|

市場調查報告書

商品編碼

1666629

智慧徽章市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Smart Badge Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

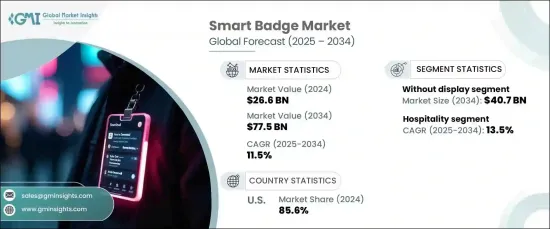

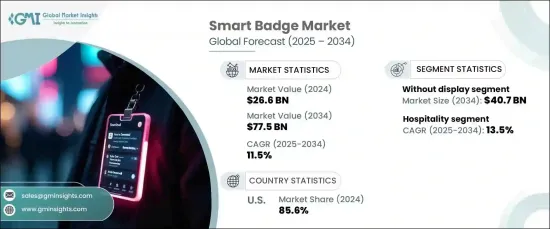

2024 年全球智慧徽章市場價值為 266 億美元,預計 2025 年至 2034 年期間將以 11.5 %的強勁複合年成長率擴張。支援物聯網的智慧徽章配有先進的偵測器和無線連接,使組織能夠準確地追蹤員工的活動、監控工作時間並以無與倫比的精度管理存取等級。

智慧徽章正在成為增強工作場所安全性和營運效率不可或缺的工具。透過提供管理人員存取的安全方法,他們大大降低了未經授權進入的風險。各行各業都在採用這些徽章作為存取控制、勞動力管理和遵守不斷發展的安全協議的可靠解決方案。對無縫和自動化系統不斷成長的需求進一步推動了市場的擴張,智慧徽章在現代化識別和追蹤流程中發揮核心作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 266億美元 |

| 預測值 | 775億美元 |

| 複合年成長率 | 11.5% |

智慧徽章市場分為兩種類型:帶顯示器的徽章和不帶顯示器的徽章。由於無顯示徽章簡單且具有成本效益,預計到 2034 年將產生 407 億美元的收入。同時,帶有顯示器的徽章提供增強的功能,例如即時資訊顯示、通知和用戶識別。這些在醫療保健、公司辦公室和活動等領域尤其有價值,因為即時溝通和資料視覺化至關重要。具有顯示功能的徽章配備 LED 或電子墨水螢幕,使用戶可以一目了然地查看警報、狀態更新和關鍵資料,以支援專業環境中的互動式動態參與。

在應用方面,智慧徽章在企業、飯店、活動和會議、政府和醫療保健等各個領域越來越受歡迎。酒店業預計將實現最快的成長,2025 年至 2034 年之間的複合年成長率為 13.5%。組織正在利用智慧徽章來簡化員工進入限制區域的權限,同時改善勞動力管理。透過將這些徽章整合到更廣泛的安全系統中,公司可以即時監控員工位置和工作時間,從而提高效率和安全性。對營運最佳化和可擴展識別解決方案的日益重視推動了大型企業對智慧徽章的需求不斷成長。

2024 年,美國佔據了全球智慧徽章市場 85.6% 的佔有率,反映出先進安全和勞動力管理技術的廣泛採用。由於企業、政府和教育等領域對私人門禁控制的需求強勁,生物識別和支援物聯網的智慧徽章的需求持續成長。市場受益於持續的技術進步和領先技術公司的支援。然而,嚴格的資料隱私法規(例如 GDPR)帶來了挑戰,推動了對安全且合規的解決方案的需求,以有效解決這些問題。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 物聯網 (IoT) 技術的應用日益廣泛

- 對增強安全解決方案的需求不斷成長

- 智慧徽章功能的技術進步

- 對勞動力管理解決方案的需求日益成長

- 轉向非接觸式和衛生解決方案

- 產業陷阱與挑戰

- 初始設定和維護成本高

- 隱私和資料安全問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:依通訊方式,2021 年至 2034 年

- 主要趨勢

- 接觸

- 非接觸式

第 6 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 帶顯示器的智慧徽章

- 無顯示幕的智慧徽章

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 公司的

- 飯店業

- 活動和會議

- 政府和醫療保健

- 其他

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abeeway

- Aioi-Systems Co., Ltd.

- ASSA ABLOY

- Beamian

- Brady Worldwide, Inc.

- Canon Inc.

- CardLogix Corporation

- Cisco.

- Dorma+Kaba Holdings AG

- Evolis

- Giesecke+Devrient GmbH

- HID Global

- IDEMIA

- Johnson Controls

- Kaba

- Kontakt.io

- Sber

- Seiko Solutions Inc.

- Thales Group

- ThinkWill

- Xerox Corporation

- Zebra Technologies Corporation

The Global Smart Badge Market was valued at USD 26.6 billion in 2024 and is projected to expand at a robust CAGR of 11.5% from 2025 to 2034. This growth is driven by the increasing integration of the Internet of Things (IoT) into smart badge technology, transforming their capabilities to enable real-time data exchange and monitoring. IoT-enabled smart badges with advanced detectors and wireless connectivity allow organizations to accurately trace employee movements, monitor work hours, and manage access levels with unparalleled precision.

Smart badges are becoming indispensable tools for enhancing workplace security and operational efficiency. By providing secure methods for managing personnel access, they significantly reduce the risk of unauthorized entry. Industries across the board are adopting these badges as reliable solutions for access control, workforce management, and compliance with evolving security protocols. The rising demand for seamless and automated systems further fuels the market's expansion, with smart badges playing a central role in modernizing identification and tracking processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26.6 Billion |

| Forecast Value | $77.5 Billion |

| CAGR | 11.5% |

The smart badge market is categorized into two types: badges with display and those without display. Badges without display are anticipated to generate USD 40.7 billion in revenue by 2034, owing to their simplicity and cost-effectiveness. Meanwhile, badges with display offer enhanced functionality, such as real-time information display, notifications, and user identification. These are particularly valuable in sectors like healthcare, corporate offices, and events, where immediate communication and data visualization are essential. Featuring LED or e-ink screens, display-enabled badges allow users to view alerts, status updates, and critical data at a glance, supporting interactive and dynamic engagement in professional environments.

In terms of application, smart badges are gaining traction across diverse sectors, including corporate, hospitality, events and conferences, government, and healthcare. The hospitality sector is poised for the fastest growth, with a CAGR of 13.5% between 2025 and 2034. In corporate environments, these badges are revolutionizing access control, attendance tracking, and user identification. Organizations are leveraging smart badges to streamline employee access to restricted areas while simultaneously improving workforce management. By integrating these badges into broader security systems, companies can monitor employee locations and working hours in real-time, enhancing both efficiency and safety. The increasing emphasis on operational optimization and scalable identification solutions drives the rising demand for smart badges in large enterprises.

In 2024, the U.S. accounted for an impressive 85.6% of the global smart badge market share, reflecting the widespread adoption of advanced security and workforce management technologies. With strong demand for private access control across sectors such as corporate, government, and education, biometric and IoT-enabled smart badges are in continuous demand. The market benefits from ongoing technological advancements and support from leading technology firms. However, stringent data privacy regulations, such as GDPR, pose challenges, driving the need for secure and compliant solutions to address these concerns effectively.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing adoption of IoT (Internet of Things) technologies

- 3.6.1.2 Rising demand for enhanced security solutions

- 3.6.1.3 Technological advancements in smart badge features

- 3.6.1.4 Growing need for workforce management solutions

- 3.6.1.5 Shift toward contactless and hygienic solutions

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial setup and maintenance costs

- 3.6.2.2 Privacy and data security concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Communication, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Contact

- 5.3 Contactless

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Smart badges with display

- 6.3 Smart badges without display

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Corporate

- 7.3 Hospitality

- 7.4 Events and conferences

- 7.5 Government and healthcare

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abeeway

- 9.2 Aioi-Systems Co., Ltd.

- 9.3 ASSA ABLOY

- 9.4 Beamian

- 9.5 Brady Worldwide, Inc.

- 9.6 Canon Inc.

- 9.7 CardLogix Corporation

- 9.8 Cisco.

- 9.9 Dorma+Kaba Holdings AG

- 9.10 Evolis

- 9.11 Giesecke+Devrient GmbH

- 9.12 HID Global

- 9.13 IDEMIA

- 9.14 Johnson Controls

- 9.15 Kaba

- 9.16 Kontakt.io

- 9.17 Sber

- 9.18 Seiko Solutions Inc.

- 9.19 Thales Group

- 9.20 ThinkWill

- 9.21 Xerox Corporation

- 9.22 Zebra Technologies Corporation