|

市場調查報告書

商品編碼

1666602

高壓電保險絲市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測High Voltage Electric Fuse Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

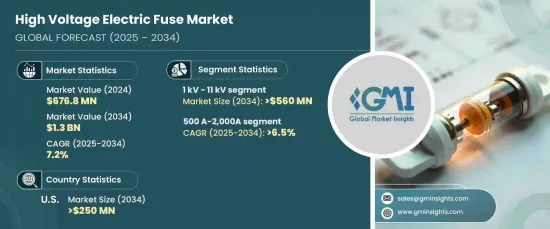

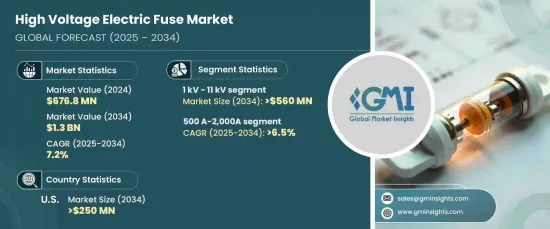

全球高壓電保險絲市場規模將於 2024 年達到 6.768 億美元,預計在 2025 年至 2034 年期間將以 7.2% 的強勁和複合年成長率成長。隨著工業和公用事業越來越重視保護關鍵設備和確保電網可靠性,市場對先進保險絲技術的投資正在增加。

各行業對安全標準的高度重視進一步推動了需求的激增,企業在遵守日益嚴格的法規的同時,優先考慮保護其資產。全球範圍內推動改善和擴大電力基礎設施,包括高壓電網的成長和鐵路系統的進步,也促進了市場上漲。政府對這些領域的投資在支持高壓電熔斷器的廣泛應用方面發揮了重要作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.768 億美元 |

| 預測值 | 13億美元 |

| 複合年成長率 | 7.2% |

在電網擴張和輸電網路持續現代化的推動下,1 kV - 11 kV 領域預計到 2034 年創造 5.6 億美元的收入。隨著這些系統變得越來越複雜,對關鍵基礎設施的可靠保護的需求變得至關重要。隨著各行業自動化程度的提高,以及更嚴格的安全法規要求採用先進的保險絲解決方案來保護高壓設備,這種需求也隨之擴大。

預計到 2034 年,500 A-2,000 A 範圍內的保險絲市場將實現 6.5% 的穩健複合年成長率。隨著緊湊型電子設備的廣泛應用和對電氣故障保護的需求不斷成長,工業部門對維護營運安全的日益關注預計將推動市場成長。

在北美,高壓電保險絲市場預計到 2034 年將創收 2.5 億美元。整合清潔能源解決方案的努力和資料中心的擴展正在促進這些基本組件的需求不斷增加。保險絲系統的技術進步,包括智慧技術和增強的即時監控,正在塑造市場的未來,並有望實現持續的成長和創新。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模與預測:按電壓,2021 – 2034 年

- 主要趨勢

- 1千伏至11千伏

- 11千伏至33千伏

- >33千伏

第 6 章:市場規模與預測:按當前評級,2021 年至 2034 年

- 主要趨勢

- 500A至2,000A

- 2,000 A 至 4,000 A

- >4,000 安

第 7 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 工業的

- 公用事業

第 8 章:市場規模與預測:依最終用途,2021 – 2034 年

- 主要趨勢

- 電力變壓器

- 電氣佈線

- 石油和天然氣

- 鐵路

- 礦業

- 其他

第 9 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 拉丁美洲

- 巴西

- 阿根廷

第10章:公司簡介

- ABB

- Bel Fuse

- Denco Fuses

- Eaton

- Ekoprom

- Fuji Electric

- GRL

- Hiitio

- Hudson Electric

- Littelfuse

- Mersen

- S&C Electric

- Schneider Electric

- Siba Fuses

- Southern States

The Global High Voltage Electric Fuse Market, reaching USD 676.8 million in 2024, is forecasted to grow at a robust CAGR of 7.2% between 2025 and 2034. This rapid expansion can be attributed to the increasing demand for reliable and high-performance fuses driven by the ongoing development of electrical infrastructure in emerging economies. As industries and utilities place higher importance on protecting critical equipment and ensuring grid reliability, the market is seeing an uptick in investments in advanced fuse technologies.

This surge in demand is further fueled by a heightened focus on safety standards across various sectors, where businesses prioritize safeguarding their assets while complying with increasingly stringent regulations. The global push to improve and expand electrical infrastructure, including the growth of high voltage grid networks and advancements in railway systems, also contributes to the market's upward trajectory. Government investments in these sectors play a significant role in supporting the broader adoption of high voltage electric fuses.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $676.8 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 7.2% |

The 1 kV - 11 kV segment is poised to generate USD 560 million by 2034, driven by the expansion of electrical grids and the ongoing modernization of transmission networks. As these systems grow more complex, the need for reliable protection of critical infrastructure becomes paramount. This demand is amplified by the rise of automation in various industries, alongside stricter safety regulations requiring the adoption of advanced fuse solutions to protect high-voltage equipment.

The market for fuses in the 500 A-2,000 A range is anticipated to see a solid CAGR of 6.5% through 2034. Growth in power generation, transmission, and distribution networks, paired with the rise of innovative technologies like smart fuses and real-time digital monitoring, will continue to fuel demand. With the widespread adoption of compact electronic devices and an ever-growing need for electrical fault protection, the industrial sector's increasing focus on maintaining operational safety is expected to drive market growth.

In North America, the high voltage electric fuse market is projected to generate USD 250 million by 2034. The region's aging power infrastructure is a key driver, alongside the growing need for components that ensure equipment protection and grid stability. Efforts to integrate clean energy solutions and the expansion of data centers are contributing to the increasing demand for these essential components. Technological advancements in fuse systems, including smart technology and enhanced real-time monitoring, are shaping the market future, promising continued growth and innovation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 – 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 1 kV-11 kV

- 5.3 11 kV-33 kV

- 5.4 > 33 kV

Chapter 6 Market Size and Forecast, By Current Rating, 2021 – 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 500 A-2,000 A

- 6.3 2,000 A-4,000 A

- 6.4 >4,000 A

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 Industrial

- 7.3 Utility

Chapter 8 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million, ‘000 Units)

- 8.1 Key trends

- 8.2 Power transformers

- 8.3 Electrical cabling

- 8.4 Oil & gas

- 8.5 Railways

- 8.6 Mining

- 8.7 Others

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Turkey

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Bel Fuse

- 10.3 Denco Fuses

- 10.4 Eaton

- 10.5 Ekoprom

- 10.6 Fuji Electric

- 10.7 GRL

- 10.8 Hiitio

- 10.9 Hudson Electric

- 10.10 Littelfuse

- 10.11 Mersen

- 10.12 S&C Electric

- 10.13 Schneider Electric

- 10.14 Siba Fuses

- 10.15 Southern States