|

市場調查報告書

商品編碼

1666634

血管移植市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Vascular Graft Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

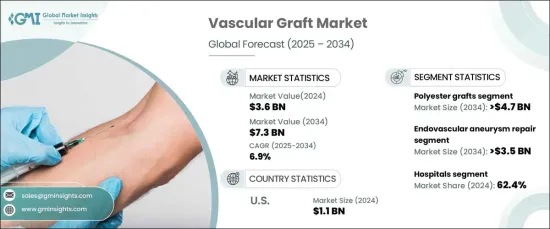

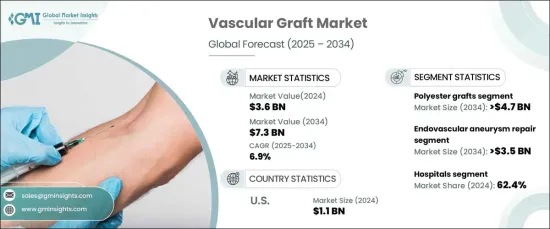

2024 年全球血管移植市場價值為 36 億美元,將實現令人矚目的成長,預計 2025 年至 2034 年的複合年成長率為 6.9%。此外,血管移植技術的進步和向微創手術的轉變正在改變醫療格局、改善患者的治療效果並使手術解決方案更容易獲得且更有效。

隨著世界各地的醫療保健系統努力應對人口老化和相關慢性病的增加,對血管移植的需求持續激增。生物工程和合成移植材料的創新正在解決生物相容性、耐用性和易用性等關鍵挑戰。混合移植物結合了多種材料的優勢,也因其提高手術成功率的能力而受到關注。隨著對個人化醫療的更加重視,製造商投資於研發,以創造適合不同醫療需求的下一代移植物,確保市場保持活力和競爭力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 36億美元 |

| 預測值 | 73億美元 |

| 複合年成長率 | 6.9% |

根據原料,市場分為聚酯移植物、膨體聚四氟乙烯 (EPTFE) 移植物、生物合成移植物和聚氨酯移植物。聚酯移植物將佔據主導地位,預計複合年成長率為 7.3%,到 2034 年其市場價值將達到 47 億美元。它們在修復大血管和解決複雜心血管問題方面的廣泛應用凸顯了它們在市場成長中的關鍵作用。

根據應用,血管移植用於血管內動脈瘤修復 (EVAR)、血液透析通路和周邊血管修復等手術。其中,EVAR 預計將達到顯著成長,預計複合年成長率為 7.7%,到 2034 年將達到 35 億美元。 這種微創手術具有切口小、恢復期短的特點,與傳統開放式手術相比越來越受到青睞。其併發症風險降低,使其成為老年和高風險患者的理想解決方案,大大促進了其在全球範圍內的採用。

在北美,血管移植市場預計將從 2024 年的 11 億美元開始,從 2025 年到 2034 年的複合年成長率為 6.1%。廣泛採用尖端醫療技術和完善的醫療保健基礎設施使北美成為全球血管移植市場創新和需求的主要驅動力。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球慢性病數量不斷增加

- 發展中經濟體末期腎病患者數量不斷增加

- 已開發國家的技術進步

- 器官移植數量增加

- 產業陷阱與挑戰

- 開發中國家缺乏技術人才

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 差距分析

- 定價分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按原料,2021 – 2034 年

- 主要趨勢

- 聚酯接枝物

- EPTFE 移植物

- 生物合成移植物

- 聚氨酯接枝物

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 血管內動脈瘤修復

- 腹主動脈瘤修復

- 胸主動脈瘤修復

- 血液透析通路

- 周圍血管修復

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott

- ARTIVION

- B. Braun

- BD (Becton, Dickinson & Company)

- Cook Medical

- Cordis

- Endologix

- GETINGE

- LeMaitre

- Medtronic

- MERIT MEDICAL

- MicroPort

- TERUMO

- Vascular Graft Solutions

- GORE

The Global Vascular Graft Market, valued at USD 3.6 billion in 2024, is set to witness impressive growth, with a projected CAGR of 6.9% from 2025 to 2034. This robust expansion is driven by multiple factors, including the escalating prevalence of cardiovascular diseases, rising occurrences of end-stage renal disease (ESRD), and increasing surgical interventions. Furthermore, technological advancements in vascular grafts and the shift toward minimally invasive procedures are transforming the landscape, enhancing patient outcomes, and making surgical solutions more accessible and effective.

As healthcare systems worldwide grapple with aging populations and the associated rise in chronic conditions, the demand for vascular grafts continues to surge. Innovations in bioengineered and synthetic graft materials are addressing critical challenges such as biocompatibility, durability, and ease of use. Hybrid grafts, which combine the strengths of multiple materials, are also gaining traction for their ability to improve surgical success rates. With a greater emphasis on personalized healthcare, manufacturers invest in research and development to create next-generation grafts tailored to diverse medical needs, ensuring the market remains dynamic and competitive.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 6.9% |

The market is segmented by raw material into polyester grafts, expanded polytetrafluoroethylene (EPTFE) grafts, biosynthetic grafts, and polyurethane grafts. Polyester grafts are positioned to dominate, with an anticipated CAGR of 7.3%, driving their market value to USD 4.7 billion by 2034. These grafts, often constructed from materials like Dacron, are lauded for their strength and longevity, particularly in high-pressure vascular environments. Their widespread application in repairing large vessels and addressing complex cardiovascular challenges highlights their critical role in the market's growth.

By application, vascular grafts are utilized in procedures such as endovascular aneurysm repair (EVAR), hemodialysis access, and peripheral vascular repair. Among these, EVAR is poised for remarkable growth, with a projected CAGR of 7.7%, reaching USD 3.5 billion by 2034. This minimally invasive approach, characterized by smaller incisions and shorter recovery periods, is increasingly favored over traditional open surgeries. Its reduced risk of complications makes it an ideal solution for elderly and high-risk patients, significantly boosting its adoption globally.

In North America, the vascular graft market is projected to grow at a CAGR of 6.1% from 2025 to 2034, starting at USD 1.1 billion in 2024. The region remains a leader in embracing advanced surgical technologies, including EVAR, which often necessitates specialized grafts like stent grafts. The widespread adoption of cutting-edge medical techniques and a well-established healthcare infrastructure position North America as a key driver of innovation and demand within the global vascular graft market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of chronic diseases worldwide

- 3.2.1.2 Growing number of end-stage renal disorders in developing economies

- 3.2.1.3 Technological advancements in developed countries

- 3.2.1.4 Rise in organ transplantation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled personnel in developing countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Raw Material, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Polyester grafts

- 5.3 EPTFE grafts

- 5.4 Biosynthetic grafts

- 5.5 Polyurethane grafts

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Endovascular aneurysm repair

- 6.2.1 Abdominal aortic aneurysm repair

- 6.2.2 Thoracic aortic aneurysm repair

- 6.3 Hemodialysis access

- 6.4 Peripheral vascular repair

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 ARTIVION

- 9.3 B. Braun

- 9.4 BD (Becton, Dickinson & Company)

- 9.5 Cook Medical

- 9.6 Cordis

- 9.7 Endologix

- 9.8 GETINGE

- 9.9 LeMaitre

- 9.10 Medtronic

- 9.11 MERIT MEDICAL

- 9.12 MicroPort

- 9.13 TERUMO

- 9.14 Vascular Graft Solutions

- 9.15 GORE