|

市場調查報告書

商品編碼

1666619

無人交通管理市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Unmanned Traffic Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

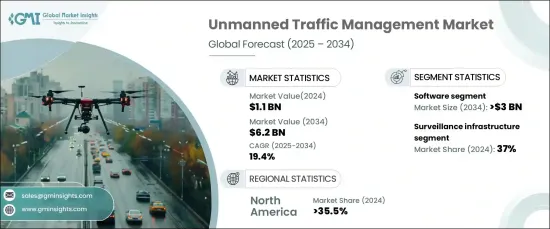

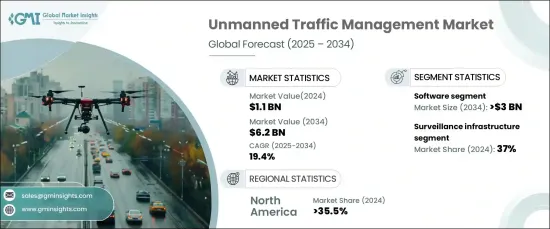

2024 年全球無人交通管理市場規模達到 11 億美元,預計 2025 年至 2034 年期間將以 19.4% 的強勁複合年成長率成長。隨著無人機成為這些領域運作不可或缺的一部分,對先進空中交通管理系統的需求激增,以確保無人機安全且有效率地融入共享空域。隨著城市地區擴大採用無人機進行最後一英里的配送和智慧城市應用,其營運管理變得更加複雜,需要可擴展且可靠的 UTM 解決方案。

此外,不斷變化的法規和對無人機技術不斷增加的投資正在催化市場的擴張。政府和私人組織正在合作建立無人機(UAV)運作框架,促進該領域的創新和發展。在解決空域擁塞挑戰的同時,專注於提高安全性和效率,預計將進一步推動市場發展。無人機相關技術的不斷進步,包括延長電池壽命、提高有效載荷能力和即時監控系統,正在塑造 UTM 系統的未來。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 11億美元 |

| 預測值 | 62億美元 |

| 複合年成長率 | 19.4% |

市場的成長也受到突破性技術進步的支持。自主飛行系統、增強型感測器、人工智慧 (AI) 驅動的決策和下一代通訊網路的創新正在顯著提高無人機的能力。這些發展不僅簡化了無人機的操作,而且迫切需要強大的 UTM 解決方案,以確保遵守不斷發展的航空標準,同時保持安全和營運效率。

UTM 市場大致分為硬體、軟體和服務。軟體在2024 年成為主導領域,佔據 48% 的市場佔有率,預計到 2034 年將創造 30 億美元的市場價值。這些系統在確保法規合規、追蹤無人機交通以及促進無人機和空中交通管制之間的安全通訊方面發揮關鍵作用。軟體解決方案的不可或缺性使這一領域成為市場成長的主要驅動力。

根據應用,市場分為導航基礎設施、監控基礎設施、通訊基礎設施和其他類別。 2024 年,監控基礎設施佔據了 37% 的市場佔有率。先進的監視系統對於防止碰撞、緩解空域擁塞和確保共享空域的順利運作至關重要。

從地區來看,北美 UTM 市場佔據主導地位,到 2024 年將佔有 35.5% 的佔有率,這得益於該地區的技術領導地位、支持性監管框架以及無人機技術的早期採用。美國是商業和政府無人機營運的全球領導者,在推動 UTM 解決方案方面發揮關鍵作用。該地區積極主動地將無人機納入國家領空,鞏固了其在全球市場的重要參與者地位。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究部分

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- UTM解決方案供應商

- 無人機製造商和營運商

- 電信和連接供應商

- 數據分析和雲端服務供應商

- 導航和感測器技術供應商

- 最終用途

- 利潤率分析

- 技術與創新格局

- 使用案例

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 城市空中交通的成長

- UTM 系統的技術進步

- 改善監管框架和標準

- 公共和私營部門對無人機領域的投資不斷增加

- 高效率交通管理的需求

- 產業陷阱與挑戰

- 隱私和安全問題

- 實施成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 軟體

- 服務

第6章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 執著的

- 非持久性

第 7 章:市場估計與預測:按部署,2021 - 2034 年

- 主要趨勢

- 本地

- 雲

第 8 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 導航基礎設施

- 監控基礎設施

- 通訊基礎設施

- 其他

第 9 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 商業的

- 政府

- 私人的

第 10 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Aeris

- Airbus

- Airspace Link

- Altitude Angel

- Anra Technologies

- DroneUp

- Droniq

- Frequentis

- InnovATM

- L3Harris Technologies

- Leonardo

- Lockheed Martin

- Onesky Technology

- PrecisionHawk

- Terra Drone

- Thales

- Unifly

- Unmanned Experts

The Global Unmanned Traffic Management Market reached USD 1.1 billion in 2024 and is projected to grow at a robust CAGR of 19.4% from 2025 to 2034. This impressive growth trajectory is primarily fueled by the rapid adoption of drones across diverse industries such as delivery, agriculture, and surveillance. With drones becoming an integral part of operations in these sectors, the need for advanced air traffic management systems has surged to ensure safe and efficient drone integration into shared airspace. As urban areas increasingly adopt drones for last-mile deliveries and smart city applications, managing their operations has grown more complex, necessitating scalable and reliable UTM solutions.

Furthermore, evolving regulations and increasing investments in drone technology are catalyzing the market's expansion. Governments and private organizations are collaborating to establish frameworks for unmanned aerial vehicle (UAV) operations, fostering innovation and development in the sector. The focus on enhancing safety and efficiency while addressing the challenges of airspace congestion is expected to further drive the market. The ongoing advancements in drone-related technologies, including improved battery life, payload capacity, and real-time monitoring systems, are shaping the future of UTM systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 19.4% |

The market growth is also underpinned by groundbreaking technological advancements. Innovations in autonomous flight systems, enhanced sensors, artificial intelligence (AI)-driven decision-making, and next-generation communication networks are significantly improving drone capabilities. These developments are not only streamlining drone operations but are also creating a pressing need for robust UTM solutions to ensure compliance with evolving aviation standards while maintaining safety and operational efficiency.

The UTM market is broadly categorized into hardware, software, and services. Software emerged as the dominant segment in 2024, capturing 48% of the market share, and is anticipated to generate USD 3 billion by 2034. Software forms the backbone of the UTM ecosystem, enabling seamless management of drone operations through efficient flight path optimization and real-time data processing. These systems play a critical role in ensuring regulatory compliance, tracking drone traffic, and facilitating secure communication between drones and air traffic control. The indispensable nature of software solutions positions this segment as a key driver of market growth.

In terms of application, the market is segmented into navigation infrastructure, surveillance infrastructure, communication infrastructure, and other categories. Surveillance infrastructure accounted for 37% of the market share in 2024. This segment is essential for maintaining safety and efficiency, particularly as drone operations increase in densely populated urban environments. Advanced surveillance systems are crucial for preventing collisions, mitigating airspace congestion, and ensuring smooth operations in shared airspace.

Regionally, the North American UTM market dominated with a 35.5% share in 2024, driven by the region's technological leadership, supportive regulatory framework, and early adoption of drone technologies. The United States, a global leader in commercial and governmental drone operations, has played a pivotal role in advancing UTM solutions. The region's proactive approach to integrating drones into national airspace has cemented its position as a key player in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research Component

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360º synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 UTM solution providers

- 3.2.2 Drone manufacturers and operators

- 3.2.3 Telecommunication and connectivity providers

- 3.2.4 Data analytics and cloud service providers

- 3.2.5 Navigation and sensor technology providers

- 3.2.6 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Use cases

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Growth of urban air mobility

- 3.8.1.2 Technological advancements in UTM systems

- 3.8.1.3 Improving regulatory frameworks and standards

- 3.8.1.4 Rising public and private sector investments in drone sector

- 3.8.1.5 Demand for efficient traffic management

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Privacy and security concerns

- 3.8.2.2 High implementation costs

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Persistent

- 6.3 Non-persistent

Chapter 7 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 On-premise

- 7.3 Cloud

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Navigation infrastructure

- 8.3 Surveillance infrastructure

- 8.4 Communication infrastructure

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Commercial

- 9.3 Government

- 9.4 Private

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Aeris

- 11.2 Airbus

- 11.3 Airspace Link

- 11.4 Altitude Angel

- 11.5 Anra Technologies

- 11.6 DroneUp

- 11.7 Droniq

- 11.8 Frequentis

- 11.9 InnovATM

- 11.10 L3Harris Technologies

- 11.11 Leonardo

- 11.12 Lockheed Martin

- 11.13 Onesky Technology

- 11.14 PrecisionHawk

- 11.15 Terra Drone

- 11.16 Thales

- 11.17 Unifly

- 11.18 Unmanned Experts