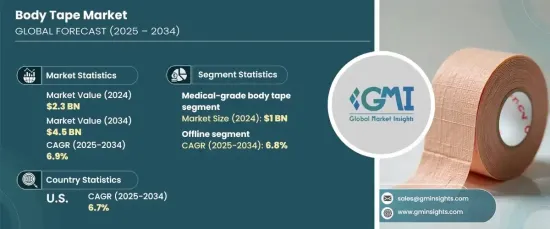

2024 年全球身體膠帶市場價值為 23 億美元,預計將大幅成長,預計 2025 年至 2034 年的複合年成長率為 6.9%。隨著服裝設計變得越來越創新和多樣化,身體膠帶可以透過固定無肩帶或露背服裝並打造時尚、精緻的外觀來解決服裝面臨的挑戰。新娘裝、禮服和運動服等領域的需求尤其強勁,因為功能性和美觀性同樣重要。

除了時尚領域以外,身體膠帶市場在運動和醫療領域的應用也日益廣泛。在運動中,運動機能學和運動膠帶因其預防傷害、支撐肌肉和提高運動表現的能力而越來越受歡迎。這些膠帶以其靈活性、耐用性和在劇烈體力活動中的彈性而聞名,已成為運動員的必備裝備。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 45億美元 |

| 複合年成長率 | 6.9% |

市場分為單面身體膠帶、雙面身體膠帶和醫用級身體膠帶。其中,醫用級身體膠帶領域脫穎而出,2024 年的收入將達到 10 億美元。醫用級身體膠帶因其卓越的黏合性、防過敏材料和皮膚友好特性而受到青睞。在全球範圍內,慢性疾病的發生率不斷上升以及外科手術數量的不斷增加進一步推動了對這些膠帶的需求,使得它們在醫療保健環境中變得不可或缺。

就分銷管道而言,市場分為線上和線下部分。線下零售佔 58.5% 的市場佔有率,預計到 2034 年將以 6.8% 的複合年成長率成長。這些網點提供即時的產品訪問,允許觸覺評估,並提供專家指導,使其成為值得信賴的選擇,特別是對於醫用級和時尚身體膠帶而言。

美國身體膠帶市場在全球處於領先地位,2024 年的市佔率達到驚人的 73.9%。美國市場預計在預測期內將以 6.7% 的穩定複合年成長率成長,鞏固其作為行業主要參與者的地位。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 消費者行為分析

- 衝擊力

- 成長動力

- 時尚服飾產業的需求不斷成長

- 在體育和醫療應用領域的應用日益廣泛

- 擴大電子商務和直銷管道

- 產業陷阱與挑戰

- 皮膚敏感和過敏反應

- 激烈的競爭與眾多替代方案的出現

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 單面身體膠帶

- 雙面身體膠帶

- 醫用級身體膠帶

第 6 章:市場估計與預測:按材料,2021 年至 2034 年

- 主要趨勢

- 棉布

- 矽酮

- 丙烯酸纖維

- 合成的

- 其他

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 個人

- 商業的

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 時尚服飾

- 醫療保健

- 化妝品和美容

- 其他

第 9 章:市場估計與預測:按價格,2021 年至 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 10 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 電子商務網站

- 公司網站

- 離線

- 專賣店

- 超市/大賣場

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 12 章:公司簡介

- 3M

- Adhex Technologies

- Avery Dennison

- Berry Global

- Booby Tape

- Braza

- DermaMed Coatings

- Easylife

- Fashion Forms

- Fearless Tape

- Hollywood Fashion Secrets

- Kinesio

- Maidenform

- Nitto Denko

- Scapa Group

The Global Body Tape Market, valued at USD 2.3 billion in 2024, is poised for significant growth, with a projected CAGR of 6.9% from 2025 to 2034. This expansion is fueled by the dynamic growth of the fashion and apparel industry, where body tape has become a must-have accessory. As clothing designs grow more innovative and versatile, body tape addresses wardrobe challenges by securing strapless or backless outfits and creating a sleek, polished appearance. The demand is particularly strong in segments like bridal wear, formal attire, and activewear, where functionality and aesthetics are equally important.

Beyond fashion, the body tape market is experiencing rising adoption in sports and medical applications. In sports, kinesiology and athletic tapes are gaining popularity for their ability to prevent injuries, support muscles, and enhance athletic performance. Known for their flexibility, durability, and resilience under intense physical activity, these tapes have become essential gear for athletes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 6.9% |

The market is segmented into single-sided body tape, double-sided body tape, and medical-grade body tape. Among these, the medical-grade body tape segment stands out, accounting for USD 1 billion in revenue in 2024. This segment is forecasted to grow at a CAGR of 7.1% during the forecast period, thanks to its critical role in wound care, surgical support, and therapeutic applications. Medical-grade body tape is favored for its superior adhesive qualities, hypoallergenic materials, and skin-friendly properties. The rising prevalence of chronic health conditions and an increasing number of surgical procedures globally are further driving demand for these tapes, making them indispensable in healthcare settings.

When it comes to distribution channels, the market is divided into online and offline segments. The offline segment commands a 58.5% market share and is expected to grow at a CAGR of 6.8% through 2034. Physical retail outlets maintain their dominance due to consumer preferences for in-store shopping. These outlets provide immediate product access, allow tactile evaluation, and offer expert guidance, making them a trusted choice, especially for medical-grade and fashion body tapes.

The U.S. body tape market leads the global landscape, holding a remarkable 73.9% share in 2024. This dominance is attributed to the country's advanced healthcare system, high volume of surgical procedures, and extensive use of medical-grade body tapes. The U.S. market is anticipated to grow at a steady CAGR of 6.7% over the forecast period, reinforcing its position as a key player in the industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Consumer behavior analysis

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing demand in the fashion and apparel industry

- 3.6.1.2 Rising adoption in sports and medical applications

- 3.6.1.3 Expansion of e-commerce and direct-to-consumer channels

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Skin sensitivity and allergic reactions

- 3.6.2.2 Intense competition and availability of alternatives

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Single-sided body tape

- 5.3 Double-sided body tape

- 5.4 Medical-grade body tape

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Cotton

- 6.3 Silicone

- 6.4 Acrylic

- 6.5 Synthetic

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Individual

- 7.3 Commercial

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Fashion and apparel

- 8.3 Medical and healthcare

- 8.4 Cosmetics and beauty

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce site

- 10.2.2 Company website

- 10.3 Offline

- 10.3.1 Specialty stores

- 10.3.2 Supermarkets/hypermarkets

- 10.3.3 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 3M

- 12.2 Adhex Technologies

- 12.3 Avery Dennison

- 12.4 Berry Global

- 12.5 Booby Tape

- 12.6 Braza

- 12.7 DermaMed Coatings

- 12.8 Easylife

- 12.9 Fashion Forms

- 12.10 Fearless Tape

- 12.11 Hollywood Fashion Secrets

- 12.12 Kinesio

- 12.13 Maidenform

- 12.14 Nitto Denko

- 12.15 Scapa Group