|

市場調查報告書

商品編碼

1666645

電熱水器市場機會、成長動力、產業趨勢分析及預測 2025-2034Electric Water Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

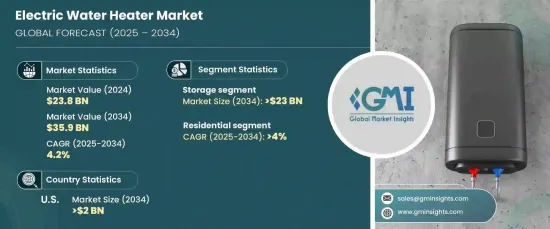

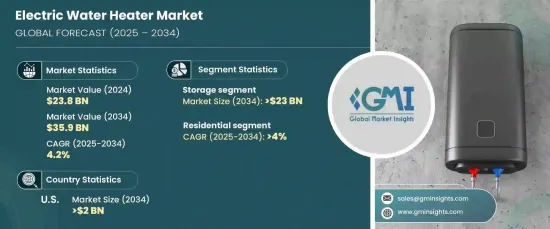

2024 年全球電熱水器市場價值為 238 億美元,預計 2025 年至 2034 年期間的複合年成長率為 4.2%。這些設備通常使用電阻元件直接加熱水,使其成為現代家庭和企業的常見選擇。

有幾個因素正在推動電熱水器市場的成長。具有競爭力的定價以及廣泛的容量選擇對消費者俱有吸引力。此外,隨著越來越多的個人和企業轉向節能系統,對電熱水器的需求也在增加。電氣化暖氣系統的發展趨勢以及再生能源融入住宅和商業基礎設施的趨勢也推動了電熱水器的普及。此外,更嚴格的能源效率法規和升級傳統低能源效率熱水器的激勵措施正在重塑市場。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 238億美元 |

| 預測值 | 359億美元 |

| 複合年成長率 | 4.2% |

政府致力於減少碳排放的政策以及基礎設施建設的投資增加,進一步促進了電熱水器的使用。由於舊建築的不斷翻新和現代化,對大容量熱水器的需求正在增加。製造商也透過為各種商業和工業應用提供客製化解決方案來響應市場,從而促進業務成長。

市場主要分為兩種產品類型:即熱式熱水器和儲水式熱水器。預計到 2034 年,儲水式熱水器市場將創造 230 億美元。多戶住宅和單戶住宅數量的不斷增加,以及飯店、餐廳和醫院等機構對按需熱水的需求不斷成長,進一步刺激了對這些設備的需求。

電熱水器市場也依用途細分,主要分為住宅用和商業用。由於屋主擴大尋求能源之星認證的型號來減少能源費用,預計到 2034 年住宅市場的複合年成長率將達到 4%。此外,Wi-Fi 連接和行動應用程式控制等智慧熱水器技術的興起正在推動產品需求,使屋主能夠遠端管理熱水器。

預計到 2034 年,美國電熱水器市場規模將達到 20 億美元。隨著更嚴格的能源效率標準的實施,越來越多的消費者選擇先進的電動車型,其中一些車型與太陽能板等再生能源系統相結合,進一步降低了能源成本。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與技術格局

- 公司市佔率

第 5 章:市場規模及預測:依產品,2021 – 2034 年

- 主要趨勢

- 立即的

- 貯存

第6章:市場規模及預測:依產能,2021 – 2034 年

- 主要趨勢

- 30公升以下

- 30 – 100 公升

- 100 – 250 公升

- 250 – 400 公升

- >400 公升

第 7 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 住宅

- 商業的

- 學院/大學

- 辦公室

- 政府/建築

- 其他

第 8 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 奧地利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 科威特

- 阿曼

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 墨西哥

第9章:公司簡介

- AO Smith

- Ariston Holding NV

- American Standard Water Heaters

- Bosch Thermotechnology Corp.

- Bradford White Corporation

- FERROLI

- GE Appliances

- Groupe Atlantic

- Haier

- Havells India

- Hubbell Heaters

- LINUO RITTER INTERNATIONAL

- Nihon Itomic Co., Ltd.

- Noritz Corporation

- Parker Boiler Company

- Racold

- Rheem Manufacturing Company

- Rinnai Corporation

- State Industries

- STIEBEL ELTRON

- Vaillant

- Viessmann

- Westinghouse Electric Corporation

- Whirlpool Corporation

- Watts

- Zenith Water Heaters

The Global Electric Water Heater Market was valued at USD 23.8 billion in 2024 and is expected to grow at 4.2% CAGR from 2025 to 2034. Electric water heaters use electrical energy to heat water for a variety of domestic and commercial purposes, such as bathing, cleaning, and cooking. These devices typically use electrical resistance elements to directly heat water, making them a common choice for modern households and businesses.

Several factors are driving the growth of the electric water heater market. Competitive pricing, along with a wide range of capacity options, is appealing to consumers. Additionally, as more individuals and businesses shift toward energy-efficient systems, the demand for electric water heaters is increasing. The growing trend to electrify heating systems and the integration of renewable energy sources into residential and commercial infrastructure is also boosting the adoption of electric water heaters. Furthermore, stricter energy efficiency regulations and incentives for upgrading from traditional, less efficient water heaters are reshaping the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.8 Billion |

| Forecast Value | $35.9 Billion |

| CAGR | 4.2% |

Government policies focused on reducing carbon emissions, along with increased investments in infrastructure development, are further promoting the use of electric water heaters. The demand for high-capacity water heaters is on the rise due to the ongoing renovation and modernization of older buildings. Manufacturers are also responding to the market by offering customized solutions for various commercial and industrial applications, which is enhancing business growth.

The market is divided into two main product types: instant and storage water heaters. The storage water heater segment is expected to generate USD 23 billion by 2034. Smart features that improve energy efficiency and reduce utility costs are a significant driver for storage water heaters. The increasing number of multi-family and single-family homes, along with the growing demand for on-demand hot water in institutions like hotels, restaurants, and hospitals, is further fueling the demand for these units.

The electric water heater market is also segmented by application, with residential and commercial being the primary categories. The residential segment is forecasted to grow at a CAGR of 4% through 2034 as homeowners increasingly seek Energy Star-certified models to reduce energy bills. Additionally, the rise in smart water heater technologies, such as Wi-Fi connectivity and mobile app controls, is boosting product demand, allowing homeowners to manage their water heaters remotely.

U.S. electric water heater market is projected to reach USD 2 billion by 2034. The growing emphasis on energy efficiency, environmental sustainability, and technological advancements in water heaters are contributing to this growth. As stricter energy efficiency standards are enforced, more consumers are opting for advanced electric models, some of which integrate with renewable energy systems like solar panels, further reducing energy costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

- 4.4 Company market share

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & ‘000 Units)

- 5.1 Key trends

- 5.2 Instant

- 5.3 Storage

Chapter 6 Market Size and Forecast, By Capacity, 2021 – 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Below 30 liters

- 6.3 30 – 100 liters

- 6.4 100 – 250 liters

- 6.5 250 – 400 liters

- 6.6 >400 liters

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.3.1 College/University

- 7.3.2 Offices

- 7.3.3 Government/Building

- 7.3.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Austria

- 8.3.6 Spain

- 8.3.7 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Kuwait

- 8.5.5 Oman

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

- 8.6.4 Mexico

Chapter 9 Company Profiles

- 9.1 A. O. Smith

- 9.2 Ariston Holding N.V.

- 9.3 American Standard Water Heaters

- 9.4 Bosch Thermotechnology Corp.

- 9.5 Bradford White Corporation

- 9.6 FERROLI

- 9.7 GE Appliances

- 9.8 Groupe Atlantic

- 9.9 Haier

- 9.10 Havells India

- 9.11 Hubbell Heaters

- 9.12 LINUO RITTER INTERNATIONAL

- 9.13 Nihon Itomic Co., Ltd.

- 9.14 Noritz Corporation

- 9.15 Parker Boiler Company

- 9.16 Racold

- 9.17 Rheem Manufacturing Company

- 9.18 Rinnai Corporation

- 9.19 State Industries

- 9.20 STIEBEL ELTRON

- 9.21 Vaillant

- 9.22 Viessmann

- 9.23 Westinghouse Electric Corporation

- 9.24 Whirlpool Corporation

- 9.25 Watts

- 9.26 Zenith Water Heaters