|

市場調查報告書

商品編碼

1666543

大豆籽萃取物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Glycine Soja (Soybean) Seed Extract Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

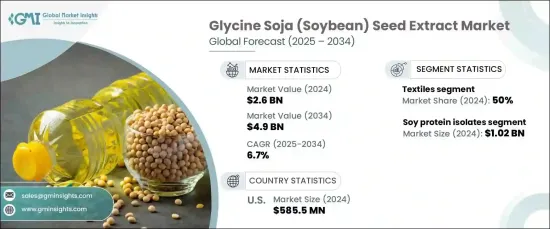

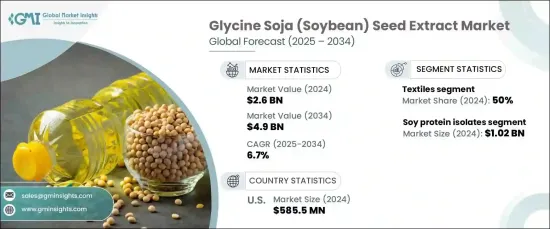

2024 年全球大豆籽萃取物市場價值估計為 26 億美元,預計 2025 年至 2034 年期間將實現 6.7% 的強勁成長率。隨著全球工業繼續優先考慮永續和高性能解決方案,大豆萃取物市場也在不斷發展以滿足這些需求。為了滿足消費者對天然和環保產品的偏好,公司在遵守嚴格的環境法規的同時,正在創新和開發更有效的配方。這些進步使大豆籽萃取物市場在競爭激烈、瞬息萬變的全球格局中佔據了長期成功的地位。

市場依產品類型細分,包括大豆異黃酮、大豆分離蛋白、大豆卵磷脂、皂苷和大豆磷脂。 2024 年,大豆分離蛋白將佔據主導地位,佔據 10.2 億美元的可觀市場。近年來,對這些大豆產品的需求激增,這主要歸功於它們在多個行業的廣泛應用。大豆卵磷脂因其出色的乳化性能而被廣泛應用於食品生產和藥品中,而大豆磷脂因其多功能性而在化妝品配方和膳食補充劑中的應用越來越廣泛,進一步推動了市場的成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 26億美元 |

| 預測值 | 49億美元 |

| 複合年成長率 | 6.7% |

根據應用,大豆籽萃取物市場分為化妝品和個人護理、食品和飲料、營養保健品和膳食補充劑、藥品和動物飼料等主要領域。紡織業在 2023 年佔據了 50% 的佔有率,仍然在市場上佔據主導地位。消費者對健康和保健的興趣日益濃厚,加速了大豆衍生產品在營養保健品、膳食補充劑和個人護理用品中的應用。蛋白質、ω-3脂肪酸和異黃酮等大豆主要成分因其眾多的健康益處而越來越受歡迎,從而推動了這些產業的擴張。

美國大豆籽萃取物市場尤其強勁,2024 年市場價值為 5.855 億美元。大豆在食品、化妝品和藥品等各個領域的適應性確保了其在市場上的持續重要性,進一步鞏固了美國在全球市場的領先地位。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 功能性食品和飲料的需求不斷成長

- 不斷成長的醫藥和營養保健品應用

- 不斷擴大的化妝品和個人護理市場

- 產業陷阱與挑戰

- 消費者認知和大豆過敏

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場規模及預測:依產品,2021-2034 年

- 主要趨勢

- 大豆分離蛋白(SPI)

- 大豆卵磷脂

- 大豆磷脂

- 大豆異黃酮

- 皂苷

第 6 章:市場規模與預測:按應用,2021-2034 年

- 主要趨勢

- 食品和飲料

- 營養保健品和膳食補充劑

- 化妝品和個人護理

- 動物飼料

- 藥品

第 7 章:市場規模及預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直接銷售

- 原料分銷商

- 網路零售商

第 8 章:市場規模與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Archer Daniels Midland Company

- BASF SE

- Bellatorra Skin Care

- Bio-alternatives

- Cargill

- Global Essence

- Grau Aromatics

- Ingredion Incorporated

- JF Natural Ingredients

- Lucas Meyer Cosmetics

- Natural Solution

- Symrise

- The Organic Pharmacy

- Wanrun Bio-Technology

The Global Glycine Soja (Soybean) Seed Extract Market, with an estimated value of USD 2.6 billion in 2024, is set to experience a robust growth rate of 6.7% CAGR from 2025 to 2034. Derived from soybeans, glycine soja seed extract is a powerhouse ingredient in the skincare and cosmetics industries, prized for its ability to hydrate the skin and provide antioxidant protection. As global industries continue to prioritize sustainable and high-performance solutions, the market for soybean-based extracts is evolving to meet these demands. In response to consumer preferences for natural and eco-friendly products, companies are innovating and developing more efficient formulations while adhering to strict environmental regulations. These advancements position the glycine soja seed extract market for long-term success in a competitive, rapidly changing global landscape.

The market is segmented by product type, including soy isoflavones, soy protein isolates, soy lecithin, saponins, and soybean phospholipids. In 2024, soy protein isolates lead the charge, capturing a substantial market share worth USD 1.02 billion. The demand for these soy-based products has surged in recent years, largely due to their versatile applications across multiple industries. Soy lecithin is widely used in food production and pharmaceuticals due to its exceptional emulsifying properties while soybean phospholipids, valued for their multifunctionality, have seen increased use in cosmetic formulations and dietary supplements, further fueling market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 6.7% |

In terms of application, the glycine soja (soybean) seed extract market is divided into key sectors such as cosmetics and personal care, food and beverages, nutraceuticals and dietary supplements, pharmaceuticals, and animal feed. The textiles industry, which held a 50% share in 2023, remains a dominant player in the market. Consumers' growing interest in health and wellness has accelerated the adoption of soy-derived products in nutraceuticals, dietary supplements, and personal care items. Key soy ingredients like protein, omega-3 fatty acids, and isoflavones are becoming more popular for their numerous health benefits, driving expansion across these sectors.

The U.S. glycine soja seed extract market is particularly strong, generating USD 585.5 million in 2024. The nation's market growth is fueled by the increasing demand for natural, sustainable products as health-conscious consumers seek cleaner, more transparent options. Soy's adaptability across various sectors, including food, cosmetics, and pharmaceuticals, ensures its continued relevance in the market, further solidifying the U.S.'s leading position in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for functional food and beverages

- 3.6.1.2 Growing pharmaceutical and nutraceutical applications

- 3.6.1.3 Expanding cosmetics and personal care market

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Consumer perception and soy allergies

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Soy Protein Isolates (SPIs)

- 5.3 Soy lecithin

- 5.4 Soybean phospholipids

- 5.5 Soy isoflavones

- 5.6 Saponins

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverages

- 6.3 Nutraceuticals & dietary supplements

- 6.4 Cosmetics & personal care

- 6.5 Animal feed

- 6.6 Pharmaceuticals

Chapter 7 Market Size and Forecast, By Distribution channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Ingredient distributors

- 7.4 Online retailers

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Archer Daniels Midland Company

- 9.2 BASF SE

- 9.3 Bellatorra Skin Care

- 9.4 Bio-alternatives

- 9.5 Cargill

- 9.6 Global Essence

- 9.7 Grau Aromatics

- 9.8 Ingredion Incorporated

- 9.9 JF Natural Ingredients

- 9.10 Lucas Meyer Cosmetics

- 9.11 Natural Solution

- 9.12 Symrise

- 9.13 The Organic Pharmacy

- 9.14 Wanrun Bio-Technology