|

市場調查報告書

商品編碼

1666595

睡眠呼吸中止設備市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Sleep Apnea Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

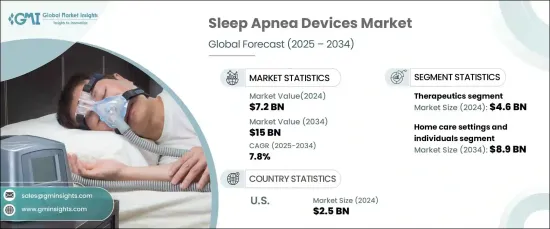

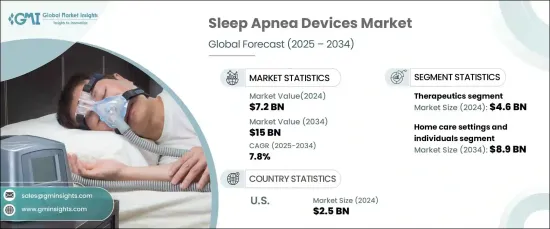

2024 年全球睡眠呼吸中止設備市場價值為 72 億美元,預計 2025 年至 2034 年的複合年成長率為 7.8%。 這一成長是由睡眠呼吸中止症和相關健康狀況的患病率上升,以及人們對該疾病及其健康影響的認知不斷提高所推動的。全球有數百萬人受到睡眠呼吸中止症的影響,但仍有大量病例未被診斷出來。導致盛行率上升的主要因素包括人口老化、肥胖率上升以及生活方式的改變。未經治療的睡眠呼吸中止症與心血管疾病和糖尿病等嚴重的健康風險有關,促使更多人尋求醫療干預。人們的認知和診斷能力的提高刺激了對先進睡眠呼吸中止症設備的需求,這些設備有助於有效地管理這種疾病。

睡眠呼吸中止症設備旨在確保睡眠期間呼吸不間斷,降低相關健康風險並改善生活品質。這些設備包括 CPAP 和 BiPAP 機器等治療解決方案,它們仍然是治療阻塞性睡眠呼吸中止症的首選。 CPAP 機器提供穩定的氣流以保持氣道暢通,而 BiPAP 設備則針對更複雜的情況提供可調節的壓力。設備技術的不斷進步,包括更安靜的操作和更強的舒適度,提高了患者對治療的依從性。提高這些療法的依從性有助於長期管理睡眠呼吸暫停,從而提高銷售並促進市場發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 72億美元 |

| 預測值 | 150億美元 |

| 複合年成長率 | 7.8% |

市場按產品細分為診斷和治療,其中治療在 2024 年的收入最高,為 46 億美元。家庭護理領域在 2024 年佔據主導地位,預計到 2034 年將達到 89 億美元。患者可以避免與醫院就診相關的費用,同時還可以享受價格實惠且有保險支援的設備。遠距醫療的採用透過實現遠端監控和個人化治療調整進一步增強了家庭護理的吸引力。這種遠距科技的整合使得家庭治療更有效率和便捷。

2024 年美國市場收入為 25 億美元,預計到 2034 年複合年成長率為 7.4%。私人醫療保健提供者以快速的服務和最先進的治療而聞名,在市場擴張中發揮著至關重要的作用。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 睡眠呼吸中止症及相關合併症的發生率不斷上升

- 對攜帶式、高效能睡眠呼吸中止症解決方案的需求不斷成長

- 人們對睡眠呼吸中止症和睡眠障礙的認知不斷提高

- 老化人口增加,需求增加

- 產業陷阱與挑戰

- 缺乏對睡眠呼吸中止症治療的依從性

- 成長動力

- 成長潛力分析

- 技術格局

- 未來市場趨勢

- 差距分析

- 監管格局

- 報銷場景

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 公司市佔率分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 療法

- 氣道清除系統

- 氣道正壓通氣 (PAP) 裝置

- 持續性呼吸道正壓通氣 (CPAP) 設備

- 雙水平氣道正壓通氣 (BiPAP) 裝置

- 自動氣道正壓通氣 (APAP) 裝置

- 自適應伺服通氣 (ASV) 設備

- 口腔器具

- 下顎前移裝置

- 舌固定裝置

- 上顎快速擴弓

- 護齒套

- 其他療法

- 診斷

- 多導睡眠圖 (PSG) 設備

- 動態 PSG 設備

- 臨床 PSG 設備

- 活動記錄系統

- 脈搏血氧儀

- 居家睡眠測試 (HST) 設備

- 類型 2

- 類型 3

- 類型 4

- 呼吸描記器

- 多導睡眠圖 (PSG) 設備

第 6 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 居家照護機構及個人

- 睡眠實驗室和醫院

第 7 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Asahi KASEI

- BMC

- Cadwell

- Drive DeVilbiss

- FISHER & PAYKEL

- Itamar Medical

- Philips

- LivaNova

- natus

- NIHON KOHDEN

- ResMed

- Teleflex

- WEINMANN

The Global Sleep Apnea Devices Market, valued at USD 7.2 billion in 2024, is set to grow at a CAGR of 7.8% from 2025 to 2034. This growth is driven by the rising prevalence of sleep apnea and related health conditions, along with increasing awareness of the disorder and its health implications. Millions worldwide are affected by sleep apnea, but a large number of cases remain undiagnosed. Key factors contributing to the rising prevalence include aging populations, higher obesity rates, and changes in lifestyle patterns. Untreated sleep apnea is linked to serious health risks such as cardiovascular disease and diabetes, prompting more individuals to seek medical intervention. Enhanced awareness and diagnosis have spurred demand for advanced sleep apnea devices, which help manage the condition effectively.

Sleep apnea devices are designed to ensure uninterrupted breathing during sleep, reducing associated health risks and improving quality of life. These devices include therapeutic solutions like CPAP and BiPAP machines, which remain the top choice for managing obstructive sleep apnea. CPAP machines provide a steady airflow to maintain open airways, while BiPAP devices offer adjustable pressures for more complex cases. Continuous advancements in device technology, including quieter operations and enhanced comfort, have increased patient adherence to treatment. Improved compliance with these therapies supports long term management of sleep apnea, driving higher sales and bolstering the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 Billion |

| Forecast Value | $15 Billion |

| CAGR | 7.8% |

The market is segmented by product into diagnostics and therapeutics, with therapeutics generating the highest revenue of USD 4.6 billion in 2024. By end use, the market is divided into home care settings and individuals, as well as sleep laboratories and hospitals. The home care segment dominated in 2024 and is projected to reach USD 8.9 billion by 2034. Home-based treatment options are gaining popularity due to their cost-effectiveness and accessibility. Patients can avoid the expenses associated with hospital visits while benefiting from affordable and insurance-supported devices. The adoption of telemedicine further enhances the appeal of home care by enabling remote monitoring and personalized adjustments to therapy. This integration of remote technologies has made home-based treatments more efficient and convenient.

The US market accounted for USD 2.5 billion in revenue in 2024, with an anticipated CAGR of 7.4% through 2034. Growth in the private healthcare sector, along with increased access to advanced diagnostic and therapeutic solutions, is fueling demand. Private healthcare providers, known for quicker services and state-of-the-art treatments, play a crucial role in the market's expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of sleep apnea and related comorbidities

- 3.2.1.2 Growing demand for portable, high-performance sleep apnea solutions

- 3.2.1.3 Surging awareness of sleep apnea and sleep disorders

- 3.2.1.4 Rising aging population amplifying demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of adherence to sleep apnea treatment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Future market trends

- 3.6 Gap analysis

- 3.7 Regulatory landscape

- 3.8 Reimbursement scenario

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Company market share analysis

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Therapeutics

- 5.2.1 Airway clearance systems

- 5.2.2 Positive airway pressure (PAP) devices

- 5.2.2.1 Continuous positive airway pressure (CPAP) devices

- 5.2.2.2 Bilevel positive airway pressure (BiPAP) devices

- 5.2.2.3 Automatic positive airway pressure (APAP) devices

- 5.2.3 Adaptive servo-ventilation (ASV) devices

- 5.2.4 Oral appliances

- 5.2.4.1 Mandibular advancement devices

- 5.2.4.2 Tongue-retaining devices

- 5.2.4.3 Rapid maxillary expansion

- 5.2.4.4 Mouth guards

- 5.2.5 Other therapeutics

- 5.3 Diagnostics

- 5.3.1 Polysomnography (PSG) device

- 5.3.1.1 Ambulatory PSG devices

- 5.3.1.2 Clinical PSG devices

- 5.3.2 Actigraphy systems

- 5.3.3 Pulse oximeters

- 5.3.4 Home sleep testing (HST) devices

- 5.3.4.1 Type 2

- 5.3.4.2 Type 3

- 5.3.4.3 Type 4

- 5.3.5 Respiratory polygraph

- 5.3.1 Polysomnography (PSG) device

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Home care settings and individuals

- 6.3 Sleep laboratories and hospitals

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Asahi KASEI

- 8.2 BMC

- 8.3 Cadwell

- 8.4 Drive DeVilbiss

- 8.5 FISHER & PAYKEL

- 8.6 Itamar Medical

- 8.7 Philips

- 8.8 LivaNova

- 8.9 natus

- 8.10 NIHON KOHDEN

- 8.11 ResMed

- 8.12 Teleflex

- 8.13 WEINMANN