|

市場調查報告書

商品編碼

1665403

智慧尾門市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Smart Tailgate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

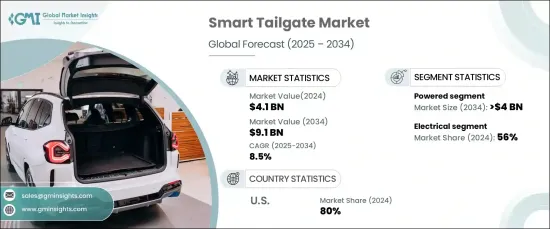

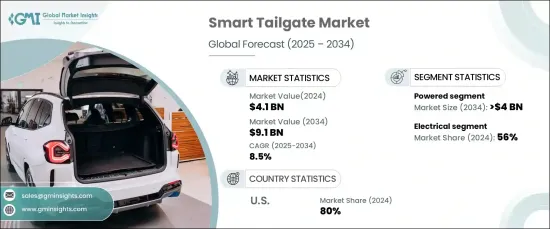

2024 年全球智慧尾門市場價值為 41 億美元,預計 2025 年至 2034 年期間的複合年成長率為 8.5%。汽車製造商正在不斷增強車輛介面以融入創新技術。具有自動開啟和關閉功能的智慧尾門系統可提供免持功能,這對於管理重物的使用者特別有用。強調使用者友善、技術先進的解決方案符合消費者對現代車輛更大便利性的偏好。

此外,SUV和跨界車等大型車輛的日益普及,大大推動了智慧尾門的普及。安全性和安保功能的增強也推動了市場的成長,因為這些系統透過整合感測器來檢測障礙物,從而降低了受傷或損壞的風險。車輛安全功能的不斷發展凸顯了這些技術在提高功能性和使用者滿意度方面的重要性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 41億美元 |

| 預測值 | 91億美元 |

| 複合年成長率 | 8.5% |

該市場分為手動、電動和免持三種選擇,其中電動部分將在 2024 年佔據超過 50% 的市場佔有率。電動智慧尾門與車輛的整合體現了汽車製造商為滿足不斷變化的期望和增強競爭優勢而做出的努力。

智慧尾門的機制包括電動系統、液壓系統和氣動系統。受消費者對易於操作和節能解決方案的需求推動,電氣系統在 2024 年佔據了 56% 的市場佔有率。這些系統透過按鈕操作開啟和關閉等功能簡化了後擋板控制。無縫、無線操作提高了效率和可及性,同時也滿足了人們對智慧、環保汽車日益成長的偏好。無鑰匙進入和遙控器等先進技術的加入進一步提高了使用者的便利性,增強了電動智慧尾門系統的吸引力。

在北美,美國在區域智慧尾門市場佔據主導地位,2024 年的佔有率高達 80%。消費者在購買汽車時優先考慮的是便利性和安全性,因此智慧尾門成為一種有價值的附加功能。這些系統方便人們輕鬆進入後車箱,滿足旅途中個人的需求。戶外生活方式和長途公路旅行的轉變繼續推動智慧尾門系統在該地區的普及。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 原物料供應商

- 零件供應商

- 製造商

- 配銷通路

- 最終用戶

- 供應商概況

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞及舉措

- 監管格局

- 成本分析

- 衝擊力

- 成長動力

- 提高車輛舒適性

- 消費者對便利性的期望不斷提高

- 車輛技術進步

- 不斷成長的豪華汽車市場

- 產業陷阱與挑戰

- 製造成本高

- 技術複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按供應量,2021 - 2034 年

- 主要趨勢

- 手動的

- 供電

- 免持

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 掀背車

- 轎車

- SUV

第 7 章:市場估計與預測:按機制,2021 - 2034 年

- 主要趨勢

- 電力

- 油壓

- 氣動

第 8 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳新銀行

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- Aisin Seiki

- Aptiv

- Bosch

- Brose

- Continental

- Ficosa

- Hella

- Huf Holding

- Johnson

- Kiekert

- Lear

- Magna

- Mitsuba

- Stabilus

- Zhejiang

The Global Smart Tailgate Market, valued at USD 4.1 billion in 2024, is projected to grow at a CAGR of 8.5% from 2025 to 2034. This expansion is largely driven by the increasing demand for advanced in-vehicle automation and convenience features. Automotive manufacturers are continuously enhancing vehicle interfaces to incorporate innovative technologies. Smart tailgate systems with automated opening and closing functions offer hands-free access, making them particularly useful for users managing heavy loads. The emphasis on user-friendly, tech-forward solutions aligns with consumer preferences for greater convenience in modern vehicles.

Additionally, the rising popularity of larger vehicles, such as SUVs and crossovers, has significantly boosted the adoption of smart tailgates. Safety and security enhancements also propel market growth, as these systems reduce the risk of injury or damage by integrating sensors to detect obstacles. The ongoing evolution of vehicle safety features highlights the importance of these technologies in improving functionality and user satisfaction.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $9.1 Billion |

| CAGR | 8.5% |

The market, segmented by offering into manual, powered, and hands-free options, saw the powered segment dominate with over 50% of the market share in 2024. By 2034, this segment is anticipated to surpass USD 4 billion, reflecting the growing consumer appetite for convenient, high-tech vehicle features. The integration of powered smart tailgates into vehicles demonstrates automakers' efforts to meet evolving expectations and enhance their competitive edge.

Mechanisms for smart tailgates include electrical, hydraulic, and pneumatic systems. Electrical systems held a 56% market share in 2024, driven by consumer demand for easily operable and energy-efficient solutions. These systems simplify tailgate control with features like button-operated opening and closing. The seamless, cordless operation improves efficiency and accessibility while aligning with the growing preference for smart, eco-friendly vehicles. The incorporation of advanced technologies like keyless entry and remote control further enhances user convenience and reinforces the appeal of electrical smart tailgate systems.

In North America, the United States dominated the regional smart tailgate market with an impressive 80% share in 2024. The rise in outdoor recreational activities, including camping and road trips, has led to increased demand for vehicles equipped with advanced features. Consumers prioritize convenience and safety when purchasing vehicles, making smart tailgates a valuable addition. These systems facilitate effortless access to the trunk, catering to the needs of individuals on the go. The shift towards outdoor-oriented lifestyles and longer road trips continues to drive the penetration of smart tailgate systems across the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 Distribution channel

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Cost analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing vehicle comfort features

- 3.9.1.2 Rising consumer convenience expectations

- 3.9.1.3 Technological advancements in vehicles

- 3.9.1.4 Growing automotive luxury segment

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High manufacturing costs

- 3.9.2.2 Technical complexity

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Manual

- 5.3 Powered

- 5.4 Hands-Free

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Hatchback

- 6.3 Sedan

- 6.4 SUVs

Chapter 7 Market Estimates & Forecast, By Mechanism, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Electrical

- 7.3 Hydraulic

- 7.4 Pneumatic

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 ANZ

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Aisin Seiki

- 9.2 Aptiv

- 9.3 Bosch

- 9.4 Brose

- 9.5 Continental

- 9.6 Ficosa

- 9.7 Hella

- 9.8 Huf Holding

- 9.9 Johnson

- 9.10 Kiekert

- 9.11 Lear

- 9.12 Magna

- 9.13 Mitsuba

- 9.14 Stabilus

- 9.15 Zhejiang