|

市場調查報告書

商品編碼

1666561

鋁酸鈣水泥市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Calcium Aluminate Cement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

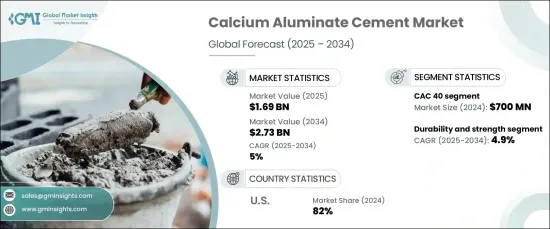

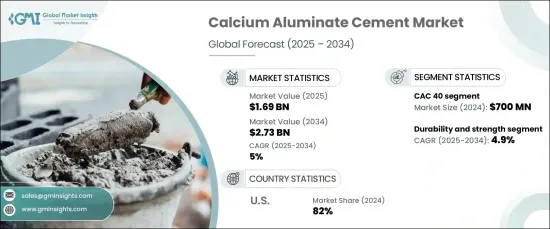

2024 年全球鋁酸鈣水泥市場價值為 16.9 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5%。 這種強勁成長源於 CAC 的獨特性能,這使其在專業建築應用中不可或缺。 CAC 以其優異的耐化學性、耐高溫性和卓越的機械強度而聞名,並在從廢水管理到高性能基礎設施項目等多個行業中繼續受到青睞。

鋁酸鈣水泥具有優異的抗化學腐蝕性能,使其成為易受酸性或化學侵蝕環境的必需材料。廢水處理、工業地板、污水系統和惡劣環境下的基礎設施項目等行業都嚴重依賴CAC的長期耐用性和性能。全球正在進行的工業化和城市化浪潮進一步加速了CAC的採用,政府和私人實體都在尋求能夠承受嚴苛條件的耐用材料。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 16.9 億美元 |

| 預測值 | 27.3億美元 |

| 複合年成長率 | 5% |

推動市場擴張的另一個因素是材料在極端條件下的表現能力。它的高耐熱性和承受重載和磨損的能力使其非常適合用於耐火襯裡、道路修復和高強度混凝土生產等應用。隨著對有彈性和高效的建築材料的需求不斷成長,CAC 的多功能性和可靠性鞏固了其在全球市場的地位。

市場按產品類型細分,主要類別為 CAC 40、CAC 50、CAC 60 和 CAC 70。 2024 年,CAC 40 板塊佔據市場主導地位,創造了 7 億美元的收入。預計到2034年仍將維持5%的成長率。

從功能面來看,市場分為耐用性和強度、耐高溫、耐化學性等類別。耐久性和強度部分在 2024 年佔據了 50% 的市場佔有率,預計未來十年的複合年成長率為 4.9%。隨著對能夠承受嚴重磨損的材料的需求不斷增加,CAC 無與倫比的耐用性仍然是其被採用的關鍵促進因素。

2024 年美國主導北美鋁酸鈣水泥市場,貢獻了該地區 82% 的收入。這項需求主要源自於基礎設施現代化方面的大量投資,包括老化橋樑、高速公路和廢水系統的翻新。隨著政府資金繼續優先用於基礎設施更新,美國基礎設施投資和就業法案等措施預計將進一步促進CAC的成長。對耐用和高性能材料的需求確保了 CAC 仍然是北美建築和工業應用的基石。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算。

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素。

- 利潤率分析。

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析。

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 增加建築活動

- 不斷成長的產品創新

- 產業陷阱與挑戰

- 市場飽和且競爭激烈

- 永續性問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品類型,2021-2034 年

- 主要趨勢

- 法國證券交易所 40

- 法國巴黎證券交易所 50

- 法國巴黎證券交易所 60

- 法國證券交易所 70

- 其他 (CAC 80 等)

第 6 章:市場估計與預測:按功能,2021 年至 2034 年

- 主要趨勢

- 耐用性和強度

- 耐高熱性

- 耐化學性

- 其他(耐腐蝕等)

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 建造

- 石油和天然氣

- 耐火

- 水和廢水處理

- 其他(採礦等)

第 8 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直接的

- 間接

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Almatis

- Buzzi Unicem

- Calucem

- Cementos Molins

- Cementos Portland Valderrivas

- Holcim Group

- Imerys Aluminates

- JK Cement

- Kerneos

- Rheinfelden Distler

- Shree Cement

- Siam Cement Group

- Sinai Cement

- Taiwan Cement Corporation

- Union Cement Company

The Global Calcium Aluminate Cement Market was valued at USD 1.69 billion in 2024 and is projected to expand at a CAGR of 5% between 2025 and 2034. This robust growth stems from the unique properties of CAC, which make it indispensable in specialized construction applications. Known for its superior chemical resistance, high-heat endurance, and exceptional mechanical strength, CAC continues to gain traction across multiple industries, from wastewater management to high-performance infrastructure projects.

Calcium aluminate cement's remarkable resistance to chemical corrosion has positioned it as an essential material for environments prone to acidic or chemically aggressive conditions. Industries such as wastewater treatment, industrial flooring, sewage systems, and infrastructure projects in harsh environments rely heavily on CAC for its long-term durability and performance. The ongoing wave of industrialization and urbanization across the globe has further accelerated the adoption of CAC, with governments and private entities seeking durable materials that can withstand demanding conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.69 Billion |

| Forecast Value | $2.73 Billion |

| CAGR | 5% |

Another factor driving the market's expansion is the material's ability to perform under extreme conditions. Its high heat resistance and capacity to bear heavy loads and abrasion make it ideal for use in applications such as refractory linings, road repairs, and high-strength concrete production. As the demand for resilient and efficient construction materials continues to grow, CAC's versatility and reliability solidify its position in the global market.

The market is segmented by product type, with CAC 40, CAC 50, CAC 60, and CAC 70 being the primary categories. In 2024, the CAC 40 segment dominated the market, generating USD 700 million in revenue. It is anticipated to sustain a growth rate of 5% through 2034. CAC 40 is favored for its excellent balance of cost-effectiveness and durability, making it the preferred choice for applications such as road repairs, industrial flooring, and high-strength concrete production.

Functionality-wise, the market is divided into categories such as durability and strength, high-heat resistance, chemical resistance, and others. The durability and strength segment accounted for 50% of the market share in 2024 and is projected to grow at a CAGR of 4.9% over the next decade. With the increasing demand for materials capable of withstanding heavy wear and tear, CAC's unparalleled durability remains a critical driver of its adoption.

The United States dominated the North American calcium aluminate cement market in 2024, contributing 82% of the region's revenue. This demand is fueled by significant investments in infrastructure modernization, including the refurbishment of aging bridges, highways, and wastewater systems. Initiatives like the U.S. Infrastructure Investment and Jobs Act are expected to bolster CAC's growth further as government funding continues to prioritize infrastructure renewal. The need for long-lasting and high-performance materials ensures that CAC remains a cornerstone of construction and industrial applications in North America.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing construction activities

- 3.6.1.2 Growing product innovation

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 CAC 40

- 5.3 CAC 50

- 5.4 CAC 60

- 5.5 CAC 70

- 5.6 Others (CAC 80, etc.)

Chapter 6 Market Estimates & Forecast, By Function, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Durability and strength

- 6.3 High-heat resistance

- 6.4 Chemical resistance

- 6.5 Others (corrosion resistance, etc.)

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Construction

- 7.3 Oil and gas

- 7.4 Refractory

- 7.5 Water and wastewater treatment

- 7.6 Others (mining, etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Almatis

- 10.2 Buzzi Unicem

- 10.3 Calucem

- 10.4 Cementos Molins

- 10.5 Cementos Portland Valderrivas

- 10.6 Holcim Group

- 10.7 Imerys Aluminates

- 10.8 JK Cement

- 10.9 Kerneos

- 10.10 Rheinfelden Distler

- 10.11 Shree Cement

- 10.12 Siam Cement Group

- 10.13 Sinai Cement

- 10.14 Taiwan Cement Corporation

- 10.15 Union Cement Company